GPU

Search documents

北京利尔涨2.03%,成交额6050.11万元,主力资金净流入38.38万元

Xin Lang Cai Jing· 2025-10-24 03:17

Core Viewpoint - Beijing Lier has shown significant stock performance with a year-to-date increase of 93.26%, despite a recent decline over the past 20 days [1][2]. Financial Performance - For the period from January to September 2025, Beijing Lier achieved a revenue of 5.446 billion yuan, representing a year-on-year growth of 9.16% [2]. - The net profit attributable to shareholders for the same period was 348 million yuan, reflecting a year-on-year increase of 12.28% [2]. Stock Market Activity - As of October 24, the stock price of Beijing Lier was 9.06 yuan per share, with a trading volume of 60.51 million yuan and a turnover rate of 0.59% [1]. - The company has appeared on the "Dragon and Tiger List" twice this year, with the most recent instance on October 16, where it recorded a net buy of -121 million yuan [1]. Shareholder Information - As of September 30, the number of shareholders for Beijing Lier was 43,200, an increase of 2.40% from the previous period [2]. - The average circulating shares per shareholder decreased by 2.35% to 26,461 shares [2]. Business Overview - Beijing Lier specializes in the production and sales of industrial refractory materials, with its main business segments being overall contracting of refractory materials (61.89%), direct sales (27.40%), and refractory material direct sales (10.71%) [2]. - The company operates in the building materials sector, specifically in the refractory materials sub-industry, and is involved in various concept sectors including energy conservation and new materials [2]. Dividend Information - Since its A-share listing, Beijing Lier has distributed a total of 445 million yuan in dividends, with 154 million yuan distributed over the past three years [3].

开盘:上证指数涨0.17% 存储芯片概念再度起势

Di Yi Cai Jing· 2025-10-24 02:10

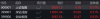

Core Points - The three major stock indices opened higher, with the Shanghai Composite Index starting at 3929.12 points, up 0.17%, the Shenzhen Component Index at 13091.34 points, up 0.51%, and the ChiNext Index at 3087.63 points, up 0.83% [1] Industry Summary - Samsung and SK Hynix both raised prices by 30%, leading to a resurgence in the memory chip sector [1] - The commercial aerospace, quantum technology, and GPU sectors saw significant gains [1] - The short video, lab-grown diamond, and coal sectors experienced slight declines [1]

开评:三大指数集体高开 量子技术等板块涨幅居前

Zheng Quan Shi Bao Wang· 2025-10-24 01:43

Core Viewpoint - The A-share market opened higher with all three major indices showing positive growth, indicating a bullish sentiment among investors [1] Market Performance - The Shanghai Composite Index increased by 0.17% - The Shenzhen Component Index rose by 0.51% - The ChiNext Index saw a gain of 0.83% [1] Sector Performance - Leading sectors with significant gains included quantum technology, memory storage, GPU, commercial aerospace, and satellite internet concepts - Sectors that experienced declines included gas, cultivated diamonds, and coal mining [1]

滚动更新丨A股三大指数集体高开,量子科技概念延续强势

Di Yi Cai Jing· 2025-10-24 01:36

Group 1 - The storage chip concept is gaining momentum again, with Samsung and SK Hynix both raising prices by 30%, leading to a resurgence in related stocks [3][1] - The commercial aerospace, quantum technology, and GPU concepts are among the top gainers in the market [1] - The Hong Kong stock market saw a significant rise, with Kanda Foods surging 163.16% after a major acquisition [4] Group 2 - The A-share market opened with all three major indices rising: the Shanghai Composite Index up 0.17%, the Shenzhen Component Index up 0.51%, and the ChiNext Index up 0.83% [2][3] - The Hang Seng Index opened up 0.81%, with the Hang Seng Tech Index increasing by 1.36%, indicating a continued rebound in tech stocks [4][5] - The central bank conducted a 168 billion yuan reverse repurchase operation with a rate of 1.40%, indicating ongoing liquidity management [5]

X @ZKsync

ZKsync (∎, ∆)· 2025-10-23 23:04

Technology Breakthrough - Airbender is the world's fastest open-source RISC-V proof system [1] - Airbender's performance allows for what previously required a large GPU cluster to be done with a single GPU [1] Industry Impact - Airbender represents a major breakthrough that paves the path for home-proving Ethereum [1]

Inside the AI Factory: How DDN Powers Scalable Data Intelligence

DDN· 2025-10-23 15:58

You need the GPU side of it which is the processing of information and then you need the data side of it a massively scalable highly efficient very power efficient data intelligence platform. So DDN has written a few million lines of code which addresses that problem. DDN has written another few million lines of code that addresses database capabilities.the acceleration of the analytics layer above the GPU side data orchestration. So it's the combination of the DDN technologies which addresses the requireme ...

三年亏损30亿元,上半年研发人员减少,上市能否救沐曦股份?

