可控核聚变概念

Search documents

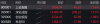

A股收评:午后拉升!深证成指、创业板指涨超1%,全市场近4400股上涨

Ge Long Hui· 2025-12-05 07:08

资金净流入 涨幅榜 5日涨幅ł 保险 林木 能源设i +5.80% +2.939 +3.87% 包装 基本金属 券商 +2.67% +2.61% +2.579 | 上证指数 | 深证成指 | 北证5C | | --- | --- | --- | | 3902.81 | 13147.68 | 1408.3 | | +27.01 +0.70% +140.96 +1.08% +21.06 +1 | | | | 科创20 | 创业板指 | 万得全/ | | 1326.10 | 3109.30 | 6250.6 | | -0.06 0.00% +41.81 +1.36% +70.62 +1 | | | | 沪深300 | 中证500 | 中证A5( | | 4584.54 | 7097.84 | 5513.7 | | +37.97 +0.84% +85.03 +1.21% +52.00 +0 | | | | 中证1000 | 中证2000 | 中证红 | | 7342.49 | 3100.31 | 5557.9 | | +93.84 +1.29% +56.78 +1.87% +5.01 +0 | | | A股三大指数今 ...

热点杂乱且个股普跌,诱空还是倒车?

Ge Long Hui· 2025-11-13 03:38

Market Performance - The three major indices collectively declined, with the Shanghai Composite Index down 0.24%, the Shenzhen Component Index down 1.07%, and the ChiNext Index down 1.58% [1] - Over 3,800 stocks in the two markets fell, with a total trading volume of 1.257 trillion [1] Sector Performance - The superhard materials sector experienced a significant drop of 4.65%, with Wald down 12.04% and other stocks like Hengsheng Medical Energy and Huifeng Diamond also seeing declines over 8% [3] - The photovoltaic sector faced heavy losses, with Tongwei Co. and Longi Green Energy reporting substantial declines [3] - The insurance sector opened strong, rising 2.45%, with China Pacific Insurance and New China Life Insurance both increasing over 3% [3] - The banking sector showed resilience, with Agricultural Bank of China and Industrial and Commercial Bank of China reaching historical highs [3] - The oil and gas sector strengthened, with PetroChina Oilfield Services and Jun Oil Co. both hitting the daily limit [3] - The food and beverage sector performed well, with Sanyuan Foods and Zhongrui Co. achieving consecutive gains [3] News Impact - SanDisk, a leader in flash memory, announced a significant price increase of up to 50% for NAND flash contracts in November [3] - The Ministry of Industry and Information Technology (MIIT) announced plans to promote the large-scale application of new technologies, particularly in industrial and humanoid robots [3] - MIIT emphasized strict control over new low-technology printed circuit board projects aimed solely at capacity expansion [3]

11月6日午间全市场共47股涨停

Mei Ri Jing Ji Xin Wen· 2025-11-06 03:52

Core Insights - The market saw a total of 47 stocks hitting the daily limit up, with 11 stocks achieving consecutive limit ups, and 21 stocks failing to maintain their limit up status, resulting in a limit up rate of 69% [1] Group 1: Market Performance - A total of 47 stocks reached the limit up today, indicating strong market activity [1] - The number of stocks with consecutive limit ups stands at 11, showcasing a trend of sustained investor interest [1] - The limit up rate, excluding ST and delisted stocks, is reported at 69%, reflecting overall market sentiment [1] Group 2: Focus Stocks - The controllable nuclear fusion concept stock, Hailu Heavy Industry (002255), achieved 4 consecutive limit ups, highlighting its strong market performance [1] - The solid-state battery sector saw Dazhong Mining (001203) and Zhenhua Co., Ltd. (603067) both achieving 4 limit ups over 7 days, indicating robust investor confidence in this sector [1] - Fujian local stock Mindong Electric Power (000993) recorded 3 consecutive limit ups, while the power grid equipment sector stock Moen Electric (002451) also achieved 3 consecutive limit ups, reflecting sector-specific growth [1]

