稳定币

Search documents

保利集团严正声明

中国能源报· 2025-10-25 05:04

Core Viewpoint - China Poly Group issued a statement to clarify that it is not involved in any activities related to "Hong Kong Poly Stablecoin" or "Poly Stablecoin Fund" [1] Group 1 - China Poly Group and its subsidiaries have not organized or participated in any business or activities related to Hong Kong stablecoins or stablecoin funds [1] - The companies registered in Hong Kong, namely "Poly Digital Industry Group Limited," "Poly Digital Asset Limited," and "Poly Digital Asset Issuance Limited," have no equity or affiliation with China Poly Group and its subsidiaries [1] - All actions taken by these Hong Kong registered companies are unrelated to China Poly Group, and the group urges the public to be cautious and verify information before engaging in investment activities [1]

今年利润预计150亿美元,利润率高达99%,用户数超5亿,估值5000亿美元!“稳定币老大”Tether“春风得意”

Hua Er Jie Jian Wen· 2025-10-25 01:48

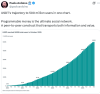

Core Insights - Tether Holdings Ltd. is attracting global capital due to its impressive profitability and market dominance, with an expected profit nearing $15 billion this year and potential financing discussions that could value the company at $500 billion [1][3][5] Financial Performance - Tether's profit margin is an astonishing 99%, driven by high-interest income from its substantial reserve assets, primarily consisting of cash and short-term U.S. Treasury securities [5][6] - The company reported a profit of approximately $13 billion last year, benefiting from the high-interest rate environment [5][6] Market Position and User Base - Tether's USDT currently has a market circulation value of about $183 billion, holding approximately 60% of the entire stablecoin market [5] - The number of "real users" of Tether has surpassed 500 million, representing about 6.25% of the global population, indicating its extensive global influence [1][7] Financing and Valuation - Tether is in negotiations to raise up to $20 billion by selling about 3% of its shares, which could elevate its valuation to around $500 billion, placing it among the world's top unicorn companies [3][6] - Major investment firms, including SoftBank and Ark Investment Management, have shown interest in participating in this financing round, which could enhance Tether's mainstream applications in technology and finance [6][7] Business Expansion - Tether plans to re-enter the U.S. market later this year with a new stablecoin project named USAT, aiming to leverage favorable policies towards cryptocurrencies [7] - The company is diversifying its investment portfolio, including a notable investment in Juventus Football Club, where it holds 11.5% of the shares and has proposed two board candidates to represent fans [7]

保利集团:未组织或参与涉及香港稳定币、稳定币基金相关业务及活动

Xin Jing Bao· 2025-10-25 00:12

保利集团及下属公司未组织或参与任何涉及香港稳定币、稳定币基金相关业务及活动。香港注册登记 的"保利數字產業集團有限公司""保利數字資產有限公司""保利数字資產發行有限公司"与保利集团及下 属公司无任何股权或隶属关系,也不存在任何投资、合作、业务等关系,其一切行为均与保利集团无 关。 新京报讯10月24日,中国保利集团发布声明: 为维护社会经济秩序和公众合法权益,保利集团针对近期网络传播的有关"香港保利稳定币""保利稳定 币基金"及相关主体情况澄清声明如下: 保利集团提醒社会各界提高警惕,注意甄别,谨慎开展投资合作,如发现违法犯罪行为,请尽快到公安 机关报案。 特此声明。 ...

Customers Bancorp Q3 2025 Earnings Transcript

Yahoo Finance· 2025-10-24 19:44

To deliver long-term and consistent value for our shareholders and our communities by putting clients first and executing with excellence. The numbers you see are the results of our leadership team executing superbly on our unique strategy of single point of contact banking, with the strongest risk management principles. Before we dive into the quarter, I'd like to take a moment to welcome Janet Lee and the TD Cowen team to coverage of Customers Bancorp. It's terrific to have you and Steve following our sto ...

美联储沃勒提案落地,USDC资金费率迎拐点,XBIT平台流动性激增200%

Sou Hu Cai Jing· 2025-10-24 07:16

Core Insights - The Federal Reserve's proposal to advance the "streamlined master account" allows eligible cryptocurrency companies and stablecoin issuers direct access to Fed payment channels, marking a significant shift in the U.S. financial regulatory stance towards digital assets [1][3] - Following the announcement, USDC trading volume on the XBIT decentralized exchange surged over 200%, reaching a daily liquidity high of $540 million, indicating strong market interest and response [1][8] Summary by Sections Federal Reserve Proposal - The "streamlined master account" plan aims to provide limited Fed payment service access to specific non-bank institutions without requiring a full banking license, facilitating faster and lower-cost dollar settlements [3] - This change allows companies like Ripple and stablecoin issuers such as Circle and Paxos to bypass traditional banking intermediaries, significantly reducing transaction costs and enhancing compliance and credibility of stablecoins [3] Market Reaction - Following the policy announcement, a significant market reaction was observed, with a whale depositing $5.438 million USDC into HyperLiquid and establishing leveraged positions, reflecting institutional investor confidence in the favorable stablecoin policy [5] - The number of USDC on-chain transactions increased by 340%, with average transaction sizes rising from $82,000 to $237,000, indicating a reallocation of stablecoin assets by institutional investors in anticipation of rate structure changes [6] XBIT Exchange Performance - XBIT decentralized exchange emerged as a major beneficiary of the policy change, with USDC trading volume reaching $542 million on October 22, a 217% increase from the previous day [8] - XBIT's fee optimization mechanism allowed it to maintain competitive rates around 0.008%, significantly lower than traditional exchanges, thus attracting large transactions and enhancing cost efficiency for traders [8] Long-term Implications - The Federal Reserve's policy shift signifies the formal entry of digital assets into the mainstream financial system, with stablecoins acting as a bridge between traditional finance and the crypto world [9] - As the "streamlined master account" system develops, the application scenarios for USDC and other major stablecoins are expected to expand, leading to more stable and transparent funding rates, which could invigorate the crypto market [9]

