HOMEY(600467)

Search documents

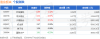

渔业板块10月28日涨0.51%,中水渔业领涨,主力资金净流入633.87万元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:33

Core Insights - The fisheries sector experienced a 0.51% increase on October 28, with Zhongshui Fisheries leading the gains [1] - The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1] Fisheries Sector Performance - Zhongshui Fisheries (000798) closed at 8.16, up 1.62% with a trading volume of 70,800 shares and a transaction value of 57.31 million yuan [1] - Dahu Co. (600257) closed at 5.60, up 0.90% with a trading volume of 116,800 shares and a transaction value of 65.10 million yuan [1] - Kaichuang International (600097) closed at 11.75, up 0.69% with a trading volume of 41,900 shares and a transaction value of 49.25 million yuan [1] - Haodangjia (600467) closed at 2.44, up 0.41% with a trading volume of 228,600 shares and a transaction value of 55.70 million yuan [1] - Zhangzidao (002069) closed at 3.91, unchanged with a trading volume of 88,400 shares and a transaction value of 34.60 million yuan [1] - Guolian Aquatic Products (300094) closed at 3.54, down 0.28% with a trading volume of 228,900 shares and a transaction value of 81.13 million yuan [1] Capital Flow Analysis - The fisheries sector saw a net inflow of 6.34 million yuan from main funds, while retail funds experienced a net outflow of 3.84 million yuan [1] - Zhongshui Fisheries had a main fund net inflow of 11.16 million yuan, accounting for 19.47% of its total [2] - Zhangzidao had a main fund net inflow of 4.61 million yuan, representing 13.34% of its total [2] - Dahu Co. had a main fund net inflow of 765,800 yuan, accounting for 1.18% of its total [2] - Guolian Aquatic Products experienced a significant main fund net outflow of 9.70 million yuan, representing -11.96% of its total [2]

好当家(600467) - 好当家关于2025年第三季度主要经营数据的公告

2025-10-28 08:25

| 经营指标 | 2025 年 1-9 | 月 | 2024 | 年 | 1-9 | 月 | 增减幅度(%) | | --- | --- | --- | --- | --- | --- | --- | --- | | 冷冻调理食品(吨) | | | | | | | | | 产量 | 15076.85 | | | 13717.45 | | | 9.91% | | 销量 | 15365.29 | | | 14060.24 | | | 9.28% | | 库存量 | 1117.73 | | | 871.56 | | | 28.24% | | 捕捞产品(吨) | | | | | | | | | 产量 | 54642.73 | | | 45537.14 | | | 20.00% | | 销量 | 55236.38 | | | 48972.66 | | | 12.79% | | 库存量 | 11373.38 | | | 4715.45 | | | 141.19% | | 海参加工制品(吨) | | | | | | | | | 产量 | 276.87 | | | 144.66 | | | 91.39% | | 销量 | 1 ...

好当家(600467) - 2025 Q3 - 季度财报

2025-10-28 08:25

证券代码:600467 证券简称:好当家 山东好当家海洋发展股份有限公司 2025 年第三季度报告 山东好当家海洋发展股份有限公司 2025 年第三季度报告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者 重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 公司董事会、监事会及董事、监事、高级管理人员保证季度报告内容的真实、准确、完整,不存 在虚假记载、误导性陈述或重大遗漏,并承担个别和连带的法律责任。 公司负责人、主管会计工作负责人及会计机构负责人(会计主管人员)保证季度报告中财务信息 的真实、准确、完整。 第三季度财务报表是否经审计 □是 √否 一、主要财务数据 (一) 主要会计数据和财务指标 单位:元 币种:人民币 | | | 本报告期比 | | 年初至报告期 | | --- | --- | --- | --- | --- | | 项目 | 本报告期 | 上年同期增 | 年初至报告期末 | 末比上年同期 | | | | 减变动幅度 | | 增减变动幅度 | | | | (%) | | (%) | | 营业收入 | 225,070,461.74 | 18.8 ...

