LHG(600186)

Search documents

莲花控股(600186) - 莲花控股股份有限公司关于2023年股票期权与限制性股票激励计划预留授予部分第一个解除限售期解除限售暨上市的公告

2025-11-10 11:17

证券代码:600186 证券简称:莲花控股 公告编号:2025-088 莲花控股股份有限公司 关于 2023 年股票期权与限制性股票激励计划预留授予 部分第一个解除限售期解除限售暨上市的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性依法承担法律责任。 重要内容提示: 本次股票上市类型为股权激励股份;股票认购方式为网下,上市股数为 620,350股。 本次股票上市流通总数为620,350股。 本次股票上市流通日期为2025 年 11 月 14 日。 莲花控股股份有限公司(以下简称"公司")于 2025 年 8 月 28 日召开了第九 届董事会第三十三次会议、第九届监事会第二十次会议,审议通过了《关于 2023 年股票期权与限制性股票激励计划预留授予部分第一个行权期行权条件成就及第 一个解除限售期解除限售条件成就的议案》。现将有关事项说明如下: 一、本激励计划已履行的决策程序和信息披露情况 1、2023 年 8 月 10 日,公司召开第九届董事会第二次会议,审议通过了《关 于公司<2023 年股票期权与限制性股票激励计划(草案)>及其摘要 ...

莲花控股涨2.11%,成交额2.31亿元,主力资金净流入2717.00万元

Xin Lang Cai Jing· 2025-11-10 06:34

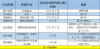

Core Viewpoint - Lianhua Holdings has shown a slight increase in stock price and significant trading activity, indicating investor interest and potential market movements [1][2]. Group 1: Stock Performance - On November 10, Lianhua Holdings' stock rose by 2.11%, reaching 5.81 CNY per share, with a trading volume of 231 million CNY and a turnover rate of 2.25%, resulting in a total market capitalization of 10.418 billion CNY [1]. - Year-to-date, the stock price has increased by 1.93%, but it has seen declines of 0.68% over the last five trading days, 2.52% over the last twenty days, and 5.83% over the last sixty days [1]. - The company has appeared on the "Dragon and Tiger List" eight times this year, with the most recent appearance on February 13, where it recorded a net buy of -154 million CNY [1]. Group 2: Company Overview - Lianhua Holdings, established on July 2, 1998, and listed on August 25, 1998, is located in Xiangcheng, Henan Province, and specializes in the research, production, and sales of food and seasoning products [2]. - The main revenue sources include amino acid seasonings (66.70%), compound seasonings (13.51%), and other products such as flour and liquid seasonings [2]. - As of September 30, the number of shareholders decreased by 17.81% to 143,700, while the average circulating shares per person increased by 21.67% to 12,429 shares [2]. Group 3: Financial Performance - For the period from January to September 2025, Lianhua Holdings reported a revenue of 2.491 billion CNY, reflecting a year-on-year growth of 28.74%, and a net profit attributable to shareholders of 253 million CNY, up 53.09% year-on-year [2]. - The company has distributed a total of 204 million CNY in dividends since its A-share listing, with no dividends paid in the last three years [3]. Group 4: Shareholder Structure - As of September 30, 2025, the fourth largest circulating shareholder is Shenwan Hongyuan Securities Co., Ltd., holding 30.8921 million shares as a new shareholder [3]. - Hong Kong Central Clearing Limited is the fifth largest shareholder, increasing its holdings by 13.3345 million shares to 26.3146 million shares [3].

