机器人概念

Search documents

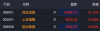

希荻微涨2.09%,成交额6608.67万元,主力资金净流入220.39万元

Xin Lang Cai Jing· 2025-10-28 03:27

Core Points - The stock price of Xidi Microelectronics increased by 2.09% on October 28, reaching 16.15 CNY per share, with a total market capitalization of 6.638 billion CNY [1] - The company has seen a year-to-date stock price increase of 45.76% and a recent five-day increase of 5.28% [1] Company Overview - Xidi Microelectronics, established on September 11, 2012, and listed on January 21, 2022, is a leading semiconductor and integrated circuit design company in China [1] - The company's main business includes the research, design, and sales of analog integrated circuit products, including power management chips and signal chain chips [1] - Key products include DC/DC chips, super-fast charging chips, lithium battery fast charging chips, port protection, and signal switching chips, primarily used in smartphones, laptops, and wearable devices [1] Financial Performance - For the first half of 2025, Xidi Microelectronics achieved a revenue of 466 million CNY, representing a year-on-year growth of 102.73% [2] - The company reported a net profit attributable to shareholders of -44.688 million CNY, showing a year-on-year increase of 61.98% [2] Shareholder Information - As of June 30, 2025, the number of shareholders increased by 16.22% to 14,200, with an average of 16,873 circulating shares per person, a decrease of 13.95% [2] - Hong Kong Central Clearing Limited is the ninth largest circulating shareholder, holding 2.9713 million shares as a new shareholder [2]

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

精工科技涨2.00%,成交额1.99亿元,主力资金净流入622.96万元

Xin Lang Zheng Quan· 2025-10-28 03:09

Core Viewpoint - Jinggong Technology's stock price has shown significant fluctuations in 2023, with a year-to-date increase of 27.65% and a recent drop of 7.33% over the past 20 days [2] Group 1: Stock Performance - As of October 28, Jinggong Technology's stock price rose by 2.00% to 20.87 CNY per share, with a trading volume of 199 million CNY and a turnover rate of 1.84%, resulting in a total market capitalization of 10.848 billion CNY [1] - The stock has experienced a 4.35% increase over the last five trading days and a 24.75% increase over the last 60 days [2] Group 2: Financial Performance - For the first half of 2025, Jinggong Technology reported a revenue of 1.061 billion CNY, reflecting a year-on-year growth of 10.31%, and a net profit attributable to shareholders of 113 million CNY, which is a 15.55% increase year-on-year [2] - The company has distributed a total of 313 million CNY in dividends since its A-share listing, with 236 million CNY distributed over the last three years [3] Group 3: Business Overview - Jinggong Technology, established in September 2000 and listed in June 2004, specializes in high-tech products including carbon fiber and composite material equipment, robotics, solar photovoltaic equipment, and energy-saving construction equipment [2] - The company's revenue composition includes carbon fiber equipment (59.31%), light textile equipment (17.38%), construction materials equipment (10.11%), polyester recycling equipment (5.75%), precision processing (4.18%), and other segments (3.26%) [2] Group 4: Shareholder Information - As of June 30, 2025, the number of shareholders for Jinggong Technology reached 59,400, an increase of 27.92% from the previous period, with an average of 8,751 circulating shares per shareholder, a decrease of 10.72% [2] - Among the top ten circulating shareholders, the Southern CSI 1000 ETF holds 3.3688 million shares, an increase of 651,100 shares compared to the previous period [3]

