TIAN AN(00028)

Search documents

天安卓健委任德勤为新任核数师

Zhi Tong Cai Jing· 2025-10-24 12:46

Core Viewpoint - Tianan Health (00383) announced the resignation of its auditor, Lixin Dehao Certified Public Accountants, effective from October 24, 2025, and appointed Deloitte Touche Tohmatsu as the new auditor to fill the vacancy until the next annual general meeting [1] Group 1 - Lixin Dehao Certified Public Accountants has resigned as the company's auditor [1] - Deloitte Touche Tohmatsu has been appointed as the new auditor effective from October 24, 2025 [1] - The appointment of Deloitte is to fill the temporary vacancy left by the resignation of Lixin Dehao [1]

天安卓健(00383)委任德勤为新任核数师

智通财经网· 2025-10-24 11:55

Core Points - Tianan Health (00383) announced the resignation of its auditor, Lixin Dehao Accounting Firm, effective from October 24, 2025 [1] - The board, upon the recommendation of the company's audit committee, has appointed Deloitte Touche Tohmatsu as the new auditor, effective from October 24, 2025, to fill the vacancy left by Lixin Dehao [1]

天安卓健(00383.HK):立信德豪辞任公司核数师

Ge Long Hui· 2025-10-24 11:53

Group 1 - The company Tianan Health (00383.HK) announced the resignation of its auditor, BDO Limited, effective from October 24, 2025 [1] - The board, upon the recommendation of the audit committee, has appointed Deloitte Touche Tohmatsu as the new auditor, effective from October 24, 2025, to fill the vacancy left by BDO's resignation [1] - The new auditor will serve until the conclusion of the company's next annual general meeting [1]

保险行业首例债券违约!天安财险53亿债券无法兑付,给了我们哪些启示呢?

Sou Hu Cai Jing· 2025-10-22 06:12

Group 1 - The core issue revolves around the default event of Tianan Property Insurance, which announced on September 30 that it would be unable to repay its 5.3 billion yuan capital supplement bond due to insufficient solvency, marking the first default in the insurance industry [3][6] - The bond, issued on September 29, 2015, had a coupon rate of 5.97% for the first five years, which would increase to 6.97% if the issuer did not exercise the redemption option. Tianan chose not to redeem the bond in September 2020, leading to the current default situation [2][3] - Tianan's solvency issues have been longstanding, with the China Banking and Insurance Regulatory Commission taking over the company in July 2020 due to severe corporate governance problems, indicating that the default was a result of accumulated risks rather than a sudden event [2][6] Group 2 - The transfer of Tianan's insurance business, assets, and liabilities to Sheneng Insurance means that customers of Tianan's insurance products will not be affected by the bond default, as Sheneng operates on a healthier platform [6][7] - The default signifies a break from the belief in the "rigid repayment" of bonds issued by large financial institutions, highlighting that even bonds from insurance companies carry risks similar to other financial products [7][9] - The event is seen as a necessary step towards the maturation of the financial market, encouraging investors to focus on the health and governance of issuing institutions rather than relying solely on their reputations [9][10]

夜北京,14景!天安门地区景观照明将升级

Huan Qiu Wang· 2025-10-21 03:29

Core Points - The article discusses Beijing's "14th Five-Year" urban lighting development plan, which aims to enhance the city's nightscape through a structured approach that emphasizes iconic scenes and landmarks [1][2][5] Group 1: Urban Nightscape Structure - Beijing will establish a nightscape structure characterized by "one core, two axes, four rings, and multiple points," highlighting the unique features of the city [1] - The "one core" refers to the capital's functional core area, while the "two axes" include the central axis and its extension, as well as Chang'an Avenue and its extension [1] - The "four rings" consist of the second, third, fourth, and fifth ring roads, with "multiple points" indicating new towns and ecological conservation areas outside the central urban area [1] Group 2: Key Areas for Lighting Enhancement - A comprehensive inspection and upgrade of the lighting in the Tiananmen Square area will be conducted, replacing lighting fixtures older than 15 years and ensuring safety measures are in place [2] - The lighting along Chang'an Avenue will gradually brighten towards Tiananmen, creating a "ceremonial light axis" that enhances the nighttime visibility of key buildings [2] - The traditional central axis will see improvements in lighting for 15 heritage sites, integrating thematic lighting for major events [5] Group 3: Nightscape Features and Attractions - The plan includes the creation of "Night Beijing" with fourteen scenic views, focusing on different perspectives such as overlooking, distant viewing, and close viewing [9][10] - Specific viewpoints include the Fragrant Hills, the Olympic Tower, and the Central Television Tower, which will showcase the city's skyline and historical landmarks [9][10] - The "Night Beijing" initiative will also feature night tours along various water systems, connecting cultural displays, consumption scenes, and urban landscapes [15][17] Group 4: Energy Efficiency and Smart Lighting - The plan aims to increase the application rate of LED light sources from 60% to 90% by 2030, with a target of saving 1.62 billion kWh of electricity annually [18] - Smart control of road lighting is expected to reach 80%, with a comprehensive lighting rate of 98% [18] - The lighting modes will be categorized into four levels based on the day, general holidays, major holidays, and major event guarantees, allowing for flexible adjustments [18] Group 5: Inclusive and Sustainable Lighting - The plan incorporates a "full-age friendly" concept, improving lighting in areas frequented by the elderly and children [19] - It also proposes the establishment of "dark sky protection zones" to promote stargazing and low-impact night tourism [19]

