CDMO业务

Search documents

同和药业(300636) - 300636同和药业投资者关系管理信息20251029

2025-10-30 10:40

Group 1: Company Operations and Production Capacity - The company has completed the construction of 5 workshops in the second phase of its second factory, with 2 workshops currently in trial production and 4 workshops in the first phase officially in operation [1] - By 2026, the company plans to achieve an annual production capacity of 1.5-1.6 billion units, with total raw material production capacity expected to exceed 2 billion units in the next 3-5 years [2] Group 2: Product Development and Market Position - The company has 17 new products in the second tier expected to see significant growth in the next 3-5 years, with 8 products in the third tier currently in the registration process [2] - The company maintains a competitive edge in the raw material drug market due to its complete industrial chain and strong manufacturing capabilities, despite the intense competition from countries like India [2] Group 3: Financial Performance and Challenges - In the third quarter, the company reported a decrease in revenue of 31.7 million, a decline of 13.18% compared to the second quarter, primarily due to the suspension of production for some older products [5] - The company recorded an asset impairment loss of over 30 million in the first three quarters, mainly due to the high costs associated with the production of new product validation batches [4] Group 4: Talent Acquisition and Retention - The company offers competitive salaries for high-end talent, with PhD salaries above the level in first-tier cities, along with government subsidies and stock incentive opportunities [4] Group 5: Future Outlook and Shareholder Returns - The company emphasizes long-term value creation for shareholders through performance improvement and increased communication with the capital market, in addition to cash dividends [5] - The CDMO business is expected to achieve rapid growth by 2027-2028, with current orders amounting to approximately 50 million, including 23 million expected in the fourth quarter [4]

医药+植保双轮驱动,联化科技前三季度净利3.16亿,海外布局加速落地

Quan Jing Wang· 2025-10-28 08:25

Core Insights - The company reported a significant increase in net profit for the first three quarters of 2025, reaching 316 million yuan, a year-on-year growth of 871.65% [1] - Total operating revenue for the same period was 4.718 billion yuan, reflecting an 8.25% year-on-year increase, with Q3 revenue alone at 1.569 billion yuan, up 13.61% [1] - The growth is attributed to a diversified business model, with the pharmaceutical sector being a key driver [1] Business Performance - The pharmaceutical business has become a crucial growth engine, with revenue reaching 1.018 billion yuan in the first half of 2025, a 42.80% increase year-on-year [1] - The subsidiary, Lianhua Angjian, reported revenue of 1.118 billion yuan and a net profit of 270 million yuan, marking a 90.4% increase [1] - The agricultural protection business is showing signs of recovery as the inventory destocking phase ends, contributing positively to overall performance [1] International Expansion - The company is making steady progress in its overseas operations, particularly with the Malaysia project aimed at producing and selling patented agricultural products [2] - The UK subsidiary has shown significant improvement, achieving a net profit of 67.97 million yuan in the first half of 2025, marking a turnaround from previous losses [2] Technological Advancements - The company is focusing on enhancing its production efficiency through technological breakthroughs, including the development of green adsorption technology to reduce energy consumption [2] - Progress has been made in biotechnology, with multiple green enzyme catalysis projects completed and a fermentation platform established for developing biopesticides and biofertilizers [2] Governance and Strategy - A new board of directors was elected in September 2025, led by Chairwoman Wang Ping, which is expected to strengthen the company's governance structure [2] - The company believes that its comprehensive supply chain and mature waste management systems provide a competitive edge in the international market [3] - The recent quarterly results signal strong confidence in the company's resilience and competitive ability amid fluctuating industry cycles and complex international environments [3]

【太平洋医药|点评】普洛药业 :Q3业绩底部已现,看好CDMO业务持续兑现

Xin Lang Cai Jing· 2025-10-27 13:29

Core Viewpoint - The company reported a decline in revenue and profit for the first three quarters of 2025, indicating pressure on profitability and a challenging market environment [1][2]. Financial Performance - For Q1-3 2025, the company achieved revenue of 7.764 billion yuan, a year-over-year decrease of 16.43%, and a net profit attributable to shareholders of 700 million yuan, down 19.48% year-over-year [1][2]. - In Q3 2025, revenue was 2.319 billion yuan, a decline of 18.94% year-over-year, with a net profit of 137 million yuan, down 43.95% year-over-year [2]. - The gross margin for Q1-3 2025 was 25.02%, an increase of 0.79 percentage points year-over-year, while the net margin was 9.02%, a decrease of 0.34 percentage points year-over-year [2]. Business Segments - The API business generated sales of 5.19 billion yuan, down over 20% year-over-year, primarily due to weak demand for antibiotics and a strategic contraction in trading activities [3]. - The CDMO business saw significant growth, with sales of 1.69 billion yuan, a nearly 20% increase year-over-year, and a gross margin of 44.4%, contributing nearly 40% to the overall gross profit [3]. - The company has a backlog of orders worth 5.2 billion yuan for the next 2-3 years, mainly from commercial orders and secondary supply transitions to commercial production [3]. Stock Buyback - The company announced a share buyback plan of 75 to 150 million yuan to support employee stock ownership plans, with a maximum buyback price of 22 yuan per share [3]. Future Outlook - The company is expected to see a gradual improvement in net profit margins from 2026 to 2027, with projected revenues of 10.332 billion yuan, 11.194 billion yuan, and 12.504 billion yuan for 2025, 2026, and 2027 respectively [4]. - The net profit forecast for the same years is 910 million yuan, 1.097 billion yuan, and 1.375 billion yuan, corresponding to a PE ratio of 20, 17, and 14 times [4].

