CNS(601098)

Search documents

文化生产力指数高居全国第四!开福区跻身全国文化产业竞争力百强区Top30

Chang Sha Wan Bao· 2025-10-25 09:56

Core Insights - The "China Cultural Industry Competitiveness Top 100 District Index (2025)" was released, highlighting the strong cultural industry performance of Changsha, with four districts ranked in the top 30 [1][3] - Among these, Kaifu District ranked 5th nationally in the comprehensive index, showcasing its robust cultural soft power [1][4] Group 1: Cultural Industry Competitiveness - The index evaluates cultural industry development at the district level based on productivity, influence, and driving force [3] - Kaifu District achieved a high cultural productivity index, ranking 4th nationally, and an influence index ranking 5th [1][4] Group 2: Integration of Culture and Technology - Kaifu District is implementing a "Cultural + Technology" development model, forming a digital cultural industry ecosystem characterized by high-tech video [6][8] - The district has established a global influence in the digital video industry, integrating content creation, production, storage, broadcasting, and trading [8] Group 3: Cultural and Tourism Integration - The district promotes a "Cultural + Tourism" strategy, enhancing the quality of the tourism industry through cultural initiatives [9] - Plans include a comprehensive cultural tourism development strategy and actions to expand cultural product offerings [9]

中南传媒:目前园区装修工作正在有序推进,招商运营稳步开展

Zheng Quan Ri Bao Zhi Sheng· 2025-10-15 12:13

Core Viewpoint - The company has successfully completed the engineering acceptance of the Malanshan project on January 9, 2025, and is currently progressing with the decoration and operational recruitment [1] Group 1 - The Malanshan project is a key initiative for the company to promote industrial transformation and upgrade, as well as to attract new industries and talents [1] - The project is expected to provide solid industrial support and spatial guarantee for the company's goal of building a world-class new mainstream publishing media group in the future [1]

出版板块10月15日涨0.01%,荣信文化领涨,主力资金净流出4186.83万元

Zheng Xing Xing Ye Ri Bao· 2025-10-15 08:37

Market Overview - The publishing sector increased by 0.01% compared to the previous trading day, with Rongxin Culture leading the gains [1] - The Shanghai Composite Index closed at 3912.21, up by 1.22%, while the Shenzhen Component Index closed at 13118.75, up by 1.73% [1] Individual Stock Performance - Rongxin Culture (301231) closed at 23.70, with a rise of 2.20% and a trading volume of 24,500 lots, amounting to a transaction value of 57.44 million [1] - Tianzhou Culture (300148) closed at 4.57, up by 1.78%, with a trading volume of 197,600 lots and a transaction value of 89.65 million [1] - Zhongwen Online (300364) closed at 25.59, increasing by 1.31%, with a trading volume of 259,400 lots and a transaction value of 654 million [1] - Other notable stocks include Guomai Culture (301052) at 46.20 (+1.09%) and Yuedu Media (002181) at 8.24 (+0.73%) [1] Capital Flow Analysis - The publishing sector experienced a net outflow of 41.87 million from institutional investors, while retail investors saw a net inflow of 23.18 million [2] - The net inflow from speculative funds was 18.69 million [2] Detailed Capital Flow for Selected Stocks - Zhongyuan Media (000719) had a net outflow of 12.14 million from institutional investors, with a retail net outflow of 17.89 million [3] - Zhongwen Online (300364) saw a net inflow of 10.05 million from institutional investors, but a net outflow of 7.53 million from retail investors [3] - Publishing Media (601999) had a net inflow of 5.02 million from institutional investors, while retail investors experienced a net outflow of 2.55 million [3]

出版板块10月14日涨0.48%,粤 传 媒领涨,主力资金净流出1亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-14 08:46

