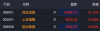

国产软件概念

Search documents

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

A股震荡走高,农业银行总市值逼近3万亿大关,中际旭创续创新高,国债大涨,人民币中间价创近一年高位

Hua Er Jie Jian Wen· 2025-10-28 02:04

Market Overview - A-shares opened lower with the three major indices experiencing fluctuations and declines, particularly in technology stocks, storage chips, and copper-clad laminate concepts [1][12] - The Hang Seng Index opened higher but turned negative, with mixed performance in tech stocks and declines in Apple-related stocks [2][3] - The bond market saw a collective rebound in government bond futures, with the 30-year main contract rising by 0.56% [3][4] A-shares Performance - As of the report, the Shanghai Composite Index fell by 0.18% to 3989.66, while the Shenzhen Component Index decreased by 0.09% to 13477.57, and the ChiNext Index rose by 0.16% to 3239.53 [1][12] - The technology sector faced a general pullback, with significant declines in storage chips and copper-clad laminate concepts, and a notable drop of nearly 6% in Shenghong Technology post-earnings [12][13] Hong Kong Market Performance - The Hang Seng Index decreased by 0.30% to 26353.17, and the Hang Seng Tech Index fell by 0.42% to 6145.14 [2][3] - The performance of Chinese tech stocks was mixed, with some stocks like Xiaopeng Motors rising over 4% [16] Commodity Market - Domestic commodity futures mostly rose, with polysilicon and lithium carbonate increasing by over 2%, while other commodities like rapeseed, glass, and iron ore also saw gains [4][5] - Precious metals experienced declines, with gold and silver dropping over 2% [5][16] CPO Concept Stocks - CPO concept stocks showed a rebound, with Zhongji Xuchuang rising nearly 4% to reach a historical high, and Lian Te Technology increasing by over 10% [6][7] Banking Sector - The banking sector exhibited mixed trends, with Agricultural Bank of China rising over 1% to approach a market capitalization of 3 trillion, while other banks like Shanghai Pudong Development Bank fell over 4% [8][9] Robotics and Software Concepts - Robotics stocks surged, with Nanjing Julong increasing over 12%, while the domestic software sector saw stocks like Rongji Software hitting the daily limit [10][12]

重回3900!

Sou Hu Cai Jing· 2025-10-15 09:58

Market Overview - The three major indices in China experienced a rise, with the Shanghai Composite Index increasing by 1.22% to return above 3900 points, the Shenzhen Component rising by 1.73%, and the ChiNext Index soaring by 2.35%. Over 4300 stocks in the market saw gains [1]. - The Hang Seng Technology Index also rebounded, gaining over 2% as internet technology stocks stopped their decline [2]. Economic Indicators - The Chinese yuan's midpoint rose to 7.10, the strongest level since November of the previous year. The Producer Price Index (PPI) for September showed a year-on-year decline of 2.3%, with the decline narrowing by 0.6 percentage points from the previous month. The core Consumer Price Index (CPI) increased by 1.0% year-on-year, marking the first return to 1% in nearly 19 months [3]. - U.S. Federal Reserve Chairman Jerome Powell indicated a potential for interest rate cuts this month, despite ongoing government shutdown impacts on economic assessments [3]. Sector Performance - The power equipment, automotive, electronics, and pharmaceutical sectors saw significant gains, while rare earth and military stocks underperformed [3]. - The innovative drug sector led the early market surge, with stocks like Guangsheng Tang and Shutaishen rising over 10%. Other notable performers included Jimin Health and Lianhuan Pharmaceutical, which hit the daily limit [5][7]. Investment Trends - The period of October to November is traditionally a peak season for business development (BD) transactions, with Chinese innovative drug BD transactions accounting for 15.37% of the global total by number and 51.73% by value as of August 17 [8]. - The domestic software sector also saw a significant uptick, with stocks like Junqi Software and Geer Software experiencing substantial gains [10]. Technology Sector Developments - The technology sector showed a strong recovery, particularly in power equipment, with stocks like Heshun Electric and Jinpan Technology hitting the daily limit [11]. - NVIDIA announced new specifications for its MGX architecture server, with over 20 industry partners showcasing new technologies, indicating a robust market for high-voltage direct current (HVDC) data centers [11]. - The robotics sector saw a surge, with companies like Sanhua Intelligent Control and Weikang Robot experiencing significant stock price increases [12]. Market Sentiment and Future Outlook - The market's recent volatility has led to increased sensitivity to events, but the recent adjustments may present better reallocation opportunities for investors [13]. - Historical patterns suggest that after significant downturns, markets often rebound strongly, as seen in April of this year [15][24]. - Investors are advised to monitor growth sectors like AI for potential rebounds, as these areas are likely to attract market interest once the current corrections conclude [18][20].