【九洲药业(603456.SH)】业绩增长向好,CDMO客户合作广度和深度持续回暖——2025年三季报点评(王明瑞/曹聪聪)

光大证券研究· 2025-10-21 23:07

Core Viewpoint - The company reported a positive performance in Q3 2025, with revenue and net profit showing significant year-over-year growth, indicating a sustained upward trend in its financial performance [4][5]. Financial Performance - In Q3 2025, the company achieved revenue of 12.90 billion (CNY) (+7.37% YOY) and a net profit of 2.22 billion (CNY) (+42.30% YOY), with a non-GAAP net profit of 2.20 billion (CNY) (+46.42% YOY) [5]. - The gross margin for Q3 2025 was 37.78% (+4.10 percentage points YOY), and the net profit margin was 17.22% (+4.13 percentage points YOY), reflecting a significant improvement in profitability [5]. CDMO Business - The CDMO business generated revenue of 22.91 billion (CNY) in H1 2025 (+16.27% YOY) with a gross margin of 41.02% (-0.04 percentage points YOY) [6]. - The company is deepening collaborations with major clients, with a notable increase in non-commercial projects from overseas core clients and a rapid growth in projects from Biotech clients in the U.S. and Europe [6]. - New orders in Q3 2025 showed a significant recovery, with an increase in key clinical batches and NDA projects, indicating a positive outlook for revenue growth in the next 1-2 years [6]. Emerging Business - The TIDES business is accelerating, with a rapid increase in new peptide projects signed overseas [7]. - The second phase of commercial capacity construction is expected to be operational by November 2025, reaching a scale of 800 kilograms per year, which will alleviate capacity bottlenecks in peptide production [7]. - The company is also establishing commercialization capacity for small nucleic acids domestically while maintaining R&D platforms internationally [7]. API Business - In H1 2025, the API business generated revenue of 5.23 billion (CNY) (-28.48% YOY) with a gross margin of 23.26% (+2.07 percentage points YOY) [9]. - In Q3 2025, prices for certain raw materials showed a slight decline, but the company anticipates an improvement in prices by Q4 2025 [9].

联化科技(002250) - 2025年9月24日投资者关系活动记录表

2025-09-25 07:22

Group 1: Pharmaceutical Business - The pharmaceutical business showed significant growth in the first half of the year, primarily due to concentrated shipments. The company continues to adhere to a major client strategy, focusing on CDMO business models and has established stable commercial relationships with several leading global pharmaceutical companies [1] - The company is actively expanding its client base, targeting strategic and high-viscosity clients, which is expected to drive further growth in the pharmaceutical sector as client product pipelines develop [1] Group 2: Agricultural Protection Business - The agricultural protection business is anticipated to recover in the second half of the year as the client inventory reduction cycle comes to an end. The business primarily focuses on CDMO, covering a range of products including insecticides, herbicides, and fungicides [1] - The company has over 20 years of experience in the agricultural protection industry and is recognized as a strategic partner by five major original research agricultural protection companies, providing comprehensive R&D, production, and supply chain solutions [1] Group 3: Overseas Subsidiaries - The UK subsidiary has improved its operational performance in the first half of the year, with increased capacity utilization and significant foreign exchange gains contributing to its revenue performance [2] - The Malaysian subsidiary is still under construction, with plans for it to focus on the production and sales of patented agricultural protection products once operational [2] Group 4: New Energy Business - The new energy business is expected to achieve significant progress this year, with collaborations established with several leading new energy companies, leading to stable supply and a substantial revenue breakthrough anticipated [2] - The company aims to optimize production and sales processes to reduce costs and enhance profitability in the new energy sector while also focusing on innovative product development [2] Group 5: Competitive Landscape - The company believes that Indian competitors cannot fully replace domestic suppliers, as clients seek to stabilize their supply chains through multi-regional sourcing [2] - China maintains a more comprehensive supply chain system, mature waste management processes, and a robust patent protection system, which provides a competitive edge in the international market [2]

