煤炭开采加工

Search documents

A股三大指数集体拉升,煤炭板块跳水

Zheng Quan Shi Bao· 2025-10-24 10:07

Market Performance - A-shares saw a collective rise in major indices, with the Shanghai Composite Index reaching a 10-year high, closing at 3950.31 points, up 0.71% [1] - The ChiNext Index surged over 3%, while the STAR 50 Index increased by more than 4% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan, an increase of over 33 billion yuan from the previous day [1] Sector Highlights - The semiconductor and chip sectors experienced significant gains, with stocks like Purun and Xiangnong Chip reaching their daily limit of 20% [1][4] - AI-related stocks, including CPO concept stocks, also saw substantial increases, with companies like Kexiang and Shengyi Electronics hitting their daily limit [9] - The satellite navigation sector rose sharply, with companies like China Satellite and Guanghe Technology reaching their daily limit [1] Coal Sector Decline - The coal sector faced a sharp decline, with companies like Antai Group and Yunmei Energy hitting their daily limit down [12][13] - Daya Energy saw a drop of over 6%, following a significant rise of nearly 150% in the previous 10 trading days [13][15] - Antai Group reported a cumulative increase of about 30% over the past six trading days, but warned of potential operational risks due to market volatility [15] Trading Volume Insights - Ten stocks in the A-share market had trading volumes exceeding 10 billion yuan, with Hanwujing and Zhongji Xuchuang leading at 23.4 billion yuan and 23.03 billion yuan respectively [2] - CITIC Securities recorded a trading volume of 8.89 billion yuan, with significant sell orders observed during the closing auction [2] Policy and Innovation Focus - The recent Central Committee meeting emphasized accelerating high-level technological self-reliance and innovation, aiming to enhance the national innovation system [6][7] - Key areas of focus include integrated circuits, advanced materials, and core technologies, which are expected to receive policy support during the 14th Five-Year Plan [7] CPO Technology Development - CPO (Co-Packaged Optics) technology is gaining traction, with expectations for commercial use between 2024 and 2025, and projected market revenue reaching $2.6 billion by 2033 [11] - Domestic companies like Zhongji Xuchuang and Xinyi Sheng are actively advancing CPO technology, alongside international players like Intel and Broadcom [11]

巨额压单!600030,尾盘突发

Zheng Quan Shi Bao· 2025-10-24 09:49

Market Overview - A-shares collectively surged on October 24, with the Shanghai Composite Index reaching a 10-year high, while the ChiNext Index and STAR 50 Index saw significant gains [1] - The Shanghai Composite Index closed up 0.71% at 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index increased by 3.57% to 3171.57 points [1] Sector Performance - Over 3000 stocks in the market were in the green, with notable surges in the semiconductor and chip sectors, including companies like Purun Co. and Xiangnong Chip, which hit the 20% daily limit [2][4] - The AI industry chain stocks also saw collective gains, with companies like Kexiang Co. and Shengyi Electronics reaching the 20% limit [8] Notable Stock Movements - The stock of Chaoying Electronics, which debuted on the Shanghai main board, surged nearly 400%, closing at 84.99 yuan per share, with a peak of 99.77 yuan, resulting in a profit of over 41,000 yuan per share at the highest price [2] - The top two stocks by trading volume were Hanwujing and Zhongji Xuchuang, with transaction volumes of 234 billion yuan and 230.3 billion yuan, respectively [2] Coal Sector Decline - The coal sector experienced a significant drop, with companies like Antai Group and Yunmei Energy hitting the daily limit down, and Dayou Energy falling over 6% [11] - Antai Group's stock fell by 10.03% to 2.87 yuan, while Yunmei Energy dropped by 9.92% to 4.63 yuan [12] Policy and Economic Outlook - The recent meeting of the Communist Party emphasized accelerating high-level technological self-reliance and innovation, which is expected to enhance the overall effectiveness of the national innovation system [6][7] - The focus on "bottleneck" areas such as integrated circuits and advanced materials indicates a strategic push for technological advancement during the 14th Five-Year Plan period [7] CPO Technology Development - CPO (Co-Packaged Optics) technology is gaining traction, with expectations for commercial use starting in 2024-2025 and projected global port sales reaching 4.5 million by 2027 [10] - Domestic companies like Zhongji Xuchuang and Xinyi Sheng are actively advancing CPO technology, indicating a competitive landscape in this emerging field [10]

