机器人概念

Search documents

华东数控股价涨5.22%,华夏基金旗下1只基金位居十大流通股东,持有846.72万股浮盈赚取474.16万元

Xin Lang Cai Jing· 2025-10-22 02:39

Core Viewpoint - Huadong CNC has experienced a significant stock price increase, reflecting positive market sentiment and potential investment opportunities in the CNC machine tool sector [1][2]. Group 1: Stock Performance - On October 22, Huadong CNC's stock rose by 5.22%, reaching a price of 11.28 CNY per share, with a trading volume of 231 million CNY and a turnover rate of 6.88%, resulting in a total market capitalization of 3.469 billion CNY [1]. - The stock has seen a continuous increase over three days, with a cumulative growth of 3.78% during this period [1]. Group 2: Company Overview - Huadong CNC, established on March 4, 2002, and listed on June 12, 2008, is located in Weihai, Shandong Province, and specializes in the research, production, and sales of CNC machine tools and their key components [1]. - The company's main business revenue is derived from machine tool products, accounting for 99.52%, with other supplementary products making up 0.48% [1]. Group 3: Shareholder Information - Among the top ten circulating shareholders of Huadong CNC, Huaxia Fund's Huaxia CSI Robotics ETF (562500) increased its holdings by 1.5809 million shares in the third quarter, now holding a total of 8.4672 million shares, which represents 2.75% of the circulating shares [2]. - The ETF has generated an estimated floating profit of approximately 4.7416 million CNY today, with a floating profit of 3.3022 million CNY during the three-day increase [2]. Group 4: Fund Performance - The Huaxia CSI Robotics ETF was established on December 17, 2021, with a current scale of 14.471 billion CNY, achieving a year-to-date return of 29.76% and a one-year return of 39.3% [2]. - The fund manager, Hualong, has a total asset scale of 21.741 billion CNY, with the best fund return during the tenure being 117.3% and the worst being -15.08% [2].

方正电机涨2.01%,成交额5833.93万元,主力资金净流出136.99万元

Xin Lang Cai Jing· 2025-10-22 02:36

Group 1 - The core viewpoint of the news is that Fangzheng Electric has experienced significant stock price fluctuations and changes in shareholder structure, with a notable increase in stock price year-to-date but recent declines in the short term [1][2]. - As of October 22, Fangzheng Electric's stock price rose by 2.01% to 9.12 CNY per share, with a total market capitalization of 4.522 billion CNY [1]. - The company has seen a year-to-date stock price increase of 70.15%, but it has declined by 4.50% in the last five trading days and 14.04% in the last 20 days [1]. Group 2 - For the first half of 2025, Fangzheng Electric reported operating revenue of 1.265 billion CNY, representing a year-on-year growth of 8.51%, while the net profit attributable to shareholders was -7.1962 million CNY, a decrease of 951.93% compared to the previous period [2]. - The company has a total of 73,500 shareholders as of June 30, which is a decrease of 1.24% from the previous period, with an average of 6,644 circulating shares per shareholder, an increase of 1.44% [2]. - Since its A-share listing, Fangzheng Electric has distributed a total of 182 million CNY in dividends, with no dividends paid in the last three years [3].

华中数控股价涨5.32%,华夏基金旗下1只基金位居十大流通股东,持有311.99万股浮盈赚取471.1万元

Xin Lang Cai Jing· 2025-10-22 02:34

Group 1 - The core viewpoint of the news is that Huazhong CNC has seen a significant increase in its stock price, rising by 5.32% to reach 29.87 CNY per share, with a total market capitalization of 5.935 billion CNY [1] - Huazhong CNC, established on October 18, 1994, and listed on January 13, 2011, is primarily engaged in the production of CNC systems and components, motors, CNC machine tools, robotic automation systems, and glass machinery [1] - The revenue composition of Huazhong CNC is as follows: CNC systems and machine tools account for 67.97%, robotic and intelligent production lines for 29.30%, and other supplementary businesses for 2.72% [1] Group 2 - Among the top circulating shareholders of Huazhong CNC, Huaxia Fund's Huaxia CSI Robotics ETF (562500) increased its holdings by 554,200 shares in the second quarter, bringing its total to 3.1199 million shares, which represents 1.6% of the circulating shares [2] - The Huaxia CSI Robotics ETF (562500), established on December 17, 2021, has a current scale of 14.471 billion CNY and has achieved a year-to-date return of 29.76%, ranking 1615 out of 4218 in its category [2] - The fund has a one-year return of 39.3%, ranking 936 out of 3869, and a cumulative return since inception of 0.82% [2]

