KAIFA(000021)

Search documents

深科技(000021) - 第十届董事会第十四次会议决议公告

2025-10-29 08:15

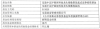

证券代码:000021 证券简称:深科技 公告编码:2025-042 深圳长城开发科技股份有限公司 第十届董事会第十四次会议决议公告 本公司及董事会全体成员保证信息披露的内容真实、准确和完整,没有虚假记载、误 导性陈述或者重大遗漏。 深圳长城开发科技股份有限公司第十届董事会第十四次会议于 2025 年 10 月 28 日以通讯方式召开,该次会议通知已于 2025 年 10 月 24 日以电子邮件方式发 至全体董事及相关与会人员,应参与表决董事 9 人,实际参与表决董事 9 人,符 合《公司法》和《公司章程》的有关规定。会议审议并通过如下事项: 一、审议通过了《2025 年第三季度经营报告》 审议结果:同意 9 票,反对 0 票,弃权 0 票,表决通过。 二、审议通过了《2025 年第三季度报告》(详见同日公告 2025-044) 公司董事会审计委员会审议通过了此议案。 二○二五年十月三十日 审议结果:同意 9 票,反对 0 票,弃权 0 票,表决通过。 三、审议通过了《中国电子财务有限责任公司风险评估专项审计报告(2025 年 9 月 30 日)》(详见巨潮资讯网 www.cninfo.com.cn) 公司独 ...

深科技:第三季度净利润同比增长0.95%

Mei Ri Jing Ji Xin Wen· 2025-10-29 08:13

Core Viewpoint - The company reported a decline in revenue for Q3 2025, but managed to achieve a slight increase in net profit, indicating a mixed performance driven by various factors [1] Financial Performance - Q3 revenue was 3.538 billion, a year-on-year decrease of 6.82% [1] - Q3 net profit was 304 million, a year-on-year increase of 0.95% [1] - Revenue for the first three quarters was 11.278 billion, a year-on-year increase of 3.93% [1] - Net profit for the first three quarters was 756 million, a year-on-year increase of 14.27% [1] Growth Drivers - The growth in performance was primarily attributed to increased gains from financial derivatives, higher investment income, and a rise in export tax rebates [1] - The successful fundraising from the technology IPO significantly boosted cash inflows from financing activities, enhancing overall profitability [1]

深科技(000021.SZ):前三季度净利润7.56亿元 同比增加14.27%

Ge Long Hui A P P· 2025-10-29 08:13

Core Insights - The company, Deep Technology (深科技), reported a revenue of 11.278 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 3.93% [1] - The net profit attributable to shareholders of the listed company reached 756 million yuan, showing a year-on-year increase of 14.27% [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was 576 million yuan, which reflects a year-on-year decrease of 6.58% [1] - The basic earnings per share (EPS) stood at 0.4833 yuan [1]

深科技:前三季度净利润7.56亿元 同比增加14.27%

Ge Long Hui· 2025-10-29 08:07

Core Viewpoint - Deep Technology (000021.SZ) reported a year-on-year increase in revenue and net profit for the first three quarters of 2025, indicating positive financial performance despite a decline in net profit excluding non-recurring items [1] Financial Performance - The company achieved operating revenue of 11.278 billion yuan, representing a year-on-year increase of 3.93% [1] - The net profit attributable to shareholders reached 756 million yuan, reflecting a year-on-year increase of 14.27% [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was 576 million yuan, showing a year-on-year decrease of 6.58% [1] - Basic earnings per share were reported at 0.4833 yuan [1]

