5G技术

Search documents

宁夏再添两家国家级5G工厂

Zhong Guo Xin Wen Wang· 2025-11-03 08:50

Core Insights - The article highlights the inclusion of two 5G factories from Ningxia in the Ministry of Industry and Information Technology's 2025 5G Factory Directory, contributing to a total of four national-level 5G factories in Ningxia [1][2] - 5G factories leverage advanced technologies such as industrial internet, artificial intelligence, and big data to enhance production efficiency and management precision, marking a shift from automation to intelligent and unmanned manufacturing [1] - Since 2022, the Ministry has initiated the "Hundred Thousand" action for 5G factories, with a total of 1,260 factories recorded over three years [1] Industry Developments - The Ningxia Industrial and Information Technology Department plans to strengthen policy support and technical empowerment for 5G factories, aiming to build a platform for experience exchange and promote high-level construction of 5G factories [2] - The initiative is part of a broader strategy to cultivate new productive forces and establish a modern industrial system in Ningxia [2]

中兴通讯的前世今生:2025年三季度营收1005.2亿行业居首,净利润53.45亿排名第三

Xin Lang Zheng Quan· 2025-10-31 13:47

Core Viewpoint - ZTE Corporation is a leading player in the global 5G technology research and standard-setting, focusing on communication network equipment and components, with a strong technical foundation and full industry chain advantages [1] Group 1: Business Performance - In Q3 2025, ZTE's revenue reached 100.52 billion yuan, ranking first among 36 companies in the industry, significantly surpassing the second-ranked Zhongji Xuchuang at 25.005 billion yuan [2] - The net profit for the same period was 5.345 billion yuan, ranking third in the industry, with Zhongji Xuchuang leading at 7.57 billion yuan and Xinyi Sheng at 6.327 billion yuan [2] - ZTE's revenue grew by 11.63% year-on-year, while the net profit decreased by 32.69% due to a decline in operator network business revenue and changes in business structure [6] Group 2: Financial Ratios - As of Q3 2025, ZTE's debt-to-asset ratio was 64.88%, higher than the previous year's 63.63% and significantly above the industry average of 38.12% [3] - The gross profit margin for Q3 2025 was 30.55%, down from 40.43% in the previous year but slightly above the industry average of 30.08% [3] Group 3: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 0.88% to 442,600, while the average number of circulating A-shares held per shareholder increased by 0.89% to 9,100.06 [5] - Major shareholders, including Hong Kong Central Clearing Limited and various ETFs, saw a reduction in their holdings compared to the previous period [5] Group 4: Executive Compensation - The chairman, Fang Rong, received a salary of 200,000 yuan in 2024, unchanged from 2023, while the president, Xu Ziyang, earned 9.8 million yuan, a decrease of 1.48 million yuan from the previous year [4] Group 5: Future Outlook - ZTE's computing power business saw a significant growth of 180% year-on-year, with strong collaboration with major internet companies and expansion into emerging overseas markets [6] - The company is expected to achieve net profits of 7.76 billion yuan, 9 billion yuan, and 10.3 billion yuan from 2025 to 2027, maintaining a "buy" rating [6]

锐明技术(002970):子公司出表,汇兑及补贴下降导致业绩承压

Changjiang Securities· 2025-10-30 09:17

Investment Rating - The investment rating for the company is "Buy" and is maintained [8]. Core Views - The company experienced a decline in revenue for Q1-Q3 2025, attributed to a reduction in sales scale and the impact of subsidiaries being excluded from consolidation. The revenue from the subsidiary Shenzhen Technology is expected to be concentrated in the second half of 2024, significantly affecting the Q3 year-on-year growth rate. For Q1-Q3 2025, the company achieved a net profit attributable to shareholders of 274 million yuan, a year-on-year increase of 24.40% [2][5]. - The company is focusing on rapid growth in overseas markets through various strategies, including establishing overseas subsidiaries and offices, increasing the proportion of local employees, and building production facilities in Vietnam. The company has also completed certifications for its products with major domestic export bus manufacturers and is expected to gradually enter the passenger car market [12]. - The company is enhancing its product offerings by integrating AI algorithms with 5G and vehicle networking technologies, transitioning from passive monitoring to proactive warning and intervention systems. This aligns with industry demands for safety and efficiency [12]. Summary by Sections Financial Performance - For Q1-Q3 2025, the company reported total revenue of 1.693 billion yuan, a year-on-year decrease of 11.75%. The net profit attributable to shareholders was 274 million yuan, reflecting a year-on-year increase of 24.40%. In Q3 2025, revenue was 537 million yuan, down 29.86% year-on-year, with a net profit of 71 million yuan, down 26.55% year-on-year [5][12]. Future Outlook - The company anticipates continued growth in the commercial vehicle information sector, with significant room for improvement in market penetration. The expected net profits for 2025-2027 are projected to be 381 million, 495 million, and 667 million yuan, representing year-on-year growth rates of 31%, 30%, and 35%, respectively. The corresponding price-to-earnings ratios are estimated to be 21, 16, and 12 times [12].