大胜达涨2.09%,成交额3067.24万元,主力资金净流入187.80万元

Xin Lang Zheng Quan· 2025-10-22 02:14

Core Viewpoint - Dazhengda's stock has shown a year-to-date increase of 28.18%, with recent fluctuations indicating a slight decline in the past five days, while the company continues to demonstrate growth in revenue and net profit [1][2]. Group 1: Stock Performance - On October 22, Dazhengda's stock price rose by 2.09%, reaching 9.27 CNY per share, with a total market capitalization of 5.099 billion CNY [1]. - The stock has experienced a net inflow of 1.878 million CNY from main funds, with significant buying activity noted [1]. - Year-to-date, Dazhengda's stock has increased by 28.18%, with a 0.96% decline over the last five trading days, a 5.94% increase over the last 20 days, and a 21.02% increase over the last 60 days [1]. Group 2: Company Overview - Zhejiang Dazhengda Packaging Co., Ltd. was established on November 22, 2004, and went public on July 26, 2019, specializing in the research, production, printing, and sales of corrugated boxes and paperboards [2]. - The company's revenue composition includes 55.26% from box and board products, 25.19% from cigarette labels, 13.41% from wine packaging, and smaller contributions from other products [2]. - As of June 30, the number of shareholders was 21,100, a decrease of 2.54% from the previous period, with an average of 26,119 circulating shares per person, an increase of 2.60% [2]. Group 3: Financial Performance - For the first half of 2025, Dazhengda reported a revenue of 1.025 billion CNY, reflecting a year-on-year growth of 4.77%, and a net profit attributable to shareholders of 59.1465 million CNY, up 22.30% [2]. - The company has distributed a total of 118 million CNY in dividends since its A-share listing, with 68.981 million CNY distributed over the past three years [3]. Group 4: Institutional Holdings - As of June 30, 2025, Hong Kong Central Clearing Limited was the ninth largest circulating shareholder, holding 2.1054 million shares, a decrease of 214,800 shares from the previous period [3].

天智航跌2.01%,成交额1387.00万元,主力资金净流入68.21万元

Xin Lang Cai Jing· 2025-10-22 02:01

Group 1 - The core viewpoint of the news is that Tianzhihang's stock has experienced fluctuations, with a year-to-date increase of 75.28% but a recent decline in the last five and twenty trading days [1] - As of October 22, Tianzhihang's stock price was 17.51 yuan per share, with a market capitalization of 7.926 billion yuan [1] - The company has seen a net inflow of main funds amounting to 682,100 yuan, with significant buying and selling activities recorded [1] Group 2 - Tianzhihang Medical Technology Co., Ltd. specializes in the research, production, sales, and service of orthopedic surgical navigation robots, with a revenue composition of 58.31% from these robots [2] - The company was established on October 22, 2010, and went public on July 7, 2020, operating within the medical device sector [2] - For the first half of 2025, Tianzhihang reported a revenue of 125 million yuan, reflecting a year-on-year growth of 114.89%, while the net profit attributable to shareholders was -57.5482 million yuan, a decrease of 23.80% [2]

三房巷涨2.38%,成交额2712.90万元,主力资金净流入215.00万元

Xin Lang Zheng Quan· 2025-10-22 02:01

Company Overview - Jiangsu Sanfangxiang Polymeric Materials Co., Ltd. is located in Jiangyin City, Jiangsu Province, established on June 13, 1994, and listed on March 6, 2003. The company's main business includes the production and sales of bottle-grade polyester chips and PTA, as well as PBT engineering plastics and thermal power [1][2]. Financial Performance - For the first half of 2025, Sanfangxiang achieved operating revenue of 10.08 billion yuan, a year-on-year decrease of 13.97%. The net profit attributable to the parent company was -271 million yuan, a year-on-year decrease of 90.89% [2]. - The company has cumulatively distributed 1.86 billion yuan in dividends since its A-share listing, with 584 million yuan distributed over the past three years [3]. Stock Performance - As of October 22, the stock price of Sanfangxiang increased by 2.38% to 2.15 yuan per share, with a total market capitalization of 8.378 billion yuan. The stock has risen 16.85% year-to-date [1]. - The stock has appeared on the daily trading leaderboard six times this year, with the most recent appearance on May 14, where it recorded a net purchase of 27.485 million yuan [1]. Shareholder Information - As of June 30, the number of shareholders for Sanfangxiang was 36,700, a decrease of 22.17% from the previous period. The average circulating shares per person increased by 28.48% to 106,172 shares [2]. Industry Classification - Sanfangxiang belongs to the Shenwan industry classification of basic chemicals, specifically in the chemical fiber and polyester sector. It is associated with concepts such as small-cap stocks, robotics, Yangtze River Delta integration, new materials, and low-priced stocks [2].

