生物柴油

Search documents

卓越新能(688196):2025Q3归母净利润同比扭亏为盈,加速全球化布局与产业链延伸

Changjiang Securities· 2025-11-04 13:13

Investment Rating - The investment rating for the company is "Accumulate" and is maintained [8] Core Insights - In Q3 2025, the company achieved revenue of 1.031 billion yuan, a year-on-year decrease of 1.05% but a quarter-on-quarter increase of 71.05%. The net profit attributable to the parent company was 50 million yuan, a year-on-year increase of 667.56% but a quarter-on-quarter decrease of 10.76%. Excluding one-time impacts, the adjusted net profit for Q3 2025 would be 67.82 million yuan [2][6][14] - The company is actively responding to the EU's anti-dumping sanctions on biodiesel, accelerating its global expansion and extending its industrial chain [2][14] Summary by Sections Financial Performance - For the first three quarters of 2025, the company reported total revenue of 2.343 billion yuan, a year-on-year decrease of 21.24%. The net profit attributable to the parent company was 167 million yuan, a year-on-year increase of 81.24%. The net profit excluding non-recurring items was 159 million yuan, a year-on-year increase of 83.78% [6][14] - In Q3 2025, the company’s revenue was 1.031 billion yuan, with a gross profit margin of 13.71%, which is a significant year-on-year increase of 15.29 percentage points and a quarter-on-quarter increase of 1.76 percentage points [14] Strategic Initiatives - The company is expanding its global footprint and enhancing its industrial chain in response to the EU's anti-dumping duties of 23.4% on its products. Strategies include legal appeals, market strategy adjustments, and international collaborations [14] - Future growth is anticipated through new production capacities in Singapore and Thailand, as well as a joint venture in Saudi Arabia [14] Profit Forecast - The projected net profit attributable to the parent company for 2025-2027 is expected to be 218 million, 406 million, and 482 million yuan, representing year-on-year growth rates of 46%, 87%, and 19% respectively [14]

开源证券给予卓越新能“买入”评级,Q3盈利同环比增长,新项目落地或推动公司成长

Sou Hu Cai Jing· 2025-11-02 03:49

Group 1 - The core viewpoint of the report is that the company,卓越新能, is rated as "buy" due to its positive Q3 earnings growth and potential for future growth driven by new projects [1] - Q3 earnings showed a sequential increase, indicating strong financial performance and growth potential for the company [1] - The demand for biodiesel remains strong, and high prices for fatty alcohols are expected to benefit the company continuously [1] Group 2 - The company is making progress in building overseas bases, which is expected to provide sufficient growth momentum in the future [1]

卓越新能(688196):Q3盈利同环比增长 新项目落地或推动公司成长

Xin Lang Cai Jing· 2025-11-01 00:38

Group 1: Financial Performance - In Q3, the company achieved operating revenue of 1.031 billion yuan, a year-on-year decrease of 1.05% but a quarter-on-quarter increase of 71.05% [1] - The net profit attributable to the parent company in Q3 was 50.02 million yuan, turning from loss to profit year-on-year, but down 10.76% quarter-on-quarter [1] - For the first three quarters of 2025, the company reported operating revenue of 2.343 billion yuan, a year-on-year decline of 21.24%, while the net profit attributable to the parent company was 166.7 million yuan, an increase of 81.24% year-on-year [1] Group 2: Market Trends and Opportunities - The demand for biodiesel continues to improve, with the FOB price of first-generation biodiesel increasing by 1.6% quarter-on-quarter, and the export volume from China reaching 250,000 tons, a 32.3% increase from Q2 [2] - The price of fatty alcohols remains high due to tight supply and strong demand in the downstream daily chemical sector, supported by high palm kernel oil prices [2] - The Ministry of Commerce's support for expanding green trade is expected to further boost biodiesel demand, particularly in the context of carbon reduction initiatives in shipping [2] Group 3: Growth Initiatives - The company is advancing its overseas base construction, with a 100,000 tons/year HVO/SAF production line entering the pipeline installation phase [3] - In Singapore, the company plans to build a first-phase capacity of 100,000 tons/year for first-generation biodiesel, while in Thailand, the project has completed land exploration and is in the design phase for a 30,000 tons/year capacity [3] - The company anticipates that its biodiesel production capacity will exceed one million tons in the future, contributing to its growth [3]

