ZHENGZHOU BANK(06196)

Search documents

郑州银行前三季度净利润22.79亿元 个人存款2671亿元增长22.44%

Zhong Guo Jing Ji Wang· 2025-10-30 12:11

Core Insights - Zhengzhou Bank reported a robust performance in Q3 2025, demonstrating resilience in a challenging external environment and contributing to the economic development of Henan province [1] Group 1: Financial Performance - As of the end of Q3 2025, Zhengzhou Bank's total assets reached 743.55 billion, marking a 9.93% increase from the end of the previous year, achieving the highest growth rate for the same period in history [2] - The bank's operating income for the first three quarters was 9.395 billion, reflecting a year-on-year increase of 3.91% [1] - Net profit attributable to shareholders was 2.279 billion, with a year-on-year growth of 1.56% [1] Group 2: Asset Growth and Lending - The asset scale increased by 67.187 billion in the first three quarters, equivalent to 1.87 times the growth of the same period last year [2] - Total loans and advances reached 406.717 billion, up 4.91% from the end of the previous year [2] - The bank focused on supporting key industries and projects, enhancing financing for advanced manufacturing and urban renewal [2] Group 3: Revenue and Retail Transformation - Net interest income for the first three quarters was 7.816 billion, showing a year-on-year increase of 5.83% [3] - Non-interest income significantly increased, showcasing the bank's profitability resilience and growth potential in a complex market [3] - Personal deposits reached 267.143 billion, a 22.44% increase from the end of the previous year, while personal loans grew by 5.88% to 96.306 billion [3]

郑州银行(002936) - 郑州银行股份有限公司第八届监事会第四次会议决议公告

2025-10-30 11:26

证券代码:002936 证券简称:郑州银行 公告编号:2025-041 郑州银行股份有限公司 第八届监事会第四次会议决议公告 郑州银行股份有限公司(以下简称"本行")及监事会全体成员保证公告内容的真实、准 确、完整,没有虚假记载、误导性陈述或重大遗漏。 一、会议召开情况 本行于 2025 年 10 月 20 日以电子邮件及书面方式向全体监事发出关于召开 第八届监事会第四次会议的通知,会议于 2025 年 10 月 30 日在郑州市商务外环 路 22 号郑州银行大厦现场召开。本次会议应出席监事 4 人,实际出席 4 人,其 中徐长生先生、耿明斋先生以视频接入方式出席会议。会议召开符合《公司法》 《深圳证券交易所股票上市规则》《香港联合交易所有限公司证券上市规则》和 《郑州银行股份有限公司章程》的规定,本次会议合法有效。会议由监事会临时 召集人胡跃先生主持。 二、会议审议情况 会议审议通过了《关于郑州银行股份有限公司 2025 年第三季度报告的议案》。 监事会认为:董事会编制和审议本行 2025 年第三季度报告的程序符合法律、 行政法规和中国证监会的规定,报告内容真实、准确、完整地反映了本行的实际 情况,不存在任 ...

郑州银行(002936) - 郑州银行股份有限公司第八届董事会第四次会议决议公告

2025-10-30 11:25

证券代码:002936 证券简称:郑州银行 公告编号:2025-040 郑州银行股份有限公司 第八届董事会第四次会议决议公告 郑州银行股份有限公司(以下简称"本行")及董事会全体成员保证公告内容的真实、准 确、完整,没有虚假记载、误导性陈述或重大遗漏。 一、会议召开情况 本行 2025 年第三季度报告在巨潮资讯网(http://www.cninfo.com.cn)披露, 供投资者查阅。 (三)会议审议通过了《郑州银行股份有限公司 2025 年第三季度第三支柱 信息披露报告》。 1 本议案同意票 9 票,反对票 0 票,弃权票 0 票。 本行于 2025 年 10 月 16 日以电子邮件及书面方式向全体董事发出关于召开 第八届董事会第四次会议的通知,会议于 2025 年 10 月 30 日在郑州市商务外环 路 22 号郑州银行大厦现场召开。本次会议应出席董事 9 人,实际出席 9 人,其 中,刘炳恒先生、刘亚天先生以电话或视频接入方式出席会议。本行全部监事列 席会议。会议召开符合《公司法》《深圳证券交易所股票上市规则》《香港联合交 易所有限公司证券上市规则》和《郑州银行股份有限公司章程》的规定。本次会 议合法有 ...

