个人信用救济政策

Search documents

壹快评|央行个人信用救济政策有温度有力度 值得点赞

Di Yi Cai Jing· 2025-10-28 06:25

Core Viewpoint - The People's Bank of China is researching a one-time personal credit relief policy aimed at individuals who have defaulted on loans below a certain amount since the pandemic but have since repaid them, with their default information not being displayed in the credit system [1] Group 1: Policy Implications - The new credit relief policy reflects the government's understanding and concern for the difficulties faced by the public, showcasing precise governance strategies during a critical economic recovery period [1] - This initiative is expected to alleviate the negative impact of credit "stains" on individuals who have repaid their debts, which can severely affect their employment, housing, and future loan applications [1] Group 2: Economic Impact - The policy aims to stimulate consumer spending by removing barriers for a large group of individuals with credit issues, thereby unlocking suppressed consumption demand, which is crucial for expanding domestic demand and strengthening the domestic economy [2] - By addressing the consumption constraints faced by this demographic, the credit relief policy is anticipated to enhance consumer confidence and spending behavior, contributing positively to economic recovery [2] Group 3: Governance and Adaptability - The credit relief initiative is seen as a modern adaptation of traditional governance practices aimed at benefiting the populace, aligning with the Party's commitment to serving the people [2] - This policy exemplifies the need for flexible and responsive governance in the face of evolving economic and social challenges, as emphasized by the recent directives from the Party's 20th Central Committee [3]

壹快评|央行个人信用救济政策有温度有力度,值得点赞

Di Yi Cai Jing· 2025-10-28 06:19

Core Viewpoint - The People's Bank of China is researching a one-time personal credit relief policy aimed at individuals who have defaulted on loans below a certain amount during the pandemic but have since repaid them, which will not be displayed in credit reports [1][2] Group 1: Policy Innovation - The new credit relief policy reflects the government's understanding and concern for the difficulties faced by the public, showcasing governance wisdom during a critical economic recovery period [1] - This initiative is seen as a modern adaptation of traditional governance practices that prioritize the welfare of the people, aligning with the Party's commitment to serve the public [2] Group 2: Economic Implications - The policy aims to stimulate consumer spending by removing barriers caused by negative credit records, thereby unlocking suppressed consumption potential, which is crucial for expanding domestic demand [2] - By addressing the credit issues of a large group of individuals, the policy is expected to enhance consumer confidence and spending behavior, contributing positively to economic recovery [2] Group 3: Strategic Context - The current economic environment in China is characterized by both strategic opportunities and challenges, necessitating flexible and responsive policy measures [3] - The credit relief policy exemplifies the call for adaptability and innovation in policy-making as outlined in the recent Party Congress, aiming for coherent and stable overall policy while addressing emerging issues [3]

央行:将研究实施支持个人修复信用的政策措施

Jing Ji Guan Cha Wang· 2025-10-28 03:43

经济观察网2025金融街论坛年会10月28日在北京举行。中国人民银行行长潘功胜在论坛上表示,将研究 实施支持个人修复信用的政策措施。根据《征信业管理条例》,在征信系统中,违约记录的存续期为5 年。过去几年,受新冠疫情等不可抗力影响,一些个人发生了债务逾期,虽然事后全额偿还,但相关信 用记录仍持续影响其经济生活。为帮助个人加快修复信用记录,同时发挥违约信用记录的约束效力,人 民银行正在研究实施一次性的个人信用救济政策,对于疫情以来违约在一定金额以下且已归还贷款的个 人违约信息,将在征信系统中不予展示。这项措施将在履行相关的程序后,由人民银行会同金融机构进 行必要的技术准备,计划在明年初执行。 ...

央行:研究实施支持个人修复信用的政策措施

Zhong Guo Jing Ji Wang· 2025-10-28 02:36

10月27日,在2025金融街论坛年会开幕式上,中国人民银行行长潘功胜表示,为帮助个人加快修复信用 记录,同时发挥违约信用记录的约束效力,人民银行正在研究实施一次性的个人信用救济政策,对于疫 情以来违约在一定金额以下且已归还贷款的个人违约信息,将在征信系统中不予展示。这项措施将在履 行相关的程序后,由人民银行会同金融机构进行必要的技术准备,计划在明年初执行。(经济日报记者 勾明扬) 中国人民银行运营的征信系统是一项重要的金融基础设施,对企业和个人的金融违约行为进行记录,并 供金融机构在开展业务时进行查询和风险评估,20多年来,对我国社会信用体系建设、防范金融风险发 挥了重要作用。根据《征信业管理条例》,在征信系统中,违约记录的存续期为5年。过去几年,受新 冠疫情等不可抗力影响,一些个人发生了债务逾期,虽然事后全额偿还,但相关信用记录仍持续影响其 经济生活。 ...

