农药助剂

Search documents

惨!新股上市9天跌7天,从76跌到47,散户:这是来卖公司的吧!

Sou Hu Cai Jing· 2025-12-07 08:43

Company Overview - The company in focus is Fengbei Biological (603334), which specializes in the comprehensive utilization of waste resources, particularly known for its "waste oil refining" business model, converting waste oils into biodiesel and bio-based materials [3][5] - Fengbei Biological holds EU ISCC certification and has established partnerships with leading agricultural companies and international firms like Shell and BP, positioning itself as a top player in the domestic biodiesel industry [3] Financial Performance - From 2022 to 2024, the company's revenue is projected to increase from 1.709 billion to 1.949 billion yuan, while the net profit attributable to shareholders is expected to decline from 133 million to 124 million yuan, indicating a "revenue growth without profit growth" scenario [5] - The Q3 2025 report shows revenue of 2.251 billion yuan and a net profit of 117 million yuan, reflecting year-on-year growth of 62.32% and 35.32% respectively, but the net profit margin has decreased from 6.97% in the first half of 2024 to 5.21% [5] Market Reaction - After its debut on November 5, the stock experienced a significant drop, with seven out of nine trading days closing lower, plummeting from a peak of 76 yuan to around 47 yuan, highlighting a volatile market response [11][13] - The stock initially surged by 172% on the first day but faced a sharp decline of 14.4% the following day, leading to substantial losses for investors who bought in at higher prices [11][13] Investor Sentiment - Investors expressed frustration over the perceived manipulation of the stock, with claims that the actual controller had already profited through related transactions and cash dividends prior to the IPO, totaling over 65 million yuan [9] - The situation has raised concerns about the role of the underwriting institution, which is seen as prioritizing profit over the quality of the offering, leading to a sentiment of betrayal among retail investors [9][13]

A股、A50,强势翻红!这一板块,涨停潮!

证券时报· 2025-11-05 04:40

Market Performance - On November 5, A-shares and Hong Kong stocks opened significantly lower but gradually stabilized, with the Shanghai Composite Index rising 0.05% by midday after initially dropping nearly 1% [3][8] - The A-share market saw over 3,000 stocks rise, while approximately 2,200 stocks declined, indicating a generally positive market sentiment despite initial losses [3][4] Sector Highlights - The power equipment sector led the gains in the A-share market, with stocks like Jinpan Technology, Zhongzhi Technology, and Zhongneng Electric hitting the daily limit of 20% [4][5] - Other notable performers included Fengyuan Co., Sun Cable, and Shunhua Electric, all of which also saw significant price increases [5][6] - The coal sector also showed strength, with stocks like Antai Group and Baotailong reaching their daily limit, and Dayou Energy experiencing a rise of over 8% [6] Hong Kong Market - The Hang Seng Index and the Hang Seng Tech Index saw their declines significantly narrow by midday, with the Hang Seng Index down 0.28% after an initial drop of over 1.7% [15] - Notable stocks in the Hang Seng Index included New Oriental and BYD, which were among the biggest decliners, while companies like Kang Shifu Holdings and WuXi AppTec led the gains [10][15] New Listings - A new stock, Fengbei Biological, debuted on November 5, with its price surging over 210% at one point during trading [12][14] - Fengbei Biological focuses on the comprehensive utilization of waste resources, particularly waste oils, and has established a strong technological foundation with numerous patents [14][16]

【10月29日IPO雷达】丰倍生物缴款

Xuan Gu Bao· 2025-10-29 00:05

Group 1 - The company has been deeply engaged in the comprehensive utilization of waste oil resources for over 10 years, establishing itself as a pioneer and promoter in the field [2] - The company has developed a relatively complete recycling industry chain for "waste materials" and has expanded into bio-based materials [2] - In the biofuel sector, the company has clients including TRAFIGURA and BIOSYNTECHANDELSGMBH, and as of the end of 2024, its biodiesel production capacity is expected to hold a market share of approximately 4.68% in the domestic biodiesel market [2] Group 2 - The company’s domestic market share for pesticide adjuvants is approximately 6.46% in 2023 [2] - The issuance price of the company's shares is set at 24.49 yuan, with a total market capitalization of 2.635 billion yuan [2] - The issuance price-earnings ratio is reported at 30.47 [2]

【10月27日IPO雷达】丰倍生物申购

Xuan Gu Bao· 2025-10-27 00:02

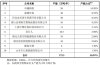

Core Viewpoint - The company Fengbei Biotechnology is set to launch an IPO with a total market value of 2.635 billion yuan and an issuance price of 24.49 yuan per share, indicating a competitive entry into the market with a focus on waste oil resource utilization and biofuel production [2][3]. Group 1: Company Overview - Fengbei Biotechnology has over 10 years of experience in the waste oil resource utilization sector, establishing a comprehensive industrial chain from waste oil to resource regeneration [2]. - The company has developed bio-based materials for agricultural applications and has a significant presence in the biofuel market, with a market share of approximately 4.68% in China's biodiesel sector by the end of 2024 [3]. Group 2: Financial Performance - The company reported a net profit of 1.948 billion yuan in the last three years, with a projected increase of 12.75% in 2024 [3]. - Revenue figures for the past three years are as follows: 1.728 billion yuan in 2023 (up 1.12%), and 1.709 billion yuan in 2022 (up 31.89%) [3]. Group 3: Business Highlights - The company’s main business segments include waste resource utilization (81.57%) and oil chemical products (18.29%), with minimal contributions from other areas (0.14%) [2]. - The company has established relationships with major clients in the biofuel sector, including TRAFIGURA and CARGILL, enhancing its market position [3]. Group 4: Fundraising Purpose - The funds raised from the IPO will be allocated to the construction of new production facilities, including 300,000 tons of oleic acid methyl ester, 10,000 tons of industrial-grade mixed oil, and 50,000 tons of biodiesel [3].

