鸿蒙概念

Search documents

金融科技ETF(159851):金融科技投入加大,板块掘金正当时

Xin Lang Cai Jing· 2026-02-05 01:38

Group 1 - The core viewpoint of the article highlights that the financial technology sector is entering a phase of "quality improvement and expansion," driven by policy support and accelerated AI penetration, with expected investment growth to 651.5 billion yuan by 2028 [3][10]. - The scale of financial technology investment by domestic financial institutions has been increasing year by year, with projections showing a steady rise from 2,691 billion yuan in 2022 to 6,515 billion yuan in 2028 [4][10]. Group 2 - The financial technology sector is characterized by high elasticity and serves as a barometer, heavily investing in computer and non-banking financial sectors, which combine financial cycles and technology growth attributes [6][10]. - The thematic concept distribution within financial technology includes internet brokerage, financial IT, AI applications, mobile payments, and the Hongmeng concept, indicating a broad coverage of popular sectors [6][11]. Group 3 - The top ten weighted stocks in the financial technology index account for 51.09% of the index, focusing on leading internet financial companies such as Dongfang Caifu, Tonghuashun, and Guidan [12][14]. - The average market capitalization of the constituent stocks is 23.389 billion yuan, with over 47% of the stocks having a market cap below 10 billion yuan, highlighting the potential for growth in small-cap stocks [13][14].

卓创资讯跌0.72%,成交额3231.14万元,近5日主力净流入-695.77万

Xin Lang Cai Jing· 2025-12-30 08:18

Core Viewpoint - The company, Zhaochuang Information, is a leading provider of commodity information services in China, focusing on data monitoring, price assessment, and industry analysis in the commodity market [2][7]. Group 1: Company Overview - Zhaochuang Information was established on April 22, 2004, and went public on October 19, 2022. It is headquartered in Zibo, Shandong Province [7]. - The company's main business segments include information services (57.19%), digital services (20.98%), exhibition services (12.08%), consulting services (9.74%), and others (0.01%) [7]. - As of September 30, 2025, the company had 11,800 shareholders, a decrease of 15.79% from the previous period, with an average of 3,025 circulating shares per person, an increase of 18.76% [7]. Group 2: Financial Performance - For the period from January to September 2025, Zhaochuang Information achieved a revenue of 263 million yuan, representing a year-on-year growth of 19.91% [7]. - The net profit attributable to the parent company was 49.52 million yuan, a decrease of 5.93% year-on-year [8]. - The company has distributed a total of 325 million yuan in dividends since its A-share listing [9]. Group 3: Recent Developments - The company has developed the HarmonyOS version of its app and the Zhaochuang Short Message app, which are expected to be launched in the app market soon [2]. - Zhaochuang Information has completed the localized deployment of the DeepSeek series large models, transitioning from technology introduction to practical application [3]. - The company has launched an AI platform and automated information production tools, significantly enhancing analysts' efficiency and improving product experience for clients [3]. Group 4: Market Activity - On December 30, the company's stock price fell by 0.72%, with a trading volume of 32.31 million yuan and a turnover rate of 1.06%, resulting in a total market capitalization of 3.225 billion yuan [1]. - The main capital flow showed a net outflow of 3.33 million yuan, accounting for 0.1% of the total, with the industry ranking 10th out of 14 [4].

卓创资讯涨1.15%,成交额3759.02万元,后市是否有机会?

Xin Lang Cai Jing· 2025-12-29 11:35

Core Viewpoint - The company, Zhaochuang Information, is a leading provider of commodity information services in China, focusing on data monitoring, price assessment, and industry analysis in the commodity market [2]. Group 1: Company Overview - Zhaochuang Information was established on April 22, 2004, and went public on October 19, 2022. The company is headquartered in Zibo, Shandong Province, China [7]. - The main business segments include information services (57.19%), digital services (20.98%), exhibition services (12.08%), consulting services (9.74%), and others (0.01%) [7]. - As of September 30, 2025, the company reported a revenue of 263 million yuan, representing a year-on-year growth of 19.91%, while the net profit attributable to shareholders was 49.52 million yuan, a decrease of 5.93% year-on-year [8]. Group 2: Technological Developments - The company has developed the HarmonyOS version of its app and the Zhaochuang Short Message app, which are expected to be launched in the market soon [2]. - Zhaochuang Information has completed the localized deployment of the DeepSeek series large models, transitioning from technology introduction to practical application [2]. - The company has launched an AI platform and automated information production tools, significantly enhancing analysts' efficiency and providing clients with a more streamlined product experience [3]. Group 3: Market Activity - On December 29, the stock price of Zhaochuang Information increased by 1.15%, with a trading volume of 37.59 million yuan and a market capitalization of 3.248 billion yuan [1]. - The stock has seen a net outflow of 2.5573 million yuan from major investors today, with a total net outflow of 8.0347 million yuan over the past two days [4][5]. - The average trading cost of the stock is 57.70 yuan, and it is currently near a resistance level of 53.92 yuan, indicating potential for upward movement if this level is surpassed [6].

