DHKJ(600288)

Search documents

豪掷3.6亿元买下徐翔母亲股权的神秘女子李蓉蓉,资金来源曝光:自有资金2.4亿元,高息借款1.2亿元!知情人:她是国企合同制员工

Mei Ri Jing Ji Xin Wen· 2025-10-11 16:35

Core Viewpoint - The auction of shares held by Zheng Suzhen, mother of Xu Xiang, has led to Daheng Technology officially becoming a company without a controlling shareholder, with the new largest shareholder being Li Rongrong, who holds 27.46 million shares, along with her concerted actor Zhou Zhengchang [1][2]. Group 1: Shareholder Changes - Zheng Suzhen's shares were auctioned and transferred on August 8, resulting in Daheng Technology's status change to having no controlling shareholder [1]. - Li Rongrong and Zhou Zhengchang together hold 9.26% of the shares, which is insufficient to control the board or significantly influence shareholder resolutions [1]. Group 2: Auction Details - The auction involved 1.3 billion shares, with Li Rongrong acquiring 27.46 million shares, and other buyers including China New Era Ltd. and several individuals [2]. - Li Rongrong's funding for the auction included 242 million yuan of personal funds and 120 million yuan raised from relatives, while Zhou Zhengchang's funds were primarily from family [4]. Group 3: Financing and Risks - Many buyers, including Li Rongrong, opted for high-interest loans to finance their purchases, with rates reaching up to 12% [4]. - Daheng Technology's explanation for the high financing costs is that the buyers did not gain control of the company and thus could not apply for acquisition loans [4]. Group 4: Future Plans and Industry Context - Daheng Technology plans to invest 600 million yuan to establish a wholly-owned subsidiary in the semiconductor sector, despite lacking relevant expertise and existing client relationships [8]. - The parent company of China New Era, which holds 82.82% of Ningbo Electronic Information Group, possesses semiconductor-related assets, indicating potential strategic alignment [9].

大恒科技“无主”:新股东高息举债接棒“徐翔系”,火速跨界埋风险

Tai Mei Ti A P P· 2025-10-11 12:48

Core Viewpoint - The control of Daheng Technology has shifted from Zheng Suzhen (mother of Xu Xiang) to "ownerless," with Li Rongrong and Zhou Zhengchang holding a combined 9.26% stake, making them the largest shareholders and acting in concert. This change follows the judicial auction of Zheng Suzhen's shares, which were sold for 1.71 billion yuan after intense bidding, raising concerns about the identities and funding sources of the new shareholders [1][2][4]. Shareholder Changes - The auction involved 8 bidders, with a total of 12.996 million shares (29.75% of the company) sold at a price of 17.1 billion yuan, reflecting a 60% premium over the starting price of 1.21 billion yuan [2][3]. - Li Rongrong, the leading bidder, is described as a middle-level cadre from a state-owned logistics company, raising questions about her ability to invest 360 million yuan [4][5]. Funding Sources and Relationships - The new shareholders have declared no shareholding proxies, but the funding sources of Li Rongrong and Zhou Zhengchang are under scrutiny due to their potential connections to the Xu Xiang family [4][5]. - Li Rongrong and Zhou Zhengchang have a common funding source, Zhou Jianbo, who is related to Zhou Zhengchang, further complicating the understanding of their financial relationships [5][11]. Financial Structure and Risks - Most of the new shareholders are heavily reliant on loans, with interest rates ranging from 4.5% to 12%. Li Rongrong has borrowed 120 million yuan at a 9% interest rate, indicating a high financial risk [7][11]. - The company has recently established a subsidiary in the semiconductor sector, a significant shift from its core business in machine vision, which raises concerns about the lack of relevant experience and resources [8][10]. Control and Future Outlook - The current ownership structure leaves Daheng Technology's control uncertain, as Li Rongrong and Zhou Zhengchang's combined stake is only 9.26%, and they have no plans to increase their holdings in the next 12 months [8][10]. - The potential for other shareholders to consolidate control poses a risk to the company's strategic direction, especially with the involvement of China New Era Limited, which has historical ties to the company [10][11].