东阳光涨2.04%,成交额6.39亿元,主力资金净流入2190.43万元

Xin Lang Cai Jing· 2025-10-28 03:03

Core Viewpoint - Dongyangguang's stock price has shown significant volatility and growth, with a year-to-date increase of 99.29% and a recent trading volume indicating strong market interest [1][2]. Group 1: Stock Performance - As of October 28, Dongyangguang's stock price rose by 2.04% to 22.50 CNY per share, with a trading volume of 639 million CNY and a market capitalization of 67.715 billion CNY [1]. - The stock has experienced a 99.29% increase year-to-date, an 8.28% rise in the last five trading days, a 10.07% decline over the last 20 days, and a 56.58% increase over the last 60 days [1]. - Dongyangguang has appeared on the "龙虎榜" three times this year, with the most recent appearance on September 11, where it recorded a net purchase of 61.529 million CNY [1]. Group 2: Company Overview - Dongyangguang, established on October 24, 1996, and listed on September 17, 1993, is located in Dongguan, Guangdong Province, and operates in four main business segments: electronic new materials, alloy materials, chemical products, and pharmaceutical manufacturing [2]. - The revenue composition of Dongyangguang includes high-end aluminum foil (40.81%), new chemical materials (27.63%), electronic components (25.40%), and other categories [2]. - As of September 30, the number of shareholders increased by 83.12% to 85,400, with an average of 35,128 circulating shares per person, a decrease of 45.39% [2]. Group 3: Financial Performance - For the period from January to September 2025, Dongyangguang reported a revenue of 10.970 billion CNY, reflecting a year-on-year growth of 23.56%, and a net profit attributable to shareholders of 906 million CNY, marking a substantial increase of 189.80% [2]. - The company has distributed a total of 2.395 billion CNY in dividends since its A-share listing, with 998 million CNY distributed over the past three years [3]. Group 4: Shareholding Structure - As of September 30, 2025, Hong Kong Central Clearing Limited is the eighth largest circulating shareholder, holding 48.7912 million shares, an increase of 11.4531 million shares from the previous period [3]. - The tenth largest circulating shareholder, 博时汇兴回报一年持有期混合 (011056), holds 24.1315 million shares, a decrease of 21.7854 million shares from the previous period [3].

依顿电子涨2.05%,成交额1.27亿元,主力资金净流出1013.03万元

Xin Lang Cai Jing· 2025-10-28 03:01

Core Insights - The stock price of Yidun Electronics increased by 2.05% to 11.97 CNY per share, with a market capitalization of 11.951 billion CNY as of October 28 [1] - The company has seen a year-to-date stock price increase of 23.89% and a recent five-day increase of 9.32% [1] Financial Performance - For the first half of 2025, Yidun Electronics reported a revenue of 2.035 billion CNY, representing a year-on-year growth of 16.05% [2] - The net profit attributable to shareholders for the same period was 261 million CNY, showing a slight increase of 0.14% year-on-year [2] Shareholder Information - As of June 30, 2025, the number of shareholders increased to 42,300, with an average of 23,600 circulating shares per shareholder, a decrease of 1.15% [2] - The company has distributed a total of 4.561 billion CNY in dividends since its A-share listing, with 538 million CNY distributed over the past three years [3] Institutional Holdings - As of June 30, 2025, Hong Kong Central Clearing Limited was the fourth-largest circulating shareholder, holding 7.2472 million shares, an increase of 396,400 shares from the previous period [3] - Southern CSI 1000 ETF and Huaxia CSI 1000 ETF were also among the top ten circulating shareholders, with increases in their holdings [3]

国安达涨2.08%,成交额2841.80万元,主力资金净流出56.97万元

Xin Lang Cai Jing· 2025-10-28 02:12

Core Points - The stock price of Guoanda increased by 2.08% on October 28, reaching 21.09 CNY per share, with a total market capitalization of 3.834 billion CNY [1] - Year-to-date, Guoanda's stock price has decreased by 7.82%, while it has seen a 3.28% increase over the last five trading days [1] - The company has reported a net profit of 2.0825 million CNY for the first nine months of 2025, reflecting a year-on-year growth of 127.30% [2] Financial Performance - For the period from January to September 2025, Guoanda achieved an operating revenue of 207 million CNY, which is a 5.45% increase compared to the previous year [2] - The company has distributed a total of 129 million CNY in dividends since its A-share listing, with 52.25 million CNY distributed over the last three years [3] Shareholder Information - As of September 30, Guoanda had 14,900 shareholders, a decrease of 2.47% from the previous period, while the average number of circulating shares per shareholder increased by 2.54% to 8,157 shares [2] Business Overview - Guoanda, established on January 10, 2008, specializes in the research, production, and sales of automatic fire extinguishing devices and other safety emergency products, with 93.70% of its revenue coming from these products [1] - The company is categorized under the machinery equipment industry, specifically in specialized equipment, and is associated with concepts such as small-cap, low-altitude economy, robotics, and drones [1]

