稳定币发行

Search documents

稳定币发行商Circle第三季度总营收及储备收入7.4亿美元,市场预期7.073亿美元;第三季度调整后EBITDA 1.66亿美元,市场预期1.325亿美元

Hua Er Jie Jian Wen· 2025-11-12 11:33

稳定币发行商Circle第三季度总营收及储备收入7.4亿美元,市场预期7.073亿美元;第三季度调整后 EBITDA 1.66亿美元,市场预期1.325亿美元。 风险提示及免责条款 市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何 意见、观点或结论是否符合其特定状况。据此投资,责任自负。 ...

稳定币巨头Tether挖角汇丰资深贵金属交易员

Ge Long Hui· 2025-11-11 14:16

全球最大稳定币发行商Tether正在从汇丰控股聘请两名全球最资深的贵金属交易员。知情人士透露,汇 丰银行全球金属交易主管Vincent Domien将在未来几个月内加入Tether,同时加入的还有欧洲、中东和 非洲贵金属发行主管Mathew O'Neill。近年来,Tether积极扩大其在贵金属领域的版图,作为其超过 1800亿美元储备资产的一部分。 ...

Monness Crespi Hardt首予Circle"买入"评级

Ge Long Hui A P P· 2025-11-10 13:43

Core Viewpoint - Investment bank Monness Crespi Hardt initiates coverage of stablecoin issuer Circle with a "Buy" rating and a target price of $150 [1] Group 1 - Circle is recognized as a stablecoin issuer, indicating its role in the cryptocurrency market [1] - The initiation of coverage suggests a positive outlook on Circle's business prospects [1] - The target price of $150 reflects the investment bank's confidence in Circle's growth potential [1]

一头5000亿美元估值巨兽,正在浮出水面

凤凰网财经· 2025-11-07 13:29

Core Viewpoint - The article discusses the rise of Tether (USDT) as a dominant stablecoin, highlighting its significant user base, market valuation, and the unique strategies that have contributed to its success in emerging markets, particularly in the context of high inflation and currency devaluation in countries like Argentina [3][10][34]. Group 1: Tether's Market Position - Tether has over 500 million "real users," representing approximately 6.25% of the global population, with a market capitalization exceeding $180 billion [9][10]. - Tether's net profit for 2024 is projected to reach $13 billion, surpassing that of some of the largest global banks [11]. - Tether is seeking to raise $15 billion with a target valuation of $500 billion, comparable to major tech companies like OpenAI and ByteDance [12][13]. Group 2: User Adoption and Growth - The adoption of stablecoins, particularly USDT, has surged in regions like Africa and South America, driven by the need for wealth preservation and efficient cross-border payments [5][6][51]. - In Argentina, approximately two-thirds of the cryptocurrencies purchased are stablecoins pegged to the US dollar, primarily USDT [6]. - The user base of Tether has grown from around 3 million in 2020 to 500 million in recent years, indicating a significant increase in demand for stablecoins [23]. Group 3: Competitive Landscape - Tether holds a dominant market share of approximately 59% in the stablecoin market, with its closest competitor, Circle's USDC, holding about 24% [34]. - The stablecoin market is expected to grow significantly, with projections suggesting it could exceed $2 trillion by 2028 [33]. - Tether's success is attributed to its ability to operate in a regulatory gray area, allowing for rapid expansion without the constraints faced by more compliant competitors like Circle [56]. Group 4: Strategic Partnerships and Innovations - Tether has invested in over 100 companies globally to establish a wide distribution network, particularly in emerging markets [49]. - The company has developed innovative projects, such as solar-powered service kiosks in Africa, to enhance its presence and utility in local markets [50]. - Tether's approach to market entry involves grassroots education and partnerships with local businesses, contrasting with competitors that focus on large institutional partnerships [48]. Group 5: Regulatory Challenges and Future Outlook - Tether faces potential regulatory scrutiny as the stablecoin market matures, with increasing emphasis on compliance and transparency [58][60]. - The competitive landscape is shifting, with regulatory compliance becoming a critical factor for success, potentially impacting Tether's market share in the long term [62]. - Despite these challenges, Tether's established liquidity and network effects may help it maintain its leading position in the short to medium term [62].

