薇诺娜宝贝

Search documents

美护板块进入击球区-如何挖掘个股机会

2026-02-10 03:24

Summary of Conference Call Records Industry Overview - The beauty and personal care sector is showing resilience after adjustments, with strong fundamentals and high historical valuation averages. The sector is expected to benefit from numerous new product launches and marketing activities in Q1 2026, particularly from companies like Proya and Betaini, as well as new materials approved in the medical beauty segment [1][2][3]. Key Points on Companies Proya - Proya's management has been adjusted, and new products are set to launch, with a high confidence level for revenue recovery. The current valuation is around 17 times earnings, significantly lower than the average cosmetics valuation of 25 times, indicating substantial room for valuation recovery [1][3]. - The company has successfully executed marketing strategies, particularly in the sunscreen category, achieving notable results even in off-peak seasons. The launch of upgraded product lines is expected to drive growth [4][5]. Betaini - Betaini has shown a clear turning point since Q4 of last year, with expected double-digit revenue growth and potentially higher profit growth. The new e-commerce head has driven high-quality growth in the main brand's e-commerce business [6]. - New brands like OXYNAT and Winona Baby, along with the acquisition of the Israeli beauty device brand Tripollar, are expected to contribute approximately 1 billion yuan in revenue this year, reducing reliance on a single brand [6]. Aimeike - Aimeike has recently obtained approval for botulinum products, which have significant growth potential. The company has established distribution channels that could lead to strong sales performance, similar to competitors that have achieved over 1 billion yuan in revenue from similar products [7]. Market Trends - The personal care industry has substantial room for growth in e-commerce penetration. Domestic companies are leveraging innovation to increase average transaction values and rapidly grow through high-leverage e-commerce channels. Notable performers include Ru Yuchen and Dengkang Oral Care [8]. - Smaller companies like Jieya, Yanjiang, and Nuobang are gaining attention as they are positioned to benefit from improved downstream demand, leading to performance growth [9]. Noteworthy Companies in the Hong Kong Market - Companies like Juzi, Shangmei, and Maogeping are highlighted for their resilience post-pandemic. Juzi and Shangmei have effectively managed public relations, maintaining brand strength and channel capabilities. Maogeping is recognized for its strong brand power and stable offline channels, despite a higher valuation [10][11]. Investment Outlook - The cosmetics industry is characterized by varying performances among companies. Brands with strong market presence and stable channels, like Maogeping, are expected to show less volatility and maintain growth potential in the long term [12]. This summary encapsulates the key insights from the conference call records, focusing on the beauty and personal care industry, specific company performances, and market trends.

贝泰妮:经营调整效果凸显,改善可期-20260209

GUOTAI HAITONG SECURITIES· 2026-02-09 02:40

Investment Rating - The investment rating for the company is "Accumulate" [5] Core Insights - The company is expected to implement a product focus and stable pricing strategy in 2025, leading to improved gross margins in the first three quarters. The main brand shows strong resilience, while the sub-brand Aikeman is experiencing breakthroughs, indicating a positive outlook for multi-brand growth to restore the company's growth momentum [2][11] - The forecast for EPS has been raised for 2025-2027 to 1.23 (+0.13), 1.56 (+0.08), and 1.90 (+0.18) yuan, respectively. A target PE of 38x for 2026 has been set, resulting in an updated target price of 59.28 yuan [11] Financial Summary - Total revenue is projected to be 5,522 million yuan in 2023, increasing to 5,736 million yuan in 2024, but decreasing to 5,479 million yuan in 2025, before rising to 6,059 million yuan in 2026 and 6,663 million yuan in 2027 [4] - Net profit attributable to the parent company is expected to decline from 757 million yuan in 2023 to 503 million yuan in 2024, with a slight recovery to 520 million yuan in 2025, and further increases to 663 million yuan in 2026 and 806 million yuan in 2027 [4] - The gross margin for the first three quarters of 2025 improved to 74.33%, a year-on-year increase of 0.6 percentage points [11] Market Performance - The company's stock price has ranged between 39.34 and 50.85 yuan over the past 52 weeks, with a total market capitalization of 20,138 million yuan [6] - The stock has shown an absolute increase of 17% over the past month, 13% over the past three months, and 18% over the past year [10] Brand Performance - The main brand, Winona, has streamlined its product series and focused on core products, achieving a ranking of 9th in the Tmall beauty industry during the Double Eleven shopping festival, maintaining its position in the top 10 for nine consecutive years [11] - The sub-brand Aikeman has seen significant growth, ranking 2nd in the Tmall beauty new brand transaction list during Double Eleven 2025, with key products achieving sales of over 100,000 units [11]