广东电信:用硬核科技打造十五运赛场“科技盛宴”

Zhong Guo Jing Ji Wang· 2025-10-22 13:38

Group 1 - The integration of advanced technology in sports events, such as AI mascots and 5G-A networks, is transforming the upcoming 15th National Games and Special Olympics into a technological feast [1] - Guangdong Telecom has developed the world's first AI mascot, "Xiyangyang Lerongrong," which can engage in intelligent conversations, answer event inquiries, and serve as a personal tour guide [2] - The deployment of the 5GA network at Shenzhen Bao'an International Airport provides internet speeds 5-10 times faster than standard 5G, enhancing the travel experience for millions [2] Group 2 - The "Beidou + 5G" integrated positioning technology offers high-precision location tracking within and outside venues, allowing real-time monitoring of personnel and vehicles [2] - The "digital track" deployed at the athletics venue uses fiber optic sensors to collect athletes' footstep sound wave data, enabling precise measurement of key performance indicators [3] - Guangdong Telecom introduced the first cross-border marathon event command system, facilitating seamless data connection between Shenzhen and Hong Kong, resulting in zero-delay and zero-contact passage for athletes and staff [3]

行业聚焦:全球移载式自主移动机器人市场头部企业份额调研(附Top 10 厂商名单)

QYResearch· 2025-10-17 09:57

Core Viewpoint - The article discusses the growth and potential of the Autonomous Mobile Robot (AMR) market, highlighting its applications in various industries and the technological advancements driving its adoption. Market Overview - The global AMR market is projected to reach USD 3.958 billion by 2030, with a compound annual growth rate (CAGR) of 4.07% in the coming years [2][5]. - The dominant product type in the AMR market is the mobile robot, which accounts for approximately 47.9% of the market share [2][4]. Application Segments - Industrial manufacturing remains the largest downstream market for AMRs, expected to account for about 47.94% of market demand in 2024 [5][10]. Key Players - Major global AMR manufacturers include Hikvision Robotics, Geek+, Siasun, Youai Zhihui, and Mobile Industrial Robots, with the top five companies holding around 44.47% of the market share [6][20]. Technological Drivers - The demand for industrial automation is increasing due to the rise of Industry 4.0 and smart manufacturing, positioning AMRs as essential logistics equipment in smart factories [10]. - The maturity and widespread adoption of 5G technology enhance AMR capabilities, enabling real-time high-precision navigation and cloud-based collaborative scheduling [10][11]. Cost Efficiency - Advances in AMR technology and the domestic production of key components have significantly reduced hardware costs, making AMRs more competitive in terms of cost-effectiveness [11]. - For instance, JD Logistics has deployed over 10,000 AMRs, reducing the cost of using a single robot by more than 40% compared to traditional manual methods [11]. Flexibility and Collaboration - AMRs exhibit strong adaptability and flexibility, allowing for efficient operation in human-machine collaborative environments [12]. - The integration of 5G technology enables AMRs to perform multi-machine collaborative tasks, enhancing efficiency in warehousing and logistics operations [12]. Labor Market Challenges - The manufacturing sector faces a labor shortage, particularly in China, where the gap in manufacturing employment reached 22 million in 2023 [13]. - The adoption of AMRs can alleviate labor pressure by replacing repetitive manual tasks, with a return on investment (ROI) period shortened to 1-2 years [13]. Development Opportunities - The industrial logistics sector continues to be a primary battlefield for AMR applications, driven by the rapid growth of e-commerce and cold chain logistics [14]. - AMRs are increasingly utilized in sectors like automotive and semiconductor manufacturing, showcasing their potential to enhance production efficiency [14][15]. Emerging Applications - The scope of AMR applications is expanding with the upgrade of smart manufacturing, supporting flexible production lines and optimizing workflows [15][16]. Challenges to Development - AMRs face technical challenges related to stability, high-precision navigation, and obstacle avoidance in dynamic environments [17]. - The initial investment costs for AMRs can be high, posing a barrier for small and medium-sized enterprises [17]. - The lack of regulations and safety standards for AMRs may hinder their development and adoption [18]. Market Acceptance - The acceptance of new technologies and the education of enterprises regarding AMRs are crucial for their promotion and widespread adoption [18].