好当家:第三季度净利润240.71万元,下降5.33%

Xin Lang Cai Jing· 2025-10-28 08:13

好当家公告,第三季度营收为2.25亿元,同比增长18.81%;净利润为240.71万元,下降5.33%。前三季 度营收为9.36亿元,同比下降3.73%;净利润为2703.19万元,同比下降8.45%。 ...

渔业板块10月27日跌0.74%,中水渔业领跌,主力资金净流出3628.24万元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:25

证券之星消息,10月27日渔业板块较上一交易日下跌0.74%,中水渔业领跌。当日上证指数报收于 3996.94,上涨1.18%。深证成指报收于13489.4,上涨1.51%。渔业板块个股涨跌见下表: | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 600467 | 好当家 | 2.43 | -0.41% | 32.98万 | 8026.73万 | | 300094 | 国联水产 | 3.55 | -0.56% | 27.46万 | 9763.61万 | | 600097 | 开创国际 | 11.67 | -0.68% | 4.16万 | 4867.73万 | | 002069 | 獐子鸟 | 3.91 | -0.76% | 12.22万 | 4780.49万 | | 600257 | 大湖股份 | 5.55 | -1.07% | 16.19万 | 8969.03万 | | 000798 | 中水渔业 | 8.03 | -1.11% | 9.05万 | 7285.54万 | 从资金流向上来看,当日 ...

渔业板块10月24日跌1.29%,中水渔业领跌,主力资金净流出1397.74万元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:21

Core Insights - The fishing sector experienced a decline of 1.29% on October 24, with Zhongshui Fisheries leading the drop at 2.52% [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Sector Performance - The following stocks in the fishing sector showed notable declines: - Zhanzi Island (002069) closed at 3.94, down 0.51% - Guolian Aquatic Products (300094) closed at 3.57, down 1.11% - Kaichuang International (600097) closed at 11.75, down 1.18% - Haodangjia (600467) closed at 2.44, down 1.21% - Dahuhua (600257) closed at 5.61, down 1.23% - Zhongshui Fisheries (000798) closed at 8.12, down 2.52% [1] Capital Flow Analysis - The fishing sector saw a net outflow of 13.98 million yuan from main funds and 10.57 million yuan from speculative funds, while retail investors had a net inflow of 24.54 million yuan [1] - Detailed capital flow for individual stocks includes: - Zhanzi Island: Main funds net inflow of 2.47 million yuan, speculative funds net inflow of 1.33 million yuan, retail net outflow of 3.80 million yuan - Zhongshui Fisheries: Main funds net inflow of 1.07 million yuan, speculative funds net inflow of 0.33 million yuan, retail net outflow of 1.40 million yuan - Kaichuang International: Main funds net outflow of 2.00 million yuan, speculative funds net outflow of 7.64 million yuan, retail net inflow of 9.65 million yuan - Dahuhua: Main funds net outflow of 2.68 million yuan, speculative funds net outflow of 2.61 million yuan, retail net inflow of 5.30 million yuan - Haodangjia: Main funds net outflow of 3.41 million yuan, speculative funds net outflow of 1.47 million yuan, retail net inflow of 4.88 million yuan - Guolian Aquatic Products: Main funds net outflow of 9.42 million yuan, speculative funds net outflow of 0.51 million yuan, retail net inflow of 9.92 million yuan [2]

渔业板块10月23日涨0.46%,开创国际领涨,主力资金净流出3210.54万元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:14

