电子材料

Search documents

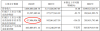

天通股份股价跌5.07%,华夏基金旗下1只基金位居十大流通股东,持有670.39万股浮亏损失348.6万元

Xin Lang Cai Jing· 2025-11-04 06:06

Group 1 - Tian Tong Co., Ltd. experienced a decline of 5.07% on November 4, with a stock price of 9.74 CNY per share, a trading volume of 534 million CNY, a turnover rate of 4.36%, and a total market capitalization of 12.014 billion CNY [1] - The company, established on February 10, 1999, and listed on January 18, 2001, is located in Haining Economic Development Zone, Zhejiang Province. Its main business involves the research, manufacturing, and sales of electronic materials (including magnetic materials, sapphire, piezoelectric crystals, etc.) and high-end equipment [1] - The revenue composition of Tian Tong includes 86.57% from electronic materials sales, 9.38% from specialized equipment manufacturing and installation services, and 4.05% from material sales and others [1] Group 2 - Among the top ten circulating shareholders of Tian Tong, one fund from Huaxia Fund is notable. The Huaxia CSI 1000 ETF (159845) reduced its holdings by 14,500 shares in the third quarter, now holding 6.7039 million shares, which accounts for 0.54% of circulating shares [2] - The estimated floating loss for Huaxia CSI 1000 ETF today is approximately 3.486 million CNY. The fund was established on March 18, 2021, with a latest scale of 45.469 billion CNY, and has achieved a year-to-date return of 27.93%, ranking 2038 out of 4216 in its category [2] - Over the past year, the fund has returned 28.58%, ranking 1824 out of 3896, and since its inception, it has achieved a return of 28.72% [2]

南大光电:公司专注先进前驱体(包含MO源)、电子特气和光刻胶三大核心电子材料的研发、生产和销售

Zheng Quan Ri Bao· 2025-11-03 14:08

证券日报网讯南大光电11月3日在互动平台回答投资者提问时表示,公司专注先进前驱体(包含MO 源)、电子特气和光刻胶三大核心电子材料的研发、生产和销售,产品广泛应用于集成电路、平板显 示、LED、第三代半导体、光伏和半导体激光器的生产制造。凭借强大的研发创新实力、领先的生产技 术、扎实的品质管理体系以及专业的市场服务能力,各类产品的技术、品质、产能和服务逐步跻身行业 前列。具体请关注公司披露的定期报告相关内容。 (文章来源:证券日报) ...

东阳光股价跌5.26%,前海开源基金旗下1只基金重仓,持有1.44万股浮亏损失1.63万元

Xin Lang Cai Jing· 2025-11-03 02:51

Group 1 - The core point of the news is that Dongyangguang's stock price dropped by 5.26% to 20.37 CNY per share, with a trading volume of 5.51 billion CNY and a turnover rate of 0.88%, resulting in a total market capitalization of 613.05 billion CNY [1] - Dongyangguang, established on October 24, 1996, and listed on September 17, 1993, operates in four main business segments: electronic new materials, alloy materials, chemical products, and pharmaceutical manufacturing [1] - The revenue composition of Dongyangguang's main business includes high-end aluminum foil at 40.81%, chemical new materials at 27.63%, electronic components at 25.40%, and other categories contributing 2.63% [1] Group 2 - According to data from the top ten heavy stocks of funds, Qianhai Kaiyuan Fund has one fund heavily invested in Dongyangguang, specifically the Qianhai Kaiyuan CSI 500 Equal Weight ETF (515590), which increased its holdings by 3,200 shares in the third quarter [2] - The Qianhai Kaiyuan CSI 500 Equal Weight ETF (515590) has a current holding of 14,400 shares, representing 0.4% of the fund's net value, ranking it as the eighth largest heavy stock [2] - The fund has a total scale of 83.87 million CNY and has achieved a year-to-date return of 27.42%, ranking 2058 out of 4216 in its category [2]

雅克科技股价跌5.16%,国寿安保基金旗下1只基金重仓,持有9500股浮亏损失3.79万元

Xin Lang Cai Jing· 2025-11-03 02:51

Core Viewpoint - On November 3, Jiangsu Yake Technology Co., Ltd. experienced a 5.16% decline in stock price, closing at 73.40 yuan per share, with a trading volume of 818 million yuan and a turnover rate of 3.45%, resulting in a total market capitalization of 34.933 billion yuan [1] Company Overview - Jiangsu Yake Technology Co., Ltd. was established on October 29, 1997, and went public on May 25, 2010. The company is located in Yixing Economic Development Zone, Wuxi, Jiangsu Province [1] - The main business activities include research, production, and sales of electronic materials, LNG insulation boards, and flame retardants. The revenue composition is as follows: semiconductor chemical materials and photoresists account for 49.23%, LNG insulation composite materials 27.13%, LNG engineering installation 7.91%, electronic specialty gases 4.56%, LDS equipment 3.17%, flame retardants 3.15%, spherical silica powder 2.99%, and other businesses 1.88% [1] Fund Holdings - According to data from the top ten holdings of funds, China Life Asset Management's fund holds Yake Technology. The fund "China Life Anbao Research Selected Mixed A" (008082) held 9,500 shares in the third quarter, unchanged from the previous period, representing 4.64% of the fund's net value, ranking as the ninth largest holding. The estimated floating loss today is approximately 37,900 yuan [2] - The fund "China Life Anbao Research Selected Mixed A" was established on December 30, 2019, with a latest scale of 11.9259 million. Year-to-date returns are 38.01%, ranking 2071 out of 8223 in its category; the one-year return is 30.64%, ranking 2727 out of 8115; and since inception, the return is 51.95% [2]