【财经早报】磁性材料龙头,重大资产重组草案出炉

Zhong Guo Zheng Quan Bao· 2025-10-11 00:09

Group 1: Government and Regulatory Updates - The State Council Information Office will hold a press conference on October 11 to discuss the achievements in high-quality development during the 14th Five-Year Plan period, focusing on urban and rural construction [1] - The Ministry of Industry and Information Technology (MIIT) is soliciting opinions on a draft notice to conduct commercial trials for satellite IoT services, aimed at supporting the healthy development of emerging industries like commercial aerospace and low-altitude economy [3] - The Financial Regulatory Bureau has issued a notice to strengthen the regulation of non-auto insurance businesses, focusing on issues like optimizing assessment mechanisms and improving underwriting and claims services [2] Group 2: Company News and Financial Performance - New Lai Fu plans to acquire 100% equity of Jin Nan Magnetic Materials for 1.054 billion yuan, which is expected to constitute a major asset restructuring [5] - Jin Ling Mining reported a net profit of 220 million yuan for the first three quarters, a year-on-year increase of 47.09% [6] - North Rare Earth expects a net profit of 1.51 billion to 1.57 billion yuan for the first three quarters, representing a year-on-year growth of 272.54% to 287.34% [6] - China Energy Construction announced that its joint venture has signed three renewable energy contracts worth approximately 2.745 billion USD, equivalent to about 19.554 billion yuan [8] - China Power Construction has signed contracts for two solar projects in Saudi Arabia, with a total contract value of approximately 117.19 billion yuan [8]

大恒科技最新公告:郑素贞不再持有公司股份,公司将变更为无控股股东、无实际控制人

Zhong Guo Ji Jin Bao· 2025-10-10 17:12

Core Viewpoint - Dahan Technology announced a change in control, with Zheng Suzhen no longer holding shares, resulting in the company becoming without a controlling shareholder or actual controller [2][4]. Group 1: Change of Control - On October 10, Dahan Technology released a notice indicating that Zheng Suzhen's shares were judicially auctioned, leading to a change in control [2][4]. - The company will now operate without a controlling shareholder or actual controller following the completion of the share transfer [4][6]. - The judicial auction involved 130 million shares, representing 29.75% of the total share capital, which were sold at a final price of 1.712 billion yuan, approximately 60.3% higher than the initial listing price of 1.068 billion yuan [4][6]. Group 2: Shareholder Details - After the auction, the largest shareholders are Li Rongrong and Zhou Zhengchang, holding a combined total of 40.46 million shares, or 9.26% of the company [4][6]. - Li Rongrong's shareholding exceeds 5%, while the other buyers include China New Era Co., Ltd., Wang Xiaoping, Yang Runzhong, and others, all purchasing shares at 13.17 yuan each [5][6]. Group 3: Market Reaction - Following the announcement of the auction results in early August, Dahan Technology's stock price initially dropped by 8.71% but subsequently hit the daily limit up [7]. - As of October 10, the stock price was 14.12 yuan per share, reflecting a year-to-date increase of 65.34%, with a total market capitalization of 6.2 billion yuan [7].