Group 1 - The publishing sector saw an increase of 0.48% on October 14, with Guangdong Media leading the gains [1] - The Shanghai Composite Index closed at 3865.23, down 0.62%, while the Shenzhen Component Index closed at 12895.11, down 2.54% [1] - Guangdong Media's stock price rose by 4.74% to 8.18, with a trading volume of 860,700 shares and a transaction value of 703 million yuan [1] Group 2 - The publishing sector experienced a net outflow of 100 million yuan from major funds, while retail investors saw a net inflow of 78.1 million yuan [2] - Major stocks like Guomai Culture and Zhongwen Online reported declines of 4.79% and 1.90%, respectively, with transaction values of 761 million yuan and 1.015 billion yuan [2] - Guangdong Media had a net inflow of 53.92 million yuan from major funds, while retail investors had a net outflow of 17.26 million yuan [3]

10月13日晚间重要公告一览

Xi Niu Cai Jing· 2025-10-13 10:13

Group 1 - Harbin Air Conditioning plans to transfer 40% equity of its subsidiary, Harbin Fushanchuan Biotechnology Development Co., Ltd. The subsidiary reported a net profit of -16.0963 million yuan for 2024, which is 218.83% of the previous year's net profit absolute value [1] - Xinhua Insurance expects a net profit of 29.986 billion to 34.122 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 45% to 65% [1][2] - Gansu Energy anticipates a net profit of 1.55 billion to 1.6 billion yuan for the first three quarters of 2025, reflecting a year-on-year increase of 11.86% to 15.47% [2][3] Group 2 - Dongfang Tower forecasts a net profit of 750 million to 900 million yuan for the first three quarters of 2025, indicating a year-on-year growth of 60.83% to 93% [4] - Meili Eco announced that its subsidiary won a bid for an EPC project worth 2.375 billion yuan [6] - Bohai Chemical's wholly-owned subsidiary will undergo routine maintenance for its 600,000 tons/year PDH unit, expected to last about 30 days [8] Group 3 - Qin Port Co. reported a total throughput of 317.02 million tons for the first nine months of 2025, a year-on-year increase of 5.56% [10] - Jianglong Shipbuilding won a bid for a 72.99 million yuan fishery enforcement vessel project, accounting for 4.22% of its 2024 audited revenue [11] - Longyuan Technology expects a net profit of 35 million to 40 million yuan for the first three quarters of 2025, representing a year-on-year increase of 50.11% to 71.55% [12] Group 4 - Naipu Mining anticipates a net profit of 61 million to 66 million yuan for the first three quarters of 2025, reflecting a year-on-year decline of 45.16% to 49.32% [14] - Jinggong Steel Structure reported a cumulative contract amount of 17.98 billion yuan for the first nine months of 2025, a year-on-year increase of 4.8% [15][16] - Shenzhen Gas reported a net profit of 918 million yuan for the first three quarters of 2025, a year-on-year decrease of 13.08% [17] Group 5 - Yabao Pharmaceutical's subsidiary received a drug registration certificate for a new diabetes medication [18] - Shaanxi Coal's coal production in September was 14.56 million tons, a year-on-year increase of 5.34% [20] - Sifang New Materials reported a 15.94% year-on-year decline in concrete production for the first three quarters [22] Group 6 - Nanjing Foods reported a consolidated revenue of 276 million yuan in September, a slight increase of 0.0016% year-on-year [23] - Pulaike received a new veterinary drug registration certificate for a flea and tick treatment [24] - Zhucheng Technology received a cash dividend of 15 million yuan from its subsidiary [25] Group 7 - David Medical's subsidiary received a medical device registration certificate for a portable electronic endoscope image processor [26] - Zhongtong Bus reported a 36.88% year-on-year increase in sales in September, totaling 1,106 units [27] - Xiantan Co. reported a 11.95% year-on-year increase in chicken sales revenue in September [28] Group 8 - Bojun Technology expects a net profit of 552 million to 662 million yuan for the first three quarters of 2025, a year-on-year increase of 50% to 80% [30] - Haishi Pharmaceutical's innovative pain relief drug clinical trial application has been accepted [31] - Lingxiao Pump Industry used 80 million yuan of idle funds to purchase financial products [32] Group 9 - Qiangda Circuit's subsidiary completed business registration changes to expand its operational scope [33] - *ST Tianyu's controlling shareholder applied for bankruptcy liquidation due to severe financial difficulties [34] - Baolidi's shareholder plans to reduce holdings by up to 1 million shares [36] Group 10 - Zijin Mining completed the acquisition of Kazakhstan's Raygorodok gold mine, controlling 100% of its rights [44] - Zhonggang Luoyang's indirect controlling shareholder completed a capital increase, raising registered capital from approximately 26.666 billion yuan to 44.824 billion yuan [46] - Jinyu Jidong's director resigned due to work adjustments [47]

