FIBOCOM(300638)

Search documents

广和通股价跌5.11%,金信基金旗下1只基金重仓,持有8.92万股浮亏损失12.58万元

Xin Lang Cai Jing· 2025-10-23 02:26

Core Viewpoint - Guanghetong experienced a decline of 5.11% on October 23, with a stock price of 26.16 yuan per share and a total market capitalization of 23.558 billion yuan [1] Company Overview - Shenzhen Guanghetong Wireless Co., Ltd. is located in Nanshan District, Shenzhen, Guangdong Province, and was established on November 11, 1999. The company went public on April 13, 2017. Its main business involves the design, research and development, and sales services of wireless communication modules and related communication solutions. The revenue composition is 99.38% from wireless communication modules and 0.62% from other supplementary services [1] Fund Holdings - According to data from the top ten holdings of funds, one fund under Jinxin Fund holds shares in Guanghetong. The Jinxin Minchang Mixed A Fund (005412) held 89,200 shares in the second quarter, unchanged from the previous period, accounting for 3.5% of the fund's net value, ranking as the ninth largest holding. The estimated floating loss today is approximately 125,800 yuan [2] Fund Performance - The Jinxin Minchang Mixed A Fund (005412) is managed by Liu Shang and Tan Zhiming. As of the report, Liu Shang has been in position for 62 days, with a total fund asset size of 113 million yuan, experiencing a best return of -3.11% and a worst return of -10.62% during his tenure. Tan Zhiming has been in position for 197 days, with a total fund asset size of 142 million yuan, achieving a best return of 39.5% and a worst return of 0.86% during his tenure [3]

广和通:1.35亿股H股22日上市,大股东持股比例降低

Sou Hu Cai Jing· 2025-10-22 13:45

Core Points - Guanghe Tong is set to list 135 million H-shares on the Hong Kong Stock Exchange on October 22, 2025 [1] - The H-shares will be traded under the Chinese name "廣和通" and the English name "FIBOCOM" with the stock code "0638" [1] - Following the issuance, major shareholder Zhang Tianyu's ownership will decrease from 36.78% (282 million shares) to 31.26% (282 million shares), and potentially to 30.57% if the overallotment option is fully exercised [1] - For the first half of 2025, Guanghe Tong reported revenue of 3.707 billion yuan and a net profit attributable to shareholders of 218 million yuan [1]

首家“A+H”无线通信模组企业来了!广和通今天登陆港交所

Zheng Quan Shi Bao Wang· 2025-10-22 13:12

Core Viewpoint - Guanghetong officially listed on the Hong Kong Stock Exchange on October 22, becoming the first wireless communication module company in China to achieve "A+H" listing and the 12th "A+H" enterprise listed this year [1] Group 1: Company Overview - Guanghetong was established in 1999 and is a leading global provider of wireless communication modules, offering products such as data transmission modules, intelligent modules, and AI modules, along with customized solutions for downstream application scenarios [2] - According to Frost & Sullivan, Guanghetong ranks as the second-largest wireless communication module provider globally, holding a market share of 15.4% [2] Group 2: Financial Performance - On its first day of trading, Guanghetong's H-shares opened at HKD 21.5, closing down 11.72% at HKD 18.98, while its A-shares fell 7.89% to CNY 27.57, indicating a premium of approximately 59.09% for A-shares compared to H-shares [1] - The company raised approximately HKD 29.03 billion through the global offering of about 135 million H-shares, with a net amount of HKD 28.11 billion after deducting issuance costs [1] Group 3: Use of Proceeds - Approximately 55% of the net proceeds from the IPO is expected to be allocated for R&D, focusing on AI and robotics technology innovation and product development [3] - About 15% of the net proceeds is planned for the construction of manufacturing facilities in Shenzhen, China, aimed at producing module products and terminal products as part of the company's solutions [3] - Around 10% of the net proceeds is intended for strategic investments and/or acquisitions, targeting companies in wireless communication, AI, robotics, and other complementary fields to enhance technological capabilities and expand market share [3] Group 4: Market Context - In 2023, 12 A-share companies have listed in Hong Kong, with four companies raising over HKD 10 billion, including CATL and Hengrui Medicine [4] - Among the 12 listed companies, 9 have seen their stock prices rise above the issue price, with some companies like Chifeng Jilong Gold and CATL doubling their stock prices [4]

结束上攻,转跌!