莲花控股股份有限公司关于2023年股票期权与限制性股票激励计划预留授予部分第一个行权期行权结果暨股份过户登记的公告

Shang Hai Zheng Quan Bao· 2025-11-04 20:04

Core Viewpoint - The announcement details the results of the first exercise period for the stock options and restricted stock incentive plan of Lianhua Holdings, with a total of 495,350 shares being exercised on November 3, 2025 [2][22]. Group 1: Incentive Plan Overview - The incentive plan was approved by the board and supervisory committee on August 28, 2025, confirming the achievement of the first exercise conditions and the lifting of restrictions [11][13]. - The plan includes a total of 795,000 stock options and restricted stocks granted to 74 incentive objects, with the first grant date being September 25, 2023 [5][6]. - The plan aims to enhance corporate governance and motivate employees towards the company's sustainable development [3][4]. Group 2: Exercise Conditions and Arrangements - The first exercise period for the stock options is set from July 22, 2025, to July 22, 2026, while the lifting of restrictions for the restricted stocks is from October 21, 2025, to October 21, 2026 [14]. - The exercise requires that certain conditions are met, including no adverse audit opinions and compliance with performance assessment criteria [15][19]. - The exercise price for the stock options is set at 3.48 yuan per share, with a total of 18 individuals participating in the exercise [21]. Group 3: Financial Impact and Stock Structure - The exercise does not involve the issuance of new shares and will not affect the company's total share capital, which remains at 1,793,107,141 yuan [28]. - The shares used for the exercise are sourced from the company's repurchased A-shares, resulting in a decrease of 495,350 shares in the repurchase account [25]. - The company received a total of 1,723,818 yuan from the exercise of stock options by the incentive objects [26].

莲花控股(600186) - 莲花控股股份有限公司关于2023年股票期权与限制性股票激励计划预留授予部分第一个行权期行权结果暨股份过户登记的公告

2025-11-04 11:02

证券代码:600186 证券简称:莲花控股 公告编号:2025-087 莲花控股股份有限公司 关于 2023 年股票期权与限制性股票激励计划预留授 予部分第一个行权期行权结果暨股份过户登记的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或 者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: ●本次行权股票数量为 495,350 股 ●本次行权登记时间为 2025 年 11 月 3 日 莲花控股股份有限公司(以下简称"公司")于 2025 年 8 月 28 日召开了第 九届董事会第三十三次会议、第九届监事会第二十次会议,审议通过了《关于 2023 年股票期权与限制性股票激励计划预留授予部分第一个行权期行权条件成 就及第一个解除限售期解除限售条件成就的议案》。现将有关事项说明如下: 一、本激励计划已履行的决策程序和信息披露情况 3、2023 年 8 月 11 日,公司在上海证券交易所网站(www.sse.com.cn)披露 《莲花健康产业集团股份有限公司 2023 年股票期权与限制性股票激励计划首次 授予激励对象名单》。2023 年 8 月 11 日,公司在内部 ...

莲花控股涨2.12%,成交额2.72亿元,主力资金净流入901.27万元

Xin Lang Cai Jing· 2025-10-31 06:02

Core Insights - Lianhua Holdings' stock price increased by 2.12% on October 31, reaching 5.77 CNY per share, with a total market capitalization of 10.346 billion CNY [1] Financial Performance - For the period from January to September 2025, Lianhua Holdings reported a revenue of 2.491 billion CNY, representing a year-on-year growth of 28.74%, and a net profit attributable to shareholders of 253 million CNY, up 53.09% year-on-year [2] Shareholder Information - As of September 30, 2025, the number of shareholders decreased by 17.81% to 143,700, while the average circulating shares per person increased by 21.67% to 12,429 shares [2] - The top ten circulating shareholders include Shenyin Wanguo Securities Co., Ltd. as the fourth largest shareholder with 30.8921 million shares, and Hong Kong Central Clearing Limited as the fifth largest with 26.3146 million shares, which increased by 13.3345 million shares compared to the previous period [3] Stock Market Activity - Lianhua Holdings has appeared on the "Dragon and Tiger List" eight times this year, with the most recent appearance on February 13, where it recorded a net buy of -154 million CNY [1]