卓创资讯跌0.42%,成交额2209.50万元,今日主力净流入-40.40万

Xin Lang Cai Jing· 2025-12-10 08:19

Core Viewpoint - The company, Zhaochuang Information, is a leading provider of commodity information services in China, focusing on data monitoring, price evaluation, and industry analysis in the commodity market [2][7]. Group 1: Company Overview - Zhaochuang Information was established on April 22, 2004, and went public on October 19, 2022. It is headquartered in Zibo, Shandong Province [7]. - The company's main business segments include information services (57.19%), digital services (20.98%), exhibition services (12.08%), consulting services (9.74%), and others (0.01%) [7]. - As of September 30, 2025, the company had 11,800 shareholders, a decrease of 15.79% from the previous period, with an average of 3,025 circulating shares per person, an increase of 18.76% [7]. Group 2: Financial Performance - For the period from January to September 2025, Zhaochuang Information achieved a revenue of 263 million yuan, representing a year-on-year growth of 19.91% [7]. - The net profit attributable to the parent company was 49.52 million yuan, a decrease of 5.93% year-on-year [8]. - The company has distributed a total of 325 million yuan in dividends since its A-share listing [9]. Group 3: Recent Developments - The company has developed a HarmonyOS version of its Zhaochuang Information APP and Zhaochuang News APP, which are expected to be launched in the application market soon [2]. - Zhaochuang Information has completed the localized deployment of the DeepSeek series large models, transitioning from technology introduction to practical application [3]. - The company has launched an AI platform and automated information production tools, significantly enhancing analysts' work efficiency and improving product experience for clients [3]. Group 4: Market Activity - On December 10, the stock price of Zhaochuang Information fell by 0.42%, with a trading volume of 22.095 million yuan and a turnover rate of 0.71%, resulting in a total market capitalization of 3.331 billion yuan [1]. - The main capital flow showed a net outflow of 404,000 yuan today, with a ranking of 6 out of 14 in the industry, indicating a reduction in main capital over three consecutive days [4][5].

立达信跌0.60%,成交额1.31亿元,近3日主力净流入2319.06万

Xin Lang Cai Jing· 2025-12-09 07:38

Core Viewpoint - The company, Lida Xin, is experiencing a decline in net profit while maintaining a significant portion of its revenue from overseas markets, benefiting from the depreciation of the RMB. Group 1: Company Performance - As of September 30, Lida Xin reported a revenue of 4.947 billion yuan, a year-on-year increase of 0.13%, while the net profit attributable to the parent company was 127 million yuan, a decrease of 54.35% year-on-year [8] - The company has distributed a total of 585 million yuan in dividends since its A-share listing, with 523 million yuan distributed over the past three years [9] Group 2: Business Operations - Lida Xin's main business includes the research, development, manufacturing, sales, and service of LED lighting products, smart home, and smart building IoT products [7] - The revenue composition of the company is as follows: lighting products and accessories 64.10%, IoT products and accessories 25.14%, home appliances and accessories 8.04%, and other products 1.56% [7] Group 3: Market Position and Strategy - The company has a significant overseas revenue share of 89.22%, benefiting from the depreciation of the RMB [3] - Lida Xin is collaborating with Huawei on the HarmonyOS, aiming to explore new forms of smart living in the intelligent lighting sector [2] Group 4: Stock Performance - On December 9, Lida Xin's stock price fell by 0.60%, with a trading volume of 131 million yuan and a turnover rate of 1.30%, resulting in a total market capitalization of 10.05 billion yuan [1]

