废弃资源综合利用

Search documents

A股、A50,强势翻红!这一板块,涨停潮!

证券时报· 2025-11-05 04:40

Market Performance - On November 5, A-shares and Hong Kong stocks opened significantly lower but gradually stabilized, with the Shanghai Composite Index rising 0.05% by midday after initially dropping nearly 1% [3][8] - The A-share market saw over 3,000 stocks rise, while approximately 2,200 stocks declined, indicating a generally positive market sentiment despite initial losses [3][4] Sector Highlights - The power equipment sector led the gains in the A-share market, with stocks like Jinpan Technology, Zhongzhi Technology, and Zhongneng Electric hitting the daily limit of 20% [4][5] - Other notable performers included Fengyuan Co., Sun Cable, and Shunhua Electric, all of which also saw significant price increases [5][6] - The coal sector also showed strength, with stocks like Antai Group and Baotailong reaching their daily limit, and Dayou Energy experiencing a rise of over 8% [6] Hong Kong Market - The Hang Seng Index and the Hang Seng Tech Index saw their declines significantly narrow by midday, with the Hang Seng Index down 0.28% after an initial drop of over 1.7% [15] - Notable stocks in the Hang Seng Index included New Oriental and BYD, which were among the biggest decliners, while companies like Kang Shifu Holdings and WuXi AppTec led the gains [10][15] New Listings - A new stock, Fengbei Biological, debuted on November 5, with its price surging over 210% at one point during trading [12][14] - Fengbei Biological focuses on the comprehensive utilization of waste resources, particularly waste oils, and has established a strong technological foundation with numerous patents [14][16]

N丰倍上午收盘涨185.91% 半日换手率60.17%

Zheng Quan Shi Bao Wang· 2025-11-05 04:00

Core Viewpoint - N Fengbei (603334) debuted today with a significant opening increase of 169.50%, and by midday, the increase expanded to 185.91%, indicating strong market interest and trading activity [1] Company Overview - N Fengbei is a high-tech enterprise in the field of waste resource utilization, primarily focusing on the production of resource-based products from waste oils [1] - The company has developed a comprehensive industrial chain for waste resource recycling, which includes "waste oils - biofuels (biodiesel) - bio-based materials" [1] - N Fengbei leverages its core technology in oil fat utilization and channel advantages to provide oil fat chemicals to customers [1] Financial Highlights - The total number of shares issued in this IPO is 35.90 million, with an online issuance of 24.21 million shares at a price of 24.49 yuan per share [1] - The issuance price corresponds to a price-to-earnings (P/E) ratio of 30.47, significantly lower than the industry average P/E ratio of 64.73 [1] - The total funds raised from the IPO amount to 879 million yuan, which will be allocated to projects including the construction of a 300,000-ton annual production facility for methyl oleate, a 10,000-ton industrial-grade mixed oil facility, and other agricultural microbial agents and fertilizers [1]

N丰倍开盘上涨169.50%

Zheng Quan Shi Bao Wang· 2025-11-05 02:18

Core Viewpoint - Company N Fengbei has successfully listed with an opening price of 66.00 yuan, reflecting a significant increase of 169.50% on its first trading day, indicating strong market interest and investor confidence in the company's business model and growth potential [2]. Company Overview - N Fengbei is a high-tech enterprise in the field of comprehensive utilization of waste resources, primarily focusing on the production of resource-based products from waste oils [2]. - The company has developed a production chain that includes waste oils, biodiesel, and bio-based materials, showcasing its commitment to sustainability and innovation in waste resource recycling [2]. Financial Performance - The total number of shares issued by the company is 35.90 million, with an online issuance of 24.21 million shares at a price of 24.49 yuan per share [2]. - The company's issuance price corresponds to a price-to-earnings (P/E) ratio of 30.47, which is significantly lower than the industry average P/E ratio of 64.73 [2]. - The total funds raised from the initial public offering (IPO) amount to 879 million yuan, which will be allocated to projects including the construction of a 300,000-ton annual production facility for methyl oleate, among others [2]. Recent IPO Performance - N Fengbei's first-day performance is part of a broader trend of newly listed stocks, with several companies experiencing substantial increases in their opening prices, indicating a robust market for IPOs in various sectors [3].

