PSBC(01658)

Search documents

“金晖”映社区 暖心办社保 邮储银行北京丰台区开阳里支行打造“金融+养老”服务新样板

Zhong Guo Jin Rong Xin Xi Wang· 2025-10-14 06:39

Core Points - The article highlights the efforts of Postal Savings Bank of China Beijing Branch in facilitating the issuance of the third-generation social security cards for retirees, emphasizing a customer-centric approach focused on elderly clients [1][2] - The bank's Kaoyangli branch has integrated financial services with community elderly care needs, providing a convenient experience for residents in obtaining their social security cards [1] Group 1 - The issuance of the third-generation social security cards began on October 9, with a focus on meeting the needs of elderly clients [1] - The Kaoyangli branch has established a "Warm Community Service" model, creating a convenient service point for card issuance within the community [1] - Volunteers at the branch are well-trained to assist elderly clients, providing personalized support and guidance throughout the card application process [1] Group 2 - The branch collaborates with local elderly care institutions and community committees to expand the reach of its services, ensuring that social security card issuance and financial consultations are accessible [2] - The bank addresses not only the core financial needs of elderly clients but also their daily service requirements, enhancing the "Financial + Elderly Care" service system [2] - The initiative aims to set a benchmark for elderly financial services in the region, reflecting the bank's commitment to serving the community [2]

政企协同赋动能 金融活水润实业

Sou Hu Cai Jing· 2025-10-14 05:15

"这笔贷款不仅免除利息负担,更让我们真切感受到工会'娘家人'的温暖与邮储银行的鼎力支持,让我 们开拓市场、做大事业更有信心和底气。"一位近期获得"抚工贷"支持的创业者感慨道。这样的心声, 正是"抚工贷"普惠属性与实效价值的生动缩影,彰显了金融服务与实体经济深度融合的显著成效。 ——抚州市总工会联合邮储银行发放"抚工贷"超3.7亿元助燃地方发展引擎 为深度践行抚州市委、市政府"工业强市"战略部署,筑牢市场主体金融支撑根基,持续释放稳就业、促 创新、惠民生的叠加效应,2025年,抚州市总工会再度携手邮储银行抚州市分行,深化工会创新创业小 额贷款"抚工贷"专项合作,以金融之力为抚州高质量跨越式发展注入强劲动能。 作为抚州市总工会与邮储银行联袂打造的普惠金融标杆产品,"抚工贷"精准锚定广大工会会员、小微企 业及创新创业群体核心需求。依托工会组织"桥梁纽带"的组织优势与邮储银行"普惠金融"的专业服务优 势,该产品有效破解初创期、成长期市场主体"融资难、融资贵"的痛点堵点,赢得社会各界尤其是创业 群体的广泛认可。截至目前,邮储银行抚州市分行已累计投放"抚工贷"1830笔,总金额突破3.7亿元; 仅2025年以来,便向全市 ...

这类独立App、网站正在退场,很多人都在用

猿大侠· 2025-10-14 04:11

Core Viewpoint - Several medium and large banks in China are shutting down their independent mobile apps, indicating a shift towards consolidating services within fewer applications to enhance user experience and operational efficiency [1][5]. Group 1: Bank App Shutdowns - China Bank announced the discontinuation of its credit card app "Binfeng Life," with all functionalities migrating to the "China Bank" app [2]. - Beijing Bank stated that its direct banking app and website will cease operations on November 12, 2025, with services moving to the "Jingcai Life" mobile banking app [3]. - Over the past year, more than ten banks, including Postal Savings Bank and Beijing Rural Commercial Bank, have closed various mobile apps, primarily credit card and direct banking apps [5]. Group 2: Reasons for App Closures - The proliferation of independent banking apps was driven by competition for customer acquisition in the mobile internet era, leading to a situation where banks developed multiple apps [6]. - The existence of overlapping functionalities between direct banking and mobile banking apps has resulted in resource duplication and increased operational costs, negatively impacting user experience [7]. - Regulatory bodies have mandated banks to eliminate low-activity and high-risk apps, emphasizing the need for regular evaluation and optimization of mobile applications [8]. Group 3: User Engagement and Profitability Issues - Financial apps generally lack strong social attributes, leading to low monthly active user rates; for instance, the monthly active users of China Merchants Bank's credit card app dropped from 41.98 million at the end of 2023 to 39.08 million by mid-2024 [10]. - Many banks are integrating credit card and direct banking app functionalities into their main mobile banking apps to enhance efficiency and user experience [10]. - The direct banking model has faced challenges, including continuous losses, as exemplified by Postal Savings Bank's direct banking unit, which has struggled to meet market demands for comprehensive financial services [15][16].

邮储银行河南省分行原副行长吕周谦接受纪律审查和监察调查

Bei Jing Shang Bao· 2025-10-14 02:17

北京商报讯(记者 宋亦桐)10月14日,据清风中原微信公众号消息,据中国邮政储蓄银行纪委和河南 省新乡市纪委监委消息:中国邮政储蓄银行河南省分行原党委委员、副行长吕周谦涉嫌严重违纪违法, 目前正接受中国邮政储蓄银行纪委纪律审查和河南省新乡市监察委员会监察调查。 ...

