贝芙汀

Search documents

贝泰妮:积极探索AI等前沿技术在皮肤健康领域的应用

Bei Jing Shang Bao· 2026-01-20 14:04

Core Viewpoint - The company emphasizes the importance of exploring AI and other cutting-edge technologies in the field of skin health, indicating a commitment to technological advancement in its operations [1] Group 1: AI Application in Business - The company has initiated the application of AI in certain business segments, such as providing AI-assisted personalized skincare solutions through its acne treatment brand "Beifuting" [1] - The company is actively pursuing collaborations, having recently formed a strategic partnership with Yaosu Technology to explore new intelligent detection methods like "AI + organ-on-chip" [1] Group 2: Commitment to Technological Innovation - The application of AI technology is identified as a key direction for the company's development driven by technology, with ongoing efforts to advance these explorations [1] - The company maintains an open research approach towards various cutting-edge technologies, stating that any significant progress will be disclosed in accordance with regulations [1]

贝泰妮:公司始终重视并积极探索AI等前沿技术在皮肤健康领域的应用

Zheng Quan Ri Bao Zhi Sheng· 2026-01-20 10:13

Core Viewpoint - The company is actively exploring the application of AI and other cutting-edge technologies in the field of skin health, emphasizing its commitment to technology-driven development [1] Group 1: AI Application in Business - The company has initiated practices involving AI in certain business segments, such as providing AI-assisted personalized skincare solutions through its acne treatment brand "Beifuting" [1] - The company has formed a strategic partnership with Yaosu Technology to explore new intelligent detection paths, including "AI + organ-on-chip" technology [1] Group 2: Future Directions - The application of AI technology is identified as a key direction for the company's development, with ongoing efforts to advance related explorations [1] - Specific details regarding collaborative scenarios, quantitative outcomes, and patent strategies are considered internal R&D and operational information [1] - The company remains open to researching various cutting-edge technologies and will disclose significant advancements in accordance with regulations [1]

贝泰妮(300957.SZ):通过专业祛痘品牌“贝芙汀”提供AI辅助的个性化护肤方案

Ge Long Hui A P P· 2026-01-20 07:39

Core Viewpoint - The company is actively exploring the application of AI and other cutting-edge technologies in the field of skin health, emphasizing its commitment to technology-driven development [1] Group 1: AI Application in Business - The company has initiated practices involving AI in certain business segments, such as providing AI-assisted personalized skincare solutions through its professional acne treatment brand "Beifuting" [1] - The collaboration with YaoSu Technology aims to explore new intelligent detection pathways, including "AI + organ-on-chip" technology [1] Group 2: Future Directions - The application of AI technology is identified as a key direction for the company's development, with ongoing efforts to advance related explorations [1] - Specific details regarding collaborative scenarios, quantifiable outcomes, and patent strategies are considered internal R&D and operational information [1]

贝泰妮:通过专业祛痘品牌“贝芙汀”提供AI辅助的个性化护肤方案

Ge Long Hui· 2026-01-20 07:26

Core Viewpoint - The company is actively exploring the application of AI and other cutting-edge technologies in the field of skin health, emphasizing its commitment to technology-driven development [1] Group 1: AI Application in Business - The company has initiated practices involving AI in certain business segments, such as providing AI-assisted personalized skincare solutions through its professional acne treatment brand "Beifuting" [1] - The collaboration with YaoSu Technology aims to explore new intelligent detection paths, including "AI + organ-on-chip" technology [1] Group 2: Future Directions - The application of AI technology is identified as a key direction for the company's development, with ongoing efforts to advance related explorations [1] - Specific details regarding collaborative scenarios, quantifiable outcomes, and patent strategies are considered internal R&D and operational information [1]