科与柯宇 专研守护丨贝泰妮集团薇诺娜以专业实力重磅开启敏感肌健康新篇

Ge Long Hui· 2026-01-13 06:58

Core Insights - The announcement of Zhou Keyu as the skincare ambassador for Winona, a core brand of Betaini Group, reflects a strategic partnership aimed at enhancing professional value and brand image in the sensitive skin care market [1][3] Group 1: Brand and Market Positioning - Winona has been recognized as the top-selling brand in China's sensitive skin care market for five consecutive years (2020-2024), showcasing its strong market presence and professional credibility [4] - The collaboration between Winona and Zhou Keyu is rooted in a shared commitment to professional values, beauty, and health, indicating a long-term strategic vision for Betaini Group [3][4] Group 2: Strategic Development and Ecosystem - Betaini Group is transitioning from a single-brand operation to a multi-brand ecosystem, emphasizing sustainable growth and collaborative synergies among its brands [7][9] - Winona is evolving from a focus on sensitivity repair to a broader range of solutions addressing various sensitive skin needs, which supports the group's ecological expansion and enhances its market offerings [6][9] Group 3: Research and Innovation - Betaini Group's commitment to research and innovation is evident in its high R&D expenditure and the successful registration of new plant-based ingredients, which strengthens its competitive edge in the market [10][13] - The company has established a comprehensive research framework that integrates clinical insights and technological advancements, ensuring the continuous development of unique products [10] Group 4: Sustainability and Social Responsibility - Betaini Group integrates sustainability into its core operations, with initiatives such as ecological restoration in raw material sourcing and a product lifecycle responsibility program [13][15] - The company's long-standing commitment to social responsibility is exemplified by the "We Smile Sunshine Program," which provides skin health services in underserved areas, reinforcing its brand value and market trust [13][15] Group 5: Future Outlook - The strategic focus on building a tightly integrated ecosystem that fosters both internal collaboration and external partnerships is crucial for the long-term viability of Betaini Group [15] - The company's approach to leveraging its professional brand advantages and research capabilities positions it well for sustained growth in the evolving beauty industry [15]

贝泰妮:深耕植物原料研发 牢筑植萃科技根基

Ren Min Ri Bao· 2025-12-30 21:58

Core Viewpoint - The company, Betaini, is leveraging the rich plant resources of Yunnan to develop and register new plant-based raw materials for cosmetics, with a focus on biodiversity protection and innovative applications in skincare products [1][4]. Group 1: Plant Resource Development - Yunnan, known as the "Kingdom of Plants," has over 19,300 species of higher plants, many of which are unique or rare in China, providing a strong resource base for Betaini's new raw material development [1]. - Betaini's research team has screened over 2,000 local plants, identifying 266 with cosmetic efficacy, and has successfully registered 17 new plant raw materials [1]. - Seven of these new raw materials have been applied in products under the brands Winona, Aikeman, and Beifuting, focusing on soothing, moisturizing, and other skincare benefits [1]. Group 2: Technological and Intellectual Property Development - Winona has achieved core technology autonomy throughout the R&D and industrialization process, establishing a robust intellectual property protection system centered on patents [2]. - The company has integrated brand synergy and comprehensive intellectual property strategies to support high-quality development [2]. Group 3: Comprehensive Service Platform - Betaini is leading the establishment of a Yunnan characteristic plant extraction laboratory, focusing on the development of functional cosmetics, food, and pharmaceuticals [3]. - The laboratory provides a full-service platform for product development, including design, target research, raw material selection, formulation, safety, and efficacy evaluation [3]. - It aims to create a cluster of characteristic plant products and enterprises, extending the industrial chain and developing high-value health products [3]. Group 4: Biodiversity Protection and Sustainable Development - The R&D team collaborates with local planting bases and communities to build raw material bases, ensuring stable supply and quality while protecting biodiversity [4]. - Betaini is committed to long-term development and biodiversity education, with initiatives like the ecological restoration project in Haba Snow Mountain [6]. - The company aims to promote the innovative application of Yunnan's plant resources on a global scale, contributing to the cosmetics industry with unique Chinese characteristics [6].

