Guangdong Fangyuan New Materials (688148)

Search documents

电池板块10月21日涨2.09%,芳源股份领涨,主力资金净流入11.68亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:29

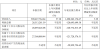

证券之星消息,10月21日电池板块较上一交易日上涨2.09%,芳源股份领涨。当日上证指数报收于 3916.33,上涨1.36%。深证成指报收于13077.32,上涨2.06%。电池板块个股涨跌见下表: 从资金流向上来看,当日电池板块主力资金净流入11.68亿元,游资资金净流出8182.68万元,散户资金 净流出10.86亿元。电池板块个股资金流向见下表: 以上内容为证券之星据公开信息整理,由AI算法生成(网信算备310104345710301240019号),不构成投资建议。 | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | | --- | --- | --- | --- | --- | --- | --- | | 301292 | 海科新浪 | 29.29 | -6.18% | 33.72万 | | 10.06亿 | | 688353 | 保障审审 | 45.47 | -5.37% | 9.59万 | | 4.47 Z | | 603026 | 石大胜华 | 55.62 | -4.22% | 13.50万 | | 7.61亿 | | 300619 | 金银河 | 36. ...

芳源股份前三季度亏1.2亿元 2021年上市两募资共10亿

Zhong Guo Jing Ji Wang· 2025-10-21 06:59

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported its Q3 2025 financial results, showing a revenue of 1.49 billion RMB, a year-on-year increase of 5.29% [1] - The company recorded a net loss attributable to shareholders of 121 million RMB, slightly worsening from a loss of 119 million RMB in the same period last year [1][3] - The net cash flow from operating activities was -59.83 million RMB, compared to -27.99 million RMB in the previous year [1] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 1.49 billion RMB, reflecting a growth of 5.29% year-on-year [1][3] - The total profit for the period was -120.70 million RMB, with a net profit attributable to shareholders also at -120.77 million RMB [3] - The net profit excluding non-recurring gains and losses was -121.73 million RMB, an improvement from -141 million RMB in the previous year [1][3] Cash Flow Analysis - The net cash flow from operating activities for the first three quarters was -59.83 million RMB, compared to -27.99 million RMB in the same period last year [1][3] - In 2024, the company reported a net cash flow from operating activities of 73.91 million RMB, a significant recovery from -326.17 million RMB in 2023 [4] Capital Raising and Financial Strategy - Fangyuan Co., Ltd. raised a total of 366 million RMB through its initial public offering, with a net amount of 301 million RMB after deducting issuance costs [5] - The company initially planned to raise 1.05 billion RMB for projects related to high-end lithium battery precursors and lithium hydroxide production [5] - The company has conducted two fundraising rounds since its listing, totaling 1.008 billion RMB [7]

芳源股份涨停 13只科创板股涨超5%

Zheng Quan Shi Bao Wang· 2025-10-21 02:13

Group 1 - The core point of the news is that Fangyuan Co., Ltd. experienced a significant stock price increase, reaching a limit up on October 21, with a trading price of 7.78 yuan and a transaction volume of 327 million yuan, indicating strong market interest [1][2] - As of the report, 472 stocks in the Sci-Tech Innovation Board were rising, with 13 stocks showing an increase of over 5%. Fangyuan Co., Ltd. led with a rise of 20.06%, followed by other companies like Jiaocheng Ultrasound and Purun Co., Ltd. [1] - The stock market showed a mixed performance, with 107 stocks declining, including notable drops from Qilin Xinan, Sinan Navigation, and Boliview, which fell by 4.18%, 3.93%, and 3.18% respectively [1] Group 2 - On the funding side, Fangyuan Co., Ltd. saw a net inflow of 16.468 million yuan from main funds on the previous trading day, with a total net inflow of 5.2313 million yuan over the last five days [2] - The latest margin trading data as of October 20 indicates a total margin balance of 139 million yuan, with a financing balance of 139 million yuan, reflecting a slight increase of 112,600 yuan or 0.08% from the previous day [2] - The company's third-quarter report revealed that it achieved a total operating revenue of 1.49 billion yuan, representing a year-on-year growth of 5.29%, while the net profit was -121 million yuan, a decline of 1.76% year-on-year [2]

芳源股份(688148.SH):第三季度净利润2805.94万元

Ge Long Hui A P P· 2025-10-20 12:14

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported a significant increase in third-quarter revenue, reaching 590 million yuan, a year-on-year growth of 57.3% [1] - The company experienced a net profit of 28.06 million yuan in the third quarter, while the net profit for the first three quarters of 2025 showed a loss of 121 million yuan [1] Revenue Growth - The revenue growth in the third quarter was primarily driven by sustained demand in the terminal sector, leading to increased market demand for positive electrode materials [1] - The company saw substantial year-on-year increases in the shipment volumes of precursor materials and cobalt sulfate, contributing to the revenue growth [1] - Revenue from technology export projects was recognized according to performance progress, further boosting the company's overall revenue [1] Profitability - The change in net profit for the third quarter was mainly influenced by rising metal prices, which led to an increase in product sales prices [1] - The recognition of revenue from technology export projects also contributed to the significant improvement in the company's comprehensive gross profit margin in the third quarter [1]