大恒科技,徐翔母亲彻底退出

Zhong Guo Ji Jin Bao· 2025-10-10 16:23

Core Viewpoint - Dahan Technology has undergone a change in control, becoming a company without a controlling shareholder or actual controller following the judicial auction of shares held by Zheng Suzhen, mother of Xu Xiang [2][5][7]. Summary by Sections Change of Control - On October 10, Dahan Technology announced a change in control, stating that Zheng Suzhen no longer holds any shares in the company, resulting in the company becoming without a controlling shareholder or actual controller [2][5]. - The judicial auction involved 130 million unrestricted circulating shares, accounting for 29.75% of the total share capital of Dahan Technology [4][5]. Auction Details - The auction was conducted by the Qingdao Intermediate People's Court, with the shares sold at a total price of 1.712 billion yuan, representing a 60.3% premium over the initial listing price of 1.068 billion yuan [7]. - The shares were distributed among several buyers, with Li Rongrong acquiring the largest portion, totaling 27.46 million shares, which is 21.13% of the auctioned shares [6][7]. Shareholder Composition - Following the transfer, Li Rongrong and Zhou Zhengchang collectively hold 40.46 million shares, making them the largest shareholders with a combined ownership of 9.26% [5][7]. - The auction saw multiple buyers, with only Li Rongrong exceeding the 5% ownership threshold among them [7]. Market Reaction - After the auction results were announced in early August, Dahan Technology's stock price initially dropped by 8.71% but subsequently hit the daily limit up [8]. - As of October 10, the stock price was reported at 14.12 yuan per share, reflecting a year-to-date increase of 65.34%, with a total market capitalization of 6.2 billion yuan [8].

大恒科技,徐翔母亲彻底退出

中国基金报· 2025-10-10 16:20

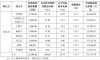

【导读】大恒科技最新公告:郑素贞不再持有公司股份,公司将变更为无控股股东、无实际 控制人 中国基金报记者 林雪 在徐翔母亲郑素贞持股被司法拍卖后,大恒科技于10月10日晚间发布公告称,公司控制权发 生变更,公司将变更为无控股股东、无实际控制人。 | | 是否发生变更 | 变更前姓名/名称 | 变更后姓名/名称 | | --- | --- | --- | --- | | 控股股东 | ☑是 □否 | 郑素贞 | 元 | | 实际控制人 | ☑是 □否 | 郑素贞 | 元 | | 变更方式(可多选) | □协议转让 ☑司法划转/拍卖 □定向增发 | | | | | □破产重整引入重整投资人 □表决权委托 | | | | | □行政划转或者变更 □一致行动关系内部转让 | | | | | □一致行动协议签署/解除/变更 □要约收购 | | | | | □间接收购 □表决权放弃 □继承 | | | | 转让方 | 受让方 | 司法拍卖 股份数量 | 占本次司法拍 卖股份比例 | 占公司总 股本比例 | 每股股价 | 司法拍卖成 交价格(万 | | --- | --- | --- | --- | --- | --- | ...

徐翔之母,所持1.3亿股股权被司法拍卖

Feng Huang Wang· 2025-10-10 14:23

大恒科技(600288.SH)今日晚间公告称,公司控股股东、实际控制人郑素贞(郑素贞为徐翔的母亲)持有的1.3亿股无限售流通股被司法拍卖,导致公司控 制权变更。 本次权益变动后,郑素贞已不再持有公司股份,李蓉蓉、周正昌合计持股4046万股,占公司总股本的9.26%,为公司第一大股东及一致行动人。 本次权益变动导致公司控制权变更,公司将变更为无控股股东、无实际控制人。 | | 是否发生变更 | 变更前姓名/名称 | 变更后姓名/名称 | | --- | --- | --- | --- | | 控股股东 | ☑是 | 郑素贞 | 元 | | 实际控制人 | ☑是 | 郑素贞 | 元 | | 变更方式(可多选) | □协议转让 ☑司法划转/拍卖 □定向增发 | | | | | □破产重整引入重整投资人 □表决权委托 | | | | | □行政划转或者变更 □一致行动关系内部转让 | | | | | □一致行动协议签署/解除/变更 □要约收购 | | | | | □间接收购 □表决权放弃 □继承 | | | ...