郑州银行(06196) - 2025 Q3 - 季度业绩

2025-10-30 11:12

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內 容 概 不 負 責,對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明,並 明 確 表 示 概 不 會就本公告全部或任何部分內容而產生或因倚賴該等內容而引致的任 何 損 失 承 擔 任 何 責 任。 Bank of Zhengzhou Co., Ltd.* 鄭州銀行股份有限公司 * (於中華人民共和國註冊成立的股份有限公司) 董事長 中國河南省鄭州市 2025年10月30日 於 本 公 告 日 期,董 事 會 成 員 包 括 執 行 董 事 趙 飛 先 生 及 李 紅 女 士;非 執 行 董 事 張 繼 紅 女 士、劉 炳 恒 先 生 及 衛 志 剛 先 生;以 及 獨 立 非 執 行 董 事 李 小 建 先 生、王 寧 先 生、劉 亞 天 先 生 及 蕭 志 雄 先 生。 * 本行並非香港法例第155章《銀 行 業 條 例》所 指 認 可 機 構,不 受 限 於 香 港 金 融 管 理 局 的 監 督,並 無 獲 授 權 在 香 港 經 營 銀 行 及╱或 接 受 存 款 業 務。 – 1 – 重 要 內 容 提 示: – 2 – ...

郑州银行2025年前三季度核心经营指标持续向好,延续营收、利润双增长趋势

Ge Long Hui· 2025-10-30 10:56

Core Insights - Zhengzhou Bank reported a significant increase in total assets, reaching 743.55 billion yuan as of the end of September, marking a year-on-year growth of 9.93%, the highest growth rate for the same period in history [1] - The bank's revenue and profit continued to grow in the first three quarters, achieving an operating income of 9.395 billion yuan, an increase of 3.91% compared to the same period last year, and a net profit attributable to shareholders of 2.279 billion yuan, up 1.56% year-on-year [1] - Total deposits reached 459.52 billion yuan, reflecting a year-on-year increase of 13.59%, while total loans and advances amounted to 406.72 billion yuan, showing a growth of 4.91% from the end of the previous year [1]