宇树科技完成第一期上市辅导工作,多只概念股获资金关注

Zheng Quan Shi Bao Wang· 2025-10-22 00:59

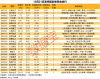

Group 1 - ST Jingfeng (000908) will be subject to delisting risk warning starting October 23, 2025, due to the acceptance of a reorganization application by the Changde Intermediate People's Court [1] - The stock will be renamed to "*ST Jingfeng" with a daily price fluctuation limit of 5%, and it will be suspended for one day on October 22, 2025 [1] - As of the end of 2023, ST Jingfeng reported negative net assets and faced liquidity issues, leading to overdue bonds and previous delisting risk warnings [1] Group 2 - Yushu Technology has completed the first phase of its IPO guidance work, with the report published on the CSRC website detailing the progress [3][5] - The guidance period started on July 18, 2025, and aims to improve corporate governance and operational standards [5] - Yushu Technology plans to submit its IPO application documents between October and December 2025, with relevant operational data to be disclosed at that time [6] Group 3 - The Yushu Robotics concept stocks have shown strong performance this year, with an average price increase of 71.37%, significantly outperforming the Shanghai Composite Index [7] - Notable stocks include Zhejiang Rongtai, Wolong Electric Drive, and Zhongdali De, with year-to-date price increases of 316.38%, 240.73%, and 202.54% respectively [8] - Companies like Aobi Zhongguang-UW have reported positive earnings forecasts, benefiting from advancements in the 3D vision perception industry and expanding application scenarios [9]

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

均普智能连续亏损却要定增募资11.6亿元 前次募投项目进度缓慢甚至信披违规

Xin Lang Zheng Quan· 2025-10-21 07:41

Core Viewpoint - Junpu Intelligent has announced a private placement plan to raise up to 1.161 billion yuan, with nearly half of the funds allocated for the research and industrialization of intelligent robots, amid ongoing financial struggles and project delays since its IPO in 2022 [1][2][3] Group 1: Financing and Project Delays - The company has experienced continuous net profit losses for two and a half years, leading to this new financing initiative [1] - The two core projects from the IPO have faced significant delays, with completion dates pushed from March 2025 to March and September 2026 [2][3] - Regulatory scrutiny has increased due to the company's failure to timely disclose project delays and other financial discrepancies [3] Group 2: Financial Performance - In the first half of 2025, the company reported a revenue of 1.032 billion yuan, a year-on-year decrease of 7.86%, and a net loss of 27.77 million yuan [3] - The company's cumulative net profit, excluding non-recurring gains and losses, has been negative since its listing, totaling a loss of 270 million yuan from 2022 to mid-2025 [3] - Cash flow from operating activities has significantly declined, dropping 84.64% from 197 million yuan in the first half of 2024 to 30.27 million yuan in the same period of 2025, indicating insufficient cash generation from core operations [3] Group 3: Market Performance - Despite poor fundamentals, Junpu Intelligent's stock has performed well in the secondary market, reaching a new high of 16.27 yuan per share on September 18, 2025, with an annual increase of over 60% [4] - As of October 21, 2025, the stock price was 12.73 yuan, representing a cumulative increase of approximately 150% since its listing, which contrasts sharply with its ongoing losses [4] - The company's market valuation has significantly exceeded the industry average, with a total market capitalization of 15.6 billion yuan, reflecting a very high price-to-earnings ratio due to its loss-making status [4]

汉得信息(300170.SZ):暂无机器人概念

Ge Long Hui· 2025-10-21 06:29

Core Viewpoint - Han's Information (300170.SZ) does not currently have a robotics concept and focuses on providing comprehensive digital and intelligent solutions for large and medium-sized enterprises [1] Group 1: Business Focus - The company specializes in full-chain digitalization and intelligence products and solutions for large and medium-sized enterprises [1] - AI intelligent application business includes AI agents, AI middle platforms, vertical AI large models, and a series of supporting services [1] - The company's services cover multiple business areas such as manufacturing, marketing, finance, and supply chain [1] Group 2: Future Plans - The company aims to actively expand its business areas to provide more intelligent products and solutions for a broader range of clients [1]