金融服务新模式

Search documents

投放1.18亿元贷款助生态惠民

Xin Lang Cai Jing· 2026-02-21 18:17

这一贷款的成功落地,既满足了小规模农牧户购买草籽、围栏等物资的资金需求,也有力支持养殖合作 社规模化发展,有效破解水土流失重点治理区生态修复资金短缺、养殖转型融资困难等痛点。通过金融 手段引导农牧民主动参与草原修复与科学养殖,确保了草原生态修复的可持续性,实现黄河上游地 区"生态美"与"百姓富"的双向奔赴。 黄南藏族自治州地处三江源核心区,拥有草场140.63公顷,其中草畜平衡草场18.79万公顷。广袤的草原 既是牧民赖以生存的家园,也是黄河上游重要的水源涵养功能区。中国人民银行黄南州分行立足辖 区"草原生态+牧户生产"核心场景,创新推出以草原生态保护补助资金为纽带的金融服务新模式,通过 构建"政策引导+金融支持+生态约束"联动机制,将牧民享有的稳定政策性补贴权益转化为有效信贷基 础,大幅提升农牧民获贷能力。金融机构根据借款人家庭草场面积、补播成效及圈养规划等指标科学核 定授信额度,单户最高可达50万元。 本报黄南讯 (记者 芈峤) 2月12日,记者从中国人民银行黄南州分行获悉,经过指导辖内4家金融机构 成功落地全州首批个人"生物多样性+草原保护修复"贷款。截至目前,金融机构已累计向超1100户农牧 民发放贷 ...

金融监管总局局长李云泽:加快推进金融强国建设

Zhong Guo Zheng Quan Bao· 2025-10-27 23:22

Core Viewpoint - The Financial Regulatory Administration emphasizes the importance of achieving high-quality financial development and risk prevention during the "14th Five-Year Plan" period, while setting goals for the "15th Five-Year Plan" to contribute to the modernization of socialism [1][2]. Group 1: Financial Development Goals - The administration aims to enhance economic and financial adaptability to promote sustainable and healthy economic development [1]. - There is a commitment to deepen reforms and expand openness to boost the dynamism and vitality of the financial sector [2]. - A focus on coordinating financial development and security to ensure a new development pattern is established [2]. Group 2: New Financial Service Models - The administration plans to create a new financial service model that balances direct and indirect financing, investment in goods and people, and aligns financing terms with industrial development [2]. - Emphasis will be placed on supporting major strategies and key areas to achieve qualitative and reasonable quantitative economic growth [2]. - The focus will be on modernizing the industrial system and fostering new productive forces through increased financial resources for traditional and emerging industries [2]. Group 3: Risk Prevention Responsibilities - The administration will prioritize risk prevention and maintain a firm stance against systemic financial risks [3]. - Efforts will be made to consolidate risk disposal achievements and facilitate the restructuring of small and medium financial institutions [3]. - There will be an acceleration in establishing a financing system that aligns with new real estate development models to mitigate local government debt risks [3].

构建金融服务新模式 稳妥有序推进中小金融机构减量提质

Sou Hu Cai Jing· 2025-10-27 22:23

Core Viewpoint - The Financial Regulatory Administration emphasizes the importance of risk prevention and aims to enhance the adaptability of the financial economy while promoting a new financial service model that balances direct and indirect financing, investment in goods and people, and aligns financing terms with industrial development [1][2][3] Group 1: Financial Development and Risk Management - The Financial Regulatory Administration will focus on the primary responsibility of risk prevention and will steadily advance the merger and restructuring of small and medium-sized financial institutions while improving quality and reducing quantity [1][3] - There has been significant progress in the high-quality development of the financial industry during the "14th Five-Year Plan" period, with important achievements in the battle against financial risks [1] - The administration aims to strengthen the financial supply-side structural reform, enhance the quality and resilience of development, and improve international influence [2][3] Group 2: Support for Economic Growth - The administration plans to support major projects and enhance funding supply to boost consumption and upgrade demand, focusing on the strategic basis of expanding domestic demand [2] - There will be a push for a new financial service model that coordinates direct and indirect financing, emphasizes long-term capital investment in technology, and supports the integration of technological and industrial innovation [2] Group 3: Regulatory Enhancements - The Financial Regulatory Administration will enhance the effectiveness of financial regulation by improving legal and regulatory frameworks and establishing a clear, precise, and effective tiered regulatory system [3] - There will be an emphasis on strengthening cross-border risk monitoring and response mechanisms to improve international regulatory cooperation and crisis management efficiency [3]