公安部交通管理局发布雾天安全行车指南

Yang Shi Wang· 2025-10-18 01:36

Core Viewpoint - The article discusses the characteristics of fog, its impact on driving safety, and provides guidelines for safe driving in foggy conditions. Group 1: Characteristics of Fog - Fog is a visible collection of tiny water droplets or ice crystals suspended in the atmosphere, reducing horizontal visibility to less than 1 km [1] - Common types of fog include radiation fog, advection fog, upslope fog, and evaporation fog, each formed under different conditions [2][3] - The article highlights the specific concern of "group fog," which has visibility below 200 meters and poses significant risks to road traffic [4] Group 2: Fog Warning Levels - Meteorological departments classify fog into different warning levels based on visibility, including light fog, heavy fog, and severe fog [5][6] - When visibility drops below 500 meters, a yellow warning is issued, and further warnings are escalated as visibility decreases [5] Group 3: Temporal and Spatial Distribution of Fog - Fog distribution in China shows significant regional and seasonal variations, with areas like the Yangtze River basin and coastal regions experiencing more fog days [10] - Seasonal patterns indicate that fog is more prevalent in autumn and winter, particularly in regions with high humidity [11] - Most fog occurs at night and in the early morning, with a peak occurrence between 5 AM and 7 AM [12] Group 4: Impact of Fog on Driving Safety - Fog is one of the most hazardous weather conditions affecting traffic safety, with higher accident rates compared to rain or snow [13] - Data from the U.S. shows that in 2023, fog-related accidents resulted in 399 fatalities, highlighting the severe risks associated with driving in fog [13] Group 5: Challenges for Drivers - Reduced visibility in fog limits drivers' ability to gather visual information, leading to decreased operational precision [15][16] - Psychological stress increases under foggy conditions, causing drivers to misjudge distances and react slower, significantly raising accident risks [17] Group 6: Vehicle Performance in Fog - Fog affects vehicle performance, particularly braking systems, due to reduced road traction and increased stopping distances [19][20] - Lighting systems struggle in fog, as standard headlights lose effectiveness, and the use of high beams can create dangerous glare [21][23] Group 7: Traffic Environment Risks - Highways are particularly vulnerable to fog-related accidents due to sudden visibility drops, leading to multi-vehicle collisions [27] - Rural and mountainous roads face compounded risks due to inadequate infrastructure and complex traffic conditions [28] - Bridges and tunnels present unique challenges in fog, with sudden visibility changes and slippery surfaces increasing accident likelihood [30] Group 8: Safe Driving Strategies in Fog - Drivers are advised to monitor weather forecasts and adjust travel plans accordingly to avoid driving in dense fog [35][36] - Techniques for assessing visibility, such as using road markings and distance markers, can enhance safety during foggy conditions [39][41] - Proper use of vehicle lighting and maintaining safe distances are critical for reducing accident risks in fog [50][54]

53亿元债券违约,天安财险敲响行业警钟:保险资本债不再安全?

Hua Xia Shi Bao· 2025-10-13 12:13

Core Viewpoint - The recent bond default by Tianan Property Insurance, amounting to 5.3 billion yuan, marks the first bond default in the history of China's insurance industry, highlighting the inherent risks in the financial market despite the industry's perceived safety [2][3][4]. Group 1: Default Event Details - Tianan Property Insurance issued a 10-year capital supplement bond in 2015 with a face value of 5.3 billion yuan and an initial interest rate of 5.97%, which would increase to 6.97% if not redeemed at the end of the fifth year [3]. - The company was placed under regulatory control in 2020 due to risks associated with the "Tomorrow System," leading to a suspension of interest payments and a stagnation in business growth [3][4]. - In 2024, a new entity, Sheneng Insurance, acquired Tianan's insurance business assets, but the bond was excluded from this transfer, eliminating hopes for bondholders to recover their investments [3][4]. Group 2: Underlying Issues - The default reflects deeper issues such as ineffective corporate governance, low operational efficiency, and deteriorating asset quality within Tianan Property Insurance [4][5]. - The company has relied heavily on low-margin property insurance and has struggled with high marketing costs, resulting in a net asset return rate consistently below industry standards [4][5]. - Other small insurance companies, like Tianan Life Insurance, also face doubts regarding their ability to repay capital supplement bonds, indicating a broader trend of solvency pressures across the industry [4][5]. Group 3: Market Implications - The default signifies a shift in the perception of insurance capital bonds, moving away from the belief in implicit guarantees, and prompting investors to focus more on the fundamentals of the issuing entities [2][6][8]. - Analysts predict that the event will lead to a more stringent credit risk assessment and a widening of credit spreads, particularly for lower-rated small insurance companies [8][9]. - Regulatory bodies are expected to enhance scrutiny over the bond issuance qualifications of insurance companies, pushing for a more compliant and professional industry landscape [9][10]. Group 4: Future Outlook - The Tianan Property Insurance default is seen as a catalyst for potential consolidation in the insurance sector, with weaker companies likely to exit the market or merge with stronger entities [10]. - The upcoming implementation of new insurance contract accounting standards in 2026 is anticipated to further strain the profitability and solvency of small insurance firms [7][9]. - The event underscores the importance of risk management and may lead to a more mature risk pricing mechanism in China's financial market [6][8].

