MJNY(000723)

Search documents

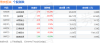

焦炭板块10月17日跌0.44%,美锦能源领跌,主力资金净流出3.39亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-17 08:37

Core Viewpoint - The coke sector experienced a decline of 0.44% on October 17, with Meijin Energy leading the drop. The Shanghai Composite Index closed at 3839.76, down 1.95%, while the Shenzhen Component Index closed at 12688.94, down 3.04% [1] Group 1: Market Performance - The coke sector's individual stock performance varied, with An Tai Group seeing a significant increase of 10.00% to a closing price of 2.97 [1] - Other notable performances included Yunmei Energy, which rose by 2.67% to 4.23, and Baotailong, which increased by 1.27% to 4.00 [1] - Conversely, Meijin Energy fell by 2.80% to 4.86, while Shanxi Coking Coal decreased by 0.72% to 4.15 [1] Group 2: Trading Volume and Capital Flow - The total trading volume for the coke sector was significant, with An Tai Group trading 1.9851 million shares and a transaction value of 5.83 million yuan [1] - The sector experienced a net outflow of 339 million yuan from main funds, while retail investors contributed a net inflow of 241 million yuan [1] - Speculative funds saw a net inflow of 98.38 million yuan, indicating varied investor sentiment within the sector [1]

美锦能源跌2.20%,成交额3.05亿元,主力资金净流出4038.10万元

Xin Lang Cai Jing· 2025-10-17 05:48

Core Viewpoint - Meijin Energy's stock price has shown fluctuations, with a year-to-date increase of 8.43% but a recent decline of 2.20% on October 17, 2023, indicating potential volatility in the market [1] Company Overview - Meijin Energy, established on January 8, 1997, and listed on May 15, 1997, is located in Taiyuan, Shanxi Province. The company primarily engages in the production and sales of coal, coke, natural gas, and hydrogen fuel cell vehicles, with 97.45% of its revenue coming from coal and coke products [1][2] - As of June 30, 2025, Meijin Energy reported a revenue of 8.245 billion yuan, a year-on-year decrease of 6.46%, and a net profit attributable to shareholders of -674 million yuan, reflecting a growth of 1.29% [2] Stock Performance - As of October 17, 2023, Meijin Energy's stock was trading at 4.89 yuan per share, with a total market capitalization of 21.533 billion yuan. The stock has experienced a trading volume of 305 million yuan and a turnover rate of 1.40% [1] - The stock has appeared on the "Dragon and Tiger List" twice this year, with the most recent instance on July 10, 2023, where it recorded a net purchase of 50.3192 million yuan [1] Shareholder Information - As of June 30, 2025, Meijin Energy had 248,700 shareholders, a decrease of 5.77% from the previous period. The average number of circulating shares per person increased by 6.12% to 17,679 shares [2][3] - The top ten circulating shareholders include significant institutional investors, with notable increases in holdings from Guotai Zhongxin Coal ETF and Southern CSI 500 ETF [3]

