专精特新

Search documents

祥鑫科技子公司常熟祥鑫汽配跻身第七批国家级专精特新“小巨人”企业

Quan Jing Wang· 2025-10-29 12:19

Core Insights - Xiangxin Technology's subsidiary, Changshu Xiangxin Auto Parts Co., Ltd., has been recognized as a national-level "specialized, refined, distinctive, and innovative" small giant enterprise, highlighting its innovation capabilities and industry competitiveness [1][2] - The title of national-level "small giant" enterprise is the highest honor in China's quality small and medium-sized enterprise evaluation system, with stringent selection criteria [1] - Changshu Xiangxin specializes in the research, development, manufacturing, and sales of automotive parts and molds, having established a solid foundation for this recognition through previous accolades [1][2] Company Performance - Changshu Xiangxin focuses on high-strength lightweight automotive seat components, achieving industry-leading performance metrics and strong market recognition [2] - The company has developed a proprietary dual-layer aluminum stamping technology that enhances production efficiency while maintaining high precision [2] - The use of high-strength aluminum alloys and dual-layer lightweight structures allows for a weight reduction of 30% to 50% compared to traditional steel components, improving vehicle energy efficiency and safety [2] Future Outlook - The recognition as a national-level "small giant" is seen as a significant affirmation of Changshu Xiangxin's commitment to innovation and core business focus [2] - The company plans to continue its "specialized, refined, distinctive, and innovative" development path, increasing R&D investment and striving to enhance its core competitiveness [2] - Changshu Xiangxin aims to contribute to the high-quality development of China's automotive industry [2]

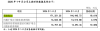

阿拉丁前三季度营收4.44亿元同比增17.59%,归母净利润5776.03万元同比降20.41%,毛利率下降0.06个百分点

Xin Lang Cai Jing· 2025-10-29 12:09

Core Insights - Aladdin's revenue for the first three quarters of 2025 reached 444 million yuan, representing a year-on-year increase of 17.59% [1] - The company's net profit attributable to shareholders was 57.76 million yuan, a year-on-year decrease of 20.41% [1] - The basic earnings per share stood at 0.17 yuan [1] Financial Performance - The gross profit margin for the first three quarters of 2025 was 63.02%, a slight decrease of 0.06 percentage points year-on-year [2] - The net profit margin was 17.38%, down 4.96 percentage points compared to the same period last year [2] - In Q3 2025, the gross profit margin improved to 66.27%, an increase of 4.44 percentage points year-on-year and 6.02 percentage points quarter-on-quarter [2] - The net profit margin for Q3 2025 was 22.81%, up 0.36 percentage points year-on-year and increased by 16.56 percentage points from the previous quarter [2] Expense Analysis - Total operating expenses for the period were 183 million yuan, an increase of 52.47 million yuan year-on-year [2] - The expense ratio was 41.32%, up 6.63 percentage points from the same period last year [2] - Sales expenses increased by 38.45%, management expenses rose by 38.37%, R&D expenses grew by 10.84%, and financial expenses surged by 761.11% [2] Shareholder Information - As of the end of Q3 2025, the total number of shareholders was 11,600, a decrease of 894 from the end of the previous half-year, representing a decline of 7.17% [2] - The average market value per shareholder increased from 339,200 yuan at the end of the previous half-year to 374,400 yuan, a growth of 10.35% [2] Company Overview - Shanghai Aladdin Biochemical Technology Co., Ltd. was established on March 16, 2009, and went public on October 26, 2020 [3] - The company's main business involves the research, development, production, and sales of reagents, with research reagents accounting for 96.96% of revenue [3] - Aladdin operates in the basic chemical industry, specifically in the chemical products sector, and is associated with concepts such as synthetic biology, e-commerce, scientific instruments, and specialized innovation [3]

北证50指数飙升8.41%,利好消息频出引爆市场

Xin Jing Bao· 2025-10-29 11:20

Core Points - The Beijing Stock Exchange (BSE) experienced a significant increase in the North Star 50 Index, rising by 8.41%, marking the third-largest single-day gain of the year, with a trading volume of 34.9 billion yuan, the highest since September 9 [1] - Positive policy signals were released during the Financial Street Forum, particularly regarding the anticipated North Star 50 ETF, which is expected to attract more active trading funds to the BSE [1][3] - The recent surge in the North Star 50 Index is attributed to two main factors: favorable policy news and a rebound in sentiment after a period of underperformance compared to the Shanghai and Shenzhen A-shares [1] Market Developments - The BSE has fully transitioned all existing company codes to the 920 series, and the launch of new specialized index funds is expected to accelerate [2] - The China Securities Regulatory Commission (CSRC) emphasized the importance of the BSE in supporting innovative small and medium-sized enterprises (SMEs) and enhancing the quality of listed companies [3] - New policies aimed at promoting long-term capital inflow into the market were introduced, including mechanisms for commercial insurance funds and encouraging share buybacks by qualified companies [3][4] Industry Outlook - The BSE currently has 280 listed companies, with over 80% being SMEs and nearly 90% being private enterprises, including a significant number of national-level "specialized and innovative" small giants [6] - The "14th Five-Year Plan" highlights the strategic importance of the BSE as a hub for innovative SMEs, with expectations for more companies focusing on core technologies to seek financing through the BSE [5][6] - The BSE's index system is set to be optimized, with plans to introduce the North Star 50 ETF and improve trading convenience [3]