芳源股份发布前三季度业绩,归母净亏损1.21亿元

Zhi Tong Cai Jing· 2025-10-20 11:33

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported a revenue of 1.49 billion yuan for the first three quarters of 2025, reflecting a year-on-year growth of 5.29% [1] - The company experienced a net loss attributable to shareholders of 121 million yuan, with a non-recurring net profit loss of 122 million yuan [1] - Basic earnings per share stood at -0.24 yuan [1]

芳源股份(688148.SH)发布前三季度业绩,归母净亏损1.21亿元

智通财经网· 2025-10-20 11:28

Group 1 - The core viewpoint of the article is that Fangyuan Co., Ltd. (688148.SH) reported its Q3 2025 results, showing a revenue increase but a net loss [1] Group 2 - The company achieved a revenue of 1.49 billion yuan in the first three quarters, representing a year-on-year growth of 5.29% [1] - The net profit attributable to shareholders was a loss of 121 million yuan [1] - The non-recurring net profit also showed a loss of 122 million yuan, with a basic earnings per share of -0.24 yuan [1]

芳源股份(688148) - 芳源股份关于召开2025年第三季度业绩说明会的公告

2025-10-20 11:15

重要内容提示: 会议召开时间:2025 年 10 月 29 日(星期三)15:00-16:00 | 证券代码:688148 | 证券简称:芳源股份 | 公告编号:2025-057 | | --- | --- | --- | | 转债代码:118020 | 转债简称:芳源转债 | | 广东芳源新材料集团股份有限公司 关于召开 2025 年第三季度业绩说明会的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性依法承担法律责任。 会 议 召 开 地 点 : 上 海 证 券 交 易 所 上 证 路 演 中 心 ( 网 址 : https://roadshow.sseinfo.com/) 会议召开方式:上证路演中心网络互动 投资者可于 2025 年 10 月 22 日(星期三)至 10 月 28 日(星期二)16:00 前登录上证路演中心网站首页点击"提问预征集"栏目或通过公司邮箱 fyhb@fangyuan-group.com 进行提问。公司将在说明会上对投资者普遍关注的问 题进行回答。 广东芳源新材料集团股份有限公司(以下简称"公司")已于 2 ...

芳源股份(688148) - 2025 Q3 - 季度财报

2025-10-20 11:10

Financial Performance - The company's operating revenue for Q3 2025 reached ¥590,427,764.64, representing a year-on-year increase of 57.30%[2] - The total profit for the quarter was ¥28,513,281.59, with a significant improvement in gross margin due to rising metal prices and increased sales prices[7] - The net profit attributable to shareholders was ¥28,059,426.08, reflecting a recovery from previous losses[2] - In the first three quarters of 2025, the company achieved a total operating revenue of RMB 149,026.22 million, representing a year-on-year growth of 5.29%[12] - In Q3 2025, the company recorded a single-quarter operating revenue of RMB 59,042.78 million, showing a significant year-on-year increase of 57.30%[12] - The net profit attributable to shareholders for the first three quarters of 2025 was RMB -12,077.48 million, while Q3 alone saw a turnaround with a net profit of RMB 2,805.94 million[13] - The comprehensive gross margin for Q3 2025 improved to 12.07%, indicating a significant enhancement in profitability due to rising metal prices and revenue recognition from a Japanese cooperation project[13] - The company's total comprehensive income for the period was -120,714,987.64 RMB, compared to -118,776,716.76 RMB in the previous year, indicating a slight increase in comprehensive losses[24] Research and Development - Research and development (R&D) expenses for the quarter totaled ¥10,784,431.05, a decrease of 49.27% compared to the same period last year[3] Assets and Liabilities - The total assets at the end of the reporting period were ¥2,942,595,914.77, down 4.76% from the end of the previous year[3] - The total equity attributable to shareholders decreased by 19.11% to ¥453,795,760.00 compared to the previous year[3] - Cash and cash equivalents decreased to ¥59,166,000.40 as of September 30, 2025, from ¥170,533,489.05 at the end of 2024[19] - Accounts receivable increased to ¥286,162,292.04 as of September 30, 2025, compared to ¥173,499,256.65 at the end of 2024, reflecting a significant rise of approximately 64.7%[19] - Inventory decreased slightly to ¥495,607,541.85 as of September 30, 2025, from ¥521,360,675.55 at the end of 2024[19] - Total liabilities were reported at ¥2,481,106,878.69 as of September 30, 2025, compared to ¥2,522,927,755.69 at the end of 2024, indicating a decrease in liabilities[21] - The company's equity attributable to shareholders decreased to ¥453,795,760.00 as of September 30, 2025, from ¥561,036,093.05 at the end of 2024[21] Cash Flow - The net cash flow from operating activities was negative at -¥59,829,724.62, primarily due to increased non-cash sales settlements[2] - The total cash inflow from operating activities decreased to 1,403,899,526.18 RMB in 2025 from 1,673,433,975.70 RMB in 2024, representing a decline of about 17.9%[27] - The net cash flow from operating activities was -59,829,724.62 RMB for the first three quarters of 2025, worsening from -27,990,616.79 RMB in 2024[27] - The cash flow from investing activities showed a net inflow of 43,890,889.57 RMB in 2025, a significant improvement from a net outflow of -62,806,554.96 RMB in 2024[28] - The cash flow from financing activities resulted in a net outflow of -80,416,925.29 RMB in 2025, compared to a net inflow of 116,710,136.61 RMB in 2024, indicating a shift in financing strategy[28] - The total cash and cash equivalents at the end of the period decreased to 43,705,880.14 RMB in 2025 from 95,288,194.81 RMB in 2024, reflecting a decline of approximately 54.1%[28] Shareholder Information - The top 10 shareholders hold a total of 15.03% of shares, with the largest shareholder, Luo Aiping, owning 76,688,693 shares[10] - The company has not engaged in any share lending or borrowing activities during the reporting period[11] Future Outlook - The company plans to continue expanding its market presence and investing in new technologies to drive future growth[7] - The company signed a technical export cooperation agreement in Q3 2025, which is expected to enhance its overseas market presence and optimize its revenue structure[15] - The company is collaborating with a Japanese firm to develop and produce NCMA/NCA/NCM series precursors, which will help mitigate trade barriers and reduce market entry costs[15] - The company confirmed revenue from technology export projects, contributing to the overall revenue growth[7] - As of the report date, the company has received RMB 2,975.95 million in service fees related to the technical export cooperation project, confirming revenue based on contract performance[16] - The company’s precursor product shipments doubled year-on-year in Q3 2025, driven by increased demand in the new energy vehicle and energy storage sectors[13]