深科技(000021) - 2025 Q3 - 季度财报

2025-10-29 08:00

Financial Performance - The company's revenue for Q3 2025 was ¥3,538,191,171.29, a decrease of 6.82% compared to the same period last year[6] - Net profit attributable to shareholders was ¥303,911,865.33, an increase of 0.95% year-on-year[6] - The net profit after deducting non-recurring gains and losses was ¥258,870,573.57, down 4.95% from the previous year[6] - Total operating revenue increased to ¥11,277,843,807.83, up from ¥10,851,685,615.18, representing a growth of approximately 3.93% year-over-year[25] - Net profit for the period reached ¥988,544,343.71, an increase from ¥812,119,811.67, marking a growth of approximately 21.69% year-over-year[25] - The net profit attributable to the parent company shareholders for the current period is approximately ¥755.73 million, an increase from ¥661.38 million in the previous period, representing a growth of about 14.25%[26] - The total comprehensive income for the current period is approximately ¥1.11 billion, compared to ¥849.27 million in the previous period, indicating an increase of around 31.06%[26] Assets and Liabilities - Total assets at the end of the reporting period reached ¥27,556,890,716.63, reflecting a 2.93% increase from the end of the previous year[6] - The company's total assets amounted to ¥27,556,890,716.63, up from ¥26,773,186,448.82, indicating a growth of about 2.93%[22] - Total liabilities decreased to ¥11,708,669,150.82 from ¥12,915,181,972.05, showing a reduction of approximately 9.36%[22] - Shareholders' equity attributable to the parent company increased by 7.22% to ¥12,734,791,742.27 compared to the end of the previous year[6] - The company's equity attributable to shareholders increased to ¥12,734,791,742.27 from ¥11,876,799,194.96, reflecting a growth of about 7.22%[22] Cash Flow - The company reported a net cash flow from operating activities of ¥2,033,492,584.88, an increase of 6.05% year-to-date[6] - The operating cash flow for the current period is approximately ¥2.03 billion, up from ¥1.92 billion in the previous period, reflecting a growth of about 6.06%[27] - The company received cash from operating activities totaling approximately ¥12.35 billion, an increase from ¥11.36 billion in the previous period, which is a growth of about 8.66%[28] - The net cash flow from investing activities is approximately -¥1.01 billion, an improvement from -¥1.26 billion in the previous period, indicating a reduction in cash outflow of about 20.00%[28] - The net cash flow from financing activities is approximately ¥1.10 billion, a significant recovery from -¥650.56 million in the previous period[29] - The total cash inflow from financing activities is approximately ¥19.88 billion, compared to ¥14.48 billion in the previous period, indicating an increase of around 37.93%[29] Shareholder Information - Total number of common stock shareholders at the end of the reporting period is 178,767[14] - The largest shareholder, China Electronics Limited, holds 34.27% of shares, totaling 538,558,777 shares[14] - The second largest shareholder, Bosheng (Hong Kong) Limited, holds 3.93% of shares, totaling 61,750,000 shares[14] Financial Expenses and Credit Lines - The company’s financial expenses increased by ¥3.49 billion compared to the same period last year, mainly due to higher derivative financial product settlement gains[10] - The company reported a financial expense of -¥376,721,109.14, compared to -¥27,767,553.02, indicating a significant increase in financial costs[25] - The company obtained a comprehensive credit line of RMB 300 million from BNP Paribas Bank (China) on September 3, 2025, with a two-year term[17] - A similar credit line of RMB 300 million was secured from China Everbright Bank on September 8, 2025, also with a one-year term[17] - The company secured an additional RMB 400 million credit line from China Merchants Bank on September 16, 2025, with a two-year term[17] Research and Development - Research and development expenses were reported at ¥293,312,192.59, compared to ¥255,586,652.19, indicating an increase of approximately 14.74% year-over-year[25] Future Outlook - Future outlook includes plans for market expansion and potential new product launches to drive revenue growth[22] Cash and Cash Equivalents - The company reported a cash balance of RMB 7,913,368,510.98 at the end of the reporting period, an increase from RMB 7,321,946,745.09 at the beginning[20] - The cash and cash equivalents at the end of the period amount to approximately ¥4.14 billion, compared to ¥2.05 billion at the end of the previous period, showing an increase of around 102.00%[29]