卓越新能(688196):Q3利润环比小幅下滑,新项目贡献成长空间

Xinda Securities· 2025-10-31 13:07

Investment Rating - The investment rating for the company is "Buy" [1] Core Insights - The company reported a slight decline in profits quarter-on-quarter for Q3, but a significant year-on-year increase in net profit due to improved cost control and new product contributions [4][2] - The company is progressing steadily with new projects, including a domestic production line for hydrocarbon-based biodiesel and an overseas biodiesel production line in Thailand, which are expected to contribute to future revenue growth [4] - The forecasted net profits for 2025-2027 are projected to be 269 million, 396 million, and 481 million yuan respectively, with significant year-on-year growth rates [4] Financial Performance Summary - For the first three quarters of 2025, the company achieved revenue of 2.343 billion yuan, a year-on-year decrease of 21.24%, and a net profit of 167 million yuan, a year-on-year increase of 81.24% [1] - In Q3 2025, the company reported a single-quarter revenue of 1.031 billion yuan, a year-on-year decrease of 1.05%, but a quarter-on-quarter increase of 71% [2] - The operating cash flow for the first three quarters was 342 million yuan, reflecting a year-on-year increase of 247.52% [1] Project Development Summary - The company has completed the main equipment installation for its domestic biodiesel production line and is currently in the pipeline installation phase [4] - The company plans to expand its biodiesel production capacity to 1.3 million tons, which includes various domestic and international projects [4] Profit Forecast and Valuation - The projected earnings per share (EPS) for 2025, 2026, and 2027 are 2.12, 3.11, and 3.78 yuan respectively, with corresponding price-to-earnings (P/E) ratios of 23.56, 16.04, and 13.20 [4][5]

生物柴油板块10月28日涨0.65%,海新能科领涨,主力资金净流入3041.83万元

Sou Hu Cai Jing· 2025-10-28 09:17

Core Insights - The biodiesel sector experienced a 0.65% increase on October 28, with Hai Xin Neng Ke leading the gains [1] - The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1] Sector Performance - The biodiesel sector stocks showed varied performance, with the following notable movements: - Ben Liu Neng Yu (300072) closed at 4.04, up 1.51% with a trading volume of 718,800 shares and a turnover of 294 million yuan - Peng Yao Environmental (300664) closed at 5.63, up 1.26% with a trading volume of 151,700 shares and a turnover of 85.2 million yuan - Shan Gao Huan Neng (000803) closed at 6.73, up 1.20% with a trading volume of 75,900 shares and a turnover of 50.7 million yuan - Zhuang Jue Xin Neng (688196) closed at 45.00, up 0.83% with a trading volume of 94,175 shares and a turnover of 42 million yuan - Jia Ao Environmental (603822) closed at 88.93, up 0.51% with a trading volume of 26,000 shares and a turnover of 2.35 billion yuan - Zhong Liang Technology (000930) closed at 5.93, down 0.17% with a trading volume of 133,100 shares and a turnover of 78.9 million yuan - Guo Ji Shi Ye (000159) closed at 6.14, down 0.49% with a trading volume of 145,700 shares and a turnover of 89.6 million yuan [1] Capital Flow Analysis - The biodiesel sector saw a net inflow of 30.4 million yuan from institutional investors, while retail investors experienced a net outflow of 19.4 million yuan [1] - Detailed capital flow for key stocks includes: - Jia Ao Environmental (603822) had a net inflow of 34.5 million yuan from institutional investors, but a net outflow of 2.97 million yuan from retail investors - Zhong Liang Technology (000930) had a net inflow of 6.6 million yuan from institutional investors, with a net outflow of 1.12 million yuan from retail investors - Hai Xin Neng Ke (300072) had a net inflow of 4.0 million yuan from institutional investors, but a significant net outflow of 1.78 million yuan from retail investors - Zhuang Jue Xin Neng (688196) experienced a net outflow of 1.16 million yuan from institutional investors [2]

