MJNY(000723)

Search documents

14.65亿元资金今日流入煤炭股

Zheng Quan Shi Bao Wang· 2025-10-23 10:45

Core Points - The Shanghai Composite Index rose by 0.22% on October 23, with 21 out of 28 sectors experiencing gains, led by coal and oil & petrochemicals, which increased by 1.75% and 1.53% respectively [1] - The coal industry topped the gainers' list, while the communication and real estate sectors saw declines of 1.51% and 0.99% respectively [1] - Overall, there was a net outflow of 33.733 billion yuan in the main funds across the two markets, with six sectors seeing net inflows, primarily in coal [1] Industry Summary - The coal industry experienced a 1.75% increase with a net inflow of 1.465 billion yuan, where 34 out of 37 stocks rose, including 8 that hit the daily limit [2] - The top three stocks in terms of net inflow were Zhengzhou Coal Electricity (2.71 billion yuan), Shanxi Coking Coal (1.82 billion yuan), and Shaanxi Black Cat (1.69 billion yuan) [2] - The coal sector had six stocks with net outflows exceeding 10 million yuan, led by Baotailong, Dayou Energy, and Yanzhou Coal Mining, with outflows of 103 million yuan, 6.258 million yuan, and 4.727 million yuan respectively [2][3]

焦炭板块10月23日涨6.18%,陕西黑猫领涨,主力资金净流入5.74亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:27

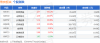

Core Insights - The coke sector experienced a significant increase of 6.18% on October 23, with Shaanxi Black Cat leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index closed at 13025.45, also up 0.22% [1] Sector Performance - Shaanxi Black Cat (601015) closed at 4.57, with a rise of 10.12% and a trading volume of 854,600 shares, amounting to a transaction value of 382 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.59, up 10.07%, with a trading volume of 1,742,800 shares and a transaction value of 779 million yuan [1] - Yunnan Coal Energy (600792) closed at 5.14, increasing by 10.06%, with a trading volume of 620,400 shares and a transaction value of 307 million yuan [1] - Antai Group (600408) closed at 3.19, up 10.00%, with a trading volume of 2,097,600 shares and a transaction value of 640 million yuan [1] - Baotailong (601011) closed at 3.99, with a rise of 3.91% and a trading volume of 3,600,700 shares [1] - Meijin Energy (000723) closed at 5.09, increasing by 3.67%, with a trading volume of 2,192,400 shares [1] - Yunwei Co. (600725) closed at 3.85, down 1.03%, with a trading volume of 686,100 shares [1] Capital Flow - The coke sector saw a net inflow of 574 million yuan from main funds, while retail funds experienced a net outflow of 312 million yuan [1] - The main fund inflows for Shanxi Coking Coal were 173 million yuan, accounting for 22.28% of the total, while retail funds saw a net outflow of 76.96 million yuan [2] - Shaanxi Black Cat had a main fund inflow of 160 million yuan, representing 41.84%, with retail funds experiencing a net outflow of 83.59 million yuan [2] - Antai Group recorded a main fund inflow of 129 million yuan, making up 20.12%, while retail funds had a net outflow of 68.87 million yuan [2] - Meijin Energy had a main fund inflow of 120 million yuan, accounting for 10.84%, with retail funds seeing a net outflow of 98.20 million yuan [2] - Yunwei Co. had a slight main fund outflow of 10.83 million yuan, while retail funds saw a net inflow of 89.10 million yuan [2]

美锦能源(000723.SZ):公司已上线启用氢能交易平台。

Ge Long Hui A P P· 2025-10-23 08:17

Core Viewpoint - Meijin Energy has launched a hydrogen trading platform, marking a significant step in its hydrogen industry chain layout and the implementation of its "one platform" development strategy in hydrogen energy [1] Group 1: Platform Launch - The hydrogen trading platform provides digital tracking services for the entire process of hydrogen production, sales, transportation, logistics, and offers online trading, contract signing, and payment settlement services [1] - The platform serves various users including hydrogen production plants, logistics companies, gas traders, hydrogen refueling stations, and industrial customers [1]

美锦能源(000723.SZ):公司已上线启用氢能交易平台

Ge Long Hui· 2025-10-23 07:59

Core Insights - The company has launched a hydrogen trading platform, marking a significant step in its hydrogen energy strategy [1] Group 1 - The platform provides digital tracking services for the entire hydrogen production, sales, transportation, and logistics process [1] - It serves various users including hydrogen production plants, logistics companies, gas traders, hydrogen refueling stations, and industrial customers [1] - The launch signifies the implementation of the company's "one platform" development strategy within its hydrogen energy initiative [1]

美锦能源(000723.SZ):光触媒海水制氢作为前沿性技术方向,仍处于研究和验证阶段

Ge Long Hui· 2025-10-23 07:59

Core Viewpoint - Meijin Energy (000723.SZ) is focusing on the research and validation of photocatalytic seawater hydrogen production as a cutting-edge technology, while monitoring developments in this area and exploring suitable application paths in line with its hydrogen energy industry chain layout [1] Group 1 - The photocatalytic seawater hydrogen production technology is still in the research and validation stage [1] - The company will continue to pay attention to the development dynamics of related technologies [1] - Meijin Energy plans to explore suitable application paths at the appropriate time [1]