华创医药周观点:医药行业2025年中报业绩综述2025/08/31

华创医药组公众平台· 2025-08-31 05:09

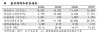

Overall Pharmaceutical Industry - In H1 2025, the pharmaceutical sector's comparable company revenue decreased by 1.9% year-on-year, while net profit attributable to shareholders fell by 2.0%, and net profit excluding non-recurring items dropped by 7.5% [16] - In Q2 2025, the sector's revenue increased by 0.2% year-on-year, net profit attributable to shareholders rose by 4.4%, and net profit excluding non-recurring items grew by 0.8% [16] - The "Innovation Chain" segment recorded the fastest revenue growth in the pharmaceutical industry, with H1 and Q2 2025 revenue increasing by 9.3% and 10.1% respectively [16] - The "Medical Devices" segment experienced the most significant revenue decline, primarily due to inventory clearance and multiple medical insurance cost control measures [16] Pharmaceutical Industry Financial Performance - The pharmaceutical industry revenue in H1 2025 was 1258.73 billion, with a net profit of 100.77 billion and a net profit excluding non-recurring items of 86.53 billion [12] - The revenue growth rates for various segments in H1 2025 included: - Pharmaceutical Industry: -3.0% - Traditional Chinese Medicine: -5.6% - Medical Devices: -6.5% - Innovation Chain: 9.3% - Medical Services: -1.4% - Retail and Distribution: 0.1% [12] Innovative Drug Companies - In H1 2025, the revenue for the innovative drug sector was 1034.3 billion, reflecting a 13.8% increase year-on-year, with net profit attributable to shareholders at 51.0 billion and net profit excluding non-recurring items at 60.5 billion [14][17] - Several innovative drug companies turned profitable for the first time in 2024, including Baiji Shenzhou, Lepu Biopharma, and Aidi Pharmaceutical [13] - The number of INDs, NDAs, and approvals for domestic innovative drugs has been increasing, with significant international licensing transactions occurring [13] Drug Formulation Sector - In H1 2025, the formulation sector's revenue was 1409.6 billion, down 5.1% year-on-year, with net profit attributable to shareholders at 143.1 billion, a decrease of 6.8% [24] - The decline in performance was attributed to price reductions from centralized procurement and insufficient demand, particularly affecting the large-volume infusion segment [24] Raw Material Drug Sector - The raw material drug sector reported revenue of 738.5 billion in H1 2025, a decrease of 3.6% year-on-year, while net profit attributable to shareholders increased by 4.7% to 97.6 billion [29]

药石科技(300725):整体稳步恢复 后端增长强劲 一体化优势有望逐步发力

Xin Lang Cai Jing· 2025-08-28 10:48

Core Viewpoint - The company reported a revenue of 920 million yuan for the first half of 2025, representing a year-on-year growth of 23.48%, while the net profit attributable to shareholders decreased by 26.54% to 72.5 million yuan [1] Group 1: Financial Performance - In Q2 2025, the company achieved a revenue of 465 million yuan, an increase of 26.48%, but the net profit attributable to shareholders fell by 25.40% to 36.71 million yuan [1] - The operating cash flow for the first half of 2025 was 467 million yuan, showing a significant increase of 240.62% [2] - The gross margin for H1 2025 was approximately 31.05%, down by 9.82 percentage points, while the expense ratio was 20.03%, a decrease of 6.61 percentage points [2] Group 2: Business Segments - Revenue from backend drug development and commercialization services reached 765 million yuan, growing by 32.27%, with CDMO services contributing 548 million yuan, a 60.92% increase [3] - The revenue from frontend drug research services was 154 million yuan, a decline of 7.59%, with CRO services experiencing a significant drop of 24.69% [4] Group 3: Strategic Focus and Future Outlook - The company is focusing on revenue scale expansion and nurturing strategic clients, which has led to a higher increase in operating costs compared to revenue growth [2] - The company is expected to gradually recover its CDMO performance as projects continue to progress towards the backend [3] - The company has adjusted its profit forecasts for 2025-2027, expecting revenues of 1.982 billion, 2.393 billion, and 3.043 billion yuan, with corresponding net profits of 178 million, 253 million, and 368 million yuan [5]

