芯片概念

Search documents

石英股份跌2.00%,成交额1.52亿元,主力资金净流出2024.67万元

Xin Lang Zheng Quan· 2025-10-22 03:37

Core Viewpoint - The stock of Quartz Co., Ltd. has experienced fluctuations, with a recent decline of 2.00% and a year-to-date increase of 33.85%, indicating volatility in its market performance [1] Company Overview - Quartz Co., Ltd. is located in Lianyungang City, Jiangsu Province, and was established on April 23, 1999, with its listing date on October 31, 2014 [1] - The company specializes in the research, production, and sales of high-purity quartz materials, including quartz sand, quartz tubes, and quartz crucibles, primarily used in the fields of light sources, photovoltaics, semiconductors, and optical fibers [1] - The revenue composition of the company includes quartz tubes (82.56%), quartz sand (13.38%), other products (3.61%), and quartz crucibles (0.45%) [1] Financial Performance - For the first half of 2025, Quartz Co., Ltd. reported a revenue of 515 million yuan, a year-on-year decrease of 30.13%, and a net profit attributable to shareholders of 107 million yuan, down 58.41% year-on-year [2] - The company has distributed a total of 3.374 billion yuan in dividends since its A-share listing, with 2.945 billion yuan distributed in the last three years [3] Shareholder Information - As of June 30, 2025, the number of shareholders of Quartz Co., Ltd. increased to 63,700, with an average of 8,509 circulating shares per person, a decrease of 9.61% from the previous period [2] - Major shareholders include Hong Kong Central Clearing Limited, holding 8.0003 million shares, and Southern CSI 500 ETF, holding 4.0076 million shares, with changes in their holdings noted [3]

海光信息涨2.07%,成交额20.78亿元,主力资金净流出4597.60万元

Xin Lang Cai Jing· 2025-10-22 02:28

Core Viewpoint - Haiguang Information's stock price has shown significant growth this year, with a year-to-date increase of 61.61% and a recent market capitalization of 562.25 billion yuan [1][2]. Financial Performance - For the period from January to September 2025, Haiguang Information achieved a revenue of 9.49 billion yuan, representing a year-on-year growth of 54.65%. The net profit attributable to shareholders was 1.96 billion yuan, reflecting a year-on-year increase of 28.56% [2]. - The company has distributed a total of 743 million yuan in dividends since its A-share listing [3]. Stock Market Activity - As of October 22, 2023, Haiguang Information's stock price was 241.80 yuan per share, with a trading volume of 2.078 billion yuan and a turnover rate of 0.38% [1]. - The stock has appeared on the "Dragon and Tiger List" twice this year, with the most recent net purchase on September 11 amounting to 155 million yuan [2]. Shareholder Structure - As of September 30, 2025, the number of shareholders increased by 59.34% to 127,500, with an average of 18,230 circulating shares per person, up by 64.54% [2]. - The top ten circulating shareholders include Hong Kong Central Clearing Limited and various ETFs, with some shareholders reducing their holdings [3]. Business Overview - Haiguang Information, established in October 2014 and listed in August 2022, specializes in the research, design, and sales of high-end processors used in servers and workstations. The main business revenue is derived from high-end processors, accounting for 99.73% of total revenue [2]. - The company operates within the semiconductor industry, specifically in digital chip design, and is associated with several concept sectors including AIPC and chip concepts [2].

思特威跌2.01%,成交额8335.29万元,主力资金净流出969.97万元

Xin Lang Cai Jing· 2025-10-22 02:06

Core Viewpoint - The stock of Sitwei (Shanghai) Electronic Technology Co., Ltd. has experienced fluctuations, with a recent decline of 2.01% and a year-to-date increase of 36.95% [1] Financial Performance - For the period from January to June 2025, Sitwei achieved a revenue of 3.786 billion yuan, representing a year-on-year growth of 54.11% [2] - The net profit attributable to shareholders for the same period was 397 million yuan, showing a significant year-on-year increase of 164.93% [2] Stock and Market Activity - As of October 22, Sitwei's stock price was 106.23 yuan per share, with a market capitalization of 42.688 billion yuan [1] - The trading volume on October 22 was 83.3529 million yuan, with a turnover rate of 0.24% [1] - The stock has seen a net outflow of main funds amounting to 9.6997 million yuan, with large orders showing a buy of 13.179 million yuan and a sell of 16.8295 million yuan [1] Shareholder Information - As of June 30, 2025, the number of shareholders increased to 13,200, a rise of 3.62% [2] - The average number of circulating shares per shareholder decreased by 3.49% to 24,397 shares [2] Dividend Information - Sitwei has distributed a total of 126 million yuan in dividends since its A-share listing [3] Institutional Holdings - As of June 30, 2025, major institutional shareholders include: - Huaxia SSE Sci-Tech Innovation Board 50 ETF, holding 15.5942 million shares, an increase of 1.6464 million shares [3] - E Fund SSE Sci-Tech Innovation Board 50 ETF, holding 11.6467 million shares, an increase of 0.3911 million shares [3] - Harvest SSE Sci-Tech Innovation Board Chip ETF, holding 6.6824 million shares, an increase of 0.6494 million shares [3]