金融监管总局局长李云泽: 加快推进金融强国建设

Zhong Guo Zheng Quan Bao· 2025-10-27 21:15

Core Viewpoint - The Financial Regulatory Administration emphasizes the importance of high-quality financial development and risk prevention during the "14th Five-Year Plan" period, aiming to contribute significantly to the modernization of socialism in the "15th Five-Year Plan" period [1] Group 1: Financial Development Goals - The Financial Regulatory Administration aims to enhance economic and financial adaptability to promote sustainable and healthy economic development [1] - There is a commitment to deepen reforms and expand openness in the financial sector to boost development momentum and vitality [2] - The focus will be on coordinating financial development and security to ensure a new development pattern is supported by a new security framework [2] Group 2: New Financial Service Models - The administration plans to create a new financial service model that balances direct and indirect financing, investment in goods and people, and aligns financing terms with industrial development [2] - Emphasis will be placed on supporting major strategies, key areas, and weak links to achieve qualitative and reasonable quantitative economic growth [2] - The focus will be on modernizing the industrial system and fostering new productive forces through financial resources, particularly in intelligent, green, and integrated sectors [2] Group 3: Risk Prevention Responsibilities - The Financial Regulatory Administration will prioritize risk prevention and maintain a firm stance against systemic financial risks [3] - Efforts will be made to consolidate risk disposal achievements and facilitate the restructuring of small and medium financial institutions [3] - There will be an acceleration in establishing financing systems that align with new real estate development models to help mitigate local government debt risks [3]

加快推进金融强国建设

Zhong Guo Zheng Quan Bao· 2025-10-27 21:03

Core Viewpoint - The Financial Regulatory Administration emphasizes the importance of high-quality financial development and risk prevention during the "14th Five-Year Plan" period, aiming to contribute significantly to the modernization of socialism in China [1] Group 1: Financial Development Goals - The Financial Regulatory Administration aims to enhance economic and financial adaptability to promote sustainable and healthy economic development [1] - There is a commitment to deepen reforms and expand openness in the financial sector to boost development momentum and vitality [2] - A new financial service model will be established, focusing on the synergy between direct and indirect financing, and balancing investments in goods and people [1][2] Group 2: Support for Industries - Financial resources will be directed towards optimizing traditional industries and nurturing emerging and future industries, with a focus on intelligent, green, and integrated development [2] - Policies will be improved to support long-term capital investment in hard technology, ensuring comprehensive financial support throughout the innovation cycle [2] Group 3: Risk Prevention and Management - The Financial Regulatory Administration will prioritize risk prevention, aiming to maintain a solid bottom line against systemic financial risks [2][3] - Efforts will be made to enhance financial regulatory efficiency and establish a clear, effective regulatory framework [3] - There will be a focus on improving the financing system to address local government debt risks and enhance the overall stability of the financial system [3]

金融监管总局局长李云泽:构建投资于物与投资于人并重的金融服务新模式

Shang Hai Zheng Quan Bao· 2025-10-27 20:50

Group 1 - The core viewpoint emphasizes the commitment to advancing financial development in line with China's unique path, aiming to contribute significantly to the modernization of socialism [2] - The focus is on enhancing economic and financial adaptability to promote sustainable and healthy economic and social development, with a new financial service model that balances direct and indirect financing, investment in goods and people, and aligns financing terms with industry development [2] - There is a strong emphasis on supporting the construction of a modern industrial system and the development of new productive forces, particularly in areas like intelligence, green technology, and integration, while also enhancing financial resources for traditional and emerging industries [2] Group 2 - The commitment to deepening reforms and expanding openness in the financial sector is highlighted, with a focus on structural reforms that enhance the quality and resilience of financial institutions and improve international influence [3] - The goal is to promote high-quality development in the financial industry by establishing a modern financial enterprise system and correcting disorderly competition to maintain a fair financial order [3][4] - There is an emphasis on enhancing the cross-border operational capabilities of Chinese institutions and actively participating in international financial governance reforms [4] Group 3 - The need for better coordination between financial development and security is stressed, with plans to create a financing system that aligns with new real estate development models to mitigate local government debt risks [5] - The approach includes reforming financial laws and regulations to establish a clear and effective regulatory framework, leveraging technology to optimize resource allocation [5] - There is a call for enhanced collaboration between central and local authorities to strengthen regulatory efforts and maintain global financial stability [5]

金融监管总局局长李云泽: 构建金融服务新模式 稳妥有序推进中小金融机构减量提质

Zheng Quan Shi Bao· 2025-10-27 18:18

Core Insights - The Financial Regulatory Administration emphasizes its commitment to risk prevention as a primary responsibility while promoting the merger and restructuring of small and medium-sized financial institutions in a steady and orderly manner [1][3] - The administration aims to enhance economic and financial adaptability, fostering a new financial service model that balances direct and indirect financing, investment in goods and people, financing terms aligned with industrial development, and the linkage between domestic and international markets [2][3] Group 1 - The administration has made significant progress in high-quality financial development during the 14th Five-Year Plan period, achieving important milestones in the battle against financial risks [1] - The focus for the 15th Five-Year Plan period will be on advancing the construction of a financial powerhouse to contribute more to the realization of socialist modernization [1][2] - There will be a strong emphasis on supporting major strategies, key areas, and weak links to enhance the quality and reasonable growth of the economy [2] Group 2 - The administration plans to deepen financial supply-side structural reforms, ensuring a more rational institutional layout and enhancing the quality and resilience of development [2][3] - There will be efforts to correct disorderly competition and maintain a healthy and fair financial order, while promoting the construction of a modern financial institution system [2][3] - The administration will strengthen cross-border risk monitoring and response mechanisms to enhance international regulatory cooperation and crisis management efficiency [3]

