PING AN OF CHINA(PNGAY)

Search documents

高盛:上调中国平安目标价至64港元维持“买入”评级

Xin Lang Cai Jing· 2025-10-30 04:33

Core Viewpoint - Goldman Sachs has slightly raised the target price for Ping An Insurance (02318) H-shares by 1.6%, from HKD 63 to HKD 64, while also adjusting the target price for its A-shares, maintaining a "Buy" rating for both [1] Group 1: Earnings Forecast - Goldman Sachs updated its forecasts for Ping An to reflect the performance in Q3 2025 and the latest investment market trends [1] - The net profit expectations for the fiscal years 2025-2027 have been increased by 3-19% [1] Group 2: Q3 Performance Highlights - Ping An's Q3 performance was better than both Goldman Sachs' and market expectations, indicating significant growth in stock investment income [1] - Strong momentum in new policy sales was observed [1] - A substantial reduction in losses from the asset management business was reported [1] - Goldman Sachs anticipates a positive market reaction to Ping An's stock price following these results [1]

高盛:上调中国平安目标价至64港元 维持“买入”评级

Zhi Tong Cai Jing· 2025-10-30 03:08

Core Viewpoint - Goldman Sachs has slightly raised the target price for Ping An Insurance (601318) H-shares by 1.6%, from HKD 63 to HKD 64, while maintaining a "Buy" rating for both H-shares and A-shares [1] Group 1: Earnings Forecast Adjustments - Goldman Sachs updated its forecasts for Ping An to reflect the performance in Q3 2025 and the latest investment market trends [1] - The net profit expectations for the fiscal years 2025-2027 have been increased by 3-19%, which corresponds to a 2-3% upward adjustment in the forecast for shareholder equity at the group level [1] - The premium forecasts for the fiscal years 2025-2027 have been raised by 5-9%, along with a similar increase of 5-9% in the expected value of new business (VONB) for the same period [1] Group 2: Q3 Performance Highlights - Ping An's Q3 performance exceeded both Goldman Sachs' and market expectations, indicating significant growth in stock investment returns [1] - The sales momentum for new policies remains strong, contributing positively to the overall performance [1] - Losses in the asset management business have significantly decreased, further enhancing the company's financial outlook [1] - The after-tax operating profit (OPAT) for Q3 increased by 9% year-on-year to RMB 38.5 billion, with life insurance profits surpassing expectations and strong growth in sales and new business value [1]

高盛:上调中国平安(02318)目标价至64港元 维持“买入”评级

智通财经网· 2025-10-30 03:08

Core Viewpoint - Goldman Sachs has slightly raised the target price for Ping An Insurance (02318) H-shares by 1.6%, from HKD 63 to HKD 64, while maintaining a "Buy" rating for both H-shares and A-shares [1] Group 1: Earnings Forecast Adjustments - Goldman Sachs updated its profit forecasts for Ping An to reflect the performance in Q3 2025, increasing net profit expectations for FY2025-2027 by 3-19%, which translates to a 2-3% increase in shareholder equity predictions for the same period [1] - The premium forecasts for FY2025-2027 have been raised by 5-9%, alongside a similar increase of 5-9% in the expected value of new business (VONB) for the same fiscal years [1] Group 2: Q3 Performance Highlights - Ping An's Q3 performance exceeded both Goldman Sachs' and market expectations, driven by significant growth in stock investment returns, strong momentum in new policy sales, and a substantial reduction in asset management losses [1] - The after-tax operating profit (OPAT) for Q3 increased by 9% year-on-year to RMB 38.5 billion, with life insurance profits surpassing expectations and a strong growth trend in sales and new business value [1]