泰金新能科创板IPO:“国家队”市占率领先, 高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 10:37

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s IPO application marks a significant step for the domestic titanium anode sector, enhancing the localization of the new energy industry chain in China [1][2]. Group 1: Company Background and Structure - Taijin New Energy is a leading player in the titanium anode market for electrolytic copper foil, with its ultimate control linked to the Shaanxi Provincial Finance Department, indicating its status as a state-owned enterprise [2]. - The company is part of a strategic initiative by the Shaanxi government to develop key industries, including aerospace and new energy, with its IPO seen as a critical step in this strategy [2]. Group 2: Market Position and Financial Performance - Taijin New Energy has established itself as a benchmark for domestic substitution in the titanium anode market, previously dominated by Japanese and European firms, ensuring the stability and cost-effectiveness of copper foil production [3]. - The company has demonstrated strong growth, with revenue projected to increase from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024, reflecting a compound annual growth rate (CAGR) of 47.78% [4]. - Net profit is expected to rise from approximately 98.29 million yuan to 195 million yuan during the same period, with a CAGR of 40.85% [4]. Group 3: Financial Structure and Competitive Advantage - The company maintains a high debt ratio, with figures of 91.35% in 2022 and 79.47% by mid-2025, yet it has low financial costs, indicating strong market positioning and customer trust [5]. - Taijin New Energy's business model includes significant advance payments from customers, which are recorded as contract liabilities, reflecting its strong bargaining power and industry position [5]. Group 4: Industry Challenges and Resilience - The company faces challenges due to structural overcapacity in the lithium battery industry, leading to a temporary decline in cash flow, with net cash flow projected to be negative in 2023 [6][7]. - Despite these challenges, Taijin New Energy's core competitiveness remains intact, supported by ongoing investments in technology and innovation, with R&D expenditures increasing over the years [7][8]. - The company has secured 90 authorized invention patents and continues to leverage its state-backed resources to maintain a competitive edge [8]. Group 5: Long-term Investment Logic - The investment rationale for Taijin New Energy is based on its combination of technological strength and state-owned enterprise backing, positioning it well for future growth if it navigates the current industry downturn successfully [10].

腾亚精工涨1.48%,成交额1.13亿元,后市是否有机会?

Xin Lang Cai Jing· 2025-10-29 10:17

Core Viewpoint - Tengya Precision Engineering Co., Ltd. has shown a positive market performance, benefiting from its recognition as a "specialized, refined, characteristic, and innovative" enterprise, along with advantages from the depreciation of the RMB and trade relations with Russia [2][3]. Company Overview - Tengya Precision Engineering, established on August 15, 2000, is located in Jiangning District, Nanjing, Jiangsu Province. The company was listed on June 8, 2022, and specializes in the research, production, and sales of fastening tools and construction hardware [7]. - The company's main business revenue composition includes power tools (73.57%), construction hardware (22.24%), and others (4.19%) [7]. Financial Performance - As of October 20, 2023, Tengya Precision reported a revenue of 295 million yuan for the first half of 2025, reflecting a year-on-year growth of 1.37%. The net profit attributable to the parent company was 970,200 yuan, showing a significant increase of 110.30% year-on-year [7]. - The company has distributed a total of 145 million yuan in dividends since its A-share listing, with 65.19 million yuan distributed over the past three years [8]. Market Activity - On October 29, 2023, Tengya Precision's stock rose by 1.48%, with a trading volume of 113 million yuan and a turnover rate of 4.54%, bringing the total market capitalization to 3.007 billion yuan [1]. - The company has seen a net inflow of 12.86 million yuan from major investors today, with a total net inflow of 188 million yuan in its industry [4][5]. Strategic Positioning - The company has been recognized as a "little giant" enterprise by the Ministry of Industry and Information Technology, indicating its strong focus on niche markets, innovation capabilities, and high market share [2]. - Tengya Precision is actively engaging in business with countries like Russia, aligning with China's Belt and Road Initiative, primarily providing power tools and related products [3]. Technical Analysis - The average trading cost of the stock is 20.53 yuan, with the current stock price approaching a resistance level of 21.33 yuan. A breakthrough of this resistance could signal a potential upward trend [6].