中南出版传媒集团股份有限公司2025年半年度权益分派实施公告

Shang Hai Zheng Quan Bao· 2025-10-12 17:31

Core Points - The company announced a cash dividend distribution of 0.1 yuan per share for its A-shares, totaling 179.6 million yuan based on a total share capital of 1,796,000,000 shares [2][4]. Distribution Plan - The profit distribution plan was approved at the annual shareholders' meeting on May 20, 2025, and at the fifth meeting of the sixth board of directors on August 26, 2025 [2]. - The distribution is applicable to all shareholders registered with the China Securities Depository and Clearing Corporation Limited, Shanghai Branch, as of the close of trading on the registration date [3]. Implementation Details - Cash dividends will be distributed through the clearing system of the China Securities Depository and Clearing Corporation Limited, with shareholders who have completed designated transactions able to receive their dividends on the payment date [5]. - The company will directly distribute cash dividends to shares held by Hunan Publishing Investment Holding Group Co., Ltd. and Hunan Shengli Investment Co., Ltd. [8]. Taxation Information - For individual shareholders holding A-shares, the tax treatment varies based on the holding period, with dividends exempt from personal income tax for holdings over one year [9]. - For Qualified Foreign Institutional Investors (QFIIs), a 10% withholding tax will be applied, resulting in a net cash dividend of 0.09 yuan per share [10]. - Other institutional investors and corporate shareholders will receive a cash dividend of 0.1 yuan per share, with tax obligations to be settled independently [11].

中南传媒(601098) - 中南传媒2025年半年度权益分派实施公告

2025-10-12 08:00

每股分配比例 A 股每股现金红利0.1元 相关日期 证券代码:601098 证券简称:中南传媒 公告编号:2025-042 中南出版传媒集团股份有限公司 2025年半年度权益分派实施公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗 漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: | 股份类别 | 股权登记日 | 最后交易日 | 除权(息)日 | 现金红利发放日 | | --- | --- | --- | --- | --- | | A股 | 2025/10/17 | - | 2025/10/20 | 2025/10/20 | 差异化分红送转: 否 一、 通过分配方案的股东会届次和日期 本次利润分配方案经公司2025 年 5 月 20 日的2024年年度股东大会及 2025 年 8 月 26 日的第 六届董事会第五次会议审议通过。 二、 分配方案 截至股权登记日下午上海证券交易所收市后,在中国证券登记结算有限责任公司上海分 公司(以下简称"中国结算上海分公司")登记在册的本公司全体股东。 3. 分配方案: 本次利润分配以方案实施前的公司总股本1,796,0 ...