氢能重卡困局:四起合作背后的虚假繁荣

3 6 Ke· 2025-10-17 00:48

Core Viewpoint - The recent collaborations in the hydrogen heavy truck industry are not indicative of an industry boom but rather a response to the core issues of "unaffordability, inadequate infrastructure, and unsuitability" faced by the sector [1] Cost Issues - The commercialization challenge for hydrogen heavy trucks is primarily cost-related, with a single vehicle priced at 1 million yuan, which is over three times the cost of a comparable diesel truck. Even with subsidies, the price remains at 900,000 yuan [1] - Companies are attempting to share costs through industry chain binding in the recent collaborations, but this does not address the fundamental cost issues [1] - Hebei Sheneng's introduction of a "wind-solar-storage hydrogen" model claims to reduce hydrogen production costs below market prices, but this relies on the unrealistic assumption that green electricity prices remain below 0.3 yuan/kWh [2] - The actual cost of hydrogen production is significantly higher due to low operational rates of decentralized hydrogen production facilities and high transportation costs, with terminal hydrogen prices unlikely to fall below 40 yuan/kg [2] - The reliance on policy subsidies for operational cost advantages raises concerns about sustainability once subsidies are reduced [2] Infrastructure Challenges - The infrastructure issue of "no hydrogen refueling stations" is a significant barrier, with only about 500 hydrogen stations built by mid-2025, mostly concentrated in specific regions, which is insufficient for cross-province logistics [2] - Existing hydrogen stations face low operational loads, with an average utilization rate of less than 30%, indicating a stagnation in the growth of new stations [2] - The high costs associated with building hydrogen stations, which can exceed 3 million yuan per station, further deter capital investment [3] Application Scenarios - The collaboration between Zhika Technology and Yuntao Hydrogen Energy to develop a customized 18-ton vehicle acknowledges the impracticality of generic hydrogen products, as previous models lacked real-world logistics applicability [4] - The operational use of hydrogen heavy trucks is currently limited to fixed routes within companies, which does not address the broader logistics needs where over 50% of operations involve long-distance transport [4] Future Outlook - The collaborations highlight a situation of "localized optimization" rather than a systemic breakthrough in the hydrogen heavy truck industry, with each company seeking to mitigate specific challenges rather than addressing the overall market barriers [5] - For a significant breakthrough, three conditions must be met: reducing green hydrogen costs to below 25 yuan/kg, relaxing approval policies for hydrogen stations to enable large-scale construction, and establishing a profit-sharing mechanism among vehicle manufacturers, energy providers, and logistics companies [5] - Current efforts are seen as preparatory steps towards a future critical point rather than immediate solutions to the industry's challenges [5]

焦炭板块10月16日涨2.01%,安泰集团领涨,主力资金净流入2.24亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Core Insights - The coke sector experienced a 2.01% increase on October 16, with Antai Group leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - Antai Group's stock price rose by 10.20% to 2.70, with a trading volume of 1.8985 million shares and a transaction value of 500 million yuan [1] - Baotailong's stock price increased by 10.03% to 3.95, with a trading volume of 3.8671 million shares and a transaction value of 1.456 billion yuan [1] - Shanxi Coking Coal's stock price rose by 1.70% to 4.18, with a trading volume of 521,600 shares and a transaction value of 217 million yuan [1] - Shaanxi Black Cat's stock price increased by 1.56% to 3.90, with a trading volume of 789,100 shares and a transaction value of 306 million yuan [1] - Yunnan Coal Energy's stock price rose by 1.23% to 4.12, with a trading volume of 386,400 shares and a transaction value of 159 million yuan [1] - Yunwei Co.'s stock price increased by 0.28% to 3.61, with a trading volume of 215,000 shares and a transaction value of 77.4935 million yuan [1] - Meijin Energy's stock price decreased by 0.60% to 5.00, with a trading volume of 778,800 shares and a transaction value of 389.7 million yuan [1] Capital Flow - The coke sector saw a net inflow of 224 million yuan from main funds, while retail funds experienced a net outflow of 113 million yuan and 111 million yuan respectively [1] - Baotailong had a main fund net inflow of 131 million yuan, while retail funds saw a net outflow of 90.41 million yuan [2] - Antai Group experienced a main fund net inflow of 60.25 million yuan, with retail funds seeing a net outflow of 44.32 million yuan [2] - Shanxi Coking Coal had a main fund net inflow of 29.04 million yuan, with retail funds experiencing a net outflow of 8.61 million yuan [2] - Shaanxi Black Cat saw a main fund net inflow of 12.34 million yuan, while retail funds had a net inflow of 0.33 million yuan [2] - Yunnan Coal Energy had a main fund net inflow of 7.76 million yuan, with retail funds seeing a net inflow of 0.86 million yuan [2] - Yunwei Co. experienced a main fund net outflow of 2.72 million yuan, while retail funds had a net inflow of 0.26 million yuan [2] - Meijin Energy had a main fund net outflow of 13.91 million yuan, with retail funds seeing a net inflow of 1.78 million yuan [2]