丰倍生物(603334) - 丰倍生物首次公开发行股票主板上市公告书

2025-11-03 11:31

股票简称:丰倍生物 股票代码:603334 苏州丰倍生物科技股份有限公司 SUZHOU FENGBEI BIOTECH STOCK CO., LTD. (江苏扬子江国际化学工业园东海路 1 号) 首次公开发行股票主板上市公告书 保荐人(主承销商) (中国(上海)自由贸易试验区商城路 618 号) 二〇二五年十一月四日 苏州丰倍生物科技股份有限公司 上市公告书 特别提示 苏州丰倍生物科技股份有限公司(以下简称"丰倍生物""发行人""本公 司"或"公司")股票将于 2025 年 11 月 5 日在上海证券交易所主板上市。 本公司提醒投资者应充分了解股票市场风险及本公司披露的风险因素,在新 股上市初期切忌盲目跟风"炒新",应当审慎决策、理性投资。 本上市公告书中若出现总数与各分项数值之和尾数不等的情况,均为四舍五 入尾差所致。 1 苏州丰倍生物科技股份有限公司 上市公告书 第一节 重要声明与提示 一、重要声明与提示 本公司及全体董事、监事、高级管理人员保证上市公告书所披露信息的真实、 准确、完整,承诺上市公告书不存在虚假记载、误导性陈述或者重大遗漏,并依 法承担法律责任。 上海证券交易所、有关政府机关对本公司股票上 ...

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:14

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products [1][2]. Company Overview - Established in 2014, Fengbei Bio primarily engages in waste oil resource utilization, with oil chemical products as a supplementary business [1]. - The company has developed a range of products including bio-based materials and biofuels, with a focus on agricultural additives and biodiesel [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 17.09 billion, 17.28 billion, and 19.48 billion CNY, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 1.33 billion, 1.30 billion, and 1.24 billion CNY, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - Fengbei Bio holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity [3]. - In the agricultural chemical sector, the company has a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives [4]. Research and Development - The company has obtained 135 patents, including 33 domestic invention patents and 3 international invention patents, and has been recognized as a national-level "little giant" enterprise [3]. Client Base - Fengbei Bio's clientele includes major global commodity traders such as TRAFIGURA and GLENCORE, as well as renowned end-users like CARGILL and BP [3].

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购丨打新早知道

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:04

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products, with a strong emphasis on bio-based materials and fuels [1][3]. Company Overview - Established in 2014, Fengbei Bio primarily engages in the comprehensive utilization of waste oil resources, with oil chemical products as a supplementary business [1]. - The company has developed a range of products, including bio-based materials (such as pesticide and fertilizer additives) and biofuels (mainly biodiesel) [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 1.709 billion, 1.728 billion, and 1.948 billion yuan, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 133 million, 130 million, and 124 million yuan, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - The company holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity as of the end of 2024 [3]. - In the agricultural chemical sector, Fengbei Bio has established long-term partnerships with leading companies, achieving a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives in 2023 [4]. Research and Development - As of June 30, 2025, Fengbei Bio and its subsidiaries have obtained 135 patents, including 33 domestic invention patents and 3 international invention patents [3]. - The company has been recognized as a national-level "little giant" enterprise and has established several engineering research centers in Jiangsu Province [3]. Investment Plans - The company plans to invest 750 million yuan in new projects, including the construction of facilities for producing 300,000 tons of oleic acid methyl ester and 50,000 tons of biodiesel, among other products [2].

丰倍生物开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:39

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a maximum subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times. The company operates in the waste resource utilization sector, focusing on converting waste oils into biofuels and biobased materials, establishing a comprehensive recycling industry chain [1]. Company Overview - Fengbei Bio is a high-tech enterprise specializing in the comprehensive utilization of waste resources, primarily focusing on waste oils to produce biobased products and biofuels. The main products include biobased materials such as pesticide and fertilizer additives, and biofuels like biodiesel [1]. - The company has established long-term partnerships with leading agricultural chemical firms, including Fengle Seed Industry, Jiuyi Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1]. Production Capacity - As of the end of 2024, Fengbei Bio's biodiesel production capacity is 105,000 tons, ranking sixth in China's biodiesel industry. Compared to peers like Zhuoyue New Energy and Jiaao Environmental Protection, Fengbei's net profit after deducting non-recurring gains is lower than Zhuoyue but higher than Jiaao and Longhai Bio [2][3]. Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.949 billion CNY for the years 2022, 2023, and 2024, respectively. Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2][4]. - Total assets as of December 31, 2024, are 12.368 billion CNY, with equity attributable to shareholders at 7.558 billion CNY. The asset-liability ratio has improved from 49.12% in 2022 to 43.13% in 2024 [4]. Profitability Metrics - For the fiscal year 2024, the company expects a net profit of approximately 1.238 billion CNY, with a basic earnings per share of 1.15 CNY. The return on equity is projected at 17.91%, down from 30.57% in 2022 [5].