1-9月委国家石油公司石油出口额达117亿美元

Shang Wu Bu Wang Zhan· 2025-10-24 04:19

有关专家认为,今年PDVSA石油出口收入或仅为145亿美元,低于此前预期的170亿美元,主要原因包 括国际油价下滑、委国家石油公司提供更多折扣以及美特朗普政府有关许可政策的变动。另有经济学家 指出,委原油生产与出口在2025年年中展现出稳定态势并实现小幅增长,日均产量约110万桶,这得益 于对亚洲地区出口量的增加以及PDVSA通过加密资产和稳定币(如USDT)等替代支付手段更好适应了 外部制裁等因素。 委《银行与商业报》10月21日报道,据石油业监测机构Petroguia数据显示,2025年1至9月,委内瑞拉国 家石油公司(PDVSA)日均出口原油85.68万桶,同比增长18%,但由于主力品种Merey原油单价较上年 同期低8至9美元,造成其总收入(117亿美元)较去年同期仅有小幅增长。 ...

企鹅PAY发布稳定币战略,加速重塑全球支付逻辑

Jiang Nan Shi Bao· 2025-10-24 04:15

Core Insights - The article emphasizes the transition of stablecoins from a niche in the cryptocurrency market to a mainstream financial tool, reshaping global payment systems [1][4] - Penguin PAY aims to build a next-generation financial operating system that connects the digital and real worlds through stablecoins, focusing on a "payment + community" dual-engine strategy [1][6] Company Overview - Penguin PAY, registered in Colorado and headquartered in Singapore, has been focused on building a global ecosystem for cryptocurrency wallets and blockchain payment systems since 2016 [1][2] - The company has expanded its team to over 1,000 personnel globally, covering key regions such as North America, Southeast Asia, and Europe [1] Stablecoin Strategy - The development of stablecoins presents a strategic opportunity for Penguin PAY, as they provide a stable payment medium compared to traditional volatile cryptocurrencies [2][4] - Penguin PAY utilizes its PENG token as a payment vehicle, establishing partnerships with various entities in high-end entertainment and shopping venues across regions like Singapore and Europe [2] DAO Governance Ecosystem - Penguin PAY is building a DAO governance ecosystem that transforms wallet users into community members, allowing them to participate in decision-making and governance [3][4] - The DAO model is designed to encourage user participation and create a value co-creation system, moving from centralized operations to decentralized governance [3][4] Payment and Community Integration - The dual-engine structure of "payment + community" is not merely functional but represents a deeply integrated ecosystem that enhances user engagement and platform value [3][6] - The payment system ensures efficient stablecoin circulation, while the community system fosters user participation and governance [3][6] Market Positioning - Penguin PAY's strategy aligns with the accelerating trend of stablecoin adoption, as evidenced by the increasing transaction volumes surpassing traditional payment networks [4][6] - The company addresses challenges in cross-border payments, such as high fees and delays, by offering a comprehensive wallet service that integrates compliance and convenience [4][5] Future Growth Plans - Penguin PAY plans to expand its global payment network, particularly in emerging markets, and enhance its community governance by opening up proposal and voting rights [8] - The company aims to continuously upgrade its wallet's cross-chain capabilities and security mechanisms to ensure a safe and efficient user experience [8] Conclusion - Penguin PAY is not just building a digital wallet but is reshaping the financial ecosystem by enabling user participation and redefining the relationship between users, assets, and communities [8]