中国基金报· 2025-10-22 12:06

Market Overview - After two consecutive days of gains, the Hong Kong stock market experienced weakness and volatility on October 22, with the Hang Seng Index closing down 0.94% at 25,781.77 points, the Hang Seng Tech Index down 1.41%, and the Hang Seng China Enterprises Index down 0.85% [4][5] - Southbound capital saw a net inflow of approximately 10 billion HKD today [5] Sector Performance Technology Sector - The technology sector saw widespread declines, with major stocks such as NetEase and BYD Electronics dropping over 4%, and Kuaishou, Bilibili, and Baidu Group falling over 2% [7][8] Banking Sector - The banking sector was active, with Agricultural Bank of China reaching a new high, closing up 1.56% at 5.85 HKD per share. Other banks like Chongqing Bank, Zheshang Bank, and CITIC Bank also saw gains exceeding 1% [10][11] Pharmaceutical Sector - The innovative drug sector opened high but closed lower, with the Hang Seng Innovation Drug Index down 2.46%. After a significant deal, Innovent Biologics saw its stock price drop nearly 2% by the end of the day [22][23] Gold Sector - The gold sector faced pressure due to a sharp drop in international gold prices, with companies like Lingbao Gold down 4.75% and major jewelry stocks also declining [12][13] Notable Company Developments Agricultural Bank of China - Agricultural Bank of China reported a market capitalization of 300.87 billion HKD and a premium of 51.47% compared to its A-share price [11] Innovent Biologics - Innovent Biologics announced a global strategic partnership with Takeda Pharmaceutical involving three core assets, with an upfront payment of 1.2 billion USD and potential milestone payments of up to 10.2 billion USD [23] Lingbao Gold - Lingbao Gold announced a 4.5% discount on the placement of 3.71 million H-shares, aiming to raise approximately 2.707 billion HKD for inventory reserves and store expansion [17][18] Guanghe Communication - Guanghe Communication debuted on the Hong Kong Stock Exchange, closing down 11.72%. The company reported a revenue decline of 9.02% year-on-year for the first half of 2025 [25][26]

广和通(00638.HK)拟10月29日举行董事会会议以审批三季度业绩

Ge Long Hui· 2025-10-22 11:46

Group 1 - The board meeting of Guanghe Tong (00638.HK) is scheduled for October 29, 2025, to consider and approve the company's performance for the nine months ending September 30, 2025 [1]

广和通:境外上市外资股(H股)挂牌并上市交易。

Xin Lang Cai Jing· 2025-10-22 10:53

Group 1 - The company Guanghetong has successfully listed its H-shares for trading in the overseas market [1]

广和通(300638) - 关于控股股东及实际控制人持股比例被动稀释跨越5%整数倍及触及1%刻度的提示性公告

2025-10-22 10:40

证券代码:300638 证券简称:广和通 公告编号:2025-072 深圳市广和通无线股份有限公司 关于控股股东及实际控制人持股比例被动稀释 跨越 5%整数倍及触及 1%刻度的提示性公告 公司控股股东、实际控制人张天瑜先生保证向公司提供的信息内容真实、准 确、完整,没有虚假记载、误导性陈述或重大遗漏。 本公司及董事会全体成员保证公告内容与信息披露义务人提供的信息一致。 特别提示: 1、张天瑜先生本次权益变动原因为: (1)2023年2月,张天瑜先生实施股份减持计划,导致其持股比例由38.05% 减少至 37.15%。张天瑜先生已于 2023 年 2 月 3 日通过公司在巨潮资讯网披露了 《关于控股股东、实际控制人减持公司股份超过 1%暨股份减持计划提前结束的 公告》(公告编号:2023-006)。 (2)2023 年 5 月至 2025 年 2 月,公司实施股权激励计划、权益分派、向 特定对象发行股份等,导致张天瑜先生持股比例由 37.15%被动稀释至 36.78%。 2、因公司实施股权激励计划,2023 年 5 月 19 日,公司完成 2021 年股权激 励计划及 2022 年股权激励计划 82,673 股 ...