中南传媒(601098) - 中南传媒关于中南博集天卷文化传媒有限公司对北京博集天卷影业有限公司委托贷款进展暨签订相关合同的公告

2025-10-09 08:30

证券代码:601098 股票简称:中南传媒 编号:临 2025-041 中南出版传媒集团股份有限公司 关于中南博集天卷文化传媒有限公司 对北京博集天卷影业有限公司委托贷款进展 暨签订相关合同的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈 述或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 中南出版传媒集团股份有限公司(以下简称"中南传媒")于 2025 年 9 月 14 日召开第六届董事会第六次会议,2025 年 9 月 30 日 召开 2025 年第二次临时股东大会,审议通过了《关于中南博集天卷 文化传媒有限公司对北京博集天卷影业有限公司委托贷款的议案》, 同意公司控股子公司中南博集天卷文化传媒有限公司(以下简称"中 南博集")通过中国民生银行长沙分行向参股子公司北京博集天卷影 业有限公司(以下简称"博集影业")提供 2,500 万元委托贷款,贷 款期限为 2 年,贷款年利率 2.85%,由黄隽青、刘洪、王勇三位自 然人为本次委托贷款提供不动产抵押担保。以上内容详见《中南传媒 关于中南博集天卷文化传媒有限公司对北京博集天卷影业有限公司 委托贷款的公告》(编号:临 20 ...

中南传媒9月30日获融资买入1834.58万元,融资余额2.11亿元

Xin Lang Cai Jing· 2025-10-09 01:29

Group 1 - The core viewpoint of the news is that Zhongnan Publishing Media Group has shown mixed financial performance, with a decrease in revenue but an increase in net profit year-on-year [2] - On September 30, Zhongnan Media's stock price increased by 0.33%, with a trading volume of 168 million yuan, and the net financing buy was negative at 2.85 million yuan [1] - As of September 30, the total margin balance for Zhongnan Media was 213 million yuan, with a financing balance of 211 million yuan, which is high compared to the past year [1] Group 2 - The company's main business includes publishing, distribution, and new media operations, with the largest revenue source being distribution at 59.40% [2] - For the first half of 2025, Zhongnan Media reported a revenue of 6.335 billion yuan, a year-on-year decrease of 8.09%, while the net profit attributable to the parent company was 1.017 billion yuan, a year-on-year increase of 31.46% [2] - The company has distributed a total of 11.548 billion yuan in dividends since its A-share listing, with 3.053 billion yuan distributed in the last three years [3]

中南传媒(601098):位列全国新书零售市场实洋占有率第一

Xin Lang Cai Jing· 2025-10-08 14:25

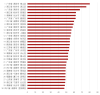

Group 1: Industry Overview - The publishing sub-sector exhibits high dividend attributes and stability within the media sector, with leading companies showing gross margins between 30%-40%, net margins around 10%, and ROE generally above 8% [1] - The competitive landscape in the publishing sector is clear, with at least one publishing group in each province, focusing on both publishing and distribution, including textbooks and educational materials as key business areas [1] - The stock price changes in the publishing sub-sector in 2023 are attributed to a market consensus on valuation reassessment, as publishing companies' content copyrights serve as important sources for structured data in the context of AI developments [1] Group 2: Company Profile - Zhongnan Publishing - Zhongnan Publishing is one of the largest leading companies in the publishing sector, with strong core business capabilities across publishing, distribution, printing, media, digital education, and financial services [2] - As of the first half of 2025, Zhongnan Publishing holds a 6.07% market share in the national new book retail market, ranking first, and a 5.25% share in the comprehensive book retail market, ranking second, with a year-on-year increase of 0.05 percentage points [2] - The company ranks first in the education, composition, and arts sectors, second in academic culture, biography, and medicine, and third in music, literature, popular science, maps, and fine arts [2] Group 3: Business Segments - The book publishing segment is the most prominent, with solid construction in both general and specialty book publishing [3] - The distribution segment focuses on "reading," maintaining a leading position in the issuance of themed publications [3] - The digital education segment has seen significant user growth, with platforms like "Beike Net" reaching 8.52 million users and "A+ Education" app having 6.37 million users by mid-2025 [3] Group 4: Financial Projections - Zhongnan Publishing is expected to maintain its leading position, with projected net profits of 1.732 billion, 1.860 billion, and 1.927 billion yuan for 2025-2027, corresponding to PE ratios of 13, 12, and 11 times respectively [3]