贝泰妮斩获第十四届金融界“金智奖”优秀营销案例奖

Sou Hu Cai Jing· 2025-12-29 22:18

Core Viewpoint - The "Qihang·2025 Financial Summit" held in Beijing highlighted the importance of high-quality development in the financial sector, with Betaini winning the "Outstanding Marketing Case Award" for its innovative marketing practices [1][3]. Group 1: Award Significance - The "Jinzhi Award" aims to set benchmarks for high-quality development, guiding listed companies to focus on core businesses, continuous innovation, and social responsibility [3]. - The award evaluation covered over 8,000 companies across A-shares, Hong Kong stocks, and Chinese concept stocks, with nearly 200 companies recognized for their achievements [3]. Group 2: Betaini's Marketing Strategy - Betaini's award-winning marketing strategy is based on a "full-domain collaboration + value deepening" system, focusing on user needs and employing an OMO (Online-Merge-Offline) channel integration model [4]. - The company maintains a strong online presence on platforms like Tmall, Douyin, and JD, while also deepening its engagement in professional channels such as OTC pharmacies [4]. Group 3: Brand Development - Betaini has established a multi-brand collaborative development framework, with its core brand, Winona, leading the sensitive skin market and achieving significant recognition [4]. - The brand has consistently ranked in the top 10 of Tmall's beauty industry for nine consecutive years and has been recognized as a "Chinese Consumer Brand" by the Ministry of Industry and Information Technology [4]. Group 4: International Expansion - Betaini has successfully entered mainstream channels in Thailand and established brand recognition through platforms like TikTok, as well as in Hong Kong and Macau [5]. - The company is focused on integrating international technology brands while promoting Chinese skincare wisdom, aiming to transition from a leader in sensitive skin to a global skin health ecosystem [5].

贝泰妮业绩陷颓势:前三季度业绩双降、销售费用率破新高达53% 上半年全渠道承压且薇诺娜销售额下滑

Xin Lang Zheng Quan· 2025-10-31 09:47

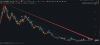

Core Viewpoint - Beitaini is experiencing significant operational challenges, reflected in its declining revenue and net profit for the first three quarters, despite a slight recovery in the third quarter [1][4][10] Financial Performance - For the first three quarters, Beitaini reported revenue of 3.464 billion yuan, a year-on-year decrease of 13.78%, and a net profit of 272 million yuan, down 34.45% year-on-year [1][4] - In the third quarter alone, the company achieved a net profit of 25.22 million yuan, marking a return to profitability, but this does not offset the overall performance decline [1][4] Market Position and Valuation - Beitaini's market capitalization has dropped significantly from over 120 billion yuan at its peak to approximately 19 billion yuan, indicating a loss of over 100 billion yuan in market value since its IPO [2][4] - The stock price has fallen below its initial offering price, reflecting investor concerns about the company's growth prospects [2] Revenue Channels - All three major revenue channels (online, OMO, and offline) have shown declines, with offline sales plummeting by 41.6% [6] - Specific declines in major e-commerce platforms include a 10.5% drop in Alibaba, 22.1% in JD.com, and 18.9% in Vipshop, while Douyin was the only platform to show a 7.4% increase [6] Product Performance - The core product categories, skincare and cosmetics, saw revenue declines of 12.0% and 7.1%, respectively, with skincare accounting for 85% of total revenue [6][7] - The primary brand, Winona, generated 1.95 billion yuan in revenue for the first half of 2025, representing 82.17% of total revenue, but its growth has slowed significantly [7] Strategic Initiatives - To mitigate reliance on its main brand, Beitaini is diversifying its product offerings, including launching new brands and acquiring existing ones [7] - However, the development of new brands requires substantial investment and may take time to yield results, leading to revised profit forecasts for 2025-2027 [7][9] Profitability Challenges - Despite a slight increase in gross margin to 74.3%, the company's expense ratio has risen to 67.7%, with sales expenses reaching a record high of 53.1%, squeezing profit margins [10][12] - The sales expense ratio has increased significantly over the years, indicating that a large portion of revenue is being consumed by marketing without driving growth [12]