A股震荡走高,农业银行总市值逼近3万亿大关,中际旭创续创新高,国债大涨,人民币中间价创近一年高位

Hua Er Jie Jian Wen· 2025-10-28 02:04

Market Overview - A-shares opened lower with the three major indices experiencing fluctuations and declines, particularly in technology stocks, storage chips, and copper-clad laminate concepts [1][12] - The Hang Seng Index opened higher but turned negative, with mixed performance in tech stocks and declines in Apple-related stocks [2][3] - The bond market saw a collective rebound in government bond futures, with the 30-year main contract rising by 0.56% [3][4] A-shares Performance - As of the report, the Shanghai Composite Index fell by 0.18% to 3989.66, while the Shenzhen Component Index decreased by 0.09% to 13477.57, and the ChiNext Index rose by 0.16% to 3239.53 [1][12] - The technology sector faced a general pullback, with significant declines in storage chips and copper-clad laminate concepts, and a notable drop of nearly 6% in Shenghong Technology post-earnings [12][13] Hong Kong Market Performance - The Hang Seng Index decreased by 0.30% to 26353.17, and the Hang Seng Tech Index fell by 0.42% to 6145.14 [2][3] - The performance of Chinese tech stocks was mixed, with some stocks like Xiaopeng Motors rising over 4% [16] Commodity Market - Domestic commodity futures mostly rose, with polysilicon and lithium carbonate increasing by over 2%, while other commodities like rapeseed, glass, and iron ore also saw gains [4][5] - Precious metals experienced declines, with gold and silver dropping over 2% [5][16] CPO Concept Stocks - CPO concept stocks showed a rebound, with Zhongji Xuchuang rising nearly 4% to reach a historical high, and Lian Te Technology increasing by over 10% [6][7] Banking Sector - The banking sector exhibited mixed trends, with Agricultural Bank of China rising over 1% to approach a market capitalization of 3 trillion, while other banks like Shanghai Pudong Development Bank fell over 4% [8][9] Robotics and Software Concepts - Robotics stocks surged, with Nanjing Julong increasing over 12%, while the domestic software sector saw stocks like Rongji Software hitting the daily limit [10][12]

机器人概念震荡拉升 南京聚隆涨超12%

Mei Ri Jing Ji Xin Wen· 2025-10-28 01:56

Group 1 - The robotics sector experienced significant fluctuations, with notable gains in several companies [1] - Nanjing Julong saw an increase of over 12% [1] - Yongmaotai previously hit the daily limit up, while Qingdao Double Star achieved three consecutive trading limits [1] Group 2 - Other companies such as Dayang Electric, Sanhua Intelligent Control, and Xinhang New Materials also showed upward trends [1]

迈赫股份(301199.SZ):2025年三季报净利润为9841.56万元

Xin Lang Cai Jing· 2025-10-28 01:29

公司营业总收入为8.57亿元,较去年同报告期营业总收入减少4299.72万元,同比较去年同期下降4.78%。归母净利润为9841.56万元。经营活动现金净流入 为-241.65万元,较去年同报告期经营活动现金净流入减少8565.43万元,同比较去年同期下降102.90%。 2025年10月28日,迈赫股份(301199.SZ)发布2025年三季报。 公司摊薄每股收益为0.53元。 公司最新总资产周转率为0.28次,较去年同期总资产周转率减少0.01次,同比较去年同期下降2.80%。最新存货周转率为0.61次,较去年同期存货周转率减少 0.04次,同比较去年同期下降5.63%。 公司股东户数为1.37万户,前十大股东持股数量为1.39亿股,占总股本比例为74.24%,前十大股东持股情况如下: | 序号 | 股东名称 | 持股 | | --- | --- | --- | | l | 山东迈赫投资有限公司 | 57.3 | | 2 | 潍坊赫力投资中心(有限合伙) | 6.00 | | 3 | 徐烟田 | 5.62 | | 4 | 王绪平 | 2.57 | | 5 | 兴业银行股份有限公司-华夏中证机器人交易型开放 ...

机构风向标 | 亚威股份(002559)2025年三季度已披露持仓机构仅6家

Xin Lang Cai Jing· 2025-10-28 01:29

Core Insights - The report indicates that as of October 27, 2025, institutional investors hold a total of 70.4621 million shares of Yawen Co., accounting for 12.82% of the total share capital, reflecting a 0.39 percentage point increase from the previous quarter [1] Institutional Holdings - Six institutional investors have disclosed their holdings in Yawen Co., including Jiangsu Yawen Technology Investment Co., Industrial Bank Co. - Huaxia CSI Robot ETF, Guotai Junan Securities - Tianhong CSI Robot ETF, Yangzhou Venture Capital Co., Hong Kong Central Clearing Limited, and China Merchants Bank - China Europe CSI Robot Index Fund [1] - The total institutional holding percentage has increased by 0.39 percentage points compared to the last quarter [1] Public Fund Holdings - Three public funds have increased their holdings this period, including Huaxia CSI Robot ETF, Tianhong CSI Robot ETF, and China Europe CSI Robot Index Fund A, with an increase in holding percentage of 0.72% [1] - A total of 31 public funds that were not disclosed in the previous quarter include Guotai CSI Machine Tool ETF, Jiashi CSI Robot ETF, Southern CSI Robot ETF, China Merchants CSI Robot ETF, and Wanjia CSI Robot ETF [1]