Figure Technology Solutions (NasdaqGS:FIGR) Fireside Chat Transcript

2025-10-23 20:32

Summary of Figure Technology Solutions Fireside Chat Company Overview - **Company**: Figure Technology Solutions - **Ticker**: NasdaqGS:FIGR - **Date of Call**: October 23, 2025 Key Points Industry and Technology - **Blockchain Utilization**: Figure utilizes blockchain technology to create a single source of truth for asset ownership and transactions, addressing issues seen in traditional systems like Tricolor [2][6][7] - **Loan Origination Process**: Loans are originated through a proprietary system that registers them on the Provenance Blockchain, ensuring that all loan characteristics are stored securely and instantly [4][5] Core Technology Features - **DART System**: The Digital Asset Registry and Transfer (DART) system operates similarly to MERS but provides real-time updates directly from the blockchain, enhancing accuracy and reducing fraud risk [10][11] - **Figure Portfolio Manager**: This tool allows clients to view and manage their asset rights, ensuring that all transactions are reflected on the blockchain, thus eliminating discrepancies [8][16] - **eVault**: All loan documents are stored in an eVault, reducing the risk of errors associated with traditional document transfer methods [9] Operational Efficiency - **Lien Perfection**: DART's method of lien perfection eliminates the need for traditional title insurance by confirming clean titles upfront and tracking ownership through blockchain [23][24] - **Stablecoin Integration**: The introduction of Yields, a stablecoin backed by short-term treasuries, enhances transparency and operational efficiency in loan servicing and fund management [19][21][22] Market Position and Future Outlook - **Market Leadership**: Figure claims a leading position in real-world assets with over $18 billion in assets and $65 billion in transactions, indicating robust growth and market traction [26] - **Interoperability Challenges**: While acknowledging the proliferation of blockchains, Figure believes that public blockchains will prevail, and interoperability will improve over time through technological advancements [25][27][28] Risk Management - **Collateral Verification**: The technology allows for easier collateral verification and auditing, which has become increasingly important post-Tricolor incident [15][16] - **Preventing Double Pledging**: The blockchain's structure prevents double pledging of assets, enhancing security and trust in transactions [7][20] Conclusion - Figure Technology Solutions is positioned to disrupt traditional capital markets through its innovative use of blockchain technology, operational efficiencies, and a strong market presence, while addressing interoperability and risk management challenges in the evolving financial landscape [12][26][28]

Revolut Secures MiCA License in Cyprus—Is a Stablecoin Next?

Yahoo Finance· 2025-10-23 16:01

Core Insights - Revolut has obtained a Markets in Crypto-Assets (MiCA) licence from the Cyprus Securities and Exchange Commission (CySEC), enabling it to provide crypto-asset services across the European Economic Area (EEA) [1] - The company plans to launch a "1:1 conversion between stablecoins and USD" without spreads, indicating a significant expansion in its crypto offerings [2] - There are ongoing speculations about Revolut launching its own stablecoin, with a plausible timeline suggested for 2026 following the MiCA approval [4] Group 1: Regulatory Developments - The MiCA licence allows Revolut to market crypto services in all 30 EEA markets, although further scrutiny from individual EU states may be required [1] - The CEO of Revolut Digital Assets Europe emphasized that the licence reflects CySEC's confidence in the company's regulatory compliance in the crypto sector [2] - Other companies, like Coinbase, are also utilizing Cyprus for MiCA approval, indicating a trend among digital banks [3] Group 2: Product Expansion - Revolut has been providing crypto trading since 2017 and has steadily expanded its services, including the launch of Revolut X, a standalone crypto exchange for trading 200 cryptocurrencies [2] - The introduction of a stablecoin by Revolut is seen as a potential development, especially with the MiCA framework now in place [4] - Legal experts suggest that Revolut is positioned to issue its own stablecoin under the EU framework, contingent on compliance with regulatory requirements [4]

2000万亿!史无前例的泡沫破裂!

商业洞察· 2025-10-23 09:28

Core Viewpoint - The article discusses the recent incident involving Paxos, which minted 300 trillion PYUSD stablecoins, highlighting the ease with which stablecoins can be created and the potential risks associated with such actions in the cryptocurrency market [4][5][9]. Group 1: Incident Overview - On October 15, Paxos minted 300 trillion PYUSD stablecoins, which are pegged to the US dollar at a 1:1 ratio [4]. - This amount, when converted, is approximately 2130 trillion RMB, and Paxos later sent all of these tokens to inaccessible wallet addresses for destruction [5][6]. - Paxos explained that this was due to an internal technical error and assured that there were no security vulnerabilities and customer funds were safe [6][7]. Group 2: Implications of the Incident - The incident raises concerns about the lack of regulation and oversight in the stablecoin market, as Paxos was able to create and destroy such a large amount of currency without significant repercussions [10][11]. - The total value of the minted tokens exceeds twice the GDP of all countries combined, prompting questions about the potential consequences if larger stablecoin issuers like USDT or USDC were to engage in similar practices [11]. Group 3: Market Context - The article notes that the stablecoin market is growing rapidly, with emerging markets like Argentina, Mexico, and Turkey seeing stablecoin usage rates of 25%-30% in cross-border trade, significantly higher than the global average of 12%-18% [18]. - In 2024, the transaction volume of stablecoin cross-border payments is projected to reach between 26.7 trillion and 27.6 trillion USD, surpassing traditional payment systems like Visa and Mastercard [19][20]. Group 4: Technology and Security Concerns - The article emphasizes that while blockchain technology offers innovations, it should not be overly glorified, as risks remain significant in the cryptocurrency market [22][26]. - Recent events, including the seizure of 127,271 bitcoins valued at approximately 15 billion USD linked to a scam operation, illustrate vulnerabilities in the perceived security of cryptocurrencies [28][34].