AOXMED瑷科缦

Search documents

贝泰妮业绩陷颓势:前三季度业绩双降、销售费用率破新高达53% 上半年全渠道承压且薇诺娜销售额下滑

Xin Lang Zheng Quan· 2025-10-31 09:47

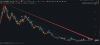

Core Viewpoint - Beitaini is experiencing significant operational challenges, reflected in its declining revenue and net profit for the first three quarters, despite a slight recovery in the third quarter [1][4][10] Financial Performance - For the first three quarters, Beitaini reported revenue of 3.464 billion yuan, a year-on-year decrease of 13.78%, and a net profit of 272 million yuan, down 34.45% year-on-year [1][4] - In the third quarter alone, the company achieved a net profit of 25.22 million yuan, marking a return to profitability, but this does not offset the overall performance decline [1][4] Market Position and Valuation - Beitaini's market capitalization has dropped significantly from over 120 billion yuan at its peak to approximately 19 billion yuan, indicating a loss of over 100 billion yuan in market value since its IPO [2][4] - The stock price has fallen below its initial offering price, reflecting investor concerns about the company's growth prospects [2] Revenue Channels - All three major revenue channels (online, OMO, and offline) have shown declines, with offline sales plummeting by 41.6% [6] - Specific declines in major e-commerce platforms include a 10.5% drop in Alibaba, 22.1% in JD.com, and 18.9% in Vipshop, while Douyin was the only platform to show a 7.4% increase [6] Product Performance - The core product categories, skincare and cosmetics, saw revenue declines of 12.0% and 7.1%, respectively, with skincare accounting for 85% of total revenue [6][7] - The primary brand, Winona, generated 1.95 billion yuan in revenue for the first half of 2025, representing 82.17% of total revenue, but its growth has slowed significantly [7] Strategic Initiatives - To mitigate reliance on its main brand, Beitaini is diversifying its product offerings, including launching new brands and acquiring existing ones [7] - However, the development of new brands requires substantial investment and may take time to yield results, leading to revised profit forecasts for 2025-2027 [7][9] Profitability Challenges - Despite a slight increase in gross margin to 74.3%, the company's expense ratio has risen to 67.7%, with sales expenses reaching a record high of 53.1%, squeezing profit margins [10][12] - The sales expense ratio has increased significantly over the years, indicating that a large portion of revenue is being consumed by marketing without driving growth [12]

三季度净利大增,但贝泰妮单品依赖还在

Bei Jing Shang Bao· 2025-10-28 13:11

Core Viewpoint - The significant increase in net profit for Betaini in Q3, up 136.55%, is seen as a potential turning point after several quarters of declining performance, although the sustainability of this growth remains uncertain due to reliance on cost-cutting measures [1][3]. Financial Performance - In Q3, Betaini reported revenue of 1.092 billion yuan, a year-on-year decline of 9.95%, while net profit reached 25.22 million yuan, marking a 136.55% increase [3]. - For the first three quarters of 2025, Betaini's operating costs were 889 million yuan, down 15.75% year-on-year, with a gross profit margin of approximately 74.33%, an increase of about 0.6 percentage points compared to the previous year [4]. - Despite the profit increase in Q3, overall performance shows significant pressure, with total revenue for the first three quarters of 2025 at 3.464 billion yuan, down 13.78%, and net profit at 272 million yuan, down 34.45% [4]. Brand Dependency - Betaini heavily relies on its main brand, Winona, which accounted for 82.17% of total revenue in the first half of 2025, indicating that other brands contribute less than 20% [7]. - Winona's revenue has shown a declining trend, with figures of 4.885 billion yuan, 5.192 billion yuan, and 4.909 billion yuan from 2022 to 2024, reflecting a slowdown in growth [7]. Strategic Initiatives - Betaini is actively seeking new growth points beyond its main brand through investments and acquisitions, including a partnership with the home-use RF beauty device brand Chupu and the acquisition of Shiseido's Za and Bomei brands [10]. - The company has increased its R&D investment, with 59 new patents obtained and R&D spending rising by 1.87% to 116 million yuan [11]. - Betaini aims to leverage its unique advantages in Chinese herbal ingredients and has established the "Yunnan Province Nest Zhi Mao Expert Workstation" to enhance product quality and technical standards [11].

贝泰妮参投新10亿级基金

Sou Hu Cai Jing· 2025-10-17 15:06

Core Viewpoint - Betaini plans to invest 50 million yuan as a limited partner in the establishment of the Wuxi Jinyu Maowu Medical Health Industry Investment Partnership, aiming to deepen cooperation in the health ecosystem and enhance its competitive edge and profitability [1][5]. Investment Details - The total committed capital for the Jinyu Fund is 1 billion yuan, with Betaini holding a 5% partnership share after the investment [1]. - The fund's primary investment focus includes consumer healthcare, national health quality improvement, pharmaceuticals, medical devices, and AI in pharmaceuticals [2][6]. Historical Investment Background - Jinyu Maowu Investment Management Co., Ltd., the fund manager, has previously invested over 100 million yuan in Betaini since 2015 [6]. - Betaini has established and invested in nine fund companies since its listing in 2021, with planned investments exceeding 700 million yuan across various sectors including AI and consumer healthcare [7]. Financial Performance of Fund Manager - Jinyu Maowu reported a revenue of 84.46 million yuan in 2024, a year-on-year increase of 4.51%, while its net profit decreased by 68.21% to 51.61 million yuan [6]. - For the first half of 2024, the company achieved a revenue of 42.97 million yuan, a decrease of 2.36%, but its net profit rose by 75.35% to 44.24 million yuan [6]. Industry Trends - The medical beauty market in China is projected to grow significantly, reaching 399.8 billion yuan by 2026, indicating a strong growth potential in this sector [10]. - Betaini has formed a strategic partnership with Lumenis Group to develop home medical beauty devices, integrating its R&D capabilities with Lumenis' technology [11]. Recent Developments - Betaini's brand AOXMED has seen rapid growth, achieving a revenue of 51.47 million yuan in the first half of 2025, a year-on-year increase of 93.90% [11]. - The company has actively engaged in the medical beauty sector, with multiple investments and product launches aimed at enhancing its market presence [12].