贝泰妮三季度业绩持续低迷,出海与线下战略何时见效?

Guan Cha Zhe Wang· 2025-10-31 09:28

Core Viewpoint - After returning to profitability in the third quarter, Betaini announced a share reduction by its second-largest shareholder, Sequoia Capital, which sold 8.43 million shares, accounting for 2% of the total share capital, raising 368 million yuan [1][2][3] Shareholder Actions - Sequoia Capital's share reduction was executed through a block trade, reducing its holding to 7.66% [2] - Since the lifting of the share lock-up in 2022, Sequoia has completed five rounds of reductions, cashing out nearly 6 billion yuan [2][4] - Other shareholders, including the controlling family of the actual controller, have also been reducing their stakes, indicating a broader trend of capital exit [4][5] Financial Performance - In Q3, Betaini reported a net profit of 252 million yuan, a year-on-year increase of 136.55%, but this was largely driven by investment income rather than core business improvement [3][8] - For the first three quarters, the company experienced a revenue decline of 13.78% to 3.464 billion yuan and a net profit drop of 34.45% to 272 million yuan, marking the first time in six years that both revenue and net profit declined [8][6] Market Challenges - The company's reliance on e-commerce and key opinion leaders (KOLs) for sales has become unsustainable, leading to a decline in profitability [3][11] - Betaini's core brand, Winona, contributed 82.17% of revenue in the first half of 2025, facing increasing competition and declining growth rates [17][18] Strategic Adjustments - The company is focusing on optimizing its multi-channel strategy and expanding its overseas business, particularly in Thailand and other international markets [12][16] - Betaini has implemented cost-cutting measures, reducing sales and management expenses while maintaining a stable R&D investment rate [13][15] Future Outlook - Investors are closely monitoring Betaini's ability to diversify its brand portfolio and reduce dependence on Winona to establish sustainable growth [18]

三季度净利大增,但贝泰妮单品依赖还在

Bei Jing Shang Bao· 2025-10-28 13:11

Core Viewpoint - The significant increase in net profit for Betaini in Q3, up 136.55%, is seen as a potential turning point after several quarters of declining performance, although the sustainability of this growth remains uncertain due to reliance on cost-cutting measures [1][3]. Financial Performance - In Q3, Betaini reported revenue of 1.092 billion yuan, a year-on-year decline of 9.95%, while net profit reached 25.22 million yuan, marking a 136.55% increase [3]. - For the first three quarters of 2025, Betaini's operating costs were 889 million yuan, down 15.75% year-on-year, with a gross profit margin of approximately 74.33%, an increase of about 0.6 percentage points compared to the previous year [4]. - Despite the profit increase in Q3, overall performance shows significant pressure, with total revenue for the first three quarters of 2025 at 3.464 billion yuan, down 13.78%, and net profit at 272 million yuan, down 34.45% [4]. Brand Dependency - Betaini heavily relies on its main brand, Winona, which accounted for 82.17% of total revenue in the first half of 2025, indicating that other brands contribute less than 20% [7]. - Winona's revenue has shown a declining trend, with figures of 4.885 billion yuan, 5.192 billion yuan, and 4.909 billion yuan from 2022 to 2024, reflecting a slowdown in growth [7]. Strategic Initiatives - Betaini is actively seeking new growth points beyond its main brand through investments and acquisitions, including a partnership with the home-use RF beauty device brand Chupu and the acquisition of Shiseido's Za and Bomei brands [10]. - The company has increased its R&D investment, with 59 new patents obtained and R&D spending rising by 1.87% to 116 million yuan [11]. - Betaini aims to leverage its unique advantages in Chinese herbal ingredients and has established the "Yunnan Province Nest Zhi Mao Expert Workstation" to enhance product quality and technical standards [11].