A股开盘速递 | A股震荡走高 存储芯片概念拉升 磷化工板块上扬

智通财经网· 2025-11-06 02:20

Core Viewpoint - The A-share market is experiencing a rebound, with significant support from government initiatives aimed at enhancing the capital market's adaptability to new industries and technologies, promoting stable development in the capital market [1] Market Performance - As of 10:04 AM, the Shanghai Composite Index rose by 0.47%, the Shenzhen Component Index increased by 0.7%, and the ChiNext Index gained 0.71% [1] Key Sectors 1. Phosphate Chemical Sector - The phosphate chemical sector is showing an upward trend, with companies like Qing Shui Yuan and Ba Tian shares hitting the daily limit, supported by strong performance in the first three quarters of the year [3] - Analysts note that despite a seasonal downturn in traditional downstream demand, high demand in sub-sectors like agricultural chemicals is bolstering profits [3] 2. Controlled Nuclear Fusion - The controlled nuclear fusion sector continues to perform strongly, with companies such as Hai Lu Heavy Industry and Bao Bian Electric hitting the daily limit [4] - The industry is entering a capital expenditure expansion phase, with core companies in the supply chain expected to benefit significantly from ongoing project tenders [4] 3. Storage Chip Concept - The storage chip sector is experiencing a surge, with Yingxin Development achieving 11 consecutive trading limits and Xiang Neng Chip Innovation rising nearly 6% to a new historical high [5] - The recent negotiations between SK Hynix and NVIDIA regarding HBM4 supply, which will see prices increase by over 50% compared to HBM3E, have positively impacted market sentiment [5] Institutional Insights 1. Shifts in Investment Style - According to Xinyi Securities, there is an increasing likelihood of style switching in investment, with a focus on low-position value sectors and potential rebounds in banking and non-bank financials [6] - The report emphasizes the importance of matching stock prices with economic expectations for future growth [7] 2. Balanced Market Outlook - Industrial trends indicate that the new momentum in technology and high-end manufacturing will continue to release advantages, suggesting a more balanced market style compared to the third quarter [8] 3. Focus on Humanoid Robotics - According to Guangda Securities, the A-share market is expected to maintain its upward trend, with a particular focus on humanoid robotics, especially in light of upcoming announcements from Tesla regarding its Optimus robot [9]

A股三大指数集体低开

第一财经· 2025-11-04 02:02

Core Insights - The article highlights the recent surge in the thorium-based molten salt reactor concept, with companies like Baose Co., Hailu Heavy Industry, and Lanshi Heavy Industry experiencing consecutive gains [3] - The controlled nuclear fusion concept is also active, with Hailu Heavy Industry and Lanshi Heavy Industry hitting the daily limit, and other companies like China Nuclear Technology and Shangneng Electric seeing significant increases [3] Market Performance - The A-share market opened lower, with the Shanghai Composite Index down 0.08%, the Shenzhen Component Index down 0.23%, and the ChiNext Index down 0.20% [5][6] - The precious metals sector saw a decline, with companies like Xiaocheng Technology and Zhongjin Gold opening nearly 2% lower, while the gas and real estate sectors experienced slight increases [6][7] Sector Trends - The precious metals sector is leading the decline, while the Hainan Free Trade Zone sector continues to rise [6] - In the Hong Kong market, the Hang Seng Index opened down 0.04%, with the technology sector also experiencing a slight drop, while the new energy theme remains active [7]

11月3日连板股分析:连板股晋级率仅一成 芳香胺概念走强

Xin Lang Cai Jing· 2025-11-03 08:06

Core Insights - The overall performance of the stock market today showed a total of 66 stocks hitting the daily limit up, with only 10 stocks classified as consecutive limit-up stocks, indicating a low advancement rate of 11.11% for consecutive limit-up stocks excluding ST and delisted stocks [1] Group 1: Market Performance - A total of over 3,500 stocks in the market experienced an increase, but the performance of consecutive limit-up stocks was weak, with notable declines in stocks like Shikong Technology, which fell over 8% [1] - Only one stock, Hefei China, managed to break through two consecutive limit-ups, while Pingtan Development achieved 9 limit-ups in 12 days, although it has shown a decrease in trading volume over the last two days [1] Group 2: Sector Highlights - The chemical sector saw a boost following the publication of a new strategy for "direct deamination" by a team led by Chinese scientist Zhang Xiaoheng in the journal Nature, with the aromatic amine concept leading the gains [1] - Stocks such as Baihehua and Meirui New Materials achieved limit-ups, while Huatai Co., Yabang Co., and Haixiang Pharmaceutical also saw limit-up performances [1] - The controllable nuclear fusion concept remained active, with stocks like Baose Co. and Hailu Heavy Industry hitting limit-ups, and Lanshi Heavy Industry achieving two limit-ups in three days [1]