中国平安H股涨超4%,创逾4年新高,前三季度寿险新业务价值强劲增长46.2%

Ge Long Hui A P P· 2025-10-30 02:52

Core Viewpoint - China Ping An (2318.HK) shows strong performance in the Hong Kong stock market, with a significant increase in share price, reaching a new high since July 2021, driven by robust operational profit growth and strong life insurance performance [1] Financial Performance - For the first three quarters of 2025, the group achieved an operating profit attributable to shareholders of 116.264 billion yuan, a year-on-year increase of 7.2%, with a 15.2% growth in the third quarter [1] - The net profit attributable to shareholders for the same period was 132.856 billion yuan, reflecting an 11.5% year-on-year growth, with a substantial 45.4% increase in the third quarter [1] - As of September 30, 2025, the group's net assets attributable to shareholders stood at 986.406 billion yuan, showing a 6.2% increase after dividends, indicating resilience in the balance sheet and sustainable profitability [1] - The total operating revenue for the first three quarters was 833.94 billion yuan, representing a 7.4% year-on-year growth [1] Life Insurance Business - The new business value for life and health insurance saw a strong growth of 46.2% in the first three quarters [2] - The average new business value per agent increased by 29.9% year-on-year [2] - The new business value from the bancassurance channel surged by 170.9% year-on-year [2] Investment Performance - The investment performance of insurance funds significantly improved, with a non-annualized comprehensive investment return rate of 5.4% for the first three quarters, up by 1.0 percentage points year-on-year [2]

机构眼中的“资产明珠”,中国平安(601318.SH/2318.HK)三季报再度起舞

Ge Long Hui· 2025-10-29 10:19

Core Insights - The Chinese capital market is showing a clear upward trend, with the Shanghai Composite Index hovering around the 4000-point mark, reaching a nearly ten-year high [1] - Goldman Sachs predicts a "slow bull" market for Chinese stocks, forecasting a potential 30% increase in the MSCI China Index over the next two years [1] - Investors are focusing on core assets that can benefit from market uptrends while maintaining fundamental resilience [1] Company Performance - China Ping An's Q3 2025 report shows a significant increase in operational profit to 116.26 billion yuan, up 7.2% year-on-year, and a net profit of 132.86 billion yuan, up 11.5% [2] - The third quarter saw a remarkable 45.4% year-on-year growth in net profit, leading to positive market reactions and a rise in stock price [2] Core Business Strength - The insurance sector remains a solid foundation for China Ping An, demonstrating resilience through channel restructuring and operational efficiency improvements [6] - New business value in life and health insurance surged by 46.2% year-on-year, indicating strong growth momentum [6][10] - The agent channel has seen a significant quality improvement, with new business value per agent increasing by 29.9% [8] Financial Ecosystem Synergy - The integration of "comprehensive finance + medical and elderly care" is enhancing long-term competitive advantages for China Ping An [11] - The company has effectively utilized customer data to match needs, leading to increased customer retention and cross-selling opportunities [13] - The medical and elderly care ecosystem has generated substantial direct and indirect value, contributing to differentiated competition in insurance products [14] Market Dynamics - The current market environment presents valuation attractiveness for China Ping An, with several institutions maintaining "buy" ratings and optimistic price targets [19] - The company's stable cash dividend policy and high dividend yield are increasingly appealing to investors seeking reliable returns [21] Technological Empowerment - AI technology is being integrated into various aspects of China Ping An's operations, enhancing efficiency, cost management, service quality, and risk prevention [22] - The use of AI in recruitment, training, and personalized sales support is driving business growth and improving investment decision-making [22] Investment Outlook - China Ping An's growth logic is robust, supported by its solid foundation in comprehensive finance, strategic depth in the medical and elderly care ecosystem, and strong technological capabilities [23] - Understanding the multiple drivers of value release is crucial for investors looking to capitalize on future opportunities with China Ping An [24]

