带状疱疹疫苗Shingrix

Search documents

全球疫苗大失速

3 6 Ke· 2025-11-11 23:30

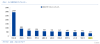

Core Viewpoint - The global vaccine industry is undergoing a significant adjustment, with major players experiencing a collective decline in vaccine business due to various macro factors, including a growing public skepticism towards vaccines in the U.S. [2][3][7] Group 1: Financial Performance of Major Vaccine Companies - The latest Q3 financial reports from major vaccine companies, including Sanofi, Merck, Pfizer, and GSK, indicate a downturn in vaccine sales, with a projected 19% decline in total sales for the top ten vaccines in 2024 compared to 2023, amounting to $38.4 billion [4][6]. - Sanofi reported a 17% decline in sales of COVID-19 and flu vaccines, with traditional vaccine revenue dropping 8% to €3.36 billion, primarily due to a slowdown in flu vaccine sales [4]. - Merck's sales of its HPV vaccine Gardasil/GARDASIL 9 fell by 24% to $1.75 billion in Q3, with a staggering 40% drop in revenue for the first three quarters of the year [5]. - Pfizer's COVID-19 vaccine Comirnaty saw a 20% global sales decline, with a 25% drop in the U.S. market, alongside disappointing performances from its pneumonia and RSV vaccines [5][6]. Group 2: Macro Factors Impacting Vaccine Trust - The decline in vaccine trust in the U.S. is attributed to the actions of Robert F. Kennedy Jr., the new Secretary of Health and Human Services, who has promoted anti-vaccine sentiments and policies that undermine public confidence in vaccines [7][8]. - A recent survey indicated that 30% of Americans are skeptical about vaccines, with a significant drop in the belief that childhood vaccines are essential, from 58% in 2019 to 40% in 2024 [8]. - The CDC reported over 1,600 confirmed measles cases in 2025, a stark increase from 285 cases the previous year, highlighting the consequences of declining vaccination rates [9]. Group 3: Historical Context and Future Implications - The current situation in the U.S. vaccine market mirrors Japan's past vaccine industry decline, which was triggered by public trust issues and government policy changes that led to a significant drop in vaccination rates [10][11]. - The ongoing crisis in vaccine trust poses a risk not only to the industry but also to public health, as evidenced by the resurgence of preventable diseases like measles [9][10].

GSK要大干一场了

Ge Long Hui· 2025-10-28 10:55

Core Viewpoint - GSK is undergoing a leadership change with the appointment of Luke Miels as the new CEO, effective January 1, 2026, amidst challenges in its core vaccine business and a goal to exceed £40 billion in total sales by 2031 [1][15]. Group 1: Leadership Transition - GSK announced the appointment of Luke Miels as CEO candidate, succeeding Emma Walmsley, who has led the company since September 2016 [1][2]. - Under Walmsley's leadership, GSK focused on biopharmaceuticals, successfully splitting its consumer healthcare business and prioritizing specialty medicines and vaccines [2][3]. Group 2: Financial Performance - GSK's total revenue for 2024 is projected to grow by only 3% to £31.376 billion, falling out of the top ten global pharmaceutical companies due to a decline in its core vaccine business [1][4]. - In 2023, GSK reported total revenue of £30.328 billion, a 5% increase year-over-year, with the vaccine segment growing by 25% [4][10]. Group 3: Business Segments - The specialty medicines segment showed strong growth, contributing £11.81 billion in 2024, with a year-over-year increase of 19% [7][13]. - The vaccine segment faced challenges, with revenues declining by 4% in 2024, while the oral and respiratory segments showed mixed results [10][11]. Group 4: Strategic Focus - GSK aims to find new growth drivers, particularly in oncology and respiratory/inflammation areas, where Miels has previously contributed significantly [15][16]. - Recent acquisitions and partnerships, including a $2 billion acquisition of Boston Pharmaceuticals, indicate GSK's strategy to enhance its pipeline and product offerings [16][21]. Group 5: Future Outlook - GSK's success in achieving its £40 billion sales target by 2031 will depend on the successful execution of its innovative pipeline and addressing challenges in its vaccine and HIV segments [22].

从GSK到奥利佳:21年老将跳槽,跨国药企迎转型阵痛

2 1 Shi Ji Jing Ji Bao Dao· 2025-09-20 05:24

Core Insights - The departure of Cecilia Qi from GSK reflects significant strategic restructuring and industry changes faced by multinational pharmaceutical companies in the Chinese market [1][2][8] - GSK's financial report indicates a 5% year-on-year revenue growth for the first half of 2025, with total revenue reaching £15.50 billion (approximately $20.16 billion) [1][3] - The performance of GSK's vaccine segment showed a mixed result, with a 1% increase in revenue to £4.19 billion (approximately $5.44 billion), while sales of the respiratory syncytial virus vaccine Arexvy dropped by 39% [1][3] Financial Performance - GSK's revenue from specialty medicines, vaccines, and generics for the first half of 2025 was £6.26 billion (approximately $8.14 billion), £4.19 billion (approximately $5.44 billion), and £5.06 billion (approximately $6.73 billion) respectively, showing a 16% increase, 1% increase, and a 3% decrease year-on-year [3] - GSK anticipates a 3% to 5% growth in annual revenue for 2025, with core operating profit expected to rise by 6% to 8% [2] Strategic Adjustments - GSK has initiated a regional integration strategy in June 2023, merging emerging markets with Greater China and Intercontinental regions to enhance market flexibility and resource allocation efficiency [3] - The appointment of a Chief Operating Officer in China aims to improve local operational efficiency [3] Market Challenges - GSK faces pressure on its main product lines, with a shift from a "mature products + high margin" model to a more competitive landscape [4][5] - The company is experiencing stagnation in market share growth for its shingles vaccine Shingrix due to competition and price control measures [5] Industry Trends - There is a noticeable divergence in performance among multinational pharmaceutical companies in China, with companies like Novartis achieving an 8% year-on-year sales growth, while Merck's revenue dropped by 70% [6] - The trend indicates a shift from a "golden era" to a phase of "adaptive competition" for multinational pharmaceutical companies in the Chinese market [8] Talent Movement - The transition of high-level talent like Cecilia Qi from multinational firms to local companies signifies a trend where experienced professionals are leveraging their expertise to enhance local firms' competitiveness [12][14] - The collaboration between GSK and local companies like Heng Rui Pharmaceutical highlights the growing importance of partnerships with domestic firms to navigate the evolving market landscape [10][13]

