连接及数据传输设备

Search documents

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

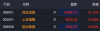

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

八马茶业、滴普科技上市聆讯获通过;A股上市公司三一重工、剑桥科技通过港交所聆讯丨港交所早参

Mei Ri Jing Ji Xin Wen· 2025-10-13 17:13

Group 1: Baima Tea Industry - Baima Tea Industry has passed the Hong Kong Stock Exchange hearing for its IPO, establishing itself as a leader in the high-end tea market in China [1] - According to Frost & Sullivan, Baima Tea ranks first in sales in the Chinese oolong and black tea markets as of 2024, with its Tieguanyin sales leading the nation for over 10 years [1] - The successful hearing paves the way for Baima Tea to raise funds for expansion and digitalization, serving as a model for other tea companies to address branding challenges [1] Group 2: SANY Heavy Industry - SANY Heavy Industry has also passed the Hong Kong Stock Exchange hearing for its IPO, with CITIC Securities as its sole sponsor [2] - Founded in 1994, SANY has transformed from a single product and country operation to a diversified, global leader in the engineering machinery industry, ranking as the largest in China and third globally based on cumulative revenue from 2020 to 2024 [2] - The IPO is a key move in SANY's globalization strategy, allowing the company to raise capital for overseas manufacturing and R&D, enhancing its international brand recognition [2] Group 3: Cambridge Technology - Cambridge Technology has received approval for its IPO application on the Hong Kong Stock Exchange, focusing on the design, development, and sales of connectivity and data transmission devices [3] - As of 2024, Cambridge Technology ranks fifth globally in the optical and wireless connectivity device industry, holding a market share of 4.1% [3] - The company's revenue primarily comes from overseas markets, and the IPO will broaden its financing channels to support R&D in optical modules, aligning with the demand for data transmission driven by artificial intelligence [3] Group 4: Dipo Technology - Dipo Technology has passed the Hong Kong Stock Exchange hearing for its IPO, specializing in enterprise-level large model AI application solutions [4] - The company ranks fifth in the Chinese market for enterprise-level large model AI application solutions, with a market share of 4.2% as of 2024 [4] - The IPO aligns with the growing trend of AI application deployment and highlights the attractiveness of the Hong Kong stock market for tech innovation companies [4]

左手融资右手减持,剑桥科技九成收入来自境外藏隐忧

Shen Zhen Shang Bao· 2025-10-12 15:54

Group 1 - The core viewpoint of the article is that Shanghai Cambridge Technology Co., Ltd. is preparing for its IPO on the Hong Kong Stock Exchange, with significant revenue fluctuations and high dependency on major clients and overseas markets posing risks to its revenue stability [1][2] Group 2 - Cambridge Technology primarily engages in the design, development, and sales of connectivity and data transmission devices, generating revenue from broadband, wireless, and optical module technology products [1] - The company's revenue declined in 2023 due to an industry-wide destocking cycle and sluggish demand, but is projected to rebound to 3.65 billion yuan in 2024 due to deferred demand release and strong sales [1] - In the first half of this year, the company's revenue exceeded 2 billion yuan, reflecting a year-on-year growth of 15.48% [1] Group 3 - The company has a high reliance on major clients, with the revenue share from the top five clients increasing from 63.5% in 2022 to 76.1% in 2024, indicating a significant concentration risk compared to industry peers [1] - The overseas market has become increasingly important, with its revenue share rising from 82.9% in 2022 to 94% in the first half of this year [1] Group 4 - Shareholders of Cambridge Technology have been frequently reducing their holdings, raising concerns among investors, particularly the actual controller, who has sold over 400 million yuan since the end of 2022 [2]