巨额压单!600030,尾盘突发

证券时报· 2025-10-24 09:40

Market Overview - A-shares experienced a collective surge on October 24, with the Shanghai Composite Index reaching a 10-year high, while the ChiNext Index and STAR 50 Index saw significant gains [1][4] - The Shanghai Composite Index closed up 0.71% at 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index increased by 3.57% to 3171.57 points [1][4] - The total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan, an increase of over 33 billion yuan compared to the previous day [1] Sector Performance - The semiconductor and chip sectors saw explosive growth, with stocks like Purun Co. and Xiangnong Chip rising by 20% to hit the daily limit, while Jiangbolong surged over 16% [1][5] - AI-related stocks, including CPO concept stocks, also experienced significant gains, with Kexiang Co. and Shengyi Electronics both hitting the daily limit of 20% [1][10] - The satellite navigation sector emerged strongly, with companies like China Satellite and Guanghe Technology reaching their daily limits [1] Notable Stocks - The newly listed company, Chaoying Electronics, saw a dramatic increase of nearly 400%, closing at 84.99 yuan per share, with an intraday high of 99.77 yuan, resulting in a profit of over 41,000 yuan per share for investors [1] - Notably, the top two stocks by trading volume were Hanwujing and Zhongji Xuchuang, with transaction volumes of 23.4 billion yuan and 23.03 billion yuan, respectively [2] Coal Sector Decline - The coal sector faced a sharp decline, with companies like Antai Group and Yunmei Energy hitting their daily limit down, and Dayou Energy dropping over 6% [1][14] - Antai Group and other coal companies have faced significant losses, with Antai Group's net profit projected to be negative for the upcoming years [16] Policy and Future Outlook - The recent meeting of the Chinese Communist Party emphasized accelerating high-level technological self-reliance and innovation, which is expected to drive growth in advanced manufacturing and hard technology sectors [7][8] - The CPO (Co-Packaged Optics) technology is anticipated to enter commercial use between 2024 and 2025, with a projected market revenue of 2.6 billion USD by 2033, indicating strong future growth potential in the optical interconnect technology sector [12]

收评:沪指涨0.71%创十年新高 元件板块领涨

Zhong Guo Jing Ji Wang· 2025-10-24 07:26

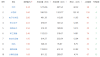

Core Viewpoint - The A-share market experienced a collective rise, with the Shanghai Composite Index reaching a ten-year high, driven by strong performances in specific sectors such as components and semiconductors [1] Market Performance - The Shanghai Composite Index closed at 3950.31 points, up by 0.71%, with a trading volume of 858.49 billion yuan - The Shenzhen Component Index closed at 13289.19 points, up by 2.02%, with a trading volume of 1115.72 billion yuan - The ChiNext Index closed at 3171.57 points, up by 3.57%, with a trading volume of 526.38 billion yuan [1] Sector Performance - Leading sectors included: - Components: up by 4.76%, with a trading volume of 183.99 million hands and a net inflow of 7.08 billion yuan - Semiconductors: up by 4.41%, with a trading volume of 296.21 million hands and a net inflow of 22.54 billion yuan - Electronic chemicals: up by 3.63%, with a trading volume of 77.29 million hands and a net inflow of 2.09 billion yuan [2] - Underperforming sectors included: - Coal mining and processing: down by 3.29%, with a trading volume of 281.50 million hands and a net outflow of 2.22 billion yuan - Oil and gas extraction and services: down by 2.66%, with a trading volume of 171.29 million hands and a net outflow of 1.37 billion yuan - Gas: down by 2.01%, with a trading volume of 113.50 million hands and a net outflow of 1.14 billion yuan [2]

利好引爆!刚刚,集体飙涨

Zhong Guo Ji Jin Bao· 2025-10-24 04:45

Market Overview - The A-share market experienced a collective rise on October 24, with the Shanghai Composite Index reaching a nearly ten-year high, closing up 0.42% [2][3] - The Shenzhen Component Index increased by 1.3%, while the ChiNext Index rose by 2.09%, and the STAR 50 Index saw a gain of 2.98% [2][3] Sector Performance - The technology sector, particularly in memory chips, commercial aerospace, satellite internet, and semiconductors, showed significant gains, leading the market [3][4] - The overall market saw a trading volume of 1.24 trillion yuan, with over 2,900 stocks rising [3] Notable Stocks - Honghua Semiconductor surged nearly 12%, leading the Hang Seng Technology Index [4] - Several stocks in the electronics sector, including Puran Co., Kexiang Co., and Shengyi Technology, hit the daily limit of 20% increase [6][7] - The stock of Zhujiang Piano initially dropped to the limit down but then surged to hit the limit up, closing at 6.81 yuan per share [13][18] Coal Sector - The coal sector faced a notable decline, with companies like Antai Group and Yunmei Energy hitting the limit down, while others like Shaanxi Black Cat and Liaoning Energy also saw significant drops [10][11] Future Industry Outlook - The National Development and Reform Commission emphasized the importance of nurturing emerging industries, projecting that the "three new" economy will account for over 18% of GDP by 2024 [8][9] - Strategic emerging industries such as new energy, new materials, and aerospace are expected to create substantial market opportunities in the coming years [9]

