PING AN OF CHINA(02318)

Search documents

中国平安10月21日现1笔大宗交易 总成交金额1510.08万元 溢价率为0.00%

Xin Lang Cai Jing· 2025-10-21 10:06

10月21日,中国平安收涨0.31%,收盘价为58.08元,发生1笔大宗交易,合计成交量26万股,成交金额 1510.08万元。 责任编辑:小浪快报 第1笔成交价格为58.08元,成交26.00万股,成交金额1,510.08万元,溢价率为0.00%,买方营业部为兴 业证券股份有限公司上海锦康路证券营业部,卖方营业部为中国国际金融股份有限公司北京建国门外大 街证券营业部。 炒股就看金麒麟分析师研报,权威,专业,及时,全面,助您挖掘潜力主题机会! 进一步统计,近3个月内该股累计发生8笔大宗交易,合计成交金额为2.25亿元。该股近5个交易日累计 上涨2.83%,主力资金合计净流入6.69亿元。 ...

保定监管分局同意中国平安曲阳支公司变更营业场所

Jin Tou Wang· 2025-10-21 04:41

Core Viewpoint - The Baoding Regulatory Bureau of the National Financial Supervision Administration has approved the relocation of the business premises for the Quyang branch of China Ping An Life Insurance Co., Ltd. [1] Group 1 - The new business location for the Quyang branch is specified as No. 3-9, Yongning Huadu Community, South Ring Road, Quyang County, Baoding City, Hebei Province [1] - China Ping An Life Insurance Co., Ltd. is required to handle the change and obtain the necessary permits in accordance with relevant regulations [1]

开封监管分局同意中国平安开封中心支公司迎宾营销服务部营业地址变更

Jin Tou Wang· 2025-10-21 03:52

Core Viewpoint - The National Financial Supervision Administration's Kaifeng Regulatory Branch has approved the relocation of China Ping An Life Insurance Co., Ltd.'s Kaifeng Center Branch's Yingbin Marketing Service Department to a new address in Kaifeng, Henan Province [1] Group 1 - The new business address for the Yingbin Marketing Service Department is now located at Building 1, 3rd Floor, Room 301, Tokyo Grand View Complex, Longting District, Kaifeng City, Henan Province [1] - China Ping An Life Insurance Co., Ltd. is required to take this approval to the National Financial Supervision Administration's Kaifeng Regulatory Branch to process the change of its insurance license and to local market supervision authorities for related procedures [1]

港股内险股全线走高 中国人寿涨5.44%

Mei Ri Jing Ji Xin Wen· 2025-10-21 02:43

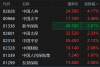

Group 1 - Hong Kong insurance stocks experienced a significant increase on October 21, with China Life (02628.HK) rising by 5.44% to HKD 24.8 [1] - New China Life (01336.HK) saw a gain of 3.68%, reaching HKD 50.1 [1] - Ping An Insurance (02318.HK) increased by 2.67%, trading at HKD 55.75 [1] - China Pacific Insurance (02328.HK) rose by 2.35%, with a price of HKD 19.19 [1]