聚灿光电跌2.02%,成交额9935.96万元,主力资金净流出1170.79万元

Xin Lang Cai Jing· 2025-10-22 01:58

Core Viewpoint - The stock of Juzan Optoelectronics has experienced fluctuations, with a recent decline of 2.02%, while the company shows a year-to-date stock price increase of 6.74% [1] Financial Performance - For the period from January to September 2025, Juzan Optoelectronics achieved a revenue of 2.499 billion yuan, representing a year-on-year growth of 23.59% [2] - The net profit attributable to shareholders for the same period was 173 million yuan, reflecting an increase of 8.43% year-on-year [2] Shareholder Information - As of September 30, 2025, the number of shareholders for Juzan Optoelectronics reached 61,200, an increase of 3.41% from the previous period [2] - The average number of circulating shares per shareholder is 11,593, which is a 31.46% increase compared to the previous period [2] Dividend Distribution - Since its A-share listing, Juzan Optoelectronics has distributed a total of 284 million yuan in dividends, with 230 million yuan distributed over the last three years [3] Institutional Holdings - As of September 30, 2025, Hong Kong Central Clearing Limited is the third-largest circulating shareholder, holding 20.1348 million shares, an increase of 10.2563 million shares from the previous period [3] - Baodao Growth Zhihang Stock A is the tenth-largest circulating shareholder, holding 3.1191 million shares as a new shareholder [3]

大为股份跌2.66%,成交额1.71亿元,主力资金净流出919.98万元

Xin Lang Zheng Quan· 2025-10-22 01:40

Group 1 - The core viewpoint of the news is that Dawi Co., Ltd. has experienced fluctuations in stock price and trading volume, with a notable increase in stock price year-to-date and recent trading activity indicating mixed investor sentiment [1][2]. Group 2 - As of October 22, Dawi's stock price decreased by 2.66% to 21.26 CNY per share, with a total market capitalization of 5.046 billion CNY [1]. - Year-to-date, Dawi's stock price has increased by 56.91%, with a 3.96% increase over the last five trading days, 20.80% over the last 20 days, and 26.55% over the last 60 days [1]. - The company has appeared on the trading leaderboard 13 times this year, with the most recent appearance on October 10, where it recorded a net purchase of 14.8074 million CNY [1]. Group 3 - Dawi Co., Ltd. is primarily engaged in the semiconductor memory business, accounting for 92.16% of its revenue, followed by automotive components and other sectors [2]. - The company was established on October 25, 2000, and went public on February 1, 2008, with its main operations located in Shenzhen, Guangdong Province [2]. - As of June 30, the number of shareholders increased by 49.58% to 64,300, while the average circulating shares per person decreased by 33.06% to 3,206 shares [2]. Group 4 - Dawi Co., Ltd. has distributed a total of 84.2937 million CNY in dividends since its A-share listing, with 4.9837 million CNY distributed over the past three years [3].

美埃科技涨1.53%,成交额7351.63万元,近3日主力净流入-2137.32万

Xin Lang Cai Jing· 2025-10-21 12:34

Core Viewpoint - The company, Meai (China) Environmental Technology Co., Ltd., is positioned as a leading player in the domestic semiconductor cleanroom equipment market, focusing on air purification products and environmental governance solutions [2][3]. Company Overview - Meai specializes in the research, production, and sales of air purification products and atmospheric environmental governance products, with its main products including fan filter units, filters, and air purification equipment [3][7]. - The company was awarded the national-level "specialized and innovative" title of "little giant" at the end of 2021, solidifying its status as a leader in the domestic electronic semiconductor cleanroom equipment sector [3]. Financial Performance - For the first half of 2025, Meai achieved operating revenue of 935 million yuan, representing a year-on-year growth of 23.51%, and a net profit attributable to shareholders of 98.02 million yuan, which is a 5.53% increase compared to the previous year [7][8]. - The company has distributed a total of 80.64 million yuan in dividends since its A-share listing [9]. Market Position and Supply Chain - Meai has developed the first domestic 28nm lithography equipment and provides essential air purification products to major semiconductor manufacturers, including Intel and ST Microelectronics, positioning itself competitively against international brands [2][3]. - The company has long-term supply agreements with SMIC, providing various filtration products to meet the stringent air cleanliness requirements of advanced semiconductor manufacturing processes [2][3]. Stock Performance - As of October 21, the stock price of Meai increased by 1.53%, with a trading volume of 73.52 million yuan and a market capitalization of 5.985 billion yuan [1]. - The average trading cost of the stock is 50.52 yuan, with recent trading activity indicating a potential shift in investor sentiment as the stock approaches a resistance level of 45.00 yuan [5][6].