美锦能源等在内蒙古成立新能源公司 含风电相关业务

Zheng Quan Shi Bao Wang· 2025-10-16 05:44

Core Viewpoint - Inner Mongolia Jinjie New Energy Co., Ltd. has been established with a registered capital of 50 million yuan, focusing on power generation and renewable energy services [1] Company Summary - The legal representative of Inner Mongolia Jinjie New Energy Co., Ltd. is Zhang Peifu [1] - The company is co-owned by Meijin Energy (000723) and Zhejiang Jujie New Energy Development Co., Ltd. through its wholly-owned subsidiary Inner Mongolia Meijin New Energy Co., Ltd. [1] Industry Summary - The business scope of the new company includes power generation, transmission, distribution, wind power generation technology services, and solar power generation technology services [1]

煤炭开采加工板块震荡拉升,宝泰隆此前涨停

Mei Ri Jing Ji Xin Wen· 2025-10-14 02:40

Core Viewpoint - The coal mining and processing sector experienced a significant rally, with multiple companies showing strong performance, indicating a positive trend in the industry [2]. Group 1: Company Performance - Baotailong previously hit the daily limit up, reflecting strong investor interest and confidence in the company [2]. - Jin控煤业, Antai Group, Meijin Energy, and Dayou Energy also saw their stock prices rise, indicating a broader positive movement within the sector [2].

焦炭板块10月13日涨1.48%,宝泰隆领涨,主力资金净流出5131.55万元

Zheng Xing Xing Ye Ri Bao· 2025-10-13 12:45

Core Insights - The coke sector experienced a 1.48% increase on October 13, with Baotailong leading the gains [1] - The Shanghai Composite Index closed at 3889.5, down 0.19%, while the Shenzhen Component Index closed at 13231.47, down 0.93% [1] Sector Performance - Baotailong (601011) closed at 3.60, up 10.09% with a trading volume of 449,300 shares and a transaction value of 162 million yuan [1] - Antai Group (600408) closed at 2.42, up 2.11% with a trading volume of 494,300 shares and a transaction value of 117 million yuan [1] - Yunwei Co. (600725) closed at 3.60, up 1.12% with a trading volume of 217,500 shares and a transaction value of 76.66 million yuan [1] - Meijin Energy (000723) closed at 4.99, up 0.60% with a trading volume of 1,890,300 shares and a transaction value of 439 million yuan [1] - Shaanxi Black Cat (601015) closed at 3.74, up 0.54% with a trading volume of 470,700 shares and a transaction value of 174 million yuan [1] - Yunmei Energy (600792) closed at 3.99, up 0.50% with a trading volume of 226,200 shares and a transaction value of 89.03 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.10, down 0.73% with a trading volume of 362,400 shares and a transaction value of 1.47 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 51.32 million yuan from institutional investors and 39.11 million yuan from retail investors, while retail investors had a net inflow of 90.43 million yuan [1] - Baotailong had a net inflow of 8.45 million yuan from institutional investors, but a net outflow of 8.79 million yuan from retail investors [2] - Yunwei Co. experienced a net inflow of 1.48 million yuan from retail investors despite a net outflow from institutional and speculative investors [2] - Shaanxi Black Cat had a net outflow of 5.27 million yuan from institutional investors but a net inflow of 15.40 million yuan from retail investors [2] - Yunmei Energy saw a significant net outflow from institutional and speculative investors, but a net inflow of 13.40 million yuan from retail investors [2] - Antai Group and Shanxi Coking Coal both experienced net outflows from institutional and speculative investors, with retail investors providing some support [2]