A股午评:三大指数集体上涨,创业板指涨0.22%北证50涨0.97%,创新药概念反弹,稀土永磁板块回调!超3200股上涨,成交额12805亿缩量4010亿

Ge Long Hui· 2025-10-15 04:51

Market Overview - The three major A-share indices experienced an upward trend in the morning session, with the Shanghai Composite Index rising by 0.1% to 3869.25 points, the Shenzhen Component Index remaining flat, and the ChiNext Index increasing by 0.22%. The North China 50 index saw a rise of 0.97%. The total trading volume in the Shanghai and Shenzhen markets reached 12,805 billion yuan, a decrease of 4,010 billion yuan compared to the previous day, with over 3,200 stocks in the market showing gains [1]. Sector Performance - The innovative drug sector rebounded, with notable performances from Asia-Pacific Pharmaceutical, which achieved two consecutive trading limits, and Guangsheng Tang, which hit the daily limit of 20%. Other companies like Anglikang and Lianhuan Pharmaceutical also saw their stocks rise by 10%. The European Society for Medical Oncology (ESMO) annual meeting is scheduled to take place in Berlin from October 17 to 21, 2025 [3]. - The retail sector showed strength, with Guoguang Chain hitting the daily limit, while Nanning Department Store and Gongxiao Daji increased by over 6% [3]. - The EDA (Electronic Design Automation) sector experienced a brief surge, with Huada Jiutian rising over 5%, and companies like Gelun Electronics and Guangliwei increasing by approximately 1%. A subsidiary of Xinkailai launched two EDA design software products [3]. - Domestic software stocks strengthened again, with Jiuqi Software and Geer Software hitting the daily limit [3]. Declining Sectors - The rare earth permanent magnet sector saw most stocks decline, with China Rare Earth, Northern Rare Earth, and Galaxy Magnet falling by over 5% [4]. - The port and shipping sector weakened, with Ningbo Shipping and Nanjing Port dropping by over 6% [4]. - The photolithography machine sector experienced widespread declines, with Xinlai Materials falling over 12%, and Guolin Technology and Kaimete falling by over 9% [4].

