Jinko Solar(688223)

Search documents

美股异动|晶科能源盘前涨超3% 签署美国华盛顿州组件供应协议

Ge Long Hui· 2025-10-29 08:17

Core Viewpoint - JinkoSolar (JKS.US) shares rose over 3% in pre-market trading following the announcement of supplying high-efficiency EAGLE® G6 modules for a solar project at Costco warehouse in Richland, Washington [1] Group 1: Project Details - The solar project is developed by Trinity Energy and utilizes approximately 1,000 JinkoSolar modules [1] - The project highlights the inclusion of JinkoSolar's "EAGLE® Environmental Program" [1] Group 2: Environmental Initiative - The EAGLE® Environmental Program allows for the free recycling of decommissioned modules, ensuring that neither Trinity Energy nor Costco incur costs [1] - This program guarantees comprehensive environmental management throughout the entire lifecycle of the modules, supporting sustainable development in Washington State [1]

TOPCon电池板块领涨,上涨4.83%

Di Yi Cai Jing· 2025-10-29 07:16

Group 1 - The TOPCon battery sector leads the market with an increase of 4.83% [1] - Canadian Solar (阿特斯) saw a significant rise of 19.97% [1] - Trina Solar (天合光能) experienced an increase of 9.68% [1] - Tongwei Co., Ltd. (通威股份) rose by 8.36% [1] - JinkoSolar (晶科能源), Fuda Alloy (福达合金), and TCL Zhonghuan (TCL中环) all saw increases of over 5% [1]

90只股中线走稳 站上半年线

Zheng Quan Shi Bao Wang· 2025-10-29 06:48

Core Points - The Shanghai Composite Index closed at 4001.98 points, above the six-month moving average, with a gain of 0.35% [1] - The total trading volume of A-shares reached 183.41 billion yuan [1] - A total of 90 A-shares have surpassed the six-month moving average today, with notable stocks showing significant deviation rates [1] Summary by Category Stock Performance - The stocks with the highest deviation rates include: - Weston (威士顿) with a deviation rate of 19.60% and a price increase of 19.99% [1] - Norsg (诺思格) with a deviation rate of 19.43% and a price increase of 20.00% [1] - Digital China (神州数码) with a deviation rate of 7.79% and a price increase of 7.88% [1] - Other stocks with smaller deviation rates that just crossed the six-month line include: - Baiyunshan (白云山) and Yuhuan CNC (宇环数控) [1] Trading Data - The trading turnover for the day was 18340.64 million yuan [1] - The stocks listed showed varying turnover rates, with Weston at 47.99% and Norsg at 15.54% [1] Additional Stock Information - Other notable stocks with significant price movements include: - Changqing (长青股份) with a price increase of 9.97% and a deviation rate of 7.77% [1] - Jinko Solar (晶科能源) with a price increase of 7.01% and a deviation rate of 6.82% [1] - The table provided lists various stocks, their trading performance, and deviation rates, indicating a diverse range of market activity [1][2]

光伏概念爆发,隆基绿能午后涨停

Di Yi Cai Jing· 2025-10-29 05:35

Core Viewpoint - The photovoltaic industry chain experienced a collective surge in stock prices, with several companies reaching their daily limit up, indicating strong market performance and investor interest [1][2]. Group 1: Stock Performance - Longi Green Energy reached the daily limit up with a trading volume exceeding 6 billion yuan [1]. - Other companies such as Canadian Solar, Tongrun Equipment, and Hongyuan Green Energy also hit the daily limit up, while Trina Solar saw an increase of over 10% [1]. - Notable stock price increases include: - Canadian Solar: +19.97% to 14.84 yuan - Trina Solar: +10.53% to 19.63 yuan - Tongrun Equipment: +10.01% to 19.34 yuan - Longi Green Energy: +10.00% to 20.79 yuan - Hongyuan Green Energy: +9.99% to 26.32 yuan [2].

光伏概念爆发,隆基绿能午后涨停

第一财经· 2025-10-29 05:32

Core Viewpoint - The photovoltaic industry chain experienced a collective surge on October 29, with several companies reaching their daily limit up, indicating strong market performance and investor interest in the sector [1]. Group 1: Company Performance - Longi Green Energy (隆基绿能) reached a limit up with a price increase of 10% to 20.79 [2]. - Canadian Solar (阿特斯) saw a significant rise of 19.97%, reaching a price of 14.84 [2]. - Trina Solar (天合光能) increased by 10.53%, with a current price of 19.63 [2]. - Tongrun Equipment (通润装备) also rose by 10.01%, reaching 19.34 [2]. - Hongyuan Green Energy (弘元绿能) increased by 9.99%, with a price of 26.32 [2]. - Other notable companies included Sungrow Power Supply (阳光电源) with a 9.70% increase to 181.97 and Aiko Solar (爱旭股份) with a 9.50% rise to 16.37 [2][3]. Group 2: Market Trends - The overall trend in the photovoltaic sector indicates a robust recovery and investor confidence, as evidenced by the significant price increases across multiple companies [1][2]. - The collective performance suggests a positive outlook for the industry, potentially driven by favorable market conditions and increasing demand for solar energy solutions [1].