战略纵深成效持续显现 贝泰妮三季度经营质量稳中提质

Quan Jing Wang· 2025-10-28 03:16

Core Viewpoint - Yunnan Betaini Biotechnology Group Co., Ltd. reported strong financial performance in Q3 2025, focusing on internal growth quality and optimizing operational strategies in a complex market environment [1] Financial Performance - The company achieved a revenue of 3.464 billion yuan and a net profit attributable to shareholders of 272 million yuan in the first three quarters [1] - In Q3 alone, the net profit reached 25.22 million yuan, marking a year-on-year increase of 136.55%, indicating improved sustainable profitability [1] Strategic Execution - The gross profit margin for the period was approximately 74.33%, an increase of 0.60 percentage points compared to the same period last year, attributed to effective operational strategies centered on brand building and member operations [2] - Operating cash flow reached 442 million yuan, a significant year-on-year increase of 6772.14%, reflecting strong cash generation capability and improved operational efficiency [2] R&D Investment - R&D expenses totaled 171 million yuan, maintaining a high R&D expense ratio of 4.95%, which supports long-term competitive advantages [3] - The company completed 17 new raw material registrations, enhancing its technical reserves in the efficacy skincare field [3] Brand Strategy - The company's multi-brand strategy showed effectiveness during the Double Eleven shopping festival, with its main brand, Winona, ranking among the top ten in Tmall's beauty pre-sale list [4] - The brand Aikeman achieved second place among domestic new brands in Tmall's beauty category, indicating successful high-end strategy implementation [4] Long-term Value Path - The steady improvement in operational quality during Q3 reflects the solid execution of the company's strategy and confirms its long-term development path [6] - The ongoing strategic transformation is gradually converting long-term investments in R&D, brand matrix, and global operations into sustainable growth momentum [7]

贝泰妮第三季度归母净利同比增136.55% 多品牌矩阵协同发力

Zheng Quan Shi Bao Wang· 2025-10-27 14:24

Core Insights - The company demonstrated resilience and operational effectiveness in a complex market environment, achieving a revenue of 3.464 billion yuan and a net profit of 272 million yuan in the first three quarters of 2025, with a significant year-on-year increase of 136.55% in net profit for Q3 [1] Financial Performance - The gross profit margin for the period was approximately 74.33%, an increase of 0.60 percentage points compared to the same period last year [1] - Operating cash flow reached 442 million yuan, reflecting a remarkable year-on-year growth of 6772.14%, indicating strong cash generation capability and improved operational efficiency [1] Strategic Initiatives - The company focused on brand building and member operation, implementing differentiated member management and brand operation strategies, while reducing promotional activities and streamlining product offerings [1] - R&D investment reached 171 million yuan in the first three quarters, maintaining a high R&D expense ratio of 4.95%, with 17 new raw material registrations completed [2] Market Positioning - The main brand, Winona, ranked among the top ten in Tmall's beauty pre-sale list, reinforcing its leading position in the sensitive skin segment, while other brands also showed strong performance in their respective categories [2] - The company's multi-brand strategy is showing diversified growth, with successful incubation of high-end and niche market brands, indicating a well-coordinated brand matrix [2] Future Outlook - The company plans to continue enhancing product competitiveness and channel penetration, aiming to create sustainable long-term value for shareholders, consumers, and society [3]