Microsoft365

Search documents

科技多头旗手”力挺五大软件股 称AI冲击被市场“过度计入末日情景

Zhi Tong Cai Jing· 2026-02-05 16:12

Core Viewpoint - The software sector in the U.S. has recently experienced significant sell-offs, but Wedbush believes the market is overreacting to fears of an impending "software winter" driven by AI advancements [1][2] Group 1: Market Sentiment and Analysis - Wedbush argues that concerns about AI disrupting traditional software business models are exaggerated, with the current market pricing reflecting a worst-case scenario [1][2] - The IGV index, which measures software industry performance, has dropped approximately 18% year-to-date, while the S&P 500 index has remained flat, indicating a significant market reaction [2] - The software sector has seen a market capitalization loss exceeding $300 billion, reflecting heightened pessimism [2] Group 2: AI Integration and Corporate Caution - Many enterprise clients are cautious about migrating to AI platforms, preferring to maintain their existing software infrastructure built over decades, despite AI being a short-term headwind [2][3] - The report highlights that AI is more likely to be integrated as "embedded tools" within existing software platforms rather than completely replacing them [2] Group 3: Individual Company Insights - Microsoft (MSFT) has a target price of $575, with expectations that its Azure cloud business and AI commercialization will accelerate, making it a key beneficiary in the AI landscape [3][4] - Palantir (PLTR) is assigned a target price of $230, with its AI platform showing strong demand in critical applications, positioning it well as enterprises move from AI trials to actual deployment [4] - Snowflake (SNOW) has a target price of $270, as it serves as a "trusted intermediary" connecting enterprise data with external AI models, emphasizing the importance of data governance [4] - Salesforce (CRM) is given a target price of $375, with its extensive data assets and recent acquisitions enhancing its competitive edge in the AI era [4] - CrowdStrike (CRWD) maintains a target price of $600, with its AI-driven security operations platform becoming increasingly vital in the context of growing cybersecurity needs [5] Group 4: Long-term Investment Opportunities - Despite the current negative sentiment surrounding the software sector, Wedbush identifies potential long-term investment opportunities, suggesting that extreme market emotions may create favorable conditions for investors [6]

微软服务器宕机 影响Office、Outlook、Teams等服务

Zheng Quan Shi Bao Wang· 2026-01-23 00:56

微软在社交媒体上发文称,其支持团队正在调查此次服务中断事件。调查人员将问题归咎于服务基础设 施。微软在美东时间下午6点21分的社交媒体帖子中表示:"我们正在重新平衡所有受影响基础设施上的 流量,以确保环境恢复到平衡状态。" 美国东部时间1月22日下午2点40分左右,微软多项服务突然中断,导致用户无法使用Office、Outlook、 Teams等服务。据故障追踪网站DownDetector的数据显示,当天下午3点左右,超过15000名用户报告了 Microsoft365产品使用问题。另有12000名用户报告了Microsoft Outlook问题,500名用户报告了Microsoft Teams问题。 ...

Omdia:到2029年 亚太生成式AI软件市场将增长至276亿美元

Zhi Tong Cai Jing· 2025-10-15 06:21

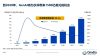

Core Insights - Independent Software Vendors (ISVs) are becoming key players in driving the commercialization of generative AI from experimentation to practical application [1][2] - The generative AI software market in the Asia-Pacific region is projected to grow to $27.6 billion by 2029, with a compound annual growth rate (CAGR) of 52.3% [1][5] - Collaboration between ISVs and cloud vendors will be crucial for the successful commercialization of generative AI [1][2] Market Opportunities - Omdia predicts that generative AI will create up to $158.6 billion in new opportunities for partners by 2028, with ISVs being among the most significant beneficiaries [2][13] - The global generative AI software market is expected to grow from $26.3 billion in 2025 to $101.3 billion by 2029, with a CAGR of 48.1% [5] Challenges Faced by ISVs - High computing and integration costs pose significant barriers for ISVs, who must invest heavily in model selection and data preparation before market validation [8] - Many ISVs lack brand recognition, making sales cycles unpredictable and complicating international market expansion due to compliance and local visibility issues [8] - The current pricing models are immature, with many projects remaining in pilot phases or highly customized deployments, hindering scalable and profitable growth [8] Cloud Vendor Strategies - Major cloud vendors are adjusting their strategies to assist ISVs in overcoming challenges, but their approaches vary [9][10] - AWS emphasizes modular combinations and a mature marketplace to help ISVs quickly build and promote AI solutions [10] - Microsoft Azure integrates AI deeply into enterprise suites but has higher entry barriers for partners [10] - Google Cloud focuses on engineering-driven paths, requiring higher self-expansion capabilities from ISVs [10] - Alibaba Cloud activates local ecosystems with low-code development tools but has a more fragmented marketplace [10] ISV Growth Stages - ISVs' growth in the generative AI space can be categorized into four stages: 1. AI Ready (Exploration Stage): Testing feasibility through APIs or demos [11] 2. AI Embedded (Deepening Stage): Integrating generative AI into existing products [11] 3. AI Native (Co-creation Stage): Embedding intelligent capabilities and enhancing market visibility [11] 4. AI Driven (Ecosystem Stage): Becoming ecosystem leaders with replicable solutions and international expansion [11] Future Outlook - Most ISVs are currently in the first two stages, focusing on reusable application scenarios and sustainable pricing models [12] - To unlock the potential of generative AI, ISVs and cloud vendors must collaborate to create scalable and practical solutions that businesses can adopt confidently [13]