全球四大重点区域生物柴油政策的实施情况介绍

Qi Huo Ri Bao Wang· 2025-10-28 00:58

Core Insights - The global biodiesel market is experiencing significant growth driven by renewable energy policies across various countries, with the largest consumption concentrated in the EU, the US, Indonesia, and Brazil [2][25]. Group A: Biodiesel Characteristics and Production - Biodiesel is a renewable and biodegradable fuel primarily derived from vegetable oils, accounting for 80% of global production [1]. - The production cost of biodiesel is typically 1.5 times that of conventional diesel, making market-driven expansion challenging without policy support [1]. - Key measures to promote biodiesel include mandating minimum usage levels and providing subsidies to lower production costs [1]. Group B: Regional Policies and Consumption - In 2024, the EU is projected to account for 28.3% of global biodiesel consumption, followed by the US at 26.7%, Indonesia at 20.3%, and Brazil at 11.4% [2]. - The EU has established a robust framework for renewable energy, with the Renewable Energy Directive (RED) setting binding targets for renewable energy consumption [6][7]. - The US has implemented the Renewable Fuel Standard (RFS), which mandates minimum blending ratios and provides tax incentives for biodiesel producers [13]. Group C: EU Biodiesel Market - The EU's biodiesel market is characterized by a combination of mandatory and sustainable policies, with a target of 42.5% renewable energy by 2030 [7]. - The use of used cooking oil (UCO) has increased significantly, making up about 25% of biodiesel feedstock in Europe, driven by sustainability policies [10][11]. - The EU's biodiesel consumption is projected to decrease by 12.27% in 2024, indicating potential market challenges [9]. Group D: US Biodiesel Market - The US is the second-largest biodiesel consumer, with a strong agricultural base supporting biodiesel production from soy and corn [12]. - The EPA's aggressive biodiesel blending targets for 2026 and 2027 indicate a commitment to expanding the biodiesel market [13]. - The industrial use of soybean oil in the US is expected to reach 7.03 million tons in 2025, marking a 26.5% increase [15]. Group E: Indonesia's Biodiesel Strategy - Indonesia, as the largest palm oil producer, has shifted its biodiesel strategy from export-oriented to domestic consumption, implementing the B30 and B40 blending standards [16][17]. - The Indonesian government plans to increase the palm oil export tax to support biodiesel production, ensuring market competitiveness [20][21]. - The B40 policy is expected to significantly impact global palm oil supply and demand dynamics [16]. Group F: Brazil's Biodiesel Development - Brazil, the largest soybean producer, has a slower biodiesel market development despite favorable conditions [22][24]. - The Brazilian government has set a gradual increase in biodiesel blending ratios, aiming for 20% by 2030, which supports soybean demand [24][25]. - Brazil's biodiesel production is projected to reach 8.019 million tons in 2025, reflecting a 2.39% increase from the previous year [25].

丰倍生物即将登陆A股,增收不增利难题待解

Xin Lang Cai Jing· 2025-10-27 02:31

Core Viewpoint - Fengbei Bio is set to list on the Shanghai Stock Exchange, facing a paradox of rising revenue but declining net profit, indicating challenges in profitability and cash flow despite growth in sales [1][6] Financial Performance - In 2024, Fengbei Bio expects revenue to reach 1.948 billion yuan, a 12.7% increase, while net profit is projected to decline by 4.5% to 124 million yuan, marking the second consecutive year of profit decrease [7] - The company's gross margin fell from 13.95% in 2023 to 11.67% in 2024, with net margin also decreasing from 7.50% to 6.37% [7] - Operating cash flow is projected to drop sharply from 162 million yuan in 2023 to only 22 million yuan in 2024, indicating a significant decline in cash generation ability [7][8] IPO and Expansion Plans - Fengbei Bio plans to raise approximately 1.04 billion yuan through its IPO to fund an expansion project aimed at producing 428,200 tons of oil-based biological materials and fuels annually, with a construction period of about two years [1][2] - The project is expected to generate an additional annual revenue of approximately 3.944 billion yuan upon reaching full capacity, nearly doubling the company's 2024 revenue [2] Market Demand and Competition - The International Energy Agency projects global biodiesel consumption to reach 59.93 million tons by 2028, growing at an annual rate of 7.16% [4] - However, the biodiesel industry faces intense competition, with many companies planning large-scale expansions, potentially leading to oversupply and downward pressure on prices and margins [4][12] New Business Ventures - The expansion project also includes plans for producing 60,000 tons of agricultural microbial agents and compound fertilizers, utilizing glycerol, a byproduct of biodiesel production [4][5] - This diversification aims to enhance value and mitigate risks, although the profitability model for this new venture remains uncertain [5] Dependency on Tax Incentives - Fengbei Bio's profitability is significantly supported by tax incentives, with VAT refunds accounting for 13.20% of total profit in 2023, which is expected to drop to 5.14% in 2024 [8] - The company's reliance on tax benefits raises concerns about the stability of its profit margins in the absence of such support [8] Export Market Vulnerabilities - The company heavily relies on overseas markets, with Switzerland and Singapore accounting for about 70% of its exports in 2024, making it vulnerable to policy changes in these regions [10] - Fluctuations in exchange rates and compliance costs pose additional risks to the company's financial performance [10][11] Supply Chain Challenges - Fengbei Bio's raw material supply is unstable, with a notable reliance on individual suppliers for waste oil, which poses quality and compliance risks [11] - The company is exploring alternative sources for waste oil, including imports from Southeast Asia, but faces uncertainties related to costs and regulatory changes [11] Industry Position - In the competitive landscape, Fengbei Bio's scale and profitability are only average compared to peers, with notable differences in net profit levels among industry players [12] - The company must navigate the interplay of policy benefits, expansion pace, and market risks to sustain its growth trajectory [13]

本周,3只新股申购!