Sou Hu Cai Jing· 2025-10-23 07:27

Core Viewpoint - Muxi Integrated Circuit (Shanghai) Co., Ltd. is preparing for its IPO on the Sci-Tech Innovation Board, with significant attention on its potential in the rapidly growing GPU market driven by AI and other technologies [1][3][5]. Company Overview - Founded in 2020, Muxi is recognized as one of the "four small dragons" in the domestic GPU chip sector, with its IPO application accepted on June 30, 2025 [3]. - The company has completed the second round of inquiries from the Shanghai Stock Exchange and submitted its prospectus [3]. Market Context - The global GPU market is projected to grow from $77.39 billion in 2024 to $472.45 billion by 2030, with a compound annual growth rate (CAGR) of 35.19% from 2024 to 2030 [5]. - The demand for GPUs is surging due to the explosion of AI, smart driving, and cloud gaming applications, leading to a significant transformation in the GPU market [5]. Product Development - Muxi focuses on developing high-performance GPU chips and computing platforms, with products covering AI computing, general computing, and graphics rendering [7]. - The company has launched several GPU series, including the Xiyun C series for training and inference, which has become a major revenue source, with sales increasing from 15.47 million yuan in 2023 to 512 million yuan in 2024 [7][8]. Financial Performance - Muxi's revenue has shown significant growth, reaching 42.64 million yuan in 2022, 530.21 million yuan in 2023, and 743 million yuan in 2024, with a first-quarter revenue of 320 million yuan in 2025 [9]. - Despite revenue growth, the company has reported net losses of 777 million yuan in 2022, 871 million yuan in 2023, and 1.409 billion yuan in 2024, indicating ongoing financial challenges [10][12]. R&D Investment - Muxi has invested heavily in R&D, with expenditures of 648 million yuan, 699 million yuan, 901 million yuan, and 218 million yuan over the past four years, totaling over 2.4 billion yuan [15]. - The company holds 255 domestic patents, including 245 invention patents, and plans to use 3.904 billion yuan from its IPO for further R&D projects [16]. Workforce Dynamics - As of March 2025, Muxi had 652 R&D personnel, a decrease from 706 at the end of 2024, attributed to internal restructuring and employee turnover [18][19]. - The company aims to expand its R&D team and increase investment to support its growth strategy [20].

近3900只个股下跌

第一财经· 2025-10-23 03:46

Market Overview - The Shanghai Composite Index fell by 0.66%, the Shenzhen Component Index dropped by 0.87%, and the ChiNext Index decreased by 1.1% during the midday session on October 23 [3] - Nearly 3,900 stocks in the two markets experienced declines, indicating a broad market downturn [3] Sector Performance - CPO and cultivated diamond concepts saw significant pullbacks, while hard technology sectors like storage chips and GPUs continued to adjust [3] - The rare earth, precious metals, and military industry sectors were sluggish, contrasting with a surge in Shenzhen state-owned enterprises and coal stocks, which saw a wave of limit-up trading [3] - The coal futures market experienced a notable increase, with the main contract rising over 4% to 1,246.5 CNY per ton [6] Notable Stocks - Several coal stocks, including Daya Energy and Shanxi Coking Coal, recorded limit-up trading, with Daya Energy achieving 9 consecutive limit-ups [8] - In the Shenzhen state-owned enterprise reform sector, stocks like Jian Kexuan and Shen Saige saw significant gains, with Jian Kexuan rising by 20.02% to 20.74 CNY [15][16] Trading Volume - The trading volume in the Shanghai and Shenzhen markets exceeded 1 trillion CNY, reflecting a decrease of nearly 50 billion CNY compared to the previous day [5] Currency and Monetary Policy - The People's Bank of China conducted a 2,125 billion CNY reverse repurchase operation with a rate of 1.40%, while 2,360 billion CNY of reverse repos were set to mature [21]

开评:三大指数小幅低开 房地产等板块涨幅居前

Zheng Quan Shi Bao Wang· 2025-10-23 01:54

Core Viewpoint - The A-share market opened slightly lower, with the Shanghai Composite Index down by 0.25%, the Shenzhen Component Index down by 0.29%, and the ChiNext Index down by 0.28% [1] Sector Performance - Real estate, quantum technology, digital government, and cybersecurity sectors showed the highest gains [1] - Nuclear power, GPU, engineering machinery, and precious metals sectors experienced the largest declines [1]

重回3900点!A股三大指数集体收涨

Sou Hu Cai Jing· 2025-10-21 08:25

Market Overview - On the 21st, all three major A-share indices closed higher, with the Shanghai Composite Index rising by 1.36% to 3916.33 points, the Shenzhen Component Index increasing by 2.06%, and the ChiNext Index up by 3.02% [1] - The total trading volume for A-shares reached 1.89 trillion yuan, with over 4600 stocks rising across the market [1] Sector Performance - The CPO, HBM, and consumer electronics sectors saw significant gains, while the electrolyte, coal, and civil aviation sectors experienced declines [4] - The fruit supply chain concept had notable performance, with companies like Luxshare Precision hitting the daily limit, and others such as Wingtech Technology and Huanxu Electronics also reaching their limits [4] - AI hardware led the gains, with Yuanjie Technology hitting a historical high, and companies like Zhongji Xuchuang and Xinyisheng seeing increases of over 10% [4] Detailed Sector Tracking - Communication equipment rose by 4.81%, energy equipment by 4.39%, and heavy machinery by 3.15% [5] - Real estate stocks strengthened, with Guangming Real Estate and Shenzhen Zhenye A hitting the daily limit, and Yunnan Chengdu Investment rising over 5% [6] - Brokerage stocks also saw gains, with Ruida Futures and Tianfeng Securities hitting the daily limit, and Changjiang Securities increasing by over 5% [6] Declines - Coal stocks generally fell, with China Coal Energy and Yanzhou Coal Mining dropping over 2% [7] - Civil aviation stocks retreated, with China Southern Airlines and China National Aviation falling by 2% [7]