机构眼中的“资产明珠”,中国平安三季报再度起舞

Ge Long Hui· 2025-10-29 09:45

Core Viewpoint - The Chinese capital market is showing a clear upward trend, with the Shanghai Composite Index hovering around the 4000-point mark, reaching a nearly ten-year high. Goldman Sachs predicts a "slow bull" market for Chinese stocks, with the MSCI China Index expected to rise by 30% over the next two years [1][2]. Group 1: Company Performance - China Ping An reported a significant increase in operational profit for the first three quarters of 2025, reaching 116.26 billion yuan, a year-on-year growth of 7.2%. The net profit attributable to shareholders was 132.86 billion yuan, up 11.5%, with a substantial quarterly increase of 45.4% [1][2]. - The company's equity attributable to shareholders reached 986.41 billion yuan as of September 30, 2025, reflecting a 6.2% increase from the beginning of the year [1]. Group 2: Business Segments - The insurance sector remains a strong foundation for China Ping An, with life and health insurance new business value growing by 46.2% year-on-year, accelerating from a mid-year growth rate of 39.8% [4][5]. - The agent channel has seen a significant improvement, with new business value per agent increasing by 29.9% year-on-year, and the overall new business value from this channel growing by 23.3% [7]. - The bancassurance channel has emerged as a key growth driver, with new business value soaring by 170.9% year-on-year, benefiting from strategic partnerships with major banks [7][9]. Group 3: Strategic Initiatives - The integration of comprehensive finance and healthcare services is enhancing customer engagement and operational efficiency, with operational profit for the first three quarters reaching 116.26 billion yuan, a 7.2% increase [10][12]. - The healthcare and elderly care services have expanded significantly, with nearly 127 billion yuan in health insurance premiums and a 58% increase in sales of pension insurance products that include home care services [13][12]. Group 4: Market Dynamics - The current market environment is characterized by a focus on stable cash returns, making Ping An's consistent dividend policy and high dividend yield attractive to investors [20]. - The company's valuation is appealing, with several institutions maintaining "buy" ratings and projecting significant potential upside based on strong core indicators [18][22]. Group 5: Technological Integration - The integration of AI technology is reshaping Ping An's business model, enhancing efficiency, cost management, service quality, and risk prevention [21]. - AI is being utilized across various functions, including agent recruitment, training, and personalized sales support, contributing to business growth and improved customer experience [21].

中国平安(601318):增配权益带动业绩超预期,NBV增速进一步扩张

KAIYUAN SECURITIES· 2025-10-29 09:12

Investment Rating - The investment rating for Ping An Insurance (601318.SH) is maintained as "Buy" [1] Core Insights - The group's operating profit for the first three quarters of 2025 reached 116.3 billion yuan, a year-on-year increase of 7.2%, significantly improving from the 3.7% growth in the first half of 2025, primarily driven by improvements in asset management and property insurance segments [4] - The net profit attributable to shareholders for the same period was 132.9 billion yuan, up 11.5% year-on-year, with a substantial increase of 45.4% in the third quarter, driven by high investment returns [4] - The new business value (NBV) for individual insurance reached 35.7 billion yuan, a year-on-year increase of 46.2%, indicating strong growth in the insurance sector [5] - The company has adjusted its net profit forecasts for 2025-2027 to 138.9 billion, 151.2 billion, and 168.0 billion yuan respectively, reflecting a positive outlook for future performance [4] Financial Performance Summary - For the first three quarters of 2025, the insurance service revenue was 253.4 billion yuan, a year-on-year increase of 3.0%, with a combined cost ratio of 97.0%, showing a year-on-year improvement of 0.8 percentage points [6] - The total investment income for the insurance fund portfolio was 5.4%, an increase of 1.0 percentage points year-on-year, indicating a solid investment performance [6] - The NBV margin improved to 30.6%, up 9.0 percentage points year-on-year, driven by a reduction in the preset interest rate and optimization of product structure [5] Valuation Metrics - The projected new business value for 2025 is 38.7 billion yuan, with a year-on-year growth of 35.5% [7] - The estimated net profit for 2025 is 138.9 billion yuan, reflecting a year-on-year increase of 9.7% [7] - The price-to-earnings (P/E) ratio for 2025 is projected at 7.57, indicating a favorable valuation compared to historical levels [7]

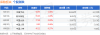

保险板块10月29日涨0.92%,中国平安领涨,主力资金净流出5.05亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Insights - The insurance sector experienced a rise of 0.92% on October 29, with China Ping An leading the gains [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Insurance Sector Performance - China Ping An (601318) closed at 58.95, with a gain of 2.06% and a trading volume of 1.0444 million shares, amounting to a transaction value of 6.172 billion [1] - New China Life Insurance (601336) closed at 70.05, up 1.49%, with a trading volume of 169,100 shares [1] - China Pacific Insurance (601601) closed at 37.60, up 0.80%, with a trading volume of 590,700 shares [1] - China Life Insurance (601628) closed at 45.22, up 0.27%, with a trading volume of 175,700 shares [1] - China Reinsurance (601319) closed at 8.83, up 0.46%, with a trading volume of 589,300 shares [1] Fund Flow Analysis - The insurance sector saw a net outflow of 505 million from institutional investors, while retail investors contributed a net inflow of 434 million [1] - Among individual stocks, New China Life Insurance had a net inflow of 27.46 million from institutional investors, while China Ping An experienced a net outflow of 306 million [2] - China Life Insurance saw a net inflow of 19.49 million from retail investors, despite a net outflow of 51.38 million from institutional investors [2]