贝泰妮:深耕植物原料研发 牢筑植萃科技根基

Ren Min Ri Bao· 2025-12-30 21:58

Core Viewpoint - The company, Betaini, is leveraging the rich plant resources of Yunnan to develop and register new plant-based raw materials for cosmetics, with a focus on biodiversity protection and innovative applications in skincare products [1][4]. Group 1: Plant Resource Development - Yunnan, known as the "Kingdom of Plants," has over 19,300 species of higher plants, many of which are unique or rare in China, providing a strong resource base for Betaini's new raw material development [1]. - Betaini's research team has screened over 2,000 local plants, identifying 266 with cosmetic efficacy, and has successfully registered 17 new plant raw materials [1]. - Seven of these new raw materials have been applied in products under the brands Winona, Aikeman, and Beifuting, focusing on soothing, moisturizing, and other skincare benefits [1]. Group 2: Technological and Intellectual Property Development - Winona has achieved core technology autonomy throughout the R&D and industrialization process, establishing a robust intellectual property protection system centered on patents [2]. - The company has integrated brand synergy and comprehensive intellectual property strategies to support high-quality development [2]. Group 3: Comprehensive Service Platform - Betaini is leading the establishment of a Yunnan characteristic plant extraction laboratory, focusing on the development of functional cosmetics, food, and pharmaceuticals [3]. - The laboratory provides a full-service platform for product development, including design, target research, raw material selection, formulation, safety, and efficacy evaluation [3]. - It aims to create a cluster of characteristic plant products and enterprises, extending the industrial chain and developing high-value health products [3]. Group 4: Biodiversity Protection and Sustainable Development - The R&D team collaborates with local planting bases and communities to build raw material bases, ensuring stable supply and quality while protecting biodiversity [4]. - Betaini is committed to long-term development and biodiversity education, with initiatives like the ecological restoration project in Haba Snow Mountain [6]. - The company aims to promote the innovative application of Yunnan's plant resources on a global scale, contributing to the cosmetics industry with unique Chinese characteristics [6].

贝泰妮:贝芙汀目前处于孵化阶段

Bei Jing Shang Bao· 2025-11-12 14:07

Core Viewpoint - Beitaini emphasizes the professional development of its acne treatment brand, Beifuting, leveraging a team of dermatology experts and AI consultation technology to provide a comprehensive acne treatment solution [1] Group 1: Brand Development - Beifuting is positioned as a specialized acne treatment brand under Beitaini, focusing on integrating food, medicine, and cosmetics for precise acne treatment [1] - The brand is currently in the incubation stage, with a strong emphasis on professional development and continuous technological iteration [1] Group 2: Research and Technology - The brand's approach is based on research accumulated from over one million cases, showcasing a commitment to evidence-based treatment [1] - AI consultation technology is utilized to enhance the user experience and treatment accuracy [1] Group 3: Future Planning - Future resource planning for the brand will be based on market feedback and strategic considerations, allowing for dynamic deployment [1] - The company aims to provide a more scientific and systematic acne treatment plan through ongoing service optimization [1]

贝泰妮:贝芙汀是公司旗下专业祛痘品牌,目前品牌处于孵化阶段

Mei Ri Jing Ji Xin Wen· 2025-11-12 13:19

Core Viewpoint - The company emphasizes the importance of its acne treatment brand, Beifutin, despite its low revenue since listing and limited growth observed on e-commerce platforms. The company is committed to developing Beifutin through a comprehensive treatment approach and ongoing technological improvements [1]. Group 1 - Beifutin is positioned as a professional acne treatment brand, leveraging a team of dermatology experts and AI consultation technology to provide integrated solutions for acne treatment [1]. - The brand is currently in the incubation stage, with the company prioritizing its professional development path and aiming to offer more scientific and systematic acne treatment solutions through continuous technological iteration and service optimization [1]. - Future resource allocation for the brand will be based on market feedback and strategic considerations, allowing for dynamic deployment and comprehensive evaluation [1].

贝泰妮业绩陷颓势:前三季度业绩双降、销售费用率破新高达53% 上半年全渠道承压且薇诺娜销售额下滑

Xin Lang Zheng Quan· 2025-10-31 09:47

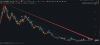

Core Viewpoint - Beitaini is experiencing significant operational challenges, reflected in its declining revenue and net profit for the first three quarters, despite a slight recovery in the third quarter [1][4][10] Financial Performance - For the first three quarters, Beitaini reported revenue of 3.464 billion yuan, a year-on-year decrease of 13.78%, and a net profit of 272 million yuan, down 34.45% year-on-year [1][4] - In the third quarter alone, the company achieved a net profit of 25.22 million yuan, marking a return to profitability, but this does not offset the overall performance decline [1][4] Market Position and Valuation - Beitaini's market capitalization has dropped significantly from over 120 billion yuan at its peak to approximately 19 billion yuan, indicating a loss of over 100 billion yuan in market value since its IPO [2][4] - The stock price has fallen below its initial offering price, reflecting investor concerns about the company's growth prospects [2] Revenue Channels - All three major revenue channels (online, OMO, and offline) have shown declines, with offline sales plummeting by 41.6% [6] - Specific declines in major e-commerce platforms include a 10.5% drop in Alibaba, 22.1% in JD.com, and 18.9% in Vipshop, while Douyin was the only platform to show a 7.4% increase [6] Product Performance - The core product categories, skincare and cosmetics, saw revenue declines of 12.0% and 7.1%, respectively, with skincare accounting for 85% of total revenue [6][7] - The primary brand, Winona, generated 1.95 billion yuan in revenue for the first half of 2025, representing 82.17% of total revenue, but its growth has slowed significantly [7] Strategic Initiatives - To mitigate reliance on its main brand, Beitaini is diversifying its product offerings, including launching new brands and acquiring existing ones [7] - However, the development of new brands requires substantial investment and may take time to yield results, leading to revised profit forecasts for 2025-2027 [7][9] Profitability Challenges - Despite a slight increase in gross margin to 74.3%, the company's expense ratio has risen to 67.7%, with sales expenses reaching a record high of 53.1%, squeezing profit margins [10][12] - The sales expense ratio has increased significantly over the years, indicating that a large portion of revenue is being consumed by marketing without driving growth [12]

