CDAYENONFER(00661)

Search documents

港股异动 | 中国大冶有色金属(00661)午后涨超16% 冶炼端反内卷利好频出 冶炼费存在向...

Xin Lang Cai Jing· 2025-11-05 06:30

Core Viewpoint - China Dajie Nonferrous Metals (00661) saw a significant stock price increase, attributed to positive developments in the domestic smelting sector aimed at reducing competition and improving profitability [1] Industry Summary - The CSPT's third-quarter general manager meeting reached a consensus on several measures to combat excessive competition, including the establishment of a user BM system, resisting the use of average pricing by traders and smelters, and initiating a blacklist system [1] - The China Nonferrous Metals Industry Association suggested setting production capacity ceilings for major metals like copper, lead, and zinc, drawing from experiences in the electrolytic aluminum sector [1] - According to Dongfang Securities, the expected implementation of "anti-involution" measures is likely to slow the growth of midstream smelting capacity, potentially leading to an upward adjustment in smelting fees in the medium term [1] Company Summary - China Dajie Nonferrous Metals reported a revenue decline of over 10% in the first half of the year, primarily due to the accelerated release of domestic and international smelting capacity and tight supply of copper concentrate [1] - The company faced continued low smelting processing fees and a reduction in product output, impacting overall financial performance [1]

中国大冶有色金属(00661.HK)午后涨超16%

Mei Ri Jing Ji Xin Wen· 2025-11-05 06:23

Group 1 - China Daye Non-Ferrous Metals (00661.HK) saw a significant increase in stock price, rising over 16% in the afternoon session [1] - As of the report, the stock price increased by 13.33%, reaching HKD 0.102 [1] - The trading volume was recorded at HKD 11.85 million [1]

中国大冶有色金属午后涨超16% 冶炼端反内卷利好频出 冶炼费存在向上改善空间

Zhi Tong Cai Jing· 2025-11-05 06:15

Core Viewpoint - China Dajie Nonferrous Metals (00661) saw a significant stock price increase, rising over 16% in the afternoon trading session, attributed to positive developments in the domestic smelting sector aimed at reducing internal competition [1] Industry Summary - On October 30, the CSPT's third-quarter general manager meeting reached a consensus on several measures, including the establishment of a user BM system, resisting the use of average pricing methods by traders and smelters, preventing malicious competition, and initiating a blacklist system [1] - On October 29, the China Nonferrous Metals Industry Association suggested setting production capacity ceilings for major metals such as copper, lead, and zinc, drawing from the experiences in electrolytic aluminum [1] - According to Dongfang Securities, the expected implementation of "anti-involution" measures is likely to slow the growth of midstream smelting capacity, indicating potential upward improvement in smelting fees in the medium term [1] Company Summary - China Dajie Nonferrous Metals reported a revenue decline of over 10% in the first half of the year, primarily due to the accelerated release of concentrated smelting capacity domestically and internationally, tight supply of copper concentrate, persistently low smelting processing fees, and reduced product output [1]

港股异动 | 中国大冶有色金属(00661)午后涨超16% 冶炼端反内卷利好频出 冶炼费存在向上改善空间

智通财经网· 2025-11-05 06:13

Core Viewpoint - China Dajie Nonferrous Metals (00661) experienced a significant stock price increase, rising over 16% in the afternoon trading session, attributed to positive developments in the domestic smelting sector aimed at reducing competition and improving profitability [1] Industry Summary - The CSPT's third-quarter general manager meeting reached a consensus on several measures to combat excessive competition, including the establishment of a user BM system, resisting the use of average pricing by traders and smelters, and initiating a blacklist system [1] - The China Nonferrous Metals Industry Association suggested considering a production capacity ceiling for major metals such as copper, lead, and zinc, drawing lessons from the electrolytic aluminum sector [1] - According to Dongfang Securities, the expected implementation of "anti-involution" measures is likely to slow the growth of midstream smelting capacity, potentially leading to an upward adjustment in smelting fees in the medium term [1] Company Summary - China Dajie Nonferrous Metals reported a revenue decline of over 10% in the first half of the year, primarily due to the accelerated release of concentrated smelting capacity domestically and internationally, tight supply of copper concentrate, persistently low smelting processing fees, and reduced product output [1]

铜业股拉升反弹,江西铜业涨3% 中国有色矿业涨1.3%

Ge Long Hui· 2025-11-05 03:45

Group 1 - Hong Kong copper stocks experienced a collective rebound, with China Daye Nonferrous Metals leading the rise at approximately 9%, followed by Jiangxi Copper at 3%, and China Gold International and China Nonferrous Mining both up by 1.3% [1] - Mining giant Glencore is reportedly planning to close its Horne smelter and associated copper refinery in Quebec, Canada, due to environmental issues and the substantial capital required for upgrades [1] - The Horne smelter has an estimated annual production capacity of over 300,000 tons, accounting for about 17% of copper imports to the United States, indicating a significant impact on the North American copper supply chain [1] Group 2 - Earlier this year, traders moved large quantities of copper into the U.S. market in anticipation of potential tariffs on copper, which led to a surge in copper prices on the New York Mercantile Exchange (Comex) [1] - In August, former President Trump decided against imposing tariffs on bulk copper, instead targeting value-added copper products, while still leaving the possibility of tariffs on raw copper starting in 2027 [1]