金融街论坛|创造良好的货币金融环境——中国人民银行行长潘功胜谈经济金融热点问题

Xin Hua Wang· 2025-10-28 00:58

Core Viewpoint - The People's Bank of China (PBOC) emphasizes the continuation of a supportive monetary policy stance to foster economic recovery and maintain financial market stability amid complex domestic and international challenges [2][3]. Group 1: Monetary Policy - As of the end of September, the total social financing stock grew by 8.7% year-on-year, broad money (M2) increased by 8.4%, and the RMB loan balance rose by 6.6%, indicating a state of moderately loose monetary policy [2]. - The PBOC has utilized various monetary policy tools to ensure ample liquidity, creating a favorable monetary environment for economic recovery and stable financial market operations [2][3]. - The PBOC plans to continue implementing a moderately loose monetary policy and will resume operations in the secondary market for government bonds to enhance the monetary policy toolkit [3]. Group 2: Credit System and Personal Financing - The PBOC is developing a one-time personal credit relief policy to help individuals who have defaulted on loans due to the pandemic but have since repaid them, aiming to improve their credit records [4]. - This policy will prevent certain default information from being displayed in the credit system, facilitating personal financing and economic participation [4]. Group 3: Digital Currency Management - The PBOC is committed to optimizing the management system for digital currency, having established operational centers in Shanghai and Beijing for international cooperation and system maintenance [5]. - The central bank will continue to monitor and regulate virtual currency activities while promoting the development of the digital RMB ecosystem [5]. Group 4: Macro-Prudential Management - The PBOC is advancing the construction of a comprehensive macro-prudential management system, focusing on systemic financial risk monitoring, risk prevention measures for key institutions, and enhancing the macro-prudential management toolkit [6]. - The central bank aims to create a dynamic and collaborative process for building this system, which is essential for maintaining overall financial stability and supporting high-quality economic development [6].

金融街论坛共塑创新变革新图景

Sou Hu Cai Jing· 2025-10-27 21:38

Core Viewpoint - The 2025 Financial Street Forum in Beijing focuses on "Innovation, Transformation, and Reshaping Global Financial Development," with key discussions on economic conditions, monetary policy, financial openness, and reforms in the ChiNext market [2] Group 1: Monetary Policy - The People's Bank of China (PBOC) emphasizes the implementation of a moderately accommodative monetary policy, utilizing various tools to maintain ample liquidity and support economic recovery [2][3] - The PBOC plans to restore open market operations for government bonds and optimize the digital RMB management system, including establishing international and operational centers for digital RMB [3] Group 2: Financial Regulation - The National Financial Regulatory Administration aims to enhance economic and financial adaptability, promoting a new financial service model that balances direct and indirect financing, and supports key sectors and industries [4][5] - The administration will deepen structural reforms in financial supply, improve the quality and resilience of financial institutions, and expand the scope of financial services for small and micro enterprises [5] Group 3: Capital Market Development - The China Securities Regulatory Commission (CSRC) is set to deepen reforms in the ChiNext market, establishing listing standards that cater to emerging industries and technologies [6] - The CSRC has launched an optimization plan for the Qualified Foreign Institutional Investor (QFII) system, aiming to provide a more transparent and efficient environment for foreign investors [6][7]

创造良好的货币金融环境——中国人民银行行长潘功胜谈经济金融热点问题

Xin Hua She· 2025-10-27 19:16

Core Viewpoint - The People's Bank of China (PBOC) is committed to maintaining a supportive monetary policy stance to foster economic recovery and financial market stability amid complex domestic and international challenges [2][3]. Monetary Policy - As of the end of September, the stock of social financing increased by 8.7% year-on-year, broad money (M2) rose by 8.4%, and the balance of RMB loans grew by 6.6%, indicating a historically low financing cost [2]. - The PBOC has utilized various monetary policy tools to ensure ample liquidity, contributing to a favorable monetary environment for economic recovery [2]. - The PBOC plans to resume operations in the secondary market for government bonds, which were previously suspended due to market imbalances and risks [2]. Credit System and Personal Credit Relief - The PBOC is developing a one-time personal credit relief policy to assist individuals who have defaulted on loans due to the pandemic but have since repaid them, aiming to improve their credit records [3]. - This policy is expected to be implemented in early next year after necessary preparations with financial institutions [3]. Digital Currency Management - The PBOC has established a digital RMB international operation center in Shanghai and an operation management center in Beijing to enhance the digital currency ecosystem [4]. - The central bank will continue to optimize the management system for digital RMB and support more commercial banks in becoming operational entities for digital RMB [4]. Macro-Prudential Management - The PBOC is advancing the construction of a comprehensive macro-prudential management system, which includes setting up cross-border financing parameters and improving real estate financial management [6]. - The focus areas for enhancing the macro-prudential management system include strengthening risk monitoring, improving risk prevention measures for key institutions, enriching the macro-prudential toolkit, and establishing efficient governance mechanisms [6].