徐翔之母,所持1.3亿股股权被司法拍卖

财联社· 2025-10-10 14:05

大恒科技(600288.SH)今日晚间公告称, 公司控股股东、实际控制人郑素贞 ( 郑素贞为徐翔的母亲) 持 有的1.3亿股无限售流通股被司法拍卖,导致公司 控制权变更 。 本次权益变动后,郑素贞已不再持有公司股份,李蓉蓉、周正昌合计持股4046万股,占公司总股本的9.26%,为公司第一大股东及一致行动人。 本次权益变动导致公司控制权变更,公司将变更为无控股股东、无实际控制人。 | | 是否发生变更 | 变更前姓名/名称 | 变更后姓名/名称 | | --- | --- | --- | --- | | 控股股东 | ☑是 □否 | 郑素贞 | 元 | | 实际控制人 | ☑是 □否 | 郑素贞 | 元 | | 变更方式(可多选) | □协议转让 ☑司法划转/拍卖 □定向增发 | | | | | □破产重整引入重整投资人 □表决权委托 | | | | | □行政划转或者变更 □一致行动关系内部转让 | | | | | □一致行动协议签署/解除/变更 □要约收购 | | | | | □间接收购 □表决权放弃 □继承 | | | 下载财联社APP获取更多资讯 7x24h电报 头条新闻 VIP资讯 实时盯盘 准确 快 ...

徐翔之母退出 大恒科技进入“无实控人”时代

Zheng Quan Shi Bao Wang· 2025-10-10 13:53

Core Viewpoint - Dahan Technology has undergone a significant change in its ownership structure, becoming a company without a controlling shareholder or actual controller following the judicial auction of shares held by its former controlling shareholder, Zheng Suzhen [1][2] Group 1: Ownership Change - Zheng Suzhen's 130 million shares, accounting for 29.75% of the total share capital, were auctioned for 1.712 billion yuan, leading to the company's transition to having no controlling shareholder or actual controller [1] - The auction was conducted through the Shandong Property Rights Exchange, and the ownership of the shares has been transferred to the buyer, lifting the freeze on the shares [1] - Following this change, Li Rongrong and Zhou Zhengchang collectively hold 40.46 million shares, becoming the largest shareholder and acting in concert, but they hold only 9.26% of the shares, which does not allow them to independently decide on the majority of board members [1][2] Group 2: Company Operations and Governance - Dahan Technology maintains independence in assets, business, and personnel from its former controlling shareholder, with no incidents of non-operating fund occupation or illegal guarantees reported [2] - The company’s governance structure will continue to operate under the "three meetings and one layer" mechanism, ensuring independent management without significant adverse effects on operations [2] - Dahan Technology specializes in mechatronic products, information technology, office automation products, digital television network editing and broadcasting systems, and semiconductor components, employing a business model of "independent research and development + production + supporting services + agency" [2] Group 3: Strategic Developments - The company announced plans to invest 600 million yuan to establish a wholly-owned subsidiary, Shanghai Xinhengxin Ruike Technology Co., Ltd., focusing on semiconductor-related auxiliary equipment [2] - This subsidiary aims to enhance the company's business layout in the semiconductor industry and emerging sectors, facilitating multidimensional strategic development breakthroughs [2]

大恒科技将变更为无控股股东、无实控人

Bei Jing Shang Bao· 2025-10-10 13:50

交易行情显示,10月10日,大恒科技收涨0.07%,收于14.12元/股,总市值61.68亿元。 公告显示,本次权益变动系大恒科技控股股东、实际控制人郑素贞持有的约1.3亿股无限售流通股被司 法拍卖所致。本次权益变动后,郑素贞已不再持有公司股份,李蓉蓉、周正昌合计持股4046万股,占公 司总股本的9.26%,为公司第一大股东及一致行动人。 北京商报讯(记者 马换换 实习记者 李佳雪)10月10日晚间,大恒科技(600288)披露公告称,公司控 股股东、实际控制人郑素贞不再持有公司股份,公司将变更为无控股股东、无实际控制人。 大恒科技表示,截至公告披露日,公司生产经营活动正常。本次控制权变更后,公司在资产、业务、人 员等方面将继续与股东保持分离,不会对公司治理结构及生产经营产生重大不利影响。 ...