0.5毫米玻璃“取代”硅 沃格光电 “玻璃基”折射“未来之光”

Shang Hai Zheng Quan Bao· 2025-10-16 18:52

Core Viewpoint - Woge Optoelectronics has transformed from a traditional optical glass processing company into a global leader in glass circuit board (GCP) technology, driven by innovation and advanced manufacturing processes [2][3][4] Company Overview - Founded in 2009, Woge Optoelectronics specializes in optical glass processing and has become a key supplier for major industry players like Tianma and BOE [3] - The company went public on the Shanghai Stock Exchange in 2018 and has focused on the industrialization of GCP products for advanced semiconductor packaging and third-generation semiconductor displays [3][4] Technological Advancements - Woge's GCP products utilize glass as a substrate, allowing for the creation of precise circuits that enhance the performance of Mini LED backlight modules, achieving a 20% reduction in manufacturing costs compared to traditional methods [3][4] - The company has developed capabilities in various core processes, including glass thinning, through-glass vias (TGV), and multi-layer precision circuit fabrication [6][7] Market Position and Growth - Woge Optoelectronics has seen a compound annual growth rate (CAGR) of 33% in revenue from 2019 to 2024, with a revenue of 1.189 billion yuan in the first half of this year, marking a 14.2% year-on-year increase [8] - The company plans to raise 1.06 billion yuan for its Mini LED backlight module project, which will add an annual production capacity of 6.05 million modules [8] Future Prospects - Woge aims to collaborate with partners in the high-end display, future communication, and advanced semiconductor packaging sectors, focusing on achieving comprehensive self-sufficiency in GCP technology [9]

140亿,瑞萨将卖掉计时业务,TI和英飞凌有意接手

半导体行业观察· 2025-10-15 02:48

Core Viewpoint - The company is considering selling its timing unit, with an estimated valuation of approximately $2 billion (around 14 billion RMB), indicating a strategic shift towards core markets like automotive and industrial chips [2][3]. Group 1: Company Actions - The Japanese semiconductor manufacturer is collaborating with JPMorgan's investment bankers regarding the potential divestiture, which is still in the early stages [2]. - The timing unit develops specialized integrated circuits for managing clock, timing, and synchronization functions, essential for orderly data flow in high-speed network devices [2][3]. Group 2: Market Context - The primary markets for the timing unit include data centers, telecommunications infrastructure, and the construction of 5G mobile networks, with demand for components surging due to advancements in AI and 5G technology [2]. - The potential divestiture reflects a broader trend in the competitive semiconductor industry, where companies frequently review their portfolios to divest non-core assets and focus on strategic areas [3]. Group 3: Industry Implications - The sale could provide significant funding for the company, allowing it to concentrate on high-growth areas within the semiconductor sector, particularly in automotive and industrial applications [2]. - Timing and clock ICs are fundamental components in nearly all advanced digital electronic devices, acting as the "metronome" for electronic systems to ensure synchronized data processing and transmission [3].