郑州银行(002936) - 2025 Q3 - 季度财报

2025-10-30 10:45

Financial Performance - Total operating income for Q3 2025 was RMB 2,704,735 thousand, an increase of 2.15% year-on-year[4] - Net profit attributable to shareholders for Q3 2025 was RMB 651,692 thousand, a slight increase of 0.22% year-on-year[4] - The bank's basic earnings per share for Q3 2025 was RMB 0.07, unchanged from the previous year[5] - The weighted average return on equity (ROE) for Q3 2025 was 5.71%, a decrease of 0.11 percentage points year-on-year[5] - The group's net profit for the nine months ended September 30, 2025, was RMB 2,300,027 thousand, slightly up from RMB 2,288,964 thousand in 2024, indicating a growth of 0.8%[48] - The total profit for the group for the nine months ended September 30, 2025, was RMB 2,638,597 thousand, compared to RMB 2,557,093 thousand in 2024, marking an increase of 3.2%[48] - The net profit for the group for the three months ended September 30, 2025, was RMB 633,671 thousand, slightly down from RMB 639,852 thousand in 2024, indicating a decrease of 0.3%[54] Assets and Liabilities - Total assets as of September 30, 2025, reached RMB 743,552,270 thousand, up 9.93% from the end of 2024[7] - The total liabilities reached RMB 685,937,978 thousand, up from RMB 620,070,469 thousand at the end of 2024, indicating an increase of about 10.66%[42] - The total equity attributable to shareholders was RMB 55,743,576 thousand, compared to RMB 54,445,031 thousand at the end of 2024, reflecting a growth of approximately 2.38%[44] - The bank's total assets under management increased significantly, with interbank lending rising by 57.69% to RMB 22,234,090 thousand compared to December 31, 2024[24] Loans and Deposits - Total loans and advances increased by 4.91% year-on-year, reaching RMB 406,716,657 thousand[7] - Customer deposits grew by 13.59% year-on-year, totaling RMB 459,517,775 thousand[7] - The total amount of loans classified as "normal" increased by 4.92% to RMB 391,274,006 thousand as of September 30, 2025[21] - The bank's loans and advances amounted to RMB 394,700,073 thousand, an increase from RMB 376,048,659 thousand at the end of 2024, showing a growth of about 4.37%[40] - The bank's total deposits reached RMB 470,280,431 thousand, compared to RMB 413,096,026 thousand at the end of 2024, indicating a growth of about 13.86%[42] Capital Adequacy and Ratios - The non-performing loan ratio stood at 1.76% as of September 30, 2025, slightly improved from 1.79% at the end of 2024[11] - The capital adequacy ratio was 12.00% as of September 30, 2025, meeting regulatory requirements[11] - As of September 30, 2025, the core tier 1 capital adequacy ratio is 8.76%, unchanged from December 31, 2024[16] - The total capital adequacy ratio stands at 12.00% as of September 30, 2025, slightly down from 12.06% at the end of 2024[16] - The leverage ratio decreased to 6.76% as of September 30, 2025, compared to 7.19% at the end of 2024[18] Cash Flow and Investments - Net cash flow from operating activities decreased by 41.13% in Q3 2025, totaling RMB 9,429,296 thousand[4] - The net cash inflow from operating activities for the group for the nine months ended September 30, 2025, was RMB 17,186,752,000, an increase of 47.5% compared to RMB 11,613,414,000 in the same period last year[60] - The net cash outflow from investment activities for the group was RMB 17,571,518,000, compared to RMB 5,521,555,000 in the previous year, indicating a significant increase in cash used for investments[62] - The total cash inflow from investment activities was RMB 86,778,609,000, compared to RMB 60,844,081,000 in the previous year, reflecting an increase of approximately 42.7%[62] - The bank's financial investments at fair value increased to RMB 48,107,116 thousand from RMB 32,484,947 thousand, reflecting a significant growth of approximately 48.00%[40] Shareholder Information - The number of ordinary shareholders reached 108,364, with A-share shareholders accounting for 108,314[27] - The total comprehensive income attributable to shareholders of the bank was RMB 257,642,000, down from RMB 491,681,000 in the same period last year, representing a decline of approximately 47.5%[56] - The basic and diluted earnings per share for the group remained stable at RMB 0.07 for both the current and previous periods[56] Other Financial Metrics - The liquidity coverage ratio is reported at 208.57% as of September 30, 2025, indicating strong liquidity position[19] - The group's credit impairment losses for the nine months ended September 30, 2025, were RMB 4,359,179 thousand, up from RMB 4,046,336 thousand in 2024, representing an increase of 7.7%[48] - The group's other comprehensive income for the nine months ended September 30, 2025, was RMB (798,664) thousand, compared to RMB 201,783 thousand in 2024, indicating a significant decline[50] - The total comprehensive income for the group for the three months ended September 30, 2025, was RMB 239,621,000, a decrease from RMB 481,262,000 in the same period last year, representing a decline of approximately 50.2%[56]

打折甩卖!这家银行1.21亿股股权“上架”

券商中国· 2025-10-30 04:10

Core Viewpoint - Zhengzhou Bank's shares held by Henan Guoyuan Trading Co., Ltd. are set for judicial auction, with a total of 121 million shares (approximately 1.33% of total shares) to be auctioned at a starting price of 1.83 yuan per share, totaling 221 million yuan [1][4]. Group 1: Auction Details - The auction includes two batches of shares: 90.2 million shares starting on December 4 with a starting price of 165.066 million yuan, and 30.8 million shares starting on December 11 with a starting price of 56.364 million yuan [2][3]. - The total starting price for both batches is 221.43 million yuan, with the current share price of Zhengzhou Bank at 2.02 yuan as of October 29 [1][4]. Group 2: Shareholder Background - Henan Guoyuan Trading Co., Ltd. has been reducing its stake in Zhengzhou Bank, decreasing from 4.24% in 2023 to 3.53% in 2024, and further down to 2.55% by mid-2025 [7][11]. - The company initially acquired shares at higher prices, paying 5.304 billion yuan for 195 million shares at 2.72 yuan each in 2011 and 4.64 billion yuan for 100 million shares at 4.64 yuan each in 2020 [8][10]. Group 3: Management Changes - Zhengzhou Bank has experienced significant management changes, with the former chairman resigning in March 2023 due to legal issues, and a new chairman appointed in July 2023 [12][14]. - The bank has faced performance challenges, leading to a lack of dividends since 2020, but reported a net profit increase in 2024, with a proposed cash dividend of 0.2 yuan per 10 shares [15].