Zheng Quan Shi Bao· 2025-10-27 00:12

Group 1: New Stock Listings - Two new stocks were listed in the A-share market last week: Kema Polo and Chaoying Electronics, with Chaoying Electronics seeing a nearly 400% increase on its first day, yielding over 40,000 yuan in profit per subscription [1] - This week, three new stocks are available for subscription: Fengbei Biological, Delijia, and Zhongcheng Consulting, with subscription dates on Monday and Tuesday [1] Group 2: Fengbei Biological - Fengbei Biological is a leading domestic company in the comprehensive utilization of waste oil resources, focusing on the production of biofuels and biobased materials [2] - The company’s IPO price is set at 24.49 yuan per share, with a maximum subscription limit of 11,000 shares per account, requiring a market value of 110,000 yuan [1][2] - Projected revenues for 2022 to 2024 are 1.709 billion yuan, 1.728 billion yuan, and 1.949 billion yuan, with net profits of 133 million yuan, 130 million yuan, and 124 million yuan respectively [2] Group 3: Delijia - Delijia specializes in the research, production, and sales of high-speed heavy-duty precision gear transmission products, primarily for wind power generation [3] - The IPO price is set at a maximum subscription limit of 9,500 shares, requiring a market value of 95,000 yuan [3] - Projected revenues for 2022 to 2024 are 3.108 billion yuan, 4.442 billion yuan, and 3.715 billion yuan, with net profits of 540 million yuan, 634 million yuan, and 534 million yuan respectively [4] Group 4: Zhongcheng Consulting - Zhongcheng Consulting focuses on providing engineering consulting services, including cost estimation, bidding agency, project supervision, and management [5] - The IPO price is set at 14.27 yuan per share, with a maximum subscription limit of 630,000 shares [5] - Projected revenues for 2022 to 2024 are 303 million yuan, 368 million yuan, and 396 million yuan, with net profits of 64 million yuan, 81 million yuan, and 105 million yuan respectively [5][6]

A股申购 | 丰倍生物(603334.SH)开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:45

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times [1] Group 1: Company Overview - Fengbei Bio is a high-tech enterprise in the field of waste resource utilization, primarily producing resource products from waste oils, forming a recycling industry chain of "waste oils - biofuels (biodiesel) - bio-based materials" [1] - The main business of the company focuses on the comprehensive utilization of waste oil resources, with auxiliary operations in oil chemical products [1] - The primary products from waste oil resource utilization include bio-based materials and biofuels, with bio-based materials mainly consisting of pesticide and fertilizer additives, and biofuels primarily being biodiesel [1] Group 2: Market Position and Partnerships - Fengbei Bio has established long-term collaborations with leading companies in the agricultural chemical sector, including Fengle Seed Industry, Jiuyue Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1] - As of the end of 2024, the company has a biodiesel production capacity of 105,000 tons, ranking sixth in China's biodiesel industry [2] Group 3: Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.948 billion CNY for the years 2022, 2023, and 2024, respectively [2] - Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2] - The company indicated that its operating cash flow was good from 2022 to 2023, but a decline in 2024 was noted due to an increase in operating receivables [2]

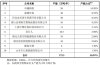

丰倍生物开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:39

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a maximum subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times. The company operates in the waste resource utilization sector, focusing on converting waste oils into biofuels and biobased materials, establishing a comprehensive recycling industry chain [1]. Company Overview - Fengbei Bio is a high-tech enterprise specializing in the comprehensive utilization of waste resources, primarily focusing on waste oils to produce biobased products and biofuels. The main products include biobased materials such as pesticide and fertilizer additives, and biofuels like biodiesel [1]. - The company has established long-term partnerships with leading agricultural chemical firms, including Fengle Seed Industry, Jiuyi Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1]. Production Capacity - As of the end of 2024, Fengbei Bio's biodiesel production capacity is 105,000 tons, ranking sixth in China's biodiesel industry. Compared to peers like Zhuoyue New Energy and Jiaao Environmental Protection, Fengbei's net profit after deducting non-recurring gains is lower than Zhuoyue but higher than Jiaao and Longhai Bio [2][3]. Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.949 billion CNY for the years 2022, 2023, and 2024, respectively. Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2][4]. - Total assets as of December 31, 2024, are 12.368 billion CNY, with equity attributable to shareholders at 7.558 billion CNY. The asset-liability ratio has improved from 49.12% in 2022 to 43.13% in 2024 [4]. Profitability Metrics - For the fiscal year 2024, the company expects a net profit of approximately 1.238 billion CNY, with a basic earnings per share of 1.15 CNY. The return on equity is projected at 17.91%, down from 30.57% in 2022 [5].