雅克科技(002409):Q3业绩符合预期,存储迎高景气周期,前驱体等核心业务有望持续加速

Shenwan Hongyuan Securities· 2025-11-02 03:15

Investment Rating - The investment rating for the company is "Buy" (maintained) [1] Core Insights - The company's Q3 performance met expectations, with revenue of 6.467 billion yuan (YoY +29%) and a net profit of 796 million yuan (YoY +6%). The storage industry is entering a high prosperity cycle, and core businesses such as precursors are expected to continue accelerating [6][5] - The demand for storage is anticipated to increase significantly due to the acceleration of AI infrastructure, with a more steep and sustained demand curve expected in the future [6] - The company is positioned to benefit from the growing demand for electronic materials, with significant growth in various product lines, including precursors and silicon powder [6] Financial Data and Profit Forecast - Total revenue is projected to reach 8.816 billion yuan in 2025, with a year-on-year growth rate of 28.5%. The net profit attributable to the parent company is expected to be 1.117 billion yuan, reflecting a growth rate of 28.2% [5][7] - The gross profit margin for Q3 was 32.78%, with a net profit margin of 13.49%. The company has been increasing its R&D investment, with R&D expenses for Q3 amounting to 97 million yuan [6] - The company's return on equity (ROE) is projected to improve from 10.2% in 2025 to 18.8% by 2027 [5]

打通绿色动脉,澎湃园区动能:成都“立园满园”周年考

Mei Ri Jing Ji Xin Wen· 2025-10-31 13:57

Core Insights - Chengdu is implementing the "Full Park, Full Garden" initiative to enhance industrial parks, focusing on optimizing services, promoting industrial clusters, and integrating ecological factors into economic development [1][2][20] - In the first three quarters of 2024, Chengdu's industrial added value increased by 7.5%, and industrial investment grew by 18%, significantly outpacing national averages [1][4] - The initiative has led to a substantial increase in major industrial projects, with 573 projects introduced in the first eight months of 2024, representing a 93.58% year-on-year growth [4][5] Industrial Development - Chengdu's foreign direct investment (FDI) reached $1.024 billion, ranking first among central and western cities, with a notable 42.97% increase in manufacturing sector FDI [5][20] - The "Full Park, Full Garden" initiative has transformed the role of ecological factors from a regulatory barrier to a driving force for development, facilitating a more efficient project approval process [1][10] Service Optimization - The introduction of the "acceptance equals approval" model has expedited environmental assessments, allowing eligible projects to receive approvals on the same day they are submitted [7][19] - Chengdu's ecological environment department has shifted from a regulatory role to a service-oriented approach, actively engaging with businesses from the project initiation stage [10][17] Cross-Department Collaboration - A collaborative model involving multiple departments has been established to streamline project lifecycle management, reducing bureaucratic fragmentation and enhancing service integration [8][12] - The city has implemented a dynamic adjustment of the environmental supervision list, increasing the number of compliant enterprises and adopting a more lenient enforcement approach [19][20] Economic Impact - Chengdu's GDP for the first three quarters of 2024 reached 1.82269 trillion yuan, with a year-on-year growth of 5.8%, surpassing national and provincial growth rates [14][20] - The production of key industrial products, such as new energy vehicles and lithium-ion batteries, has seen significant increases, indicating robust industrial performance [14][20]

至纯科技2025年第三季度净利润环比增56.09%

Zheng Quan Shi Bao Wang· 2025-10-31 07:04

Core Viewpoint - The company reported significant growth in revenue and net profit for the third quarter of 2025, indicating strong operational performance and market expansion efforts [1] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 2.367 billion yuan and a net profit of 84.6967 million yuan [1] - In the third quarter alone, the net profit reached 45.378 million yuan, representing a quarter-on-quarter increase of 56.09% [1] Market Expansion - The company's contract liabilities grew to 741 million yuan in the third quarter, reflecting a robust order backlog [1] - The company has made significant progress in the electronic materials sector, with successful expansion into new business areas related to domestic large-scale gas stations, which is expected to become a stable profit contributor [1]