深科技:第三季度净利润为3.04亿元,同比增长0.95%

Di Yi Cai Jing· 2025-10-29 07:57

Core Viewpoint - The company reported a decline in revenue for the third quarter while showing growth in net profit, indicating mixed financial performance [1] Financial Performance - The third quarter revenue was 3.538 billion, a year-on-year decrease of 6.82% [1] - The net profit for the third quarter was 304 million, reflecting a year-on-year increase of 0.95% [1] - For the first three quarters, the total revenue reached 11.278 billion, representing a year-on-year growth of 3.93% [1] - The net profit for the first three quarters was 756 million, which is a year-on-year increase of 14.27% [1]

深科技涨2.10%,成交额11.54亿元,主力资金净流入412.69万元

Xin Lang Zheng Quan· 2025-10-29 02:13

Core Viewpoint - Shenzhen Technology Co., Ltd. (深科技) has shown significant stock performance and financial growth in 2023, with a notable increase in share price and market capitalization, indicating strong investor interest and potential for future growth [1][2]. Financial Performance - As of October 20, 2025, Shenzhen Technology achieved a revenue of 7.74 billion yuan, representing a year-on-year growth of 9.71%, and a net profit attributable to shareholders of 452 million yuan, up 25.39% year-on-year [2]. - The company has distributed a total of 3.96 billion yuan in dividends since its A-share listing, with 702 million yuan distributed over the past three years [2]. Stock Market Activity - On October 29, 2023, the stock price increased by 2.10% to 30.08 yuan per share, with a trading volume of 1.15 billion yuan and a turnover rate of 2.48%, leading to a total market capitalization of 47.27 billion yuan [1]. - The stock has risen 59.41% year-to-date, with an 8.08% increase over the last five trading days, a 32.34% increase over the last 20 days, and a 57.65% increase over the last 60 days [1]. Shareholder Structure - As of June 30, 2025, the top ten circulating shareholders include Southern CSI 500 ETF, holding 16.17 million shares (an increase of 4.12 million shares), and Hong Kong Central Clearing Limited, holding 12.99 million shares (an increase of 3.21 million shares) [3]. Business Overview - Shenzhen Technology, established on July 4, 1985, and listed on February 2, 1994, specializes in advanced manufacturing of hard disk heads, electronic products, measurement systems, payment terminal products, digital home products, and LED technology [2]. - The company's revenue composition includes high-end manufacturing (50.52%), storage semiconductor business (27.13%), and intelligent terminal measurement (21.70%) [2]. Market Position - Shenzhen Technology is categorized under the electronics sector, specifically in consumer electronics and components, and is involved in various concept sectors such as packaging and testing, active mainland stock trading, storage concepts, smart grids, and state-owned enterprise reforms [2].

10月28日生物经济(970038)指数跌0.16%,成份股美亚光电(002690)领跌

Sou Hu Cai Jing· 2025-10-28 12:22

Core Points - The Bioeconomy Index (970038) closed at 2277.51 points, down 0.16%, with a trading volume of 18.883 billion yuan and a turnover rate of 1.2% [1] - Among the index constituents, 23 stocks rose while 27 fell, with Iwubio leading the gainers at 6.71% and Meiya Optoelectronics leading the decliners at 3.02% [1] Index Constituents Summary - The top ten constituents of the Bioeconomy Index include: - Mindray Medical (sz300760) with a weight of 13.81%, latest price at 225.09 yuan, and a market cap of 272.908 billion yuan [1] - Changchun High-tech (sz000661) with a weight of 5.41%, latest price at 116.50 yuan, and a market cap of 47.525 billion yuan [1] - Kanglong Chemical (sz300759) with a weight of 4.66%, latest price at 31.97 yuan, and a market cap of 56.849 billion yuan [1] - Other notable constituents include Shishihistory (sz002252), Table Pharmaceutical (sz300347), and Muyuan Foods (sz002714) [1] Capital Flow Analysis - The Bioeconomy Index constituents experienced a net outflow of 871 million yuan from institutional investors, while retail investors saw a net inflow of 544 million yuan [3] - Key capital flows include: - Iwubio (300357) with a net inflow of 52.9277 million yuan from institutional investors [3] - Dabo Medical (002901) with a net inflow of 31.8434 million yuan from institutional investors [3] - Changchun High-tech (000661) with a net inflow of 27.6452 million yuan from institutional investors [3]