Core Insights - The fishery sector experienced a 0.46% increase on October 23, with KaiChuang International leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index also rose by 0.22% to 13025.45 [1] Stock Performance - KaiChuang International (600097) closed at 11.89, with a rise of 2.32% and a trading volume of 89,400 shares, amounting to a transaction value of 106 million yuan [1] - ZhongShui Fishery (000798) saw a 0.97% increase, closing at 8.33 with a trading volume of 62,700 shares and a transaction value of 51.95 million yuan [1] - DaHu Co. (600257) increased by 0.53%, closing at 5.68 with a trading volume of 122,000 shares and a transaction value of 68.95 million yuan [1] - HaoDangJia (600467) remained unchanged at 2.47, with a trading volume of 282,400 shares and a transaction value of 69.44 million yuan [1] - ZhangZiDao (002069) also remained unchanged at 3.96, with a trading volume of 89,500 shares and a transaction value of 35.24 million yuan [1] - YuanLian Aquatic Products (300094) decreased by 0.55%, closing at 3.61 with a trading volume of 248,500 shares and a transaction value of 89.31 million yuan [1] Capital Flow - The fishery sector saw a net outflow of 32.11 million yuan from main funds, while retail investors contributed a net inflow of 32.45 million yuan [1] - Detailed capital flow for key stocks indicates that KaiChuang International had a net inflow of 2.90 million yuan from main funds, while ZhongShui Fishery experienced a net outflow of 5.19 million yuan [2] - DaHu Co. and HaoDangJia also faced significant net outflows from main funds, amounting to 5.26 million yuan and 5.83 million yuan respectively [2]

渔业板块10月22日跌0.09%,獐子岛领跌,主力资金净流出3794.35万元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

Market Overview - On October 22, the fishery sector declined by 0.09%, with Zhuangzi Island leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Stock Performance - Key stocks in the fishery sector showed mixed performance, with the following closing prices and changes: - Zhongshui Fishery (000798): 8.25, +0.49% - Kaichuang International (600097): 11.62, +0.43% - Haodangjia (600467): 2.47, +0.41% - Guolian Aquatic Products (300094): 3.63, -0.27% - Dahuhua (600257): 5.65, -0.70% - Zhuangzi Island (002069): 3.96, -1.00% [1] Capital Flow - The fishery sector experienced a net outflow of 37.94 million yuan from main funds and 18.56 million yuan from speculative funds, while retail investors saw a net inflow of 56.51 million yuan [1] - Detailed capital flow for key stocks includes: - Guolian Aquatic Products: Main fund net inflow of 1.55 million yuan, retail net inflow of 2.11 million yuan - Zhongshui Fishery: Main fund net outflow of 2.70 million yuan, retail net inflow of 4.19 million yuan - Kaichuang International: Main fund net outflow of 3.48 million yuan, retail net inflow of 7.73 million yuan - Zhuangzi Island: Main fund net outflow of 4.08 million yuan, retail net inflow of 6.34 million yuan - Haodangjia: Main fund net outflow of 11.32 million yuan, retail net inflow of 15.19 million yuan - Dahuhua: Main fund net outflow of 17.90 million yuan, retail net inflow of 20.95 million yuan [2]