午评:三大指数早间高开高走 元件板块涨幅居前

Zhong Guo Jing Ji Wang· 2025-10-24 03:42

Core Viewpoint - The A-share market experienced a positive trend with all three major indices rising, indicating a bullish sentiment among investors [1]. Market Performance - The Shanghai Composite Index closed at 3938.98 points, up by 0.42% - The Shenzhen Component Index closed at 13195.25 points, up by 1.30% - The ChiNext Index closed at 3126.05 points, up by 2.09% [1]. Sector Performance Top Gaining Sectors - Components sector increased by 4.34% with a total trading volume of 1215.66 million hands and a total transaction value of 467.54 billion - Semiconductor sector rose by 3.60% with a trading volume of 1867.55 million hands and a transaction value of 1323.77 billion - Electronic chemicals sector grew by 2.86% with a trading volume of 491.39 million hands and a transaction value of 112.89 billion [2]. Top Losing Sectors - Coal mining and processing sector decreased by 3.65% with a trading volume of 2013.24 million hands and a transaction value of 140.76 billion - Oil and gas extraction and services sector fell by 2.57% with a trading volume of 1232.37 million hands and a transaction value of 66.00 billion - Gas sector declined by 1.95% with a trading volume of 846.26 million hands and a transaction value of 56.42 billion [2].

午评:科创50指数半日涨近3%,半导体、商业航天等泛科技板块爆发

Xin Lang Cai Jing· 2025-10-24 03:31

Market Performance - The three major indices collectively rose in early trading, with the Shanghai Composite Index up 0.42%, the Shenzhen Component Index up 1.3%, and the ChiNext Index up 2.09% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.2393 trillion yuan, an increase of 181.3 billion yuan compared to the previous day [1] - Over 2900 stocks in the market experienced gains [1] Sector Performance - The storage chip, commercial aerospace, computing hardware, and quantum technology sectors saw significant gains [1] - The storage chip sector had a collective surge, with companies like Kexiang Co., Puran Co., and Dawi Co. hitting the daily limit, while Xiangnong Chip Innovation rose over 15% to reach a historical high [1] - The commercial aerospace sector also experienced a breakout, with Aerospace Intelligent Equipment hitting the daily limit and companies like Dahua Intelligent, China Satellite, and Zhongtian Rocket also reaching the daily limit [1] - The computing hardware stocks performed strongly, with Zhongji Xuchuang hitting a new high and Shengyi Electronics reaching the daily limit, alongside other companies like Huilv Ecology and Shenghong Technology showing upward movement [1] - Other active sectors included quantum technology, military equipment, and brain-computer interface [1] Declining Sectors - The coal mining and oil and gas extraction sectors collectively retreated, with companies like Yunmei Energy and Antai Group hitting the daily limit down, while companies like Quanyou Co., Beiken Energy, and Tongyuan Petroleum saw significant declines [1] - Shenzhen local stocks experienced a substantial pullback, with Shen Shui Guiyuan dropping over 10%, and companies like Shen Property A and Shen Textile A leading the decline [1]

煤炭板块大幅跳水,安泰集团跌停,大有能源等下挫

Zheng Quan Shi Bao Wang· 2025-10-24 03:00

煤炭板块24日盘中大幅跳水,截至发稿,安泰集团跌停,云煤能源、陕西黑猫、宝泰隆跌超9%,大有 能源跌超6%。 公司目前生产经营正常,市场环境、行业政策亦未发生重大调整。公司2025年上半年实现营业收入19.2 亿元,较上年同期减少6.8亿元;归属于上市公司股东的净利润-8.51亿元,较上年同期减少3.62亿元; 归属于上市公司股东的扣除非经常性损益的净利润-8.68亿元,较上年同期减少3.82亿元。公司目前股价 涨幅已严重脱离公司基本面,请广大投资者注意公司经营业绩风险。 安泰集团近6个交易日累计涨约30%,公司日前提示,公司目前生产经营正常,外部经营环境也未发生 重大变化,不存在应披露而未披露的重大信息。近年来,公司业绩因受钢铁焦化行业和市场波动影响连 续亏损,公司2023年度、2024年度、2025年半年度归属于上市公司股东的净利润分别为-6.78亿 元、-3.35亿元、-0.93亿元,未来行业的整体盈利水平存在不确定性,提醒投资者注意公司经营风险。 值得注意的是,大有能源此前10个交易日累计大涨近150%,其中有9个交易日涨停。公司23日晚间发布 风险提示称,公司股价短期涨幅严重偏离同期上证指数和煤炭开 ...

煤炭开采加工板块震荡回调,安泰集团跌超9%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 02:01

Core Viewpoint - The coal mining and processing sector is experiencing a significant downturn, with major companies facing substantial declines in stock prices [1] Company Summary - Antai Group has seen a drop of over 9% in its stock price [1] - Yunmei Energy and Liaoning Energy both reported declines exceeding 8% [1] - Baotailong also experienced a similar drop of over 8% [1] - Shaanxi Black Cat and Shanxi Coking Coal followed suit with declines in their stock prices [1]

A股煤炭股、燃气股齐跌:百川能源触及跌停,安泰集团跌超9%

Ge Long Hui· 2025-10-24 02:01

格隆汇10月24日|燃气板块震荡走低,百川能源触及跌停,国新能源、长春燃气、深圳燃气、万憬能 源、凯添燃气跟跌。 煤炭开采加工板块震荡回调,安泰集团跌超9%,云煤能源、辽宁能源、宝泰隆跌 超8%,陕西黑猫、山西焦化跟跌。 ...