Tether Surpasses $10B Net Profit in 2025, Expands US Treasuries Holdings

Yahoo Finance· 2025-10-31 17:57

Financial Performance - Tether International reported net profits exceeding $10 billion for the year, with expectations to reach $15 billion by the end of 2025 [1] - The company closed Q3 2025 with excess reserves of $6.8 billion, indicating a strong financial buffer above outstanding liabilities [6] US Treasury Holdings - Tether's total exposure to US Treasuries reached approximately $135 billion, making it the 17th-largest holder of US government debt globally [2] - The company issued over $17 billion in new USDT during Q3, increasing the circulating supply to over $174 billion [3] Market Position and User Base - By October 2025, the number of USDT tokens in circulation surpassed $183 billion, contributing to a stablecoin market cap exceeding $300 billion [4] - Tether's user base has expanded to over 500 million, driven by global demand for reliable stablecoins amid macroeconomic volatility [4] Reserve Strategy - Tether's reserves included $12.9 billion in gold and $9.9 billion in Bitcoin, accounting for around 13% of total reserves [5] - The company maintains a separation between proprietary investments in AI, energy, and communications and the reserves backing USDT [5] CEO Insights - Tether's CEO, Paolo Ardoino, emphasized the results as a sign of continued trust and growth, with increasing investor interest in USDT for stability and liquidity [7]

首个日元稳定币上线,3小时发行1500万日元

日经中文网· 2025-10-28 08:00

Core Viewpoint - The launch of the JPYC stablecoin, pegged to the Japanese yen, marks a significant milestone in Japan's monetary history and is seen as a test for the penetration of yen-based stablecoins in society [4]. Group 1: Launch and Initial Performance - JPYC began issuing its stablecoin on October 27, with an issuance amount reaching 15 million yen within the first three hours [2]. - The global stablecoin market has expanded rapidly, with a total market size of approximately $300 billion, predominantly driven by USD-pegged stablecoins [2][4]. Group 2: Market Context and Trends - The issuance of JPYC is part of a broader global trend where major financial institutions in Europe and the U.S. are developing and issuing stablecoins for various applications, including international remittances and asset management [4]. - Stablecoins are designed to maintain a 1:1 value with fiat currencies, with JPYC effectively equating to 1 yen, despite minor price fluctuations [5]. Group 3: Technological Foundation - JPYC, like other stablecoins, is based on blockchain technology, which allows for low-cost and rapid remittance capabilities [5].

今年利润预计150亿美元,利润率高达99%,用户数超5亿,估值5000亿美元!“稳定币老大”Tether“春风得意”

美股IPO· 2025-10-25 05:14

Core Insights - Tether is expected to achieve a profit close to $15 billion this year, driven by a remarkable profit margin of 99% and substantial returns from reserve assets in a high-interest-rate environment [1][3][7] - The company is in talks for a financing round that could value it at $500 billion, potentially making it one of the most valuable private companies globally [1][6][8] - Tether's USDT market capitalization accounts for approximately 60% of the stablecoin market, with over 500 million users, reflecting its expanding global footprint [1][4][9] Financial Performance - Tether's unique business model supports its high profitability, with a reserve asset portfolio primarily consisting of cash and short-term U.S. Treasury securities, generating significant interest income [7] - The company reported a profit of about $13 billion last year, benefiting from the high-interest environment [7] - Tether's USDT currently has a circulating value of approximately $183 billion, representing a dominant market share [7] Financing and Valuation - Tether is negotiating to raise up to $20 billion by selling about 3% of its shares, which would elevate its valuation to around $500 billion, surpassing companies like ByteDance and matching OpenAI [6][8] - The company has received significant interest from major investors, including SoftBank and Ark Investment Management, indicating strong external confidence in Tether's business model [8] User Base and Market Expansion - Tether's user base has surpassed 500 million, equating to about 6.25% of the global population, showcasing its extensive reach [4][9] - The company plans to re-enter the U.S. market later this year with a new stablecoin project named USAT, aiming to leverage favorable regulatory conditions [9] - Tether is diversifying its investment portfolio, including a notable investment in Juventus Football Club, where it holds 11.5% of shares and is seeking to influence the board [9]

今年利润预计150亿美元,利润率高达99%,用户数超5亿,估值5000亿美元!“稳定币老大”Tether“春风得意”