渔业板块10月20日涨1.18%,獐子岛领涨,主力资金净流入88.83万元

Zheng Xing Xing Ye Ri Bao· 2025-10-20 08:21

Core Insights - The fisheries sector experienced a rise of 1.18% on October 20, with Zhangzidao leading the gains [1] - The Shanghai Composite Index closed at 3863.89, up 0.63%, while the Shenzhen Component Index closed at 12813.21, up 0.98% [1] Fisheries Sector Performance - Zhangzidao (002069) closed at 3.80, with an increase of 2.43% and a trading volume of 142,600 shares, amounting to a transaction value of 53.69 million yuan [1] - Haodangjia (600467) closed at 2.41, up 1.69%, with a trading volume of 276,100 shares and a transaction value of 66.06 million yuan [1] - Zhongshui Fisheries (000798) closed at 8.04, increasing by 1.52%, with a trading volume of 44,600 shares and a transaction value of 35.68 million yuan [1] - Kaichuang International (600097) closed at 11.19, up 0.81%, with a trading volume of 31,600 shares and a transaction value of 35.14 million yuan [1] - Guolian Aquatic Products (300094) closed at 3.60, with a slight increase of 0.56%, trading 173,900 shares for a total of 62.43 million yuan [1] - Dahuhua (600257) closed at 5.52, up 0.18%, with a trading volume of 109,100 shares and a transaction value of 60.10 million yuan [1] Capital Flow Analysis - The fisheries sector saw a net inflow of 888,300 yuan from institutional investors, while retail investors contributed a net inflow of 1,009,320 yuan [1] - Speculative funds experienced a net outflow of 1,098,150 yuan [1] - Specific stock capital flows included: - Haodangjia (600467) had a net inflow of 8.02 million yuan from institutional investors, but a net outflow of 6.36 million yuan from speculative funds [2] - Dahuhua (600257) saw a net inflow of 495,700 yuan from retail investors despite a net outflow from institutional and speculative funds [2] - Zhangzidao (002069) experienced a net outflow of 998,300 yuan from institutional investors, but a net inflow of 1.71 million yuan from retail investors [2] - Guolian Aquatic Products (300094) had a significant net inflow of 4.89 million yuan from retail investors despite outflows from other investor types [2]

渔业板块10月15日涨0.05%,大湖股份领涨,主力资金净流出283.84万元

Zheng Xing Xing Ye Ri Bao· 2025-10-15 08:27

Core Insights - The fishing sector experienced a slight increase of 0.05% on October 15, with Dahu Co. leading the gains [1] - The Shanghai Composite Index closed at 3912.21, up 1.22%, while the Shenzhen Component Index closed at 13118.75, up 1.73% [1] Sector Performance - Dahu Co. (600257) closed at 5.51, with a rise of 2.04% and a trading volume of 201,900 shares, amounting to a transaction value of 111 million yuan [1] - Zhanzi Island (002069) saw a closing price of 4.04, up 1.00%, with a trading volume of 93,100 shares and a transaction value of 37.49 million yuan [1] - Haodangjia (600467) closed at 2.42, up 0.41%, with a trading volume of 281,400 shares and a transaction value of 68.06 million yuan [1] - Zhongshui Fishery (000798) closed at 8.05, down 0.25%, with a trading volume of 46,000 shares and a transaction value of 36.98 million yuan [1] - Kaichuang International (600097) closed at 11.25, down 0.88%, with a trading volume of 33,900 shares and a transaction value of 38.06 million yuan [1] - Guolian Aquatic Products (300094) closed at 3.69, down 1.34%, with a trading volume of 289,800 shares [1] Capital Flow Analysis - The fishing sector saw a net outflow of 2.84 million yuan from institutional investors and 1.81 million yuan from speculative funds, while retail investors had a net inflow of 4.65 million yuan [1] - Dahu Co. had a net inflow of 9.12 million yuan from institutional investors, but a net outflow of 3.98 million yuan from speculative funds and 5.14 million yuan from retail investors [2] - Haodangjia experienced a net inflow of 1.60 million yuan from institutional investors, with a net inflow of 0.32 million yuan from speculative funds, but a net outflow of 1.92 million yuan from retail investors [2] - Zhanzi Island had a net inflow of 0.86 million yuan from institutional investors, but a significant net outflow of 4.26 million yuan from speculative funds and a net inflow of 3.39 million yuan from retail investors [2] - Kaichuang International faced a net outflow of 0.21 million yuan from institutional investors, with a net inflow of 0.24 million yuan from speculative funds and a negligible net outflow from retail investors [2] - Zhongshui Fishery had a net outflow of 0.48 million yuan from institutional investors, with a net outflow of 1.48 million yuan from speculative funds and a net inflow of 1.96 million yuan from retail investors [2] - Guolian Aquatic Products experienced a significant net outflow of 13.73 million yuan from institutional investors, but a net inflow of 7.35 million yuan from speculative funds and a net inflow of 6.38 million yuan from retail investors [2]