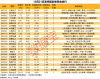

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

格科微涨2.11%,成交额1.72亿元,主力资金净流入1527.20万元

Xin Lang Cai Jing· 2025-10-21 05:53

Core Viewpoint - Geke Micro's stock price has shown fluctuations, with a recent increase of 2.11% and a year-to-date increase of 19.17%, despite a decline in the last five trading days [1] Financial Performance - For the first half of 2025, Geke Micro reported revenue of 3.636 billion yuan, a year-on-year increase of 30.33%, while net profit attributable to shareholders was 29.76 million yuan, a decrease of 61.59% [2] - Cumulative cash dividends since the company's A-share listing amount to 152 million yuan [3] Shareholder Information - As of June 30, 2025, the number of Geke Micro shareholders decreased by 8.99% to 26,700, with an average of 54,363 circulating shares per shareholder, an increase of 9.88% [2] - The top ten circulating shareholders include notable ETFs, with changes in their holdings indicating varying levels of investment interest [3]

广立微涨2.04%,成交额2.55亿元,主力资金净流入414.49万元

Xin Lang Cai Jing· 2025-10-21 05:51

Core Viewpoint - Guangli Microelectronics has shown significant growth in revenue and profit, indicating strong performance in the semiconductor industry, particularly in EDA software and testing equipment [2][3]. Financial Performance - As of June 30, Guangli Microelectronics achieved a revenue of 246 million yuan, representing a year-on-year growth of 43.17% [2]. - The net profit attributable to shareholders reached 15.68 million yuan, marking a substantial increase of 518.42% compared to the previous period [2]. - Since its A-share listing, the company has distributed a total of 217 million yuan in dividends [3]. Stock Market Activity - On October 21, Guangli Microelectronics' stock price increased by 2.04%, reaching 77.04 yuan per share, with a trading volume of 255 million yuan [1]. - The stock has appreciated by 48.66% year-to-date, although it has experienced a decline of 6.04% over the last five trading days [1]. - The company has a total market capitalization of 15.43 billion yuan [1]. Shareholder Information - As of June 30, the number of shareholders increased to 29,300, up by 18.89% from the previous period [2]. - The average number of circulating shares per shareholder decreased by 15.89% to 3,667 shares [2]. - Notable institutional investors include Noan Optimized Allocation Mixed A and Guolian An Zhongzheng All-Index Semiconductor Products and Equipment ETF, with both increasing their holdings [3]. Business Overview - Guangli Microelectronics, established on August 12, 2003, specializes in the design, development, and service of integrated circuit EDA software and wafer-level electrical testing equipment [1]. - The company's revenue composition includes 62.40% from testing equipment and accessories, 37.00% from software development and licensing, and 0.60% from testing services and others [1]. - The company operates within the computer software development sector, focusing on vertical application software, and is involved in several key industry concepts such as photolithography machines and artificial intelligence [1].

强力新材涨2.03%,成交额1.18亿元,主力资金净流入304.62万元

Xin Lang Cai Jing· 2025-10-21 03:38

Core Viewpoint - The stock of Strongly New Materials has shown fluctuations in price and trading volume, with a notable increase in net inflow of funds, indicating potential investor interest despite recent declines in stock price [1][2]. Company Overview - Strongly New Materials, established on November 22, 1997, and listed on March 24, 2015, is located in Changzhou, Jiangsu Province. The company specializes in the research, production, and sales of electronic chemical products, particularly photoresists [2]. - The company's revenue composition includes: 27.33% from other-purpose photoinitiators, 18.98% from PCB photoinitiators, 17.93% from LCD photoinitiators, and other segments contributing smaller percentages [2]. Financial Performance - For the first half of 2025, Strongly New Materials reported a revenue of 458 million yuan, a year-on-year decrease of 1.58%. The net profit attributable to the parent company was -17.09 million yuan, reflecting a significant decline of 1733.02% [2]. - The company has distributed a total of 205 million yuan in dividends since its A-share listing, with no dividends paid in the last three years [3]. Shareholder Information - As of June 30, 2025, the number of shareholders for Strongly New Materials was 75,300, an increase of 20.23% from the previous period. The average number of circulating shares per shareholder was 5,297, a decrease of 16.83% [2]. - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited held 2.1431 million shares, a reduction of 830,100 shares compared to the previous period [3].