凯雷集团(CG.US)拟10亿美元出售HSO给贝恩资本(BCSF.US) 私募交易市场加速复苏

Zhi Tong Cai Jing· 2025-08-13 07:05

Group 1 - The private equity giant Carlyle Group is nearing a significant deal to sell its Dutch tech services company HSO to Bain Capital, with an estimated valuation of approximately $1 billion [1][2] - HSO's management plans to reinvest in the business through this transaction, indicating a commitment to the company's future development [1] - The deal reflects a resurgence in the private equity market after a prolonged period of inactivity, driven by investor demands for accelerated capital deployment and cash flow [1] Group 2 - HSO specializes in designing, implementing, and operating business application systems based on Microsoft cloud technologies, serving around 1,200 clients globally with approximately 2,800 employees [2] - Carlyle Group made a strategic investment in HSO in 2019 and has since expanded its business through multiple acquisitions, including the purchase of cloud transformation service provider Motion10 in 2022 [2] - If the transaction proceeds, it will mark another landmark deal in the private equity sector, enhancing Bain Capital's influence in the cloud computing and enterprise services space [2]

微软研究发现“无限工作日”正在降低效率:AI或成解药,也可能是加速剂

Sou Hu Cai Jing· 2025-06-18 22:41

Group 1 - The core finding of Microsoft's research indicates that the promise of a "work-life balance" has not been fulfilled, leading to an increase in "infinite workdays" where employees work over 12 hours daily, affecting productivity negatively [2][3] - The report highlights that 40% of employees start checking emails as early as 6 AM, and meetings occupy the most productive hours of the day, leading to a fragmented work experience [2][3] - There has been a 16% increase in meetings held after 8 PM compared to the previous year, with employees sending over 50 messages outside of working hours [2][3] Group 2 - Approximately 20% of employees begin handling emails on weekends, with over 5% still sending emails on Sunday evenings, indicating a pervasive work culture [3] - Average Microsoft 365 users deal with 117 emails and 153 Teams messages daily, resulting in interruptions almost every two minutes, contributing to a chaotic work rhythm [3] - Microsoft suggests that AI could be a solution to combat "infinite workdays" by automating low-value tasks and promoting agile, results-oriented teams [3][4] Group 3 - Previous studies have indicated that the most productive work pattern is a "75/33" rhythm, where employees work for 75 minutes followed by a 33-minute break, contrasting with the current continuous work trend [4] - The report raises concerns about whether AI will serve as a lifeline or exacerbate the issue of overwork, highlighting a critical question for both companies and employees [4]

人工智能行业专题:2025Q1海外大厂CapEx和ROIC总结梳理

Guoxin Securities· 2025-05-06 04:35

Investment Rating - The investment rating for the industry is "Outperform the Market" (maintained rating) [1] Core Insights - A review of the capital expenditures and performance of major cloud vendors in Q1 2025 shows that Microsoft, Meta, and Amazon experienced a slowdown in year-over-year capital expenditure growth, while Microsoft saw stable revenue and profit growth driven by AI [2] - Overall cloud revenue growth is slowing, but all vendors continue to see increases in cloud revenue. The return on invested capital (ROIC) for Meta and Amazon has decreased quarter-over-quarter due to the impact of overall revenue and profit trends [2] Summary by Sections 1. Capital Expenditures and Performance Review of Cloud Vendors - In Q1 2025, Microsoft's capital expenditure decreased by 5.3% quarter-over-quarter to $21.4 billion, primarily due to normal fluctuations related to data center leasing delivery times. Future capital expenditures are expected to increase [8][14] - Meta's capital expenditure in Q1 2025 was $13.7 billion, a year-over-year increase of 104%, but slightly below expectations. The company raised its full-year capital expenditure guidance to between $64 billion and $72 billion, reflecting additional investments in data centers to support AI initiatives [20][27] - Google's capital expenditure in Q1 2025 was $17.2 billion, a year-over-year increase of 43.2% and a quarter-over-quarter increase of 20.5%, slightly exceeding market expectations [35][41] - Amazon's capital expenditure in Q1 2025 was $24.3 billion, a year-over-year increase of 63.09%, but a quarter-over-quarter decrease of 7.6%, primarily directed towards AWS to meet AI service demands [48][55] 2. Cloud Revenue and ROIC Situation - Microsoft reported Q1 2025 cloud revenue of $26.7 billion, with Azure and other cloud services growing by 33%, contributing 16% to Azure's revenue growth from AI [70] - Amazon's AWS revenue in Q1 2025 was $29.3 billion, a year-over-year increase of 16.9%, with AI business achieving annualized revenue in the billions and continuing to grow at triple-digit percentages [55][70] - Google's cloud revenue in Q1 2025 was $12.26 billion, a year-over-year increase of 28.06%, driven by GCP growth, including AI infrastructure and generative AI solutions [70] - The ROIC for Microsoft and Google increased quarter-over-quarter, while Meta and Amazon saw declines, reflecting the impact of AI demand on capital expenditures and overall performance [71]