美锦能源(000723.SZ):目前暂无涉及稀土相关业务的规划

Ge Long Hui· 2025-10-23 07:59

Core Viewpoint - The company is currently focused on two main businesses: coal coking and hydrogen energy, aiming to build an integrated industrial chain of "coal-coke-gas-hydrogen" [1] Group 1 - The company has no current plans to engage in rare earth-related businesses, and any future developments will be disclosed in accordance with information disclosure requirements [1] - Investors are advised to pay attention to the company's subsequent announcements regarding matters related to its potential listing on the Hong Kong stock market [1]

焦炭板块10月22日跌2.82%,宝泰隆领跌,主力资金净流出1.63亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

Core Insights - The coke sector experienced a decline of 2.82% on October 22, with Baotailong leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunwei Co. rising by 3.18% to a closing price of 3.89, while other stocks like Yutailong and Shanxi Coking fell by 6.34% and 1.65% respectively [1] - The trading volume for Yunwei Co. was 687,400 shares, with a transaction value of 264 million yuan, while Yutailong had a trading volume of 3,113,100 shares and a transaction value of 1.222 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 163 million yuan from main funds, while retail investors contributed a net inflow of 145 million yuan [1] - Individual stock capital flows indicated that Baotailong had the highest net outflow from main funds at 80.61 million yuan, while Yunwei Co. had a net inflow of 4.28 million yuan from main funds [2]

焦炭板块10月21日跌0.86%,安泰集团领跌,主力资金净流出3.76亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:28

Core Insights - The coke sector experienced a decline of 0.86% on October 21, with Antai Group leading the losses [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunmei Energy rising by 3.44% and Antai Group falling by 7.34% [1] - The trading volume for Yunmei Energy was 1.5663 million shares, while Antai Group had a trading volume of 2.7398 million shares [1] Capital Flow - The coke sector saw a net outflow of 376 million yuan from main funds, while retail investors contributed a net inflow of 158 million yuan [1] - The detailed capital flow indicates that major funds withdrew from several stocks, including Antai Group and Shanxi Coking, while retail investors showed interest in stocks like Yunmei Energy and Meijin Energy [2]

焦炭板块10月20日涨6.02%,陕西黑猫领涨,主力资金净流入5.08亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-20 08:37

Core Insights - The coke sector experienced a significant increase of 6.02% on October 20, with Shaanxi Black Cat leading the gains [1] - The Shanghai Composite Index closed at 3863.89, up 0.63%, while the Shenzhen Component Index closed at 12813.21, up 0.98% [1] Sector Performance - Shaanxi Black Cat (601015) closed at 4.24, with a rise of 10.13% and a trading volume of 1.5557 million shares, amounting to a transaction value of 632 million yuan [1] - Antai Group (600408) closed at 3.27, up 10.10%, with a trading volume of 2.8265 million shares [1] - Baotailong (601011) closed at 4.40, increasing by 10.00%, with a trading volume of 4.7728 million shares, resulting in a transaction value of 2.059 billion yuan [1] - Yunmei Energy (600792) closed at 4.65, up 9.93%, with a trading volume of 508,000 shares [1] - Shanxi Coking Coal (600740) closed at 4.34, increasing by 4.58%, with a trading volume of 803,700 shares [1] - Meijin Energy (000723) closed at 5.01, up 3.09%, with a trading volume of 1.404 million shares [1] - Yunwei Co. (600725) closed at 3.75, increasing by 2.74%, with a trading volume of 520,200 shares [1] Capital Flow - The coke sector saw a net inflow of 508 million yuan from main funds, while retail funds experienced a net outflow of 340 million yuan [1] - The detailed capital flow for individual stocks indicates that Baotailong had a net inflow of 254 million yuan from main funds, while it faced a net outflow of 132 million yuan from retail investors [2] - Shaanxi Black Cat had a net inflow of 104 million yuan from main funds, but also saw a net outflow of approximately 90 million yuan from retail investors [2] - Yunmei Energy recorded a net inflow of 81.515 million yuan from main funds, with a net outflow of around 39 million yuan from retail investors [2] - Meijin Energy had a net inflow of 56.43 million yuan from main funds, while retail investors experienced a net outflow of about 5.12 million yuan [2]

焦炭板块10月17日跌0.44%,美锦能源领跌,主力资金净流出3.39亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-17 08:37

Core Viewpoint - The coke sector experienced a decline of 0.44% on October 17, with Meijin Energy leading the drop. The Shanghai Composite Index closed at 3839.76, down 1.95%, while the Shenzhen Component Index closed at 12688.94, down 3.04% [1] Group 1: Market Performance - The coke sector's individual stock performance varied, with An Tai Group seeing a significant increase of 10.00% to a closing price of 2.97 [1] - Other notable performances included Yunmei Energy, which rose by 2.67% to 4.23, and Baotailong, which increased by 1.27% to 4.00 [1] - Conversely, Meijin Energy fell by 2.80% to 4.86, while Shanxi Coking Coal decreased by 0.72% to 4.15 [1] Group 2: Trading Volume and Capital Flow - The total trading volume for the coke sector was significant, with An Tai Group trading 1.9851 million shares and a transaction value of 5.83 million yuan [1] - The sector experienced a net outflow of 339 million yuan from main funds, while retail investors contributed a net inflow of 241 million yuan [1] - Speculative funds saw a net inflow of 98.38 million yuan, indicating varied investor sentiment within the sector [1]