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:14

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products [1][2]. Company Overview - Established in 2014, Fengbei Bio primarily engages in waste oil resource utilization, with oil chemical products as a supplementary business [1]. - The company has developed a range of products including bio-based materials and biofuels, with a focus on agricultural additives and biodiesel [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 17.09 billion, 17.28 billion, and 19.48 billion CNY, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 1.33 billion, 1.30 billion, and 1.24 billion CNY, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - Fengbei Bio holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity [3]. - In the agricultural chemical sector, the company has a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives [4]. Research and Development - The company has obtained 135 patents, including 33 domestic invention patents and 3 international invention patents, and has been recognized as a national-level "little giant" enterprise [3]. Client Base - Fengbei Bio's clientele includes major global commodity traders such as TRAFIGURA and GLENCORE, as well as renowned end-users like CARGILL and BP [3].

A股申购 | 丰倍生物(603334.SH)开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:45

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times [1] Group 1: Company Overview - Fengbei Bio is a high-tech enterprise in the field of waste resource utilization, primarily producing resource products from waste oils, forming a recycling industry chain of "waste oils - biofuels (biodiesel) - bio-based materials" [1] - The main business of the company focuses on the comprehensive utilization of waste oil resources, with auxiliary operations in oil chemical products [1] - The primary products from waste oil resource utilization include bio-based materials and biofuels, with bio-based materials mainly consisting of pesticide and fertilizer additives, and biofuels primarily being biodiesel [1] Group 2: Market Position and Partnerships - Fengbei Bio has established long-term collaborations with leading companies in the agricultural chemical sector, including Fengle Seed Industry, Jiuyue Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1] - As of the end of 2024, the company has a biodiesel production capacity of 105,000 tons, ranking sixth in China's biodiesel industry [2] Group 3: Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.948 billion CNY for the years 2022, 2023, and 2024, respectively [2] - Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2] - The company indicated that its operating cash flow was good from 2022 to 2023, but a decline in 2024 was noted due to an increase in operating receivables [2]

丰倍生物开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:39

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a maximum subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times. The company operates in the waste resource utilization sector, focusing on converting waste oils into biofuels and biobased materials, establishing a comprehensive recycling industry chain [1]. Company Overview - Fengbei Bio is a high-tech enterprise specializing in the comprehensive utilization of waste resources, primarily focusing on waste oils to produce biobased products and biofuels. The main products include biobased materials such as pesticide and fertilizer additives, and biofuels like biodiesel [1]. - The company has established long-term partnerships with leading agricultural chemical firms, including Fengle Seed Industry, Jiuyi Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1]. Production Capacity - As of the end of 2024, Fengbei Bio's biodiesel production capacity is 105,000 tons, ranking sixth in China's biodiesel industry. Compared to peers like Zhuoyue New Energy and Jiaao Environmental Protection, Fengbei's net profit after deducting non-recurring gains is lower than Zhuoyue but higher than Jiaao and Longhai Bio [2][3]. Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.949 billion CNY for the years 2022, 2023, and 2024, respectively. Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2][4]. - Total assets as of December 31, 2024, are 12.368 billion CNY, with equity attributable to shareholders at 7.558 billion CNY. The asset-liability ratio has improved from 49.12% in 2022 to 43.13% in 2024 [4]. Profitability Metrics - For the fiscal year 2024, the company expects a net profit of approximately 1.238 billion CNY, with a basic earnings per share of 1.15 CNY. The return on equity is projected at 17.91%, down from 30.57% in 2022 [5].

年入19亿,“地沟油”干出IPO

Sou Hu Cai Jing· 2025-08-12 12:41

Core Viewpoint - The IPO market is experiencing significant activity, with companies like Fengbei Bio aiming to transform waste cooking oil into valuable bio-based materials and biodiesel, marking a potential first in the A-share market for waste oil resource utilization [2][3] Company Overview - Fengbei Bio is set to raise 750 million yuan through its IPO, with a pre-IPO valuation of approximately 4 billion yuan [2][8] - The company was founded by a Fudan University graduate who was motivated by the dangers of waste cooking oil, leading to the development of various eco-friendly technologies over a decade [2][4] - Fengbei Bio has achieved a market share of 6.72% and 6.46% in agricultural pesticide and fertilizer additives, respectively [6] Market Challenges - The transformation of waste cooking oil faces three main challenges: technical difficulties, limited market demand for biodiesel, and unclear policies regarding biodiesel standards [3][6] - Despite the challenges, Fengbei Bio has managed to secure A-round financing from a prominent local venture capital firm, indicating growing interest in the green economy sector [6][8] Financial Performance - The company reported revenues of 1.709 billion yuan, 1.728 billion yuan, and 1.948 billion yuan for the years 2022, 2023, and 2024, respectively, but faced a decline in net profit [8] - The gross profit margins have also decreased, with figures of 13.55%, 13.95%, and 11.67% over the same period, indicating a challenging profitability landscape [8][9] Future Prospects - Fengbei Bio aims to utilize the IPO proceeds to enhance its production capacity and focus on new product lines, including a new annual production of 300,000 tons of fatty acid methyl esters and 50,000 tons of agricultural microbial agents [9][10] - The company’s founder holds an 85.4% stake, and a successful IPO could significantly increase his wealth, potentially exceeding 3 billion yuan [10][11]