中国平安(601318):2025年三季报点评:投资驱动,增速转正

Huachuang Securities· 2025-10-29 07:31

Investment Rating - The report maintains a "Strong Buy" rating for Ping An Insurance (601318) with a target price of 74.3 CNY [1][6]. Core Insights - In Q1-Q3 2025, the group achieved a net profit attributable to shareholders of 132.9 billion CNY, a year-on-year increase of 11.5%, and an operating profit of 116.3 billion CNY, up 7.2% year-on-year [1]. - The new business value (NBV) for life insurance increased by 46.2% year-on-year to 35.7 billion CNY, indicating strong growth in new business [1]. - The combined ratio (COR) for property insurance improved by 0.8 percentage points to 97%, reflecting better cost management and a decrease in natural disaster impacts [1]. - The non-annualized net investment return rate was 2.8%, down 0.3 percentage points year-on-year, while the comprehensive investment return rate rose to 5.4%, an increase of 1 percentage point year-on-year [1]. Financial Performance Summary - For Q1-Q3 2025, the life insurance segment's new business premium (NBP) grew by 2.3% year-on-year to 141.8 billion CNY, marking a return to positive growth [1]. - The bank insurance channel saw a remarkable increase of 170.9% in NBV, driven by the expansion of external cooperation networks and product upgrades [1]. - The overall property insurance segment reported a premium income of 256.2 billion CNY, with non-auto insurance premiums growing by 14.3% [1]. - The investment portfolio size exceeded 6.41 trillion CNY, reflecting an 11.9% increase since the beginning of the year [1]. Earnings Forecast - The report adjusts the EPS forecast for 2025-2027 to 8.0, 8.8, and 9.5 CNY respectively, up from previous estimates of 7.1, 8.2, and 9.1 CNY [1][7]. - The projected net profit for 2025 is 145.1 billion CNY, representing a year-on-year growth of 14.6% [7].

2025广东企业500强出炉:中国平安、华润、华为位居前三

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 06:01

Core Insights - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1] - The total operating revenue of the top 500 enterprises reached 19.36 trillion yuan, with total assets exceeding 68 trillion yuan and total R&D investment amounting to 584.96 billion yuan [1][3] Revenue Growth - The total revenue of Guangdong's top 500 enterprises has increased from 16.73 trillion yuan in 2021 to 19.36 trillion yuan in 2025, marking a historical high with a growth rate of 3.36% in 2025, a significant rebound from 0.37% in 2024 [3][5] - The revenue growth reflects the resilience and innovative vitality of these enterprises amid complex international situations and domestic reform challenges [3] Asset Expansion - The total assets of Guangdong's top 500 enterprises grew from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5] - This growth indicates a continuous strengthening of the comprehensive strength of these enterprises [5] R&D Investment - The total R&D expenditure of Guangdong's top 500 enterprises is projected to reach 584.96 billion yuan by 2025, with a focus on basic research and key core technology areas [5] - The knowledge-intensive sectors, particularly scientific research and technical services, show a high R&D intensity of 19.00%, with R&D expenses amounting to 191.65 billion yuan [6] Tax Contributions - Despite the growth in assets and revenue, the total tax contributions of these enterprises have steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [6] Regional Coordination - The report highlights a significant disparity in the distribution of enterprises, with 98.25% of revenue and 98.91% of net profit concentrated in the Pearl River Delta region, while other regions like East Guangdong and West Guangdong have less than 0.3% [8][10] - To address this imbalance, the report suggests establishing a regional collaborative system that combines innovation radiation from the Pearl River Delta with the unique characteristics of East and West Guangdong [10]