蔡丹离任宝盈中证沪港深科技龙头指数发起式

Zhong Guo Jing Ji Wang· 2025-10-27 08:33

Core Viewpoint - The recent announcement from Baoying Fund indicates a change in the management of the Baoying CSI Hong Kong-Shenzhen Technology Leaders Index Fund, with Cai Dan leaving and Yang Zhixuan taking over as the fund manager [1][2]. Group 1: Fund Performance - The Baoying CSI Hong Kong-Shenzhen Technology Leaders Index Fund A/C was established on November 23, 2022, and has shown a year-to-date return of 41.21% and 40.98% respectively [1]. - Since its inception, the fund has achieved a cumulative return of 58.85% and 57.78%, with a cumulative net value of 1.5885 yuan and 1.5778 yuan [1]. Group 2: Management Changes - Cai Dan has been dismissed as the fund manager of the Baoying CSI Hong Kong-Shenzhen Technology Leaders Index Fund [2]. - Yang Zhixuan, who joined Baoying Fund in July 2018, has held various positions including research assistant, quantitative researcher, and assistant fund manager before becoming the current fund manager [1].

10月24日深证国企ESG(970055)指数涨0.39%,成份股深科技(000021)领涨

Sou Hu Cai Jing· 2025-10-24 10:55

Core Viewpoint - The Shenzhen State-owned Enterprise ESG Index (970055) closed at 1402.3 points on October 24, with a gain of 0.39% and a trading volume of 35.566 billion yuan, indicating a stable performance in the market [1]. Group 1: Index Performance - On the same day, 24 constituent stocks of the index rose, with Deep Technology leading at a 6.01% increase, while 25 stocks declined, with China National Chemical leading the decline at 4.16% [1]. - The turnover rate of the index was 1.02%, reflecting moderate trading activity [1]. Group 2: Constituent Stocks Details - The top ten constituent stocks of the Shenzhen State-owned Enterprise ESG Index are as follows: - Hikvision (sz002415) with a weight of 9.64% and a latest price of 33.29 yuan, down 0.42% [1]. - BOE Technology Group (sz000725) with a weight of 9.31% and a latest price of 4.05 yuan, unchanged [1]. - Wuliangye Yibin (sz000858) with a weight of 8.62% and a latest price of 120.29 yuan, down 0.86% [1]. - Inspur Information (sz000977) with a weight of 7.30% and a latest price of 67.80 yuan, up 3.23% [1]. - Weichai Power (sz000338) with a weight of 6.78% and a latest price of 14.20 yuan, up 0.14% [1]. - AVIC Optoelectronics (sz002179) with a weight of 4.48% and a latest price of 37.45 yuan, up 1.22% [1]. - Shenwan Hongyuan (sz000166) with a weight of 4.14% and a latest price of 5.46 yuan, up 0.55% [1]. - Yunnan Aluminum (sz000807) with a weight of 4.08% and a latest price of 23.18 yuan, up 1.09% [1]. - Changchun High-tech (sz000661) with a weight of 3.73% and a latest price of 117.84 yuan, up 0.16% [1]. - China Merchants Shekou (sz001979) with a weight of 3.31% and a latest price of 9.50 yuan, down 2.56% [1]. Group 3: Capital Flow - The net inflow of main funds into the constituent stocks of the Shenzhen State-owned Enterprise ESG Index totaled 86.5205 million yuan, while the net outflow of speculative funds was 306 million yuan, and the net inflow of retail funds was 21.9 million yuan [1]. - Detailed capital flow for specific stocks shows that Inspur Information had a net inflow of 34.2 million yuan from main funds, while Deep Technology experienced a net outflow of 12.26 million yuan from speculative funds [2].