广和通(300638) - 关于境外上市外资股(H股)挂牌并上市交易的公告

2025-10-22 10:40

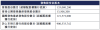

证券代码:300638 证券简称:广和通 公告编号:2025-071 深圳市广和通无线股份有限公司 关于境外上市外资股(H 股)挂牌并上市交易的公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚假 记载、误导性陈述或重大遗漏。 深圳市广和通无线股份有限公司(以下简称"公司")正在进行发行境外上 市外资股(H 股)并在香港联合交易所有限公司(以下简称"香港联交所")主 板挂牌上市(以下简称"本次发行上市")的相关工作。 二О二五年十月二十二日 经香港联交所批准,公司本次发行的 135,080,200 股 H 股股票(行使超额配 售权之前)于 2025 年 10 月 22 日在香港联交所主板挂牌并上市交易。公司 H 股 股票中文简称"廣和通",英文简称"FIBOCOM",股票代码"0638"。 本次发行上市完成后,公司持股 5%以上的股东及其一致行动人持股变动情 况如下: | | 本次发行上市前 | 假设超额配售选择权 | | 本次发行上市日后 | | | | --- | --- | --- | --- | --- | --- | --- | | 股东 名称 | | | | | 假设超额配售选 ...

广和通上市预冷:首日下跌12%,公司市值171亿港元,上半年利润降31%,勤道赣通浮亏5860万

3 6 Ke· 2025-10-22 09:37

Core Viewpoint - Guanghetong Wireless Co., Ltd. has successfully listed on the Hong Kong Stock Exchange, raising approximately HKD 2.911 billion, but its stock performance has been disappointing, closing down 11.72% from the issue price on the first day of trading [1][2]. Fundraising and Investor Participation - Guanghetong issued about 135 million H-shares at an offer price of HKD 21.5, with net proceeds of approximately HKD 2.811 billion after deducting issuance costs of HKD 93.6 million [1]. - Key cornerstone investors include Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), and others, collectively subscribing for HKD 1.26 billion [2]. Stock Performance - The stock opened at HKD 21.5 but closed at HKD 18.98, resulting in a market capitalization of HKD 17.092 billion, which is significantly lower than its A-share market cap of RMB 21 billion [2]. Financial Performance - For the first half of the year, Guanghetong reported revenue of RMB 2.48 billion, with a profit decline of 31% year-on-year [3][8]. - Revenue projections for 2022, 2023, and 2024 are RMB 5.2 billion, RMB 5.65 billion, and RMB 6.97 billion, respectively, with corresponding gross profits of RMB 1.066 billion, RMB 1.187 billion, and RMB 1.267 billion [6][7]. Business Overview - Guanghetong specializes in wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules, with applications in automotive electronics, smart homes, consumer electronics, and smart retail [5]. - The company has acquired 100% of Shenzhen Ruiling to expand its presence in the overseas automotive market, but plans to divest this business by July 2024 due to challenging international market conditions [5]. Shareholding Structure - As of June 30, 2025, Zhang Tianyu holds a 36.78% stake in the company, while other significant shareholders include Ying Lingpeng and New Yu Guanghe Chuanghong Investment Partnership [12][18].

广和通募29亿港元首日破发跌12% 广发基金管理等浮亏

Zhong Guo Jing Ji Wang· 2025-10-22 08:57

Core Viewpoint - Guanghetong Wireless Co., Ltd. (stock codes: 300638.SZ, 00638.HK) was listed on the Hong Kong Stock Exchange, closing at HKD 18.98, down 11.72% from its issue price, with an intraday low of HKD 18.89 [1] Summary by Sections Share Issuance and Capital Structure - The total number of shares issued under the global offering was 135,080,200 H-shares, with 13,508,200 shares for the Hong Kong public offering and 121,572,000 shares for international offering [2] - The number of shares issued at listing (before the exercise of the over-allotment option) was 900,533,742 [2] Key Investors - The cornerstone investors included Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), GF Fund Management, GF International, Ruihua Investment, Zhidu Investment, Zhang Xiaolei, Guotai Junan Securities Investment, and Junyi Hong Kong Fund [5] Pricing and Proceeds - The final offer price was HKD 21.50, with total proceeds amounting to HKD 2,904.2 million, and net proceeds after estimated listing expenses of HKD 93.6 million were HKD 2,810.6 million [7] - Approximately 55% of the net proceeds are expected to be allocated for R&D, particularly in AI and robotics technology innovation and product development [7] Use of Proceeds - About 15% of the net proceeds is planned for building manufacturing facilities in Shenzhen, China, primarily for module products [7] - 10% of the net proceeds is expected to be used for repaying certain interest-bearing bank loans [7] - Another 10% is anticipated for strategic investments and/or acquisitions, focusing on companies in wireless communication, AI, robotics, and other complementary fields [7] - The remaining 10% is expected to be used for working capital and other general corporate purposes [7] Company Overview - Guanghetong is a provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules [8] - The company provides customized solutions based on its module products, including edge AI solutions, robotic solutions, and other applications [8]