卓创资讯涨1.14%,成交额4334.12万元,近5日主力净流入-367.06万

Xin Lang Cai Jing· 2025-12-01 10:18

Core Viewpoint - The company, Zhaochuang Information, is a leading provider of commodity information services in China, focusing on data monitoring, price assessment, and industry analysis in the commodity market [2]. Group 1: Company Overview - Zhaochuang Information was established on April 22, 2004, and went public on October 19, 2022. The company is headquartered in Zibo, Shandong Province [7]. - The main business revenue composition includes information services (57.19%), intelligent services (20.98%), exhibition services (12.08%), consulting services (9.74%), and others (0.01%) [7]. - As of September 30, 2025, the company reported a revenue of 263 million yuan, representing a year-on-year growth of 19.91%, while the net profit attributable to shareholders was 49.52 million yuan, a decrease of 5.93% year-on-year [7][8]. Group 2: Recent Developments - The company has developed the HarmonyOS version of its app and the Zhaochuang Short Message app, which are expected to be launched in the market soon [2]. - Zhaochuang Information has completed the localized deployment of the DeepSeek series large models, transitioning from technology introduction to practical application [3]. - The company has launched an AI platform and automated information production tools, significantly enhancing analysts' work efficiency and improving product experience for clients [3]. Group 3: Market Activity - On December 1, the stock price of Zhaochuang Information increased by 1.14%, with a trading volume of 43.34 million yuan and a turnover rate of 1.35%, resulting in a total market capitalization of 3.441 billion yuan [1]. - The main net inflow of funds today was 5.8857 million yuan, accounting for 0.14%, with the industry ranking at 3 out of 14 [4]. - The average trading cost of the stock is 59.25 yuan, with the current stock price fluctuating between resistance at 57.68 yuan and support at 55.73 yuan, indicating potential for range trading [6].

立达信涨0.91%,成交额1.27亿元,近5日主力净流入-1314.61万

Xin Lang Cai Jing· 2025-12-01 07:25

Core Viewpoint - The company, Lida Xin, is experiencing growth in its stock performance and is benefiting from collaborations in the smart lighting and IoT sectors, particularly through its partnership with Huawei's HarmonyOS [2][3]. Group 1: Company Overview - Lida Xin is primarily engaged in the research, development, manufacturing, sales, and service of LED lighting products, smart home, and smart building IoT products [7]. - The company's main revenue sources are lighting products and accessories (64.10%), IoT products and accessories (25.14%), home appliances and accessories (8.04%), and other products (1.56%) [7]. - As of September 30, the company had 14,600 shareholders, an increase of 16.11%, with an average of 34,370 circulating shares per person, a decrease of 13.88% [8]. Group 2: Financial Performance - For the period from January to September 2025, Lida Xin achieved a revenue of 4.947 billion yuan, a year-on-year increase of 0.13%, while the net profit attributable to shareholders decreased by 54.35% to 127 million yuan [8]. - The company has distributed a total of 585 million yuan in dividends since its A-share listing, with 523 million yuan distributed over the past three years [9]. Group 3: Market Position and Trends - The company has a significant overseas revenue share of 89.22%, benefiting from the depreciation of the Chinese yuan [3]. - Lida Xin's stock price increased by 0.91% on December 1, with a trading volume of 127 million yuan and a turnover rate of 1.41%, leading to a total market capitalization of 8.921 billion yuan [1].

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

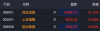

鸿蒙概念股盘初拉升

Di Yi Cai Jing· 2025-10-28 03:10

Group 1 - Dahua Intelligent has achieved a four-day consecutive increase in stock price [1] - Rongji Software has reached the daily limit on its stock price [1] - Tax Friend Co., Kingsoft Office, Geer Software, Hehe Information, and Zhiyuan Interconnection have all seen stock price increases [1]

鸿蒙概念股盘初拉升 达华智能4连板

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-28 01:54

Core Viewpoint - The Hongmeng concept stocks experienced a significant surge in early trading, indicating strong market interest and potential investment opportunities in this sector [1] Company Performance - Dahua Intelligent achieved a four-day consecutive increase in stock price [1] - Rongji Software reached its daily limit up [1] - Tax Friend Co., Kingsoft Office, Geer Software, Hehe Information, and Zhiyuan Interconnect also saw their stock prices rise in response to the trend [1]