郑州银行:携“首”共进,“郑”当时——2025年四季度投资策略报告会圆满落幕

Sou Hu Cai Jing· 2025-10-27 06:40

Core Insights - The investment strategy report meeting hosted by Zhengzhou Bank focused on macroeconomic trends and asset allocation opportunities for the fourth quarter of 2025 [1][8] - The event gathered industry experts and valued clients to discuss the current economic environment and investment strategies [1][3] Group 1: Opening Remarks - The opening speech was delivered by Sun Runhua, Vice President of Zhengzhou Bank, emphasizing the bank's commitment to being a "professional wealth manager" amidst a complex economic landscape [3] - The bank aims to protect value and guide clients through market cycles, fostering a collaborative approach to wealth management [3] Group 2: Macroeconomic Insights - The first keynote address was presented by Dr. Chen Hui, Assistant President of the Asset Management Division at Shichuang Securities, who analyzed the macroeconomic situation and capital market outlook during the economic transformation cycle [4] - This analysis provided valuable references for investors' strategic planning [4] Group 3: Investment Strategies - Dr. Sun Min, an investment manager at Shichuang Securities, discussed investment opportunities in equity markets and fixed-income products, advocating for a "steady progress and dynamic balance" allocation strategy [6] - This presentation aimed to create a clear investment roadmap for the fourth quarter [6] Group 4: Interactive Session - The event featured an interactive Q&A session where attendees engaged with experts on asset allocation and industry opportunities for the fourth quarter [7] - The expert team provided detailed and insightful answers, enhancing participants' investment confidence and creating a lively atmosphere [7] Group 5: Future Outlook - The report meeting concluded with a reaffirmation of Zhengzhou Bank's commitment to client-centric services and collaboration with top partners to deliver professional market insights and customized wealth management solutions [8] - The bank aims to be a trusted wealth manager, helping clients seize timely investment opportunities [8]

银行股三季报陆续披露 多家银行业绩均有改善 银行业净息差或企稳(附概念股)

Zhi Tong Cai Jing· 2025-10-27 02:12

Core Viewpoint - The A-share listed banks are expected to show overall revenue and net profit growth in the third quarter of 2025, with improvements in asset quality and a narrowing decline in net interest margins [1][2][3]. Group 1: Financial Performance - Huaxia Bank reported operating income of 64.881 billion yuan, a year-on-year decrease of 8.79%, and net profit attributable to shareholders of 17.982 billion yuan, down 2.86%, with a narrowing decline of 5.09 percentage points compared to the first half of the year [1]. - Chongqing Bank achieved operating income of 11.740 billion yuan, a year-on-year increase of 10.40%, and net profit of 5.196 billion yuan, up 10.42% [2]. - Ping An Bank reported operating income of 100.668 billion yuan, a year-on-year decrease of 9.8%, and net profit of 38.339 billion yuan, down 3.5%, with a narrowing decline compared to the first half of the year [2]. Group 2: Market Trends - Ten banks have seen shareholding increases from shareholders and executives this year, indicating a positive outlook for the banking sector amid macroeconomic stabilization and easing monetary policy [3]. - Analysts expect cumulative revenue and net profit for listed banks in the first three quarters of 2025 to grow by 0.4% and 1.1% year-on-year, respectively, driven by a narrowing decline in net interest margins and reduced credit costs [3]. Group 3: Interest Margin Outlook - Zhongtai Securities suggests that the net interest margin for banks may stabilize in the third quarter due to reduced re-pricing pressure on assets and a greater decline in deposit rates compared to the Loan Prime Rate (LPR) [4]. - The projected increase in net interest margin for the third and fourth quarters is 0.7 basis points and 0.3 basis points, respectively, indicating stability in the banking sector [4]. Group 4: Related Stocks - Goldman Sachs reported that the A-shares and H-shares of major banks have recorded absolute returns of 12% and 21% year-to-date, driven by improvements in asset quality and narrowing declines in net interest margins [5]. - Ping An Insurance increased its stake in Postal Savings Bank, acquiring 6.416 million shares at an average price of 5.3638 HKD per share [6].

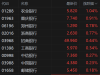

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]