华为合作

Search documents

研报掘金丨国海证券:首予江淮汽车“增持”评级,华为赋能高端化加速

Ge Long Hui A P P· 2025-11-21 06:52

Core Insights - The report from Guohai Securities indicates that in October 2025, the sales of commercial vehicles and new energy vehicles experienced a year-on-year increase, contributing to a positive growth in total sales for Jianghuai Automobile during the same month [1] - In Q3 2025, the company's revenue showed both quarter-on-quarter and year-on-year growth, although the net profit attributable to the parent company faced short-term pressure due to intensified overseas competition and a high base from asset disposal gains in the previous year [1] - The launch of the high-end model, the Zun Jie S800, in collaboration with Huawei has been successful, with over 15,000 units sold within four months, indicating a strong market entry [1] - The company is accelerating its high-end product strategy and has initiated a new product cycle with Huawei, leading to an "overweight" rating for the stock [1] Financial Performance - Jianghuai Automobile's Q3 2025 revenue increased both quarter-on-quarter and year-on-year, reflecting a positive trend in sales performance [1] - The company's gross margin and revenue per vehicle also saw quarter-on-quarter growth, indicating improved operational efficiency [1] Market Position - The collaboration with Huawei is a significant factor in the company's strategy, particularly with the introduction of the Zun Jie S800, which has successfully penetrated the luxury vehicle market [1] - The report highlights the company's ability to "break the circle" in the high-end market segment, suggesting a shift in consumer perception and demand for its products [1]

赛力斯启动全球发售:折价或高达27%及基石阵容失衡背后 估值与业绩匹配失衡及独立性挑战凸显

Xin Lang Zheng Quan· 2025-10-30 02:15

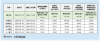

Core Viewpoint - The company, Seres, is set to launch a global offering on October 27, with a pricing date of November 3 and listing on the Hong Kong Stock Exchange on November 5. The offering price is capped at HKD 131.50 per share, with a base issuance of approximately 100 million shares, potentially raising up to HKD 174.3 billion if the overallotment option is fully exercised. This IPO could become the third largest in Hong Kong this year and the largest for a complete vehicle manufacturer since 2022. However, the offering features an unusual discount of over 26%, a lack of participation from foreign long-term funds, and a reliance on government and industrial capital, indicating deeper risks related to valuation and performance, particularly the dependency on Huawei [1][5][13]. Pricing Strategy - The pricing strategy for Seres' IPO shows a stark contrast to similar large A to H projects this year, with a discount of 26.9% compared to the A-share closing price of CNY 163.99. This discount is significantly higher than the typical range for comparable projects, where discounts are generally kept below 20% [2][4]. Investor Composition - The IPO attracted 22 cornerstone investors, raising a total of USD 830 million, which accounts for 48.7% of the base issuance. However, the investor composition is heavily skewed towards government and industrial capital, with foreign long-term funds largely absent, raising concerns about the long-term value perception of the company [5][6]. Performance and Valuation Concerns - Seres' sales data indicates a weakening growth trend, with September 2025 sales of 48,000 vehicles showing an 8.33% year-on-year increase, but a cumulative decline of 7.79% for the first nine months. The company's reliance on Huawei is diminishing, as evidenced by its ranking among Huawei's electric vehicle models, where it faces increasing competition from other manufacturers [7][9][12]. Financial Metrics - As of the current valuation, Seres has a market capitalization of HKD 306.9 billion, with projected P/E ratios for 2024, TTM, and 2025 at 47.2x, 38.6x, and 27.9x respectively. These figures are significantly higher than the average P/E ratios of traditional automakers in Hong Kong, which hover around 14.9x to 22x, indicating a potential valuation bubble lacking solid fundamental support [10][11][12]. Dependency on Huawei - The valuation premium associated with Seres is largely attributed to its partnership with Huawei. Prior to this collaboration, Seres had a market value of only CNY 10 billion, which skyrocketed to over CNY 250 billion post-collaboration. However, as Huawei diversifies its partnerships with other manufacturers, Seres risks losing its competitive edge and growth momentum, raising concerns about its long-term sustainability [13].

赛力斯赴港IPO,张兴海不想当“躺赢王”

Sou Hu Cai Jing· 2025-05-14 13:46

Core Viewpoint - The announcement of Seres' secondary listing in Hong Kong is seen as a significant event, especially with its projected revenue and profit growth in the electric vehicle sector for 2024, despite recent challenges in sales performance [1][2]. Financial Performance - In 2024, Seres is expected to achieve revenue of 145.2 billion yuan, a year-on-year increase of 305.04%, and a net profit of 5.946 billion yuan, up 342.72%, making it the fourth profitable electric vehicle company globally after Tesla, BYD, and Li Auto [2]. - In Q1 2025, Seres reported revenue of 19.15 billion yuan, a decline of 27.91% year-on-year, but net profit increased to 747.8 million yuan, a growth of 240.6% [6][7]. Sales and Market Dynamics - The sales volume of Seres' electric vehicles saw a significant decline in early 2025, with January sales down 51.39% year-on-year, February down 41.04%, and March down 32.19% [7]. - However, the launch of the new models, particularly the Wanjie M9, which sold 23,290 units in Q1 2025 (up 117.83%), helped maintain profitability despite overall sales declines [8]. Strategic Partnerships and Dependencies - The collaboration with Huawei is crucial for Seres, but there are concerns about the sustainability of this partnership as Huawei expands its collaborations with other brands [11][12]. - The potential dilution of benefits from Huawei's technology and marketing support poses a risk to Seres' competitive edge in the market [13][14]. Future Growth and Challenges - Seres plans to use 70% of its IPO proceeds for R&D, 20% for new marketing channels and overseas sales, and 10% for working capital [17]. - The company faces challenges in expanding its product line and entering new markets, particularly overseas, where brand recognition and financial stability are critical [19][21]. Conclusion - While Seres has short-term growth potential, its long-term outlook remains uncertain due to its reliance on Huawei and the competitive landscape in the electric vehicle market [10][14].