普洛药业2025年中报简析:净利润同比下降9.89%,盈利能力上升

Zheng Quan Zhi Xing· 2025-08-20 22:41

Core Viewpoint - Prolo Pharmaceutical's recent financial report indicates a decline in revenue and net profit for the first half of 2025, while showing improvements in profitability metrics such as gross margin and net margin [1][4]. Financial Performance - Total revenue for the first half of 2025 was 5.444 billion yuan, a decrease of 15.31% year-on-year [1]. - Net profit attributable to shareholders was 563 million yuan, down 9.89% year-on-year [1]. - In Q2 2025, total revenue was 2.714 billion yuan, a decline of 15.98% year-on-year, with net profit at 315 million yuan, down 17.48% year-on-year [1]. - Gross margin improved to 25.73%, an increase of 4.18% year-on-year, while net margin rose to 10.34%, up 6.44% year-on-year [1]. Cost and Expenses - Total selling, administrative, and financial expenses amounted to 443 million yuan, representing 8.13% of revenue, an increase of 11.64% year-on-year [1]. - Cash flow from operating activities decreased significantly by 58.48%, attributed to a reduction in contract liabilities and accounts payable [3]. Asset and Liabilities - Cash and cash equivalents decreased to 3.574 billion yuan, down 9.48% year-on-year [1]. - Interest-bearing liabilities increased to 1.208 billion yuan, a rise of 15.30% year-on-year [1]. Investment and Returns - The company's return on invested capital (ROIC) was 13.02%, indicating strong capital returns, with a historical median ROIC of 12.88% over the past decade [4]. - Analysts project the company's performance for 2025 to reach 1.052 billion yuan, with an average earnings per share of 0.91 yuan [4]. Fund Management - Prolo Pharmaceutical is held by prominent fund manager Xu Yan from Dachen Fund, who has recently increased his holdings in the company [5][6]. - The largest fund holding Prolo Pharmaceutical is Dachen Rui Xiang Mixed A, with a scale of 5.194 billion yuan and a recent net value increase of 0.86% [6]. Business Outlook - The company's CDMO (Contract Development and Manufacturing Organization) business is primarily driven by overseas revenue, expected to grow significantly in the next 3 to 5 years, with projections of reaching 6 to 7 billion yuan by 2030 [7].

太平洋给予普洛药业买入评级:Q2利润阶段性承压,CDMO业务毛利贡献创新高

Mei Ri Jing Ji Xin Wen· 2025-08-20 06:09

Group 1 - The core viewpoint of the report is that Pacific Securities has given a "buy" rating for Pro Pharmaceutical (000739.SZ) based on several positive indicators [2] - Q2 revenue and profit faced pressure, but gross margin showed significant improvement [2] - The CDMO (Contract Development and Manufacturing Organization) business is gradually entering a harvest period, with gross margin contribution surpassing that of the API (Active Pharmaceutical Ingredient) business for the first time [2] - The stock buyback reflects the company's confidence in its long-term development [2]

药石科技20250812

2025-08-12 15:05

Summary of the Conference Call for Yaoshi Technology Industry and Company Overview - Yaoshi Technology has been deeply engaged in the molecular building block sector for 19 years, accumulating extensive experience in independent research and patent development, establishing an integrated service system from early research to commercial production [2][5][6] - The core growth point for the company is small molecules, which are essential for new drug development [2][5] Key Points and Arguments - The company has demonstrated excellent performance in cost reduction and efficiency enhancement, with faster delivery speeds and improved service quality, making it difficult for new entrants to penetrate the market [2][8] - In the first half of 2025, the overall revenue of the company grew by 32%, with CDMO (Contract Development and Manufacturing Organization) business increasing by over 60% and order growth approaching 20% [2][11] - The number of phase III and commercial projects increased by 51% year-on-year, indicating a strong pipeline of high-value projects [2][11] - The company expects to adjust its revenue forecast for 2025 to between 1.5 billion to 2 billion, driven by better-than-expected backend revenue and improved capacity utilization [3][13] Future Growth Trends - The backend CDMO business is entering a harvest period, with significant growth expected as commercial projects ramp up [4][12] - By the end of 2025, the company anticipates completing renovations at its Nanjing R&D center, which will alleviate supply-side pressures and restore growth in front-end demand [4] - The company’s integrated service model from research to commercialization is expected to return to a rapid growth trajectory, with net profit anticipated to show significant elasticity in 2026 [4][13] Unique Advantages - Yaoshi Technology has a dedicated information collection team that researches cutting-edge patents globally, allowing the company to provide innovative building blocks to clients [7] - The company’s ability to design, synthesize, and scale building blocks enhances customer dependency and loyalty, creating a competitive edge [7][9] - The proprietary nature of the building blocks, protected by patents, ensures that certain technologies cannot be bypassed, further solidifying the company's market position [9][10] Financial Performance and Projections - The company’s gross margin is expected to recover to between 30% and 35%, with profit elasticity becoming evident as capacity utilization improves [3][13] - The current valuation of the company is considered reasonable but has significant upside potential as order growth accelerates [14] Additional Important Insights - The company has established a comprehensive platform that spans from chemical drug discovery to chemical development and subsequent commercialization [10] - The anticipated increase in capacity utilization and the launch of new projects are expected to enhance profitability and market competitiveness [12][13]