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

机构风向标 | 莲花控股(600186)2025年三季度已披露持仓机构仅8家

Xin Lang Cai Jing· 2025-10-31 02:24

Core Insights - Lotus Holdings (600186.SH) reported its Q3 2025 results on October 31, 2025, indicating a significant institutional investor presence with a total holding of 501 million shares, representing 27.95% of the company's total equity [1] Institutional Holdings - As of October 30, 2025, eight institutional investors disclosed their holdings in Lotus Holdings, with a combined ownership increase of 1.92 percentage points compared to the previous quarter [1] - The institutional investors include Wuhu Lian Tai Investment Management Center, Zhoukou Zhongkong Investment Co., Zhoukou Innovation Investment Group, Shenwan Hongyuan Securities, Hong Kong Central Clearing Limited, Galaxy Derui Capital Management, Anhui Hongkai Investment Management, and Guotai Junan Securities [1] Public Fund Activity - In this reporting period, 84 public funds were disclosed, including notable ETFs such as Southern CSI 1000 ETF, Huaxia CSI 1000 ETF, and others focused on food and beverage sectors [1] Foreign Investment - One foreign fund, Hong Kong Central Clearing Limited, increased its holdings by 0.74% compared to the previous period [1]

莲花控股前三季度营收净利创历史同期新高 算力业务板块收入同比增长超75%

Zheng Quan Shi Bao Wang· 2025-10-31 00:29

Core Insights - Lotus Holdings (600186) reported a significant increase in revenue and profit for the first three quarters of 2025, with operating income reaching 2.491 billion yuan, a year-on-year growth of 28.74%, and net profit attributable to shareholders at 253 million yuan, up 53.09% [1] - The company has successfully implemented a "dual-driven" strategy focusing on consumption and technology, leading to substantial growth in its computing power service business, which saw revenue of 97.67 million yuan, a 75.32% increase year-on-year [1][3] Financial Performance - For the first three quarters of 2025, Lotus Holdings achieved a historical high in both operating income and net profit, with net profit exceeding the total for the previous year [1] - The company's net profit margin improved due to optimized product structure, cost control, and economies of scale, contributing to the overall increase in profit [1] Business Development - The computing power service business has expanded rapidly, with contracts signed leading to a monthly collection of 3.4002 million yuan as of October 28, 2025 [1] - Lotus Holdings has established intelligent computing centers in multiple cities across China, particularly in the Yangtze River Delta region, focusing on large B-end clients and state-owned enterprises [2] Sales Growth - Online sales revenue reached 281 million yuan, a remarkable increase of 154.47%, while offline sales revenue was 2.196 billion yuan, growing by 20.48% [2] - The company’s new product development has been successful, with significant sales growth in products like chicken essence and soy sauce, the latter seeing a staggering increase of 911.68% [2] Strategic Initiatives - In September 2025, Lotus Holdings launched an employee stock ownership plan with high-performance targets, aiming for a net profit growth rate of no less than 40% year-on-year [2] - This initiative is designed to enhance team motivation and drive long-term development for the company [2] Market Position - Analysts believe that the "dual-driven" strategy of consumption and technology is providing continuous momentum for the company's growth, reinforcing its leading position in the industry [3] - The supportive national policies for technology are further propelling the development of the computing power service business, marking a new phase of high-quality growth for the company [3]

莲花控股:10月30日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-30 16:01

Group 1 - The core point of the article is that Lianhua Holdings announced a board meeting to discuss the cancellation of certain stock options and the repurchase of restricted stocks, indicating ongoing corporate governance activities [1] - For the fiscal year 2024, Lianhua Holdings' revenue composition is as follows: 96.86% from food manufacturing, 3.05% from computing services, and 0.09% from other businesses, highlighting the company's strong focus on the food sector [1] - As of the report, Lianhua Holdings has a market capitalization of 10.1 billion yuan, reflecting its valuation in the market [1]

莲花控股:2025年前三季度净利润约2.53亿元

Mei Ri Jing Ji Xin Wen· 2025-10-30 15:52

Group 1 - Company Lotus Holdings reported a revenue of approximately 2.491 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 28.74% [1] - The net profit attributable to shareholders of the listed company was approximately 253 million yuan, reflecting a year-on-year increase of 53.09% [1] - Basic earnings per share were 0.1409 yuan, which is a year-on-year increase of 52.99% [1] Group 2 - As of the report date, the market capitalization of Lotus Holdings is 10.1 billion yuan [2]