A股翻红,国产软件概念爆发,创新药强势反弹,多股涨停

21世纪经济报道· 2025-10-15 04:11

Market Overview - On October 15, the market experienced fluctuations, with the Shanghai Composite Index rising by 0.1%, the Shenzhen Component Index remaining flat, and the ChiNext Index increasing by 0.22%. The half-day trading volume exceeded 1.28 trillion yuan [1]. Sector Performance - The market showed a mixed performance with notable activity in sectors such as pharmaceuticals, domestic software, and consumer goods. The domestic software sector rebounded strongly, with stocks like Jiuqi Software and Geer Software hitting the daily limit. The innovative drug sector also saw significant gains, with stocks like Angli Kang and Yatai Pharmaceutical reaching their daily limits [2][4]. Domestic Software Sector - The domestic software sector saw a notable rise, with Geer Software and Jiuqi Software both hitting the daily limit. Other companies like Pinming Technology and Haocen Software also experienced substantial increases, with Haocen Software rising by 15% [2][3]. EDA Software Development - The launch of two domestically developed EDA (Electronic Design Automation) software products by Wuhan Qiyunfang Technology Co., a subsidiary of Xinkailai, is seen as a milestone for China's semiconductor and electronic software autonomy. The domestic EDA market currently has a localization rate of less than 20%, dominated by overseas giants. The new products reportedly improve performance by 30% and reduce hardware development cycles by 40% [4]. Innovative Drug Sector - The innovative drug sector showed strong performance, with several stocks reaching their daily limits. Notable mentions include Guangsheng Tang, which rose by 20%, and Shutaishen, which increased by 14.4% [5][7]. - Recent approvals for clinical trials of multiple injectable drugs by Heng Rui Pharmaceutical are expected to boost the sector. Analysts suggest that the recent market pullback in pharmaceuticals presents a buying opportunity, with expectations of a recovery in innovative drug research and development [7]. Investment Outlook - Analysts remain optimistic about the long-term growth of the innovative drug sector, highlighting the trend of innovative drugs entering overseas markets. The end of the year is anticipated to see a surge in business development (BD) activities, which could lead to significant opportunities for investors [7].

A股午评:创业板指涨0.22%,超3200股上涨!创新药概念反弹,稀土永磁板块回调

Ge Long Hui A P P· 2025-10-15 03:47

Market Overview - The three major A-share indices rose in early trading, with the Shanghai Composite Index up 0.1% at 3869.25 points, the Shenzhen Component Index flat, and the ChiNext Index up 0.22% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 12,805 billion yuan, a decrease of 4,010 billion yuan from the previous day, with over 3,200 stocks rising across the market [1] Sector Performance - The innovative drug concept stocks rebounded, with Asia-Pacific Pharmaceutical gaining for two consecutive days, Guangsheng Tang hitting the daily limit, and Anglikang and Lianhuan Pharmaceutical also reaching the daily limit [1] - The retail sector strengthened, with Guoguang Chain hitting the daily limit and Nanning Department Store and Gongxiao Daji rising over 6% [1] - EDA concept stocks saw a temporary surge, with BGI Tech rising over 5%, and other companies like Gelun Electronics and Guangliwei increasing by about 1% [1] - Domestic software stocks strengthened again, with Jiuqi Software and Geer Software hitting the daily limit [1] Declining Sectors - The rare earth permanent magnet concept stocks mostly retreated, with China Rare Earth, Northern Rare Earth, and Galaxy Magnet falling over 5% [1] - The port and shipping sector weakened, with Ningbo Shipping and Nanjing Port dropping over 6% [1] - The photolithography machine concept stocks generally declined, with Xinlai Materials (rights protection) falling over 12%, and Guolin Technology and Kaimete falling over 9% [1] Technical Indicators - A MACD golden cross signal has formed, indicating a positive trend for certain stocks [1]

盈建科:关注到近期市场对于国产软件概念关注度较高

Zhi Tong Cai Jing· 2025-10-14 11:40

Core Viewpoint - The company Yingjianke (300935.SZ) has experienced a significant stock price fluctuation, with a cumulative increase of over 30% in closing prices over three consecutive trading days, indicating abnormal trading activity [1] Group 1: Stock Performance - The company's stock has shown a cumulative increase of over 30% in closing prices over three consecutive trading days, which is classified as abnormal stock trading behavior [1] Group 2: Market Context - The company has noted a heightened market interest in domestic software concepts, which may be influencing the stock price movements [1] Group 3: Company Disclosure - The company has disclosed its operational status in relevant fields in its periodic reports, including future development prospects and associated risks [1]