三季度净利大增,但贝泰妮单品依赖还在

Bei Jing Shang Bao· 2025-10-28 13:11

Core Viewpoint - The significant increase in net profit for Betaini in Q3, up 136.55%, is seen as a potential turning point after several quarters of declining performance, although the sustainability of this growth remains uncertain due to reliance on cost-cutting measures [1][3]. Financial Performance - In Q3, Betaini reported revenue of 1.092 billion yuan, a year-on-year decline of 9.95%, while net profit reached 25.22 million yuan, marking a 136.55% increase [3]. - For the first three quarters of 2025, Betaini's operating costs were 889 million yuan, down 15.75% year-on-year, with a gross profit margin of approximately 74.33%, an increase of about 0.6 percentage points compared to the previous year [4]. - Despite the profit increase in Q3, overall performance shows significant pressure, with total revenue for the first three quarters of 2025 at 3.464 billion yuan, down 13.78%, and net profit at 272 million yuan, down 34.45% [4]. Brand Dependency - Betaini heavily relies on its main brand, Winona, which accounted for 82.17% of total revenue in the first half of 2025, indicating that other brands contribute less than 20% [7]. - Winona's revenue has shown a declining trend, with figures of 4.885 billion yuan, 5.192 billion yuan, and 4.909 billion yuan from 2022 to 2024, reflecting a slowdown in growth [7]. Strategic Initiatives - Betaini is actively seeking new growth points beyond its main brand through investments and acquisitions, including a partnership with the home-use RF beauty device brand Chupu and the acquisition of Shiseido's Za and Bomei brands [10]. - The company has increased its R&D investment, with 59 new patents obtained and R&D spending rising by 1.87% to 116 million yuan [11]. - Betaini aims to leverage its unique advantages in Chinese herbal ingredients and has established the "Yunnan Province Nest Zhi Mao Expert Workstation" to enhance product quality and technical standards [11].

业绩不佳,194亿护肤品龙头盯上产业基金

21世纪经济报道· 2025-10-17 10:18

Core Viewpoint - Betaini (300957.SZ), known as the "first stock in functional skincare," is intensifying its capital market strategy by investing in a new healthcare fund, aiming to diversify its business beyond its core beauty segment [1]. Investment Strategy - On October 13, Betaini announced plans to invest as a limited partner in the Wuxi Jinyu Maowu Medical Health Industry Investment Partnership (referred to as "Jinyu Fund"), with a total fund size of 1 billion CNY, focusing on consumer healthcare, pharmaceuticals, medical devices, and AI drug development [1][4]. - Betaini will contribute 50 million CNY, acquiring a 5% stake in the Jinyu Fund, which is part of a broader strategy to deepen cooperation with professional funds and enhance its presence in the health ecosystem [4]. Historical Investments - Over the past three years, Betaini has invested approximately 280 million CNY in various funds, including the Sequoia Fund and the San Zheng Fund, indicating a strategic shift towards capital investments to seek growth opportunities [3][9]. - The company has made several notable investments: 100 million CNY in the Sequoia Fund in June 2022, another 100 million CNY in the San Zheng Fund in April 2023, and 30 million CNY in the Jinguo Fund in October 2023 [5][9]. Financial Performance - Betaini's revenue growth has been declining, with reported revenues of 4.022 billion CNY in 2021, 5.014 billion CNY in 2022, 5.522 billion CNY in 2023, and 5.736 billion CNY in 2024, showing a decreasing growth rate from 52.57% to 3.87% [9]. - The net profit has also seen a downward trend, with figures of 863 million CNY in 2021, 1.051 billion CNY in 2022, 757 million CNY in 2023, and 503 million CNY in 2024, reflecting a significant decline in profitability [9]. Market Position and Competition - Betaini's core brand, Winona, has been a major revenue driver, contributing approximately 97% of total revenue in 2022, which decreased to around 86% in 2024, indicating a heavy reliance on a single brand [9]. - Other beauty brands, such as Proya and Marubi, are also increasing their capital investments to seek growth, highlighting a trend among leading beauty companies to diversify and enhance their market positions [10][11].