Hua Er Jie Jian Wen· 2025-10-25 01:48

Core Insights - Tether Holdings Ltd. is attracting global capital due to its impressive profitability and market dominance, with an expected profit nearing $15 billion this year and potential financing discussions that could value the company at $500 billion [1][3][5] Financial Performance - Tether's profit margin is an astonishing 99%, driven by high-interest income from its substantial reserve assets, primarily consisting of cash and short-term U.S. Treasury securities [5][6] - The company reported a profit of approximately $13 billion last year, benefiting from the high-interest rate environment [5][6] Market Position and User Base - Tether's USDT currently has a market circulation value of about $183 billion, holding approximately 60% of the entire stablecoin market [5] - The number of "real users" of Tether has surpassed 500 million, representing about 6.25% of the global population, indicating its extensive global influence [1][7] Financing and Valuation - Tether is in negotiations to raise up to $20 billion by selling about 3% of its shares, which could elevate its valuation to around $500 billion, placing it among the world's top unicorn companies [3][6] - Major investment firms, including SoftBank and Ark Investment Management, have shown interest in participating in this financing round, which could enhance Tether's mainstream applications in technology and finance [6][7] Business Expansion - Tether plans to re-enter the U.S. market later this year with a new stablecoin project named USAT, aiming to leverage favorable policies towards cryptocurrencies [7] - The company is diversifying its investment portfolio, including a notable investment in Juventus Football Club, where it holds 11.5% of the shares and has proposed two board candidates to represent fans [7]

蚂蚁、京东暂停香港发币计划

Guan Cha Zhe Wang· 2025-10-20 10:34

Group 1 - Ant Group and JD.com have suspended their plans to issue stablecoins in Hong Kong due to regulatory directives from the People's Bank of China and the Cyberspace Administration of China [1] - The Hong Kong Legislative Council passed the Stablecoin Regulation Draft on May 21, which took effect on August 1, leading to expectations of the first compliant Hong Kong dollar stablecoin by the end of the year [1] - Stablecoins are seen as a bridge between traditional financial systems and cryptocurrency, enhancing transaction stability and cross-border payment capabilities [1][2] Group 2 - HSBC Jintrust Fund noted that the introduction of stablecoin regulations in Hong Kong and the U.S. has significantly increased regulatory clarity, which is expected to accelerate the development of the stablecoin industry [2] - JD.com has received a sandbox approval from the Hong Kong Monetary Authority for stablecoin issuance and is in the second phase of its testing plan [2] - JD.com's founder expressed ambitions for global stablecoin licensing to reduce cross-border payment costs by 90% and improve efficiency to under 10 seconds [2] Group 3 - Ant Group's blockchain subsidiary has been exploring blockchain applications for several years, including a successful issuance of a cross-border RWA project in Hong Kong [3] - Ant Group is also planning to apply for stablecoin licenses in Singapore and Hong Kong, focusing on integrating AI and blockchain technologies into large-scale applications [3] - The challenges for stablecoins lie not in replacing the U.S. dollar but in altering how it flows within the global system [3] Group 4 - Mainstream stablecoins like USDT and USDC are still pegged to the U.S. dollar but are changing the mode of dollar circulation by enabling peer-to-peer transactions on blockchain networks, bypassing traditional banking systems [4] - The reserve structure of stablecoins may diversify beyond the U.S. dollar to include assets like gold, euros, Hong Kong dollars, or even digital yuan [4] - As of the latest market close, Yunfeng Financial and Yaocai Securities experienced declines of 7.7% and 5.5%, respectively [4]

美债最大“接盘侠”诞生,大举买走1.6万亿,但偏偏不是英国、日本

Sou Hu Cai Jing· 2025-10-10 19:12

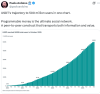

Core Insights - The article discusses the rising prominence of stablecoins in the context of increasing U.S. national debt and global economic challenges, highlighting their potential to reshape financial transactions and investment dynamics [3][5][12]. Group 1: Stablecoin Market Dynamics - Stablecoins, particularly those pegged to the U.S. dollar, have gained traction, with regulations requiring issuers to maintain 1:1 reserves in real dollars or short-term government bonds [5][9]. - The total market capitalization of stablecoins surged from $200 billion at the beginning of the year to $280 billion, reflecting a quarterly growth of 22% [7][9]. - Major players like Tether and Circle have significantly increased their holdings in U.S. Treasury bonds, with Tether holding $105 billion and Circle holding $55.2 billion in short-term debt [7][9]. Group 2: Regulatory and Technological Developments - The U.S. regulatory environment is becoming more favorable for stablecoins, with Texas issuing the first licenses and major firms like BlackRock and Deloitte involved in reserve management and auditing [9][10]. - The integration of stablecoins into payment systems is accelerating, with cross-border transactions now accounting for 37% of their use, benefiting various sectors including remittances and e-commerce [7][12]. Group 3: Future Projections and Risks - Analysts predict that the issuance of stablecoins could reach $1.9 trillion by 2030, with a bullish scenario suggesting it could even hit $4 trillion, surpassing the holdings of Japan, the UK, and China combined [10][18]. - While stablecoins provide benefits such as faster transactions and reduced costs, concerns about their impact on the traditional banking system and potential risks of financial instability are emerging [12][18].