广东芳源新材料集团股份有限公司可转债转股结果暨股份变动公告

Shang Hai Zheng Quan Bao· 2025-10-09 18:55

Core Viewpoint - The announcement details the conversion status of the convertible bonds issued by Guangdong Fangyuan New Materials Group Co., Ltd., highlighting the low conversion rate and the remaining unconverted bonds as of September 30, 2025 [2][6]. Convertible Bond Issuance and Status - The company issued 6,420,000 convertible bonds with a total fundraising of RMB 64,200 million, with a maturity period from September 23, 2022, to September 22, 2028 [3]. - The initial conversion price was set at RMB 18.62 per share, which was adjusted to RMB 18.63 following the repurchase and cancellation of certain restricted shares [4]. Conversion Details - As of September 30, 2025, only RMB 24.30 million worth of bonds had been converted into 13,039 shares, representing 0.00255% of the total shares before conversion [2][6]. - The total amount of unconverted bonds stood at RMB 64,175.70 million, accounting for 99.96215% of the total issuance [2][6]. - No bonds were converted during the quarter from July 1, 2025, to September 30, 2025, with a conversion quantity of 0 shares [5]. Share Repurchase and Reduction Plan - The company repurchased 3,320,000 shares from February 23, 2024, to May 22, 2024, which is 0.65% of the total share capital, to maintain company value and shareholder rights [10]. - As of September 30, 2025, the company had sold 1,440,000 repurchased shares, representing 0.28% of the total share capital, leaving 22,337,702 shares in the repurchase account, which is 4.38% of the total share capital [12].

芳源股份(688148) - 芳源股份关于回购股份集中竞价减持股份进展公告

2025-10-09 09:02

| 证券代码:688148 | 证券简称:芳源股份 | 公告编号:2025-056 | | --- | --- | --- | | 转债代码:118020 | 债券简称:芳源转债 | | 广东芳源新材料集团股份有限公司 关于回购股份集中竞价减持股份进展公告 本公司董事会、全体董事及相关股东保证本公告内容不存在任何虚假记载、 误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性依法承担法律 责任。 重要内容提示: 回购股份的基本情况 广东芳源新材料集团股份有限公司(以下简称"芳源股份")于 2024 年 2 月 23 日至 2024 年 5 月 22 日期间累计回购用于维护公司价值及股东权益所必需 的股份数量为 3,320,000 股,占公司目前总股本的 0.65%。公司将就前述股份在 披露回购结果暨股份变动公告(即 2024 年 5 月 23 日)后十二个月后采用集中竞 价交易方式出售,并在披露回购结果暨股份变动公告后三年内完成出售;若公司 未能在上述期限内完成回购股份出售,将依法履行减少注册资本程序,对未出售 的股份予以注销。 减持计划的进展情况 2025 年 8 月 5 日,公司在上海证券交易所网站 ...