丹娜生物(920009):深耕病原微生物体外诊断,国家级专精特新“小巨人”

Shanxi Securities· 2025-10-29 09:27

Investment Rating - The report assigns a favorable investment rating to Danah Biotechnology, highlighting its potential in the invasive fungal disease diagnostics market [5]. Core Insights - Danah Biotechnology specializes in early diagnosis of invasive fungal diseases and other pathogen microbiology diagnostics, recognized as a national high-tech enterprise and a key "little giant" [2][27]. - The market for invasive fungal disease diagnostic reagents in China is projected to grow from 240 million yuan in 2018 to 3.03 billion yuan by 2030, with a compound annual growth rate (CAGR) of 23.5% [3]. - Danah Biotechnology has significant competitive advantages, including a strong R&D team, multiple technology platforms, and a comprehensive product range that fills domestic market gaps [4][27]. Financial Performance - The company's revenue for 2022-2025H1 is projected at 295 million yuan, 237 million yuan, 240 million yuan, and 116 million yuan, with growth rates of 26.11%, -19.78%, 1.21%, and -1.38% respectively [5]. - The net profit for the same period is expected to be 45 million yuan, 78 million yuan, 87 million yuan, and 50 million yuan, with growth rates of -36.56%, 73.90%, 12.36%, and 29.55% respectively [5]. - The company's 2024 price-to-earnings (PE) ratio is estimated at 10.86X, significantly lower than the average PE of comparable companies at 26.33X [5][24]. Market Position - Danah Biotechnology holds a strong position in the invasive fungal disease diagnostics sector, with a diverse product lineup and advanced core technologies [15][27]. - The company has established a robust sales and customer service network, contributing to its brand recognition and market presence [4][27]. Product Offerings - The company offers a range of diagnostic products categorized into five series: enzyme kinetics, enzyme-linked immunosorbent assay (ELISA), immunochromatography, chemiluminescence, and quantitative PCR, primarily for diagnosing invasive fungal diseases [2][27]. - Danah's products include unique offerings that have been recognized in national directories or received local certifications, enhancing its competitive edge [4][27].

产融共生,向新而行——2025金融街论坛年会投融资专场活动顺利启幕

Cai Jing Wang· 2025-10-29 08:02

Core Viewpoint - The 2025 Financial Street Forum aims to enhance the integration of capital and innovation, facilitating investment and financing needs to promote high-quality economic development [1] Group 1: Event Overview - The event, themed "Symbiosis of Industry and Finance, Moving Towards New Directions," was officially launched on October 28, 2025, with support from various governmental and financial institutions [1] - Key officials, including representatives from the Beijing Municipal Government and the Ministry of Industry and Information Technology, attended and delivered speeches [1] Group 2: Initiatives for SMEs - A total of 146 "specialized, refined, distinctive, and innovative" enterprises were announced as part of the "green channel" for transitioning to the New Third Board, marking the first results of a new mechanism established in 2023 [2] - The Ministry of Industry and Information Technology launched the "Tax and Finance" section on the China SME Service Network, utilizing AI and advanced technologies to assist SMEs in tax management and compliance [2] Group 3: Support Measures - The Beijing Economic and Information Bureau released a "Service List for SMEs," outlining 22 support measures across five areas to aid the high-quality development of SMEs in Beijing [3] - The Xicheng District Economic Promotion Bureau initiated a call for professional service providers to support local SMEs in various fields, including policy services and management consulting [3] - The Ministry of Industry and Information Technology provided a detailed explanation of the evaluation index system for "specialized, refined, distinctive, and innovative" SMEs, offering guidance for improvement [3]

ETF市场日报 | 沪指突破4000点,光伏板块集体领涨!银行ETF批量回调

Sou Hu Cai Jing· 2025-10-29 07:51

Market Overview - Major A-share indices collectively rose, with the Shanghai Composite Index closing above 4000 points, up 0.70% [1] - The Shenzhen Component Index increased by 1.95%, and the ChiNext Index rose by 2.93%, while the North China 50 Index surged by 8.41% [1] - The total trading volume in the Shanghai, Shenzhen, and Beijing markets approached 2.3 trillion yuan [1] Sector Performance - The photovoltaic sector led the gains, with several ETFs showing significant increases, including the ChiNext 50 ETF (up 12.29%) and various photovoltaic ETFs (ranging from 8.10% to 8.81%) [2] - The strong performance in the photovoltaic sector is attributed to a 31.79% month-on-month increase in new installed capacity in September, totaling 9.7 GW [3] Demand and Supply Dynamics - Domestic demand for electricity is rising, with structural new energy needs emerging, supported by market reforms and carbon market developments [3] - The photovoltaic industry is experiencing a recovery in pricing and a reduction in disorderly competition, aided by coordination among industry associations [3] - Internationally, Chinese photovoltaic companies are securing significant orders, indicating strong overseas demand despite some trade environment challenges [3] ETF Trading Activity - The Short-term Bond ETF recorded the highest trading volume at 33.3 billion yuan, followed by other ETFs such as the Silver Day Benefit ETF and Hong Kong Securities ETF [5] - The turnover rate for the benchmark government bond ETF reached 148%, indicating high trading activity [6] New ETF Launch - A new ETF tracking the CSI 500 Index is set to launch, appealing to long-term investors seeking market-average returns and those looking to diversify their portfolios [7]