中美双方即将重返谈判桌,港股高开高走,恒生中国企业ETF(159960)涨1.6%

Sou Hu Cai Jing· 2025-10-21 02:34

Group 1 - The core viewpoint of the articles indicates that the US and China are set to return to the negotiation table, which has positively impacted stock markets, with US stocks rising and Hong Kong stocks opening higher [1] - The Hang Seng China Enterprises ETF (159960) increased by 1.60%, with notable gains in constituent stocks such as China Life (02628) up 6.21%, SMIC (00981) up 4.39%, and Xpeng Motors-W (09868) up 4.18% [1] - The US President has identified three major issues for negotiation: rare earths, fentanyl, and soybeans, while the Chinese Foreign Ministry emphasized the need for equal and respectful negotiations [1] Group 2 - According to China Merchants Securities, the Hong Kong stock market is expected to experience a period of volatility before a potential upward trend, driven by factors such as continuous innovation in the Chinese tech industry and a low probability of high tariffs being implemented [1] - The upcoming Fourth Plenary Session of the Communist Party discussing the "14th Five-Year Plan" is anticipated to boost risk appetite among investors [1] - The expectation of continued interest rate cuts by the Federal Reserve is likely to lead to sustained capital inflows, improving fundamentals and profit expectations, which may drive a slow bull market trend in Hong Kong stocks [1] Group 3 - The Hang Seng China Enterprises ETF closely tracks the performance of the Hang Seng China Enterprises Index, which includes all H-share companies listed on the Hong Kong Stock Exchange [2] - As of October 20, 2025, the top ten weighted stocks in the Hang Seng China Enterprises Index include Alibaba-W (09988), Tencent Holdings (00700), and China Construction Bank (00939), collectively accounting for 55.33% of the index [2]

内险股全线走高 受益于权益投资收益增长 多家险企业绩盈喜大超预期

Zhi Tong Cai Jing· 2025-10-21 02:31

光大证券发布研报称,受益于权益投资收益增长,业绩大超预期。该行认为2025年前三季度三家上市险 企在去年同期"924行情"带来的较高基数下进一步实现利润高增的共同原因为股票市场回稳向好推动权 益投资收益同比大幅增长,其中第三季度沪深300指数累计上涨17.9%,涨幅较去年同期扩大1.8pct。该 行指出,股票仓位明显提升,险企资产端弹性加大。 内险股全线走高,截至发稿,中国人寿(02628)涨5.44%,报24.8港元;新华保险(601336)(01336)涨 3.68%,报50.1港元;中国平安(02318)涨2.67%,报55.75港元;中国财险(02328)涨2.35%,报19.19港 元。 消息面上,近期多家险企发布2025年前三季度业绩预增公告。中国人寿预计前三季净利润1568-1777亿 元,同比增长50%-70%;新华保险预计前三季净利润299.9-341.2亿元,同比增长45%-65%;中国财险预 计前三季净利润375-428亿元,同比增长40%-60%。 ...

港股异动 | 内险股全线走高 受益于权益投资收益增长 多家险企业绩盈喜大超预期

智通财经网· 2025-10-21 02:27

智通财经APP获悉,内险股全线走高,截至发稿,中国人寿(02628)涨5.44%,报24.8港元;新华保险 (01336)涨3.68%,报50.1港元;中国平安(02318)涨2.67%,报55.75港元;中国财险(02328)涨2.35%,报 19.19港元。 光大证券发布研报称,受益于权益投资收益增长,业绩大超预期。该行认为2025年前三季度三家上市险 企在去年同期"924行情"带来的较高基数下进一步实现利润高增的共同原因为股票市场回稳向好推动权 益投资收益同比大幅增长,其中第三季度沪深300指数累计上涨17.9%,涨幅较去年同期扩大1.8pct。该 行指出,股票仓位明显提升,险企资产端弹性加大。 消息面上,近期多家险企发布2025年前三季度业绩预增公告。中国人寿预计前三季净利润1568-1777亿 元,同比增长50%-70%;新华保险预计前三季净利润299.9-341.2亿元,同比增长45%-65%;中国财险预 计前三季净利润375-428亿元,同比增长40%-60%。 ...

港股内险股集体拉升上涨,中国人寿涨超4%

Mei Ri Jing Ji Xin Wen· 2025-10-21 01:56

Core Viewpoint - The Hong Kong insurance stocks experienced a collective surge, with notable increases in share prices for major companies in the sector [1] Group 1: Stock Performance - China Life Insurance led the gains with an increase of over 4% [1] - China Pacific Insurance rose by 3.5% [1] - New China Life Insurance saw a rise of 2.6% [1] - Other companies such as New China Life, Ping An Insurance, China Pacific Insurance, and AIA Group all recorded increases of over 2% [1]

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]