散奶

Search documents

未知机构:国金农业再次强调牧场与生猪投资机会节后散奶价的偏弱运行使得板-20260228

未知机构· 2026-02-28 02:40

【国金农业】再次强调牧场与生猪投资机会 随着天气逐步转暖以及南方补栏需求的提升,节后价格有望快速上涨。 中期来看行业产能去化幅度巨大,牛价有望破历史新高,看好肉奶共振的牧业大周期。 #重点推荐:优然牧业、现代牧业、中国圣牧等,以及关注受益的紫燕食品、光明肉业等。 节后散奶价的偏弱运行使得板块近期存在调整,淡季乳企本就会适当减少收奶量从而增加散奶供给,目前的价格 明显优于去年同期,而且散奶价格的下跌利好行业产能进一步去化,中期奶价反转趋势不变。 牛肉端来看:#冻品价格持续上涨,目前均价54.4元/公斤,周环比+1.7%,上涨驱动为下游补库和一致看多情绪。 牛市正月十五之前交易量较小,目前公牛犊成交价格稳定在40 【国金农业】再次强调牧场与生猪投资机会 节后散奶价的偏弱运行使得板块近期存在调整,淡季乳企本就会适当减少收奶量从而增加散奶供给,目前的价格 明显优于去年同期,而且散奶价格的下跌利好行业产能进一步去化,中期奶价反转趋势不变。 牛肉端来看:#冻品价格持续上涨,目前均价54.4元/公斤,周环比+1.7%,上涨驱动为下游补库和一致看多情绪。 牛市正月十五之前交易量较小,目前公牛犊成交价格稳定在40元/公斤左右, ...

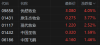

港股异动丨乳制品股反弹 优然牧业涨4% 中国飞鹤涨1.5% 机构指奶价拐点仍可期

Ge Long Hui· 2025-10-28 03:45

Core Viewpoint - The Hong Kong dairy stocks have rebounded after a period of decline, with several companies showing positive price movements, although the overall dairy price remains below cost levels, indicating ongoing industry challenges [1]. Group 1: Market Performance - Yurun Dairy increased by 4%, Ecological Dairy by 3.77%, Modern Dairy by 2.5%, China Shengmu by 1.5%, and China Feihe by 1.46% [2]. - The rebound in stock prices is attributed to pre-holiday inventory buildup and increased demand for student milk production [1]. Group 2: Industry Conditions - Despite the short-term support for milk prices due to holiday factors, the trend of capacity reduction in the dairy industry continues [1]. - The overall milk price remains below the cost line, leading to ongoing industry losses and financial pressures from silage [1]. - The number of dairy cows decreased by 0.18% month-on-month in September, following a 0.2% decline in August, with a cumulative reduction of approximately 8% [1]. Group 3: Future Outlook - The capacity reduction trend may be nearing its end, and a turning point in the milk price cycle is anticipated [1].

天风证券:散奶价格短期反弹难改去化大势 奶价拐点仍可期

Zheng Quan Shi Bao Wang· 2025-10-16 00:25

Core Viewpoint - Despite a rebound in raw milk prices in some regions due to pre-holiday stocking and student milk production demand, overall milk prices in major production areas remain stable and below cost lines, indicating ongoing industry losses and financial pressures from silage [1] Group 1: Milk Price Trends - Since September, some regions have seen a rebound in raw milk prices, but major production areas still maintain stable prices [1] - Current milk prices are below the cost line, leading to continued industry losses and financial pressures [1] Group 2: Production Capacity and Inventory - The dairy industry is experiencing ongoing capacity reduction, with a 0.18% month-on-month decrease in dairy cow inventory in September, following a 0.2% decrease in August [1] - The cumulative reduction in dairy cow inventory has reached approximately 8% [1] Group 3: Future Outlook - The short-term support for milk prices from holiday factors is expected to diminish, leading to a continuation of the capacity reduction trend [1] - The capacity reduction may be nearing its end, and a turning point in milk prices is anticipated [1]

散奶价格短期反弹难改去化大势,奶价拐点仍可期

Tianfeng Securities· 2025-10-14 14:41

Investment Rating - Industry rating is maintained at "Outperform the Market" [5] Core Viewpoints - The short-term rebound in raw milk prices does not change the ongoing destocking trend, but a price turning point is anticipated [1] - After significant destocking, beef cattle prices are gradually recovering, with September average prices reaching 25.99 CNY/kg, up 10.7% from the beginning of the year [2] - The rise in beef cattle prices is positively impacting the prices of cull cows, which in September averaged 19.33 CNY/kg, up 19.2% year-to-date [3] Summary by Sections 1) Raw Milk Price Analysis - Despite a short-term price rebound due to holiday stocking and school milk demand, overall prices remain below cost levels, leading to continued industry losses and destocking [1] - The September cow inventory decreased by 0.18% month-on-month, with a cumulative reduction of approximately 8% [1] 2) Beef Cattle Price Analysis - The average price of beef cattle in September was 25.99 CNY/kg, reflecting a 10.7% increase since the start of the year and a 15.6% increase from previous lows [2] - The average price of calves rose to 32.42 CNY/kg, marking a 39% increase from the lowest point in 2024 [2] 3) Impact of Beef Prices on Dairy Companies - The increase in beef cattle prices has led to a rise in cull cow prices, which is expected to improve the financial performance of dairy companies [3] - The trend of narrowing losses from cull cows is likely to continue for an extended period due to the long replenishment cycle in the beef industry [3] 4) Investment Recommendations - The core logic of the sector remains unchanged, with expectations for a price turning point and attractive valuations [4] - Recommended stocks include: Yuran Dairy, China Shengmu, Aoyuan Group, Modern Dairy, and Tianrun Dairy for dairy; and China Shengmu, Guangming Meat, and Fucheng Co. for beef [4]