盈建科:近期公司股价累计涨幅较大 提醒广大投资者理性投资

Zheng Quan Shi Bao Wang· 2025-10-14 11:36

Core Viewpoint - Yingjianke (300935) announced on October 14 that its stock price has experienced an abnormal fluctuation, with a cumulative increase of over 30% in closing price deviation over three consecutive trading days [1] Company Summary - The company noted a heightened market interest in domestic software concepts, which may have contributed to the stock price movement [1] - In its periodic report, the company disclosed its operational status in relevant fields, including future development prospects and associated risks [1] - The company emphasized the importance of value investment and urged investors to have a correct understanding of its business development and the risks associated with secondary market trading [1]

原以为大跌,没操作只亏了24元!”A股周一出现“奇迹日

Yang Zi Wan Bao Wang· 2025-10-13 10:46

Market Overview - On October 13, the Shanghai Composite Index opened lower but recovered, closing down 0.19% at 3889.5 points, while the Shenzhen Component Index fell 0.93% and the ChiNext Index dropped 1.11% [1][2] - The total trading volume for A-shares was 2.37 trillion yuan, down from 2.53 trillion yuan the previous day [1] Sector Performance - The rare earth permanent magnet sector saw a surge, with multiple stocks hitting the daily limit, including AnTai Technology and Baotou Steel Rare Earth [2] - The semiconductor sector also experienced significant activity, with stocks like Huahong Semiconductor and various photolithography machine manufacturers showing strong gains [2] - The domestic software sector was active, with companies like Kingsoft Office and China Software seeing notable increases in stock prices [3] Investment Sentiment - Investor sentiment appeared cautious but optimistic, with some expressing relief over minimal losses despite market fluctuations [1] - Social media discussions indicated a focus on maintaining positions and cautious trading strategies, reflecting a mixed outlook among retail investors [1] Analyst Insights - Analysts from Guojin Securities noted that there is no excessive panic in the market, suggesting that global risk assets may not experience severe adjustments but will require time to digest current conditions [4] - Longjiang Securities highlighted potential market corrections due to external factors like U.S. tariffs, but emphasized that the likelihood of these threats materializing is low [5]

A股,突变!

中国基金报· 2025-10-13 05:04

Market Overview - The A-share market opened lower but showed resilience, with the Shanghai Composite Index closing at 3846.25 points, down 1.3%, and the Shenzhen Component Index down 2.56% [1] - The total market turnover was 1.59 trillion yuan, slightly lower than the previous day, with 4545 stocks declining and 840 stocks rising [3] Sector Performance - The banking sector led the gains among major industries, with notable increases in stocks such as Shanghai Pudong Development Bank up over 4% and Nanjing Bank up over 3% [8] - The environmental protection sector also performed well, with Huicheng Environmental reaching a 20% limit up and several other stocks hitting their daily limits [10] - Aerospace and military industries showed strength, with stocks like Changcheng Military Industry and Aopu Optoelectronics hitting their daily limits [11] Concept Stocks - The "New Kailai" concept stocks were particularly active, with Tonghui Electronics hitting a 30% limit up and several other stocks like Xinlai Materials and Kaimeite Gas also reaching their daily limits [18] - The domestic software sector saw a collective surge, with stocks like Rongji Software and China Software hitting their daily limits [12] Notable Stock Movements - The banking sector saw significant gains, with Shanghai Pudong Development Bank at 12.37 yuan, up 4.48%, and Nanjing Bank at 11.19 yuan, up 3.52% [9] - In the environmental sector, Huicheng Environmental reached 169.85 yuan, up 19.28%, and Guolin Technology at 21.55 yuan, up 13.18% [10] - The military sector saw North Long Dragon at 152.66 yuan, up 15.41%, and Licheng Navigation at 59.45 yuan, up 12.70% [11] Regulatory and Policy Updates - The Ministry of Commerce announced new export controls on certain rare earth-related items, which has sparked discussions in the market [15] - The Ministry of Industry and Information Technology, along with six other departments, released a plan to promote service-oriented manufacturing innovation from 2025 to 2028, focusing on technology services and industrial design [15]