能源ETF(159930)开盘跌2.27%,重仓股中国神华跌0.78%,中国石油跌1.69%

Xin Lang Cai Jing· 2025-10-13 01:36

Core Viewpoint - The Energy ETF (159930) opened with a decline of 2.27%, indicating a negative market sentiment towards energy stocks [1] Group 1: ETF Performance - The Energy ETF (159930) opened at 1.333 yuan, reflecting a drop in value [1] - Since its establishment on August 23, 2013, the fund has achieved a return of 37.76% [1] - The fund's performance over the past month shows a return of 3.11% [1] Group 2: Major Holdings Performance - Major holdings in the Energy ETF experienced declines, including: - China Shenhua down 0.78% - China Petroleum down 1.69% - China Petrochemical down 1.30% - Shaanxi Coal and Chemical Industry down 1.79% - China National Offshore Oil Corporation down 1.64% - Yanzhou Coal Mining down 2.28% - Jereh Group down 3.94% - China Coal Energy down 1.68% - Shanxi Coking Coal down 2.60% - Meijin Energy down 2.82% [1] Group 3: Management Information - The Energy ETF is managed by Huatai-PineBridge Fund Management Co., Ltd. [1] - The fund managers are Dong Jin and Sun Hao [1]

煤炭行业周报(10月第1周):南热北寒需求旺,煤炭红利避险优选-20251012

ZHESHANG SECURITIES· 2025-10-12 03:45

Investment Rating - The industry investment rating is "Positive" [1] Core Viewpoints - The coal sector has shown a rise, outperforming the CSI 300 index by 4.81 percentage points, with a weekly increase of 4.3% as of October 10, 2025 [2] - The report anticipates that winter coal prices could reach 800 RMB/ton, with expectations of price increases during the heating season [6][25] - The supply-demand balance is expected to gradually improve in the fourth quarter, leading to a steady rise in coal prices [6][25] Supply Side Summary - Key monitored enterprises reported an average daily coal sales volume of 6.55 million tons from October 3 to October 9, 2025, a week-on-week decrease of 13% and a year-on-year decrease of 13.6% [2] - The average daily coal production from key monitored enterprises was 6.74 million tons, with a week-on-week decrease of 100% [2] - Total coal inventory (including port storage) reached 25.36 million tons, with a week-on-week increase of 4.4% and a year-on-year decrease of 9% [2][23] Demand Side Summary - Cumulative coal consumption in the power and chemical industries has decreased by 2.9% and increased by 15.4% year-on-year, respectively [2] - Iron and steel production has seen a year-on-year increase of 1.4% [2] Price Summary - The price of thermal coal (Q5500K) in the Bohai Rim was 677 RMB/ton, with a week-on-week increase of 0.15% [3] - The price of coking coal at major ports remained stable, while the price of metallurgical coke increased by 3.18% [4] - The report indicates that coal prices are expected to rise, particularly during the heating season [6][25] Sentiment Summary - The report highlights that the current coal asset dividends are reasonable, with a positive fundamental outlook [6][25] - The report suggests focusing on flexible thermal coal companies and coking coal companies undergoing turnaround [6][25]

山西美锦能源股份有限公司 关于非独立董事辞职暨选举职工董事的公告

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-11 04:58

Group 1 - The resignation of non-independent director Mr. Yao Jinjian was due to personal reasons, and he does not hold any shares in the company [2][3] - The resignation will not affect the company's daily operations or the legal number of board members [2] - The company has elected Mr. Lin Shuai as the employee representative director, effective from the date of the employee representative assembly [3] Group 2 - The board of directors held a meeting on October 10, 2025, to discuss the adjustment of the sustainable development committee members [4][10] - Mr. Zhao Jia was elected as a member of the sustainable development committee, and the other committee members remain unchanged [4][10] - The meeting was attended by all nine directors, and the voting results were unanimous in favor of the adjustments [9][11] Group 3 - Mr. Lin Shuai holds 250,000 shares in the company, acquired through equity incentives, and has not faced any penalties from regulatory authorities [7] - His professional background includes various roles in chemical engineering and management within the company and its subsidiaries [6]