汇成真空涨2.25%,成交额3.62亿元,后市是否有机会?

Xin Lang Cai Jing· 2025-10-29 07:48

Core Viewpoint - The company, Guangdong Huicheng Vacuum Technology Co., Ltd., is experiencing significant market activity, with a recent stock price increase and notable trading volume, indicating investor interest in its operations and growth potential [1]. Company Overview - Guangdong Huicheng Vacuum Technology Co., Ltd. was established on August 14, 2006, and is located in Dongguan, Guangdong Province. The company specializes in the research, development, production, sales, and technical services of vacuum coating equipment [8]. - The company's main business revenue composition includes: 49.29% from industrial vacuum coating equipment, 19.27% from other consumer products, 10.64% from scientific research, 9.91% from consumer electronics, 5.88% from technical services, and 5.01% from accessories and consumables [8]. Market Position and Clientele - The company has developed a strong client base, including well-known enterprises such as Apple, Foxconn, BYD, Jabil, and others, which highlights its recognition and integration into the supply chains of major industry players [3]. - The company has been recognized as a "specialized, refined, distinctive, and innovative" small giant enterprise, which is a prestigious title in China, indicating its strong market position and technological capabilities [4]. Financial Performance - As of June 30, 2025, the company reported a revenue of 263 million yuan, a year-on-year decrease of 9.71%, and a net profit attributable to shareholders of 42.64 million yuan, down 27.82% compared to the previous year [9]. - The company has distributed a total of 55 million yuan in dividends since its A-share listing [10]. Stock Performance and Trading Activity - The stock price of Huicheng Vacuum recently increased by 2.25%, with a trading volume of 362 million yuan and a turnover rate of 6.20%, leading to a total market capitalization of 14.361 billion yuan [1]. - The main capital inflow for the stock today was 16.89 million yuan, with a net outflow of 312 million yuan in the industry over the past two days, indicating mixed investor sentiment [5][6]. Technical Analysis - The average trading cost of the stock is 155.51 yuan, with recent reductions in holdings but at a slowing rate. The current stock price is near a support level of 139.80 yuan, which is critical for potential rebounds [7].

春立医疗跌4.31%,成交额8023.52万元,后市是否有机会?

Xin Lang Cai Jing· 2025-10-29 07:41

Core Viewpoint - Spring Medical experienced a decline of 4.31% in stock price, with a trading volume of 802.35 million yuan and a market capitalization of 9.877 billion yuan [1] Company Overview - Spring Medical is a leading domestic manufacturer of orthopedic medical devices, focusing on the research, production, and sales of implantable orthopedic medical devices, including oral metal and invisible orthodontics, as well as oral implants and restorations [2][5] - The company is recognized as a "specialized, refined, distinctive, and innovative" small giant enterprise, which signifies its strong innovation capabilities and high market share in niche markets [3] - The company is located in Tongzhou District, Beijing, and was established on February 12, 1998, with its stock listed on December 30, 2021 [7] Product and Market Position - Spring Medical's main products include joint prosthetics and spinal implants, covering major human joints such as hip, knee, shoulder, and elbow, as well as a full range of spinal internal fixation systems [2][8] - The company has obtained registration certificates for hip and knee surgical robots and medical image processing software, indicating its investment in smart medical technology [2][3] Financial Performance - For the first half of 2025, Spring Medical achieved operating revenue of 488 million yuan, representing a year-on-year growth of 28.27%, and a net profit attributable to shareholders of 114 million yuan, up 44.85% year-on-year [8] - The company has distributed a total of 359 million yuan in dividends since its A-share listing, with 309 million yuan distributed in the past three years [8] Shareholder and Market Activity - As of June 30, 2025, the number of shareholders decreased by 17.57% to 5,920, while the average circulating shares per person increased by 341.41% to 48,836 shares [8] - The stock has seen a net outflow of 1.5025 million yuan from major funds today, with a continuous reduction in major fund holdings over the past three days [4][5]