中国邮政储蓄银行河南省分行原党委委员、副行长吕周谦接受纪律审查和监察调查

Yang Shi Wang· 2025-10-14 01:57

央视网消息:据"清风中原"微信公众号消息,据中国邮政储蓄银行纪委和河南省新乡市纪委监委消息: 中国邮政储蓄银行河南省分行原党委委员、副行长吕周谦涉嫌严重违纪违法,目前正接受中国邮政储蓄 银行纪委纪律审查和河南省新乡市监察委员会监察调查。 ...

金融搭台 文旅唱戏

Jin Rong Shi Bao· 2025-10-14 01:14

Group 1 - The core viewpoint of the articles highlights the robust growth in domestic tourism and cultural consumption during the recent National Day and Mid-Autumn Festival holiday, with 888 million domestic trips taken and total spending reaching 809 billion yuan, reflecting the effectiveness of financial support policies for consumption [1] - Various banking institutions are targeting the cultural and tourism market by enhancing services from mere payment tools to comprehensive consumer service partners, offering credit and payment discounts while integrating tourism resources through digital platforms [1][2] - In Jiangxi, banks are focusing on consumer experience by improving payment convenience and providing targeted financial support to local businesses, which has effectively stimulated holiday consumption [2][3] Group 2 - In Sichuan, the launch of the National Day Cultural and Tourism Consumption Month aims to enhance quality tourism offerings and meet public demand, with local banks implementing promotional activities to boost both dining and housing needs [4][5] - Fujian is leveraging its unique natural and cultural resources to attract over 46 million visitors, with banks providing tailored financial products to support local hospitality businesses facing seasonal challenges [7][8] - The integration of digital financial services in Fujian is facilitating smoother transactions for tourists and merchants, promoting a cycle of comfortable consumer experiences and efficient business operations [8]

邮储银行发生2笔大宗交易 合计成交617.10万元

Zheng Quan Shi Bao Wang· 2025-10-13 14:09

Core Viewpoint - Postal Savings Bank of China experienced significant trading activity on October 13, with a total of 1.1 million shares traded through block trades, amounting to 6.171 million yuan at a price of 5.61 yuan per share [2] Trading Activity Summary - On October 13, there were 2 block trades for Postal Savings Bank, totaling 1.1 million shares and 6.171 million yuan in transaction value, with a consistent price of 5.61 yuan [2] - Over the past three months, the stock has seen a total of 6 block trades, accumulating a transaction value of 18.757 million yuan [2] Stock Performance Summary - The closing price for Postal Savings Bank on the same day was 5.61 yuan, reflecting a decline of 0.88%, with a daily turnover rate of 0.26% and a total transaction value of 981 million yuan [2] - The stock has experienced a cumulative decline of 5.40% over the past five days, with a net outflow of funds totaling 312 million yuan during this period [2] Margin Trading Summary - The latest margin financing balance for Postal Savings Bank stands at 752 million yuan, having increased by 15.3201 million yuan over the past five days, representing a growth rate of 2.08% [2]

中国邮政储蓄银行股份有限公司入围《经济观察报》2024—2025年度受尊敬企业

Jing Ji Guan Cha Wang· 2025-10-13 09:46

2025年10月13日,中国邮政储蓄银行股份有限公司在优质运营、创新突破、社会贡献等指标中表现优 异,入围《经济观察报》2024—2025年度受尊敬企业。根据经观中国上市公司综合价值评估体系,营业 收入、净利润、总资产、员工薪酬连续三年实现正增长。 ...

邮储银行今日大宗交易平价成交110万股,成交额617.1万元

Xin Lang Cai Jing· 2025-10-13 09:41

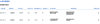

| 交易日期 | 证券简称 | 证券代码 | 成交价(元) | 成交金额(万元) 成交量( * ) 买入营业部 | | | | 卖出营业部 | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 2025-10-13 | 邮储银行 | 601658 | 5.61 | 448.8 | 80 | 国联民生证券股份 有限公司总部 | 华泰证券股份有限 公司泰州兴化英武 中路证券营业部 | | | 2025-10-13 | 邮储银行 | 601658 | 5.61 | 168.3 | 30 | 中信证券股公有限 公司深圳分公司 | 华泰证券股份有限 公司总部 | | 10月13日,邮储银行大宗交易成交110万股,成交额617.1万元,占当日总成交额的0.63%,成交价5.61元,较市场收盘价5.61元持平。 ...

邮储银行股价连续7天下跌累计跌幅7.43%,汇安基金旗下2只基金合计持25.82万股,浮亏损失11.62万元

Xin Lang Cai Jing· 2025-10-13 09:08

Core Viewpoint - Postal Savings Bank of China has experienced a continuous decline in stock price over the past week, raising concerns among investors regarding its performance and market position [1][2]. Company Overview - Postal Savings Bank of China, established on March 6, 2007, and listed on December 10, 2019, is headquartered in Beijing, China, and provides a range of banking and financial services [1]. - The bank's main business segments include personal banking (69.57% of revenue), corporate banking (19.70%), funding business (10.65%), and other services (0.07%) [1]. Stock Performance - As of October 13, the bank's stock price fell by 0.88% to 5.61 CNY per share, with a total market capitalization of 673.73 billion CNY [1]. - The stock has seen a cumulative decline of 7.43% over the past seven days [1]. Fund Holdings - Two funds under Huian Fund have significant holdings in Postal Savings Bank, totaling 258,200 shares, resulting in a floating loss of approximately 11,620 CNY over the past week [2]. - The specific funds include Huian Fengheng Mixed A and Huian Xinzhe Steady One-Year Holding Period Mixed A, with respective holdings of 144,500 shares and 113,700 shares [2].