金融街论坛丨创造良好的货币金融环境——中国人民银行行长潘功胜谈经济金融热点问题

Xin Hua Wang· 2025-10-27 16:35

Core Viewpoint - The People's Bank of China (PBOC) emphasizes the importance of maintaining a supportive monetary policy stance to foster a favorable economic and financial environment amid complex domestic and international challenges [2][3]. Monetary Policy - As of the end of September, the total social financing stock grew by 8.7% year-on-year, broad money (M2) increased by 8.4%, and the RMB loan balance rose by 6.6%, indicating a state of moderately loose monetary policy [2]. - The PBOC has utilized various monetary policy tools to ensure ample liquidity, supporting economic recovery and stabilizing financial markets [2][3]. Debt Market Operations - The PBOC plans to resume government bond trading operations in the open market after a pause earlier this year due to imbalances in supply and demand in the bond market [3]. - The central bank will continue to implement a supportive monetary policy stance, providing liquidity arrangements across short, medium, and long terms [3]. Credit System and Personal Financing - The PBOC is developing a one-time personal credit relief policy to assist individuals who have defaulted on loans due to the pandemic but have since repaid them, aiming to improve their credit records [4]. - This policy is expected to be implemented early next year after necessary technical preparations [4]. Digital Currency Management - The PBOC has established a digital RMB international operation center in Shanghai and an operation management center in Beijing to enhance the digital currency ecosystem [5]. - The central bank will continue to optimize the management system for digital RMB and support more commercial banks in its implementation [5]. Macro-Prudential Management - The PBOC is advancing the construction of a comprehensive macro-prudential management system, focusing on monitoring systemic financial risks and enhancing risk prevention measures in key sectors [6]. - The central bank aims to build a dynamic and collaborative macro-prudential management framework to promote high-quality economic and financial development [6].

央行行长潘功胜:研究实施支持个人修复信用的政策措施|快讯

Sou Hu Cai Jing· 2025-10-27 16:20

人民银行运营的征信系统是一项重要的金融基础设施,对企业和个人的金融违约行为进行记录,并供金 融机构在开展业务时进行查询和风险评估。20多年来,对我国社会信用体系建设、防范金融风险发挥了 重要作用。 根据《征信业管理条例》,征信机构对个人不良信息的保存期限,自不良行为或者事件终止之日起为5 年;超过5年的,应当予以删除。在不良信息保存期限内,信息主体可以对不良信息作出说明,征信机 构应当予以记载。 文/付乐 10月27日,在2025金融街论坛年会开幕式上,中国人民银行行长潘功胜表示,过去几年,受新冠疫情等 不可抗力影响,一些个人发生了债务逾期,虽然事后全额偿还,但相关信用记录仍持续影响其经济生 活。 潘功胜指出,为帮助个人加快修复信用记录,同时发挥违约信用记录的约束效力,人民银行正在研究实 施一次性的个人信用救济政策,对于疫情以来违约在一定金额以下且已归还贷款的个人违约信息,将在 征信系统中不予展示。 "这项措施我们将在履行相关的程序后,由人民银行会同金融机构进行必要的技术准备,计划在明年初 执行。"潘功胜表示。 博通分析金融行业资深分析师王蓬博对《华夏时报》记者表示,政策通过征信不予展示规则,精准覆盖 非恶意 ...

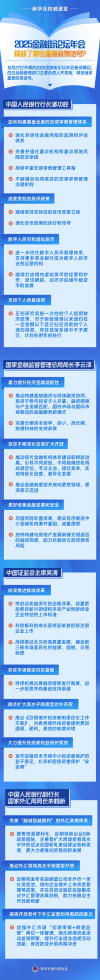

新华社权威速览|2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua Wang· 2025-10-27 16:13

Core Insights - The 2025 Financial Street Forum released significant policy signals regarding macroeconomic management and financial stability [2] Group 1: Macro Prudential Management - The People's Bank of China aims to accelerate the establishment of a comprehensive macro-prudential management system [3] - There will be a focus on enhancing the monitoring and assessment of systemic financial risks [4] - The central bank will continue to support a moderately accommodative monetary policy stance [7] Group 2: Digital Currency and Credit Policies - Efforts will be made to optimize the management system for digital renminbi [5] - The central bank is researching a one-time personal credit relief policy for individuals who have defaulted on loans below a certain amount since the COVID-19 pandemic, with plans to implement this by early next year [8] Group 3: Financial Adaptability and Reform - The National Financial Regulatory Administration emphasizes improving economic and financial adaptability [9] - There will be a push to create a new financial service model that balances direct and indirect financing, and aligns financing terms with industry development [10] - The administration will also focus on enhancing long-term capital investment policies and promoting the development of modern financial institutions [10] Group 4: Capital Market Reforms - The China Securities Regulatory Commission will deepen reforms in the ChiNext board, introducing listing standards that better fit emerging industries [12] - There are plans to launch a refinancing framework and expand support channels for mergers and acquisitions [13] Group 5: Foreign Exchange Policy - The State Administration of Foreign Exchange is set to introduce new policies to enhance trade facilitation, including expanding cross-border trade pilot programs [15] - Upcoming measures will include the implementation of a unified currency pool for multinational companies and integrated foreign exchange management reforms in free trade zones [16]