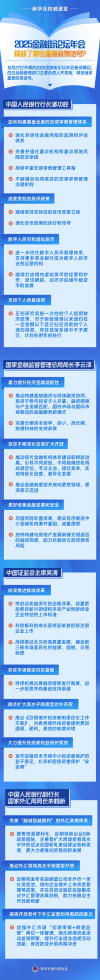

新华社权威速览|2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua Wang· 2025-10-27 16:13

Core Insights - The 2025 Financial Street Forum released significant policy signals regarding macroeconomic management and financial stability [2] Group 1: Macro Prudential Management - The People's Bank of China aims to accelerate the establishment of a comprehensive macro-prudential management system [3] - There will be a focus on enhancing the monitoring and assessment of systemic financial risks [4] - The central bank will continue to support a moderately accommodative monetary policy stance [7] Group 2: Digital Currency and Credit Policies - Efforts will be made to optimize the management system for digital renminbi [5] - The central bank is researching a one-time personal credit relief policy for individuals who have defaulted on loans below a certain amount since the COVID-19 pandemic, with plans to implement this by early next year [8] Group 3: Financial Adaptability and Reform - The National Financial Regulatory Administration emphasizes improving economic and financial adaptability [9] - There will be a push to create a new financial service model that balances direct and indirect financing, and aligns financing terms with industry development [10] - The administration will also focus on enhancing long-term capital investment policies and promoting the development of modern financial institutions [10] Group 4: Capital Market Reforms - The China Securities Regulatory Commission will deepen reforms in the ChiNext board, introducing listing standards that better fit emerging industries [12] - There are plans to launch a refinancing framework and expand support channels for mergers and acquisitions [13] Group 5: Foreign Exchange Policy - The State Administration of Foreign Exchange is set to introduce new policies to enhance trade facilitation, including expanding cross-border trade pilot programs [15] - Upcoming measures will include the implementation of a unified currency pool for multinational companies and integrated foreign exchange management reforms in free trade zones [16]

金融街论坛丨金融监管总局:推动构建投资于物与投资于人并重的金融服务新模式

Xin Hua She· 2025-10-27 15:01

Core Viewpoint - The National Financial Regulatory Administration aims to establish a new financial service model that balances direct and indirect financing, investment in goods and people, financing terms aligned with industrial development, and the linkage between domestic and international markets to support economic quality and reasonable growth [1][2]. Group 1: Financial Service Model - The administration will promote a collaborative financial service model focusing on direct and indirect financing [1]. - Emphasis will be placed on supporting major strategies, key areas, and weak links to enhance economic quality and growth [1]. Group 2: Modern Industrial System - The administration will efficiently support the construction of a modern industrial system and the development of new productive forces [1]. - Focus areas include intelligent, green, and integrated development, providing more financial resources for traditional and emerging industries [1]. Group 3: Financial Reform and Opening Up - There will be a commitment to deepen reforms and expand openness in the financial sector to enhance development momentum and vitality [1]. - The administration aims to guide various financial institutions to find their positioning and focus on their main businesses for differentiated development [1]. Group 4: Financial Stability and Risk Management - The administration will consolidate risk disposal achievements and promote the merger and reorganization of small financial institutions [2]. - Efforts will be made to enhance the disposal of non-performing assets and capital replenishment to ensure the stability of the financial system [2]. - A new financing system will be constructed to align with the new model of real estate development, aiding in the resolution of local government debt risks [2].

金融监管总局局长李云泽:高效服务现代化产业体系建设和新质生产力发展

Zhong Guo Jing Ying Bao· 2025-10-27 13:12

Core Insights - The National Financial Regulatory Administration emphasizes the significant achievements in China's economic and social development during the "14th Five-Year Plan" period, highlighting the solid steps taken towards high-quality financial development and the important progress made in preventing and mitigating financial risks [1] Group 1 - The financial regulatory authority aims to enhance economic and financial adaptability to better promote sustainable and healthy economic and social development [1] - A new financial service model will be established, focusing on the synergy between direct and indirect financing, balancing investments in physical assets and human capital, aligning financing terms with industrial development, and linking domestic and international markets [1] - Support will be strengthened for major strategies, key areas, and weak links to facilitate qualitative improvements and reasonable quantitative growth in the economy [1] Group 2 - Financial services will efficiently support the construction of a modern industrial system and the development of new productive forces, with a focus on intelligent, green, and integrated directions [2] - Financial resources will be provided to optimize and enhance traditional industries while nurturing and expanding emerging and future industries [2] - Policies will be improved to support long-term capital investment in hard technology, reinforcing comprehensive financial guarantees throughout the investment cycle [2] - The strategy of expanding domestic demand will be emphasized, with a focus on strengthening funding for major projects to boost consumption [2] - Trade financing and export credit insurance services will be optimized to accelerate the integration of domestic and international trade, enhancing the domestic and international dual circulation [2]