光伏概念震荡拉升 隆基绿能等多股涨停

Xin Lang Cai Jing· 2025-10-29 05:24

Core Viewpoint - The photovoltaic sector experienced a significant rally, with stocks such as Longi Green Energy and Canadian Solar hitting their daily limit up, following a notable increase in China's solar power installations in September [1] Group 1: Market Performance - The photovoltaic concept saw a strong upward movement in the afternoon session, with Longi Green Energy, Canadian Solar, and Hongyuan Green Energy reaching their daily limit up [1] - Sunshine Power surged over 8%, reaching a historical high, while other companies like Trina Solar, JinkoSolar, Aiko Solar, and Tongwei also saw gains [1] Group 2: Industry Data - According to the National Energy Administration, China's newly installed photovoltaic capacity in September was 9.7 GW, representing a month-on-month increase of 31.79% compared to August [1]

光伏设备板块午后持续拉升,阿特斯触及20cm涨停

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 05:19

Core Viewpoint - The photovoltaic equipment sector experienced a significant rally, with multiple companies reaching their daily price limits and showing strong percentage increases in stock prices [1] Company Performance - Canadian Solar (阿特斯) hit the daily limit of a 20% increase in stock price [1] - Tongrun Equipment (通润装备) previously reached its daily limit [1] - Longi Green Energy (隆基绿能) and Hongyuan Green Energy (弘元绿能) both saw stock price increases exceeding 9% [1] - JinkoSolar (晶科能源) and Tongwei Co., Ltd. (通威股份) also experienced upward movement in their stock prices [1]

光伏设备板块午后涨幅扩大,阿特斯触及20cm涨停

Xin Lang Cai Jing· 2025-10-29 05:12

Core Viewpoint - The photovoltaic equipment sector experienced significant gains in the afternoon, with notable stocks such as Canadian Solar hitting the daily limit up, indicating strong market performance and investor interest in the sector [1] Company Performance - Canadian Solar reached the daily limit up of 20%, reflecting robust investor confidence [1] - Tongrun Equipment previously hit the daily limit up, showcasing strong market momentum [1] - Longi Green Energy and Hongyuan Green Energy both saw increases exceeding 9%, indicating positive market sentiment towards these companies [1] - JinkoSolar and Tongwei Co. also experienced upward movement, contributing to the overall positive trend in the sector [1]

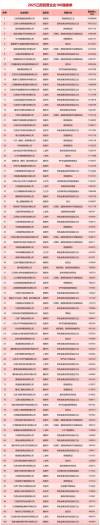

2025江西民营企业100强榜单出炉 入围门槛48.18亿元

Sou Hu Cai Jing· 2025-10-29 03:55

Core Insights - The 2025 Jiangxi Top 100 Private Enterprises list was released, highlighting significant growth in revenue thresholds for inclusion, with the manufacturing sector seeing a notable increase in the number of companies exceeding 10 billion yuan in revenue [7][8]. Group 1: Overall Rankings - The top three companies in the 2025 Jiangxi Private Enterprises 100 list are Jiangxi Shuangbantian Holdings Co., Ltd. with 103.87 billion yuan, Jiangxi Fangda Steel Group Co., Ltd. with 100.73 billion yuan, and JinkoSolar Co., Ltd. with 92.47 billion yuan in revenue [8]. - A total of 38 companies reported revenues exceeding 10 billion yuan, an increase of 2 companies from the previous year [8]. Group 2: Manufacturing Sector - The 2025 Jiangxi Top 100 Private Manufacturing Enterprises list also reflects strong performance, with Jiangxi Shuangbantian Holdings Co., Ltd. leading at 103.87 billion yuan, followed by Jiangxi Fangda Steel Group Co., Ltd. at 100.73 billion yuan, and JinkoSolar Co., Ltd. at 92.47 billion yuan [4][8]. - The revenue threshold for inclusion in the manufacturing sector reached 3.78 billion yuan, an increase of 376 million yuan from the previous year [7]. Group 3: Service Sector - The 2025 Jiangxi Top 20 Private Service Enterprises list shows a revenue threshold of 3.05 billion yuan, which is an increase of 697 million yuan from the previous year [7]. - The leading company in the service sector is Yingtan Copper Industry Development Investment Co., Ltd. with a revenue of 2.73 billion yuan [7].

晶科能源涨2.03%,成交额2.11亿元,主力资金净流入872.32万元

Xin Lang Cai Jing· 2025-10-29 03:01

Core Viewpoint - JinkoSolar's stock price has shown volatility, with a year-to-date decline of 22.22%, but a recent uptick in the last five and twenty trading days, indicating potential recovery signs in the market [1][2]. Financial Performance - For the first half of 2025, JinkoSolar reported a revenue of 31.83 billion yuan, a year-on-year decrease of 32.63%, and a net profit attributable to shareholders of -2.91 billion yuan, reflecting a significant decline of 342.38% [2]. - Cumulative cash dividends since the company's A-share listing amount to 3.355 billion yuan, with 3.125 billion yuan distributed over the past three years [3]. Shareholder Structure - As of June 30, 2025, the number of shareholders increased to 74,200, with an average of 134,811 circulating shares per person, a slight decrease of 0.88% [2]. - The top ten circulating shareholders include Hong Kong Central Clearing Limited as the second-largest shareholder with 438 million shares, an increase of 57.21 million shares from the previous period [3].