至纯科技扣非前三季降8成去年亏 终止买威顿晶磷股权

Zhong Guo Jing Ji Wang· 2025-10-31 06:37

Core Viewpoint - Zhichun Technology (603690.SH) announced the termination of the acquisition of 83.7775% of Guizhou Weidun Crystal Phosphorus Electronic Materials Co., Ltd. and related fundraising due to a lack of consensus on key transaction terms and changes in market conditions since the initial planning of the transaction [1] Financial Performance Summary - In 2023, Zhichun Technology reported revenue of 3.151 billion yuan, a year-on-year increase of 3.33%, and a net profit attributable to shareholders of 377 million yuan, up 33.58%. However, the net profit after deducting non-recurring gains and losses was 102 million yuan, down 64.25%, with a net cash flow from operating activities of -811 million yuan [2] - In 2024, the company achieved revenue of 3.605 billion yuan, a 14.40% increase year-on-year, but the net profit attributable to shareholders dropped to 24 million yuan, a decrease of 93.75%. The net profit after deducting non-recurring gains and losses was -57 million yuan, compared to 102 million yuan in 2023, with a net cash flow from operating activities of -463 million yuan [3][4] - For the first three quarters of 2025, Zhichun Technology's revenue was 2.367 billion yuan, a decline of 10.33% year-on-year, with a net profit of 85 million yuan, down 56.08%. The net profit after deducting non-recurring gains and losses was 34 million yuan, a decrease of 81.08%, and the net cash flow from operating activities was -502 million yuan [4][5]

中石科技股价跌5.17%,信达澳亚基金旗下1只基金位居十大流通股东,持有84.69万股浮亏损失215.96万元

Xin Lang Cai Jing· 2025-10-31 02:55

Core Viewpoint - Zhongshi Technology experienced a decline of 5.17% on October 31, with a stock price of 46.81 yuan per share and a total market capitalization of 14.02 billion yuan [1] Group 1: Company Overview - Beijing Zhongshi Weiye Technology Co., Ltd. was established on April 10, 1997, and listed on December 27, 2017 [1] - The company specializes in the research, design, production, sales, and technical services of thermal conductive materials, EMI shielding materials, and power filters [1] - The main business revenue composition is 98.05% from thermal conductive materials and 1.95% from other supplementary products [1] Group 2: Shareholder Information - The fund "Xinda Australia Fund" has a position in Zhongshi Technology, with the "Xinao Craftsmanship Selected Two-Year Holding Period Mixed Fund" (010363) newly entering the top ten circulating shareholders, holding 846,900 shares, which is 0.41% of the circulating shares [2] - The estimated floating loss for this fund today is approximately 2.16 million yuan [2] - The fund was established on October 30, 2020, with a latest scale of 1.738 billion yuan, and has achieved a year-to-date return of 41.32% [2] Group 3: Fund Performance - The fund manager of "Xinao Craftsmanship Selected Two-Year Holding Period Mixed Fund" is Zhu Ran, who has a cumulative tenure of 7 years and 361 days, with a total fund asset size of 5.066 billion yuan [3] - The best fund return during Zhu Ran's tenure is 342.67%, while the worst return is -7.06% [3] Group 4: Top Holdings - The "Xinda Australia Fund" also holds a significant position in Zhongshi Technology through the "Xinao Intelligent Selection Pioneer One-Year Holding Period Mixed A Fund" (015440), which holds 139,400 shares, accounting for 4.64% of the fund's net value [4] - The estimated floating loss for this fund today is approximately 355,500 yuan [4] - This fund was established on June 14, 2022, with a latest scale of 102 million yuan, achieving a year-to-date return of 36.01% [4]

首轮融资超亿元 湖南这家黑马材企加速拓展 高端电子市场

Sou Hu Cai Jing· 2025-10-31 01:08

Group 1 - Hunan Kairuisi Microelectronics Materials Technology Co., Ltd. has completed a first round of financing exceeding 100 million RMB, with investments from Guotai Junan Innovation Investment, Zhongqi Capital, and Dicer Capital, aimed at expanding production capacity and increasing R&D investment to meet market demand [2][3] - The project leader from Guotai Junan Innovation Investment highlighted the complex material system for AI high-end servers, with significant market growth and demand gaps, particularly in advanced packaging processes like stacked packaging, where many high-end liquid adhesives and tape materials remain in a state of domestic production void, dominated by overseas suppliers [3] - Kairuisi has diversified its product offerings in copper-clad laminates and various advanced packaging materials, with notable advantages in upstream material development and downstream process technology, and has established strategic partnerships with leading global clients [3][5] Group 2 - Kairuisi, established in 2021 and located in Zhuzhou, Hunan Province, specializes in multiple semiconductor advanced packaging materials and high-speed, high-frequency copper-clad laminate materials, focusing on the least domestically produced stacked packaging materials [5] - The core team of Kairuisi has decades of experience in high-end electronic materials, possessing capabilities in resin synthesis and formulation development, and has extensive production experience in high-speed copper-clad laminates, closely tied to leading PCB and IC clients [5] - The company integrates R&D, production, and sales to provide systematic advanced material solutions, aiming to become a global leader in electronic information new materials [5]