能将地沟油变成生物柴油的公司来了 下周3只新股可申购

Sou Hu Cai Jing· 2025-10-26 04:55

Group 1: New IPOs Overview - Three new stocks available for subscription in the A-share market next week: Fengbei Bio, Delijia, and Zhongcheng Consulting [1] - Fengbei Bio focuses on waste oil resource utilization, transforming waste cooking oil into biodiesel [1] - Delijia specializes in precision gear transmission, with its core product being wind power main gearboxes [2] Group 2: Fengbei Bio Financials - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 1.709 billion, 1.728 billion, and 1.948 billion respectively, indicating steady growth [2] - The company expects a decline in net profit from 136 million to 115 million during the same period, highlighting a situation of increasing revenue but decreasing profit [2] - The IPO aims to raise 750 million, with funds allocated for new production projects including biodiesel and microbial fertilizers [2] Group 3: Delijia Financials and Projects - Delijia's revenue is expected to grow by 81.13% year-on-year by mid-2025, with a net profit increase of 63.56% [2] - The company has secured over 4 billion in orders, providing a strong performance outlook for the coming years [2] - The IPO funds will be used for expanding production capacity for large onshore and offshore wind power gearboxes [3] Group 4: Zhongcheng Consulting Overview - Zhongcheng Consulting provides engineering cost, bidding agency, and project management services, with operations primarily in Jiangsu and surrounding provinces [3] - The company anticipates a revenue decline of 3.04% in 2025, with net profit expected to decrease by 4.14% [3] - The decline in performance is attributed to the complex international environment and fluctuations in the real estate market [3]

从事废弃资源综合利用丰倍生物(603334.SH)拟于上交所主板IPO上市

智通财经网· 2025-10-16 12:22

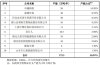

Group 1 - The company, Fengbei Bio (603334.SH), plans to issue 35.90 million shares, accounting for 25.02% of the total shares post-issuance, with a total share capital of 143.50 million shares after the public offering [1] - The initial strategic placement will involve 7.18 million shares, representing 20.00% of the total issuance [1] - The company operates in the field of waste resource utilization, primarily focusing on converting waste oils into resource products, forming a production chain from waste oils to biofuels and bio-based materials [1] Group 2 - The main business of the company is waste oil resource utilization, with secondary operations in oil chemical products; key products include bio-based materials and biofuels [2] - The company's revenue for the reporting periods was 1,708.69 million, 1,727.78 million, 1,948.02 million, and 1,478.13 million yuan, with net profits of 135.92 million, 123.04 million, 115.32 million, and 84.70 million yuan after excluding non-recurring gains and losses [2] - The company plans to invest a total of 750 million yuan from the fundraising into projects related to its main business, including the construction of facilities for producing various bio-based products and biofuels [2]

从事废弃资源综合利用丰倍生物拟于上交所主板IPO上市

Zhi Tong Cai Jing· 2025-10-16 12:21

Group 1 - The company, Fengbei Biotechnology (603334.SH), plans to issue 35.90 million shares in its initial public offering (IPO), representing 25.02% of the total shares post-issuance, with a total share capital of 143.50 million shares after the IPO [1] - The initial strategic placement will involve 7.18 million shares, accounting for 20.00% of the total issuance, with the pricing inquiry date set for October 22, 2025, and subscription date for October 27, 2025 [1] - The company specializes in the comprehensive utilization of waste resources, primarily focusing on converting waste oils into resource products, forming a production chain from waste oils to biodiesel and bio-based materials [1] Group 2 - The main business of the company revolves around the comprehensive utilization of waste oils, with secondary operations in oil chemical products; key products include bio-based materials and biodiesel [2] - The company's revenue has shown a consistent growth trend over the reporting periods, with total revenues of 1,708.69 million, 1,727.78 million, 1,948.02 million, and 1,478.13 million yuan, while the net profit attributable to the parent company after deducting non-recurring gains and losses was 135.92 million, 123.04 million, 115.32 million, and 84.70 million yuan [2] - The net proceeds from the IPO, after deducting issuance costs, will be invested in projects related to the main business, including the construction of facilities for producing 300,000 tons of methyl oleate, 10,000 tons of industrial-grade mixed oil, and other agricultural microbial agents, totaling an investment of 750 million yuan [2]