从GSK到奥利佳:21年老将跳槽 跨国药企迎转型阵痛

2 1 Shi Ji Jing Ji Bao Dao· 2025-09-20 05:22

Core Insights - The departure of Cecilia Qi from GSK after 21 years reflects significant strategic restructuring and industry changes faced by multinational pharmaceutical companies in the Chinese market [2][3][10] Financial Performance - GSK reported a total revenue of £15.502 billion (approximately $20.157 billion) for the first half of 2025, marking a 5% year-on-year increase [2] - Revenue from GSK's vaccine segment reached £4.186 billion (approximately $5.443 billion), with a 1% year-on-year growth [2] - Sales of the respiratory syncytial virus vaccine Arexvy fell by 39% to £144 million (approximately $187 million) [2] - Sales of the shingles vaccine Shingrix decreased by 1% to £1.720 billion (approximately $2.236 billion) [2] - GSK anticipates a 3% to 5% growth in total revenue and a 6% to 8% increase in core operating profit for the full year of 2025 [2] Strategic Adjustments - GSK's business structure is based on three pillars: specialty medicines, vaccines, and generics, with respective revenues of £6.260 billion ($8.141 billion), £4.186 billion ($5.443 billion), and £5.056 billion ($6.573 billion) for the first half of 2025 [5] - GSK initiated a regional integration strategy in June 2025, merging emerging markets with Greater China and intercontinental regions to enhance market flexibility and resource allocation efficiency [5] - The appointment of a Chief Operating Officer in China aims to improve local operational efficiency [5] Market Challenges - GSK faces pressure on its main product lines, with growth drivers becoming insufficient, particularly in the vaccine and specialty drug sectors [6][7] - The company’s traditional high-margin model is under threat due to increased competition and pricing pressures from domestic generic drugs [7] - GSK's strategic focus has shifted towards oncology and immunology, but its pipeline in these areas lags behind competitors like Pfizer and AstraZeneca [7] Industry Trends - There is a noticeable divergence in performance among multinational pharmaceutical companies in China, with Novartis achieving $2.2 billion in sales (an 8% increase) while Merck's revenue plummeted by 70% to $1.075 billion [8][9] - The trend of multinational companies adjusting their strategies from broad coverage to focused approaches is evident, with companies like BMS and Merck restructuring their operations in China [9] - The flow of high-level talent from multinational firms to local companies is increasing, as these professionals bring valuable experience and global perspectives to enhance local competitiveness [12][13] Collaborations and Future Outlook - GSK's collaboration with Heng Rui Medicine, potentially worth up to $12 billion, aims to enhance its pipeline in respiratory and oncology treatments [11] - The shift in multinational companies' strategies indicates a transition from "in China, for China" to "in China, for the world," leveraging local talent and innovation for global markets [13]

GSK迎新人事变动!

Xin Lang Cai Jing· 2025-06-07 04:04

Core Insights - GSK has appointed Dr. Sanjay Gurunathan from Sanofi as the head of its vaccine and infectious disease R&D department, indicating a strategic shift in response to challenges in its vaccine business [1][5] - Gurunathan brings over 20 years of experience from Sanofi, where he held significant roles in vaccine development and regulatory approval [3][4] Company Developments - Gurunathan will be based in Boston and report directly to GSK's Chief Scientific Officer, Tony Wood, overseeing the innovation and development of GSK's extensive vaccine and infectious disease product line [3] - The previous head of this department, Phil Dormitzer, left GSK in December 2023 to start a consulting firm [3] Industry Context - The recent talent exchange between GSK and Sanofi reflects a competitive landscape in the global vaccine industry, which is undergoing strategic adjustments [5] - GSK's vaccine sales have faced pressure, with a reported 8% year-over-year decline in Q1 2025, amounting to £2.1 billion (approximately $2.8 billion) [5] Market Challenges - The CDC's restrictive immunization guidelines have limited the market potential for GSK's RSV vaccine, Arexvy, which is now only recommended for specific high-risk groups aged 60 and above [6] - GSK has adjusted its full-year vaccine revenue expectations to a single-digit decline due to these sales challenges [5] Future Outlook - GSK's vaccine pipeline includes promising projects targeting COVID-19, HIV, and influenza, indicating potential for future growth [7] - Gurunathan's role will likely focus on optimizing the R&D pipeline and enhancing the market presence of existing products, which is crucial for GSK's strategic direction in the evolving vaccine market [7]