龙虎榜复盘 | 稀土分化,eSIM异动

Xuan Gu Bao· 2025-10-14 10:36

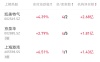

Group 1: Institutional Trading Insights - On the institutional trading leaderboard, 42 stocks were listed, with 26 experiencing net buying and 16 facing net selling [1] - The top three stocks with the highest net buying by institutions were: KaiMeiTeQi (2.68 billion), JingQuanHua (1.81 billion), and Shanghai GangWan (1.43 billion) [1] Group 2: Company Highlights - KaiMeiTeQi's electronic specialty gas project produces ultra-pure gases and photolithography products essential for chip manufacturing, achieving high quality and certifications from leading international companies [2] - NewLaiFu's acquisition of JinNan Magnetic Materials for 10.54 billion focuses on key components for micro-special motors, holding over 60% global market share in motor magnetic strips [2] - AnTai Technology specializes in high-end powder metallurgy materials, advanced functional materials, and environmental engineering materials [2] Group 3: eSIM Market Developments - DongXinHePing's eSIM products and management platform are applied in various fields including vehicle networking and smart homes, with multiple GSMA certifications [3] - China Unicom announced the opening of eSIM reservation channels, indicating a growing trend in eSIM applications alongside the proliferation of 5G technology [4] - The eSIM market is projected to expand significantly, becoming a key technology in the IoT sector, with applications in smart transportation, smart cities, wearables, and more [4]

剥离呼叫路由业务Iconectiv优化显著 爱立信(ERIC.US)Q3利润增长翻倍

智通财经网· 2025-10-14 06:34

Core Insights - Ericsson reported a significant increase in adjusted EBITDA for Q3, more than doubling year-over-year after divesting its call routing subsidiary Iconectiv [1] - Despite a 9% decline in sales compared to the previous year, the company exceeded analyst expectations due to improved gross margins driven by operational optimization [1][2] - The company achieved a notable increase in adjusted EBIT and adjusted EBITA, reaching 15.5 billion SEK (approximately 1.62 billion USD) and 15.8 billion SEK (approximately 1.67 billion USD) respectively [1] Financial Performance - Q3 sales decreased from 61.8 billion SEK to 56.2 billion SEK, with organic sales down 2% year-over-year [1] - Adjusted gross margin improved from 46.3% to 48.1%, attributed to effective operational execution and cost optimization measures [1] - Capital gains from the divestiture of Iconectiv contributed 7.6 billion SEK, leading to an adjusted EBITA margin increase to 27.6% [1] Market Position and Future Outlook - Ericsson secured multiple key customer agreements in markets including India, Japan, and the UK, maintaining its industry-leading position with its 5G Open RAN product portfolio certified by Gartner and Omdia [2] - The company anticipates stabilization in organic sales for enterprise business in Q4, with the wireless access network market expected to remain stable [2] - As of now, the company's net cash position has increased to 51.9 billion SEK, providing room for enhanced shareholder returns [2] Competitive Landscape - The telecommunications equipment market remains highly competitive, with Ericsson and its Nordic rival Nokia facing challenges from weak demand and the delayed realization of expected 5G-related spending [2] - The weakening of the US dollar has also impacted the performance of both companies [2] Stock Performance - Year-to-date, Ericsson's stock price has declined by approximately 13% [3]

所有服务,都值得用新技术重新做一遍

Sou Hu Cai Jing· 2025-10-13 15:20

Core Insights - The article emphasizes the necessity for companies to undergo digital transformation in response to evolving consumer demands and technological advancements, particularly in AI and data utilization [2][6][8] - It highlights China Mobile's launch of the "Mobile Love Purchase" smart life mall as a strategic move to enhance user engagement and redefine business-user relationships through innovative technology [11][12][23] Group 1: Digital Transformation and Market Trends - The competition landscape is shifting from traditional metrics like supply chain efficiency to digital capabilities, with data becoming a core asset [6][8] - IDC predicts global digital transformation spending will approach $4 trillion by 2027, indicating a significant market trend towards digital investments [7] - Traditional business models are facing challenges, with stagnant revenue growth in sectors like telecommunications and rising customer acquisition costs in e-commerce [8][9] Group 2: "Mobile Love Purchase" Business Model - The "Mobile Love Purchase" mall utilizes an "AI Bean" system to foster long-term emotional connections with users, moving beyond traditional loyalty programs [13][15] - The "Lingxi Intelligent Body" enhances user experience by providing personalized, seamless service across the shopping journey, addressing pain points of traditional service models [16][18] - The integration of "AI Beans" and "Lingxi" creates a B2B2C ecosystem, allowing for cross-industry collaboration and resource sharing, enhancing value for both B2B partners and C-end users [20][22][23] Group 3: Strategic Implications for Companies - Companies are encouraged to view digital transformation as essential for survival rather than an optional strategy, with immediate action required to adapt to changing market dynamics [8][27] - The case of "Mobile Love Purchase" serves as a model for other enterprises, illustrating the importance of aligning user needs with technological capabilities to drive growth [26][28]