港股异动丨铜业股拉升反弹,江西铜业涨3% 中国有色矿业涨1.3%

Ge Long Hui A P P· 2025-11-05 03:41

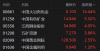

Group 1 - The core viewpoint of the news is that copper stocks in Hong Kong have collectively rebounded, led by China Daye Nonferrous Metals with a rise of approximately 9% [1] - Glencore is planning to close its Horne smelter and associated copper refinery in Quebec, Canada, due to environmental issues and the need for significant capital investment for upgrades [1] - The Horne smelter has an estimated annual production capacity of over 300,000 tons, accounting for about 17% of copper imports to the United States, indicating a potential disruption in the North American copper supply chain [1] Group 2 - Earlier this year, traders moved large quantities of copper into the U.S. market in anticipation of potential tariffs on copper, leading to a surge in copper prices on the COMEX [1] - In August, former President Trump decided not to impose tariffs on bulk copper but targeted tariffs on processed copper products, while leaving the possibility of tariffs on raw copper starting in 2027 [1] Group 3 - The stock performance of key companies includes: - China Daye Nonferrous Metals: latest price 0.098, up 8.89% - Jiangxi Copper: latest price 30.740, up 2.95% - China Gold International: latest price 125.400, up 1.37% - China Nonferrous Mining: latest price 13.390, up 1.36% [2]

中国大冶有色金属(00661) - 股份发行人的证券变动月报表 (截至2025年10月31日)

2025-11-03 08:07

FF301 致:香港交易及結算所有限公司 公司名稱: 中國大冶有色金屬礦業有限公司 呈交日期: 2025年11月3日 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 00661 | 說明 | 普通股 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | | 法定/註冊股本 | | | 上月底結存 | | | 30,000,000,000 | HKD | | 0.05 | HKD | | 1,500,000,000 | | 增加 / 減少 (-) | | | | | | | HKD | | | | 本月底結存 | | | 30,000,000,000 | HKD | | 0.05 | HKD | | 1,500,000,000 | 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年1 ...

港股异动丨国际铜价新高,铜业股集体高开,江西铜业股份涨超6%

Ge Long Hui· 2025-10-30 01:34

Group 1 - The core viewpoint of the article highlights that international copper prices have reached a new high, leading to a collective rise in Hong Kong copper stocks, with Jiangxi Copper Co. rising over 6% and other companies also experiencing significant gains [1] - The London Metal Exchange (LME) copper futures hit a historical high due to increasing global mining supply constraints, with copper prices rising 8.86% this month and 27.38% year-to-date, driven by production disruptions at major copper mines [1] - Mining giant Glencore has lowered its 2025 copper production forecast to 850,000 to 875,000 tons, down from a previous estimate of 850,000 to 890,000 tons, intensifying market concerns over supply tightness [1] Group 2 - Anglo American reported a 9% year-on-year decline in copper production for the first nine months of the year, indicating ongoing pressure on global mining supply [1] - Analysts from ANZ Bank noted that in addition to supply-side factors, the increase in European automobile sales also contributes positively to demand for copper [1] - The article provides specific stock performance data for various companies, including Jiangxi Copper Co. at 34.840 with a 6.15% increase, Minmetals Resources at 7.150 with a 4.23% increase, and others [1]

铜业股集体走高 中美关税谈判主导宏观情绪 预期积极带动铜价接近高点

Zhi Tong Cai Jing· 2025-10-27 04:58

Group 1 - Copper stocks collectively rose, with notable increases: China Daye Non-Ferrous Metals up 10% to HKD 0.099, Luoyang Molybdenum up 7.28% to HKD 17.38, Jiangxi Copper up 4.29% to HKD 35.04, and Zijin Mining up 4.29% to HKD 35.04 [1] - The U.S.-China trade talks in Kuala Lumpur led to preliminary consensus on several key economic issues, indicating a potential easing of tariff pressures [1] - The Grasberg copper mine has no news on resuming production, contributing to tight copper supply and challenging smelting profit environments, with downstream consumption not meeting last year's levels during the traditional peak season [1] Group 2 - Downstream acceptance of copper prices is gradually improving, with better procurement reported this week [2] - Codelco plans to raise the copper surcharge for the European market to USD 345 per ton by 2026, marking a historical high and reflecting market concerns over tight copper supply next year [2] - The long-term outlook for copper prices remains positive, with the sector's valuation at historically low levels, suggesting a buy adjustment [2]

港股异动丨铜业股大涨 中国大冶有色金属涨超14% 中国有色矿业涨5.3%

Ge Long Hui· 2025-10-27 02:17

Group 1 - The core viewpoint of the article highlights a significant rise in Hong Kong copper stocks, driven by a surge in copper prices, which reached a historical high of $11,035 per ton on the London Metal Exchange (LME) [1] - Copper prices have increased by approximately 25% this year, recovering from a sharp sell-off triggered by the escalation of the trade war in April [1] - Supply challenges have become a focal point for investors, particularly due to the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia following a landslide [1] Group 2 - Citigroup's recent research report indicates that global manufacturing sentiment remains mixed, and cyclical demand growth continues to face pressure [1] - Data from Citigroup shows that copper consumption growth in August was weak, rising only 1.3% year-on-year, which is below the strong performance driven by the solar industry in the first half of the year [1] - The bank anticipates that copper consumption growth will remain moderate for the remainder of the year, but maintains a positive outlook for copper prices, predicting they will rise to $12,000 per ton by the second quarter of next year [1] Group 3 - Notable stock performances include China Daye Non-Ferrous Metals rising over 14%, China Nonferrous Mining up 5.3%, Jiangxi Copper and Minmetals Resources increasing by 4%, China Gold International rising by 2.5%, and China Metal Resources up by 1.2% [1]