内险股全线走低 天安财险53亿元债务官宣违约 机构称或事件为市场化风险定价开端

Zhi Tong Cai Jing· 2025-10-13 03:44

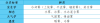

Core Viewpoint - The insurance sector is experiencing a decline, with major companies like Xinhua Insurance, China Pacific Insurance, and China Life all reporting significant stock price drops following a default event in the industry [1] Group 1: Stock Performance - Xinhua Insurance (01336) fell by 3.77%, trading at 45.98 HKD [1] - China Pacific Insurance (02328) decreased by 3.1%, trading at 17.79 HKD [1] - China Life (02628) dropped by 2.54%, trading at 21.5 HKD [1] - China Taiping (02601) saw a decline of 2.93%, trading at 30.48 HKD [1] Group 2: Default Event - Tianan Insurance announced a default on a capital replenishment bond totaling 5.3 billion CNY due to insufficient solvency and inability to repay principal and interest [1] - This event marks the first default on insurance capital replenishment bonds in the industry [1] - According to Founder Securities, this default may signal the beginning of market-driven risk pricing, prompting a need to monitor the stability of shareholders and management, funding cost trends, liability structure, and risk management mechanisms [1] Group 3: Market Opportunities - The return of dividend-type health insurance after 22 years is expected to create new development opportunities in the health insurance sector [1] - The release of high-quality development opinions for health insurance aims to enhance product offerings and service attractiveness, potentially reducing risk in profit margins for insurance companies [1] - This development is anticipated to improve profitability and valuation levels for the insurance sector [1]

港股异动 | 内险股全线走低 天安财险53亿元债务官宣违约 机构称或事件为市场化风险定价开端

智通财经网· 2025-10-13 03:15

Group 1 - The insurance sector is experiencing a decline, with major companies like Xinhua Insurance, China Pacific Insurance, China Life, and China Property & Casualty Insurance reporting significant drops in stock prices, ranging from 2.54% to 3.77% [1] - Tianan Insurance announced a default on a capital replenishment bond totaling 5.3 billion yuan due to insufficient solvency and inability to repay principal and interest, marking the first default in the insurance capital replenishment bond market [1] - According to Founder Securities, Tianan Insurance's default may signal the beginning of market-oriented risk pricing, prompting attention to the stability of shareholders and management, trends in funding costs, liability structure, and risk management mechanisms [1] Group 2 - A new type of dividend-based health insurance has returned to the market after 22 years, with the release of high-quality development opinions for health insurance expected to enhance product offerings and attract more customers [1] - The development of health insurance is anticipated to create new opportunities for various health insurance products, potentially reducing the risk of interest margin losses for insurance companies and improving profitability and valuation levels [1]

首例保险债券违约,天安财险53亿元巨债:债务重组还是全额减记?

Mei Ri Jing Ji Xin Wen· 2025-10-11 07:19

Core Viewpoint - Tianan Property Insurance Co., Ltd. announced that it is unable to repay the principal and interest of its 2015 capital supplement bond due on September 30, 2025, due to insufficient solvency ratio and inability to meet other liabilities [1][3] Group 1: Company Situation - The bond, known as "15 Tianan Insurance Bond," was issued on September 29, 2015, with a total scale of 5.3 billion yuan and a 10-year term [3] - The company has suspended the disclosure of quarterly solvency reports since Q2 2020, with solvency ratios of 185.59% and 236.99% as of Q4 2019 [1] - Tianan Insurance has been under regulatory takeover since July 2020, and it did not exercise its redemption option for the bond in September 2020, leading to interest being accrued without payment [3][6] Group 2: Industry Implications - This event marks the first bond default in the insurance sector, indicating a shift away from rigid repayment practices and towards market-driven risk pricing [1][6] - Analysts suggest that investors need to reassess the risk-return characteristics of capital instruments issued by financial institutions, particularly insurance companies [6][7] - The incident is expected to have a limited systemic impact due to the small size and low importance of Tianan Insurance in the market [7][8] Group 3: Future Solutions - Potential solutions for the bond issue include debt restructuring with extended repayment or full write-off of the capital debt [4][6] - The risk resolution approach for Tianan Insurance involves a "new establishment and bankruptcy" model, with its insurance business being transferred to Sheneng Insurance [8][9]