A股三指数下挫,福建牛股11天8板,港股中芯国际跌超5%

21世纪经济报道· 2025-10-31 04:30

Market Overview - The three major indices collectively declined, with the Shanghai Composite Index down 0.63% and the ChiNext Index down 1.49%. The total trading volume in the Shanghai and Shenzhen markets reached 1.58 trillion yuan, an increase of 27.4 billion yuan compared to the previous trading day [1][2]. Index Performance - The Shanghai Composite Index closed at 3961.62, down 25.28 points or 0.63%. The Shenzhen Component Index closed at 13447.94, down 84.19 points or 0.62%. The ChiNext Index closed at 3214.48, down 48.54 points or 1.49%. The Wande All A Index decreased by 15.14 points or 0.24% [2]. Sector Performance - The North Exchange 50 Index surged over 3%, with companies like Lijia Technology, Better Ray, Kunming Technology, and Guozi Software each rising over 10%. The pharmaceutical sector saw gains, with Sanofi and Lianhuan Pharmaceutical hitting the daily limit [3]. - In contrast, the computing hardware sector experienced a collective decline, with major players in optical modules facing significant adjustments. Storage chip stocks also weakened, with Jiangbolong dropping over 10% [4]. Hong Kong Market - The Hang Seng Index and the Hang Seng Tech Index both closed in the red, with notable declines in stocks such as China CRRC, which fell nearly 9%, and BYD, which dropped over 5% [4]. Gold Market - The price of gold jewelry in China has returned to 1200 yuan per gram, with brands like Chow Sang Sang and Lao Feng Xiang seeing increases of 28 yuan and 17 yuan per gram, respectively [10]. - The gold market is experiencing high-frequency fluctuations, with banks adjusting investment thresholds to align with market dynamics. Despite this, the outlook for gold remains optimistic due to a weakening dollar and expectations of interest rate cuts [12].

沪指盘中突破4000点大关 续创逾10年新高

Zheng Quan Shi Bao Wang· 2025-10-28 02:59

Core Viewpoint - The stock market is experiencing a strong upward trend, with major indices reaching new highs, driven by various sectors such as semiconductors, automotive, pharmaceuticals, and real estate [1] Market Performance - As of the report, the Shanghai Composite Index has surpassed the 4000-point mark, achieving its highest level in over a decade [1] - The ChiNext Index and the STAR 50 Index are also showing positive movements [1] Sector Analysis - Key sectors contributing to the market rally include: - Semiconductors - Automotive - Pharmaceuticals - Real Estate - Military trade concepts - Storage chips - Controlled nuclear fusion concepts [1] Economic Outlook - Short-term market performance is expected to remain strong due to: - The goals outlined in the 20th National Congress of the Communist Party of China, which aim to boost market confidence through new policy deployments - Ongoing US-China trade negotiations and the anticipated interest rate cuts by the Federal Reserve in October [1] - Mid-term outlook suggests potential improvement in corporate earnings, which could provide new momentum for the market [1] Earnings and Recovery - Current corporate earnings are still stabilizing, with the economic recovery process being relatively slow, although some areas show improvement [1] - Domestic exports are expected to remain resilient, and the sustainability of domestic demand improvements may exceed expectations [1] - Overall, policy support is anticipated to lead to a slight recovery in A-share earnings in the fourth quarter, adding new momentum to the market [1] Investment Strategy - Mid-term focus on TMT (Technology, Media, and Telecommunications) and advanced manufacturing sectors - In case of market fluctuations, attention should be directed towards sectors with stagnant growth, such as high-dividend and consumer sectors [1]

收盘丨沪指放量涨超1%逼近4000点,存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:12

Core Viewpoint - The A-share market shows strong upward momentum with significant trading volume and a broad increase in stock prices, indicating a potential shift towards a more vibrant market phase driven by policy support and restored investor confidence [2][4][7]. Market Performance - The total trading volume in the Shanghai and Shenzhen markets reached 2.34 trillion yuan, an increase of 365.9 billion yuan compared to the previous trading day [4]. - The Shanghai Composite Index rose by 1.18%, closing at 3996.94 points, while the Shenzhen Component Index increased by 1.51% to 13489.40 points, and the ChiNext Index gained 1.98%, reaching 3234.45 points [2][3]. Sector Performance - The storage chip sector experienced a surge, with multiple stocks hitting the daily limit, including Zhaoyi Innovation, which reached a new high [3]. - Other strong-performing sectors included consumer electronics, CPO, and circuit board concepts, while gaming, Hainan, and oil and gas sectors faced declines [3]. Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [6]. - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion yuan, 1.016 billion yuan, and 867 million yuan, respectively [6]. Institutional Insights - According to Citic Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies the market entering a new, more dynamic phase, although sustained upward momentum will depend on solid economic fundamentals and improved corporate earnings [7]. - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [8]. - Guo Cheng Investment indicates that the market's continued upward trend should be monitored, particularly around the 4200-point resistance level for the Shanghai Composite Index [9].

A股,冲刺!

中国基金报· 2025-10-27 05:01

Market Overview - The A-share market opened positively on October 27, with major indices closing in the green: Shanghai Composite Index up 1.04%, Shenzhen Component Index up 1.26%, and ChiNext Index up 1.54%, approaching the 4000-point mark [2][3] - The total market turnover reached 1.58 trillion yuan, showing a significant increase compared to the previous day, with over 3700 stocks rising [3] Sector Performance - Key sectors that performed well included telecommunications, steel, non-ferrous metals, and electronics, with notable gains in controlled nuclear fusion, Fujian local stocks, and storage chips [3][4] - The CPO concept stocks remained active, with Fujian local stocks collectively rising, including Haixia Innovation hitting the daily limit with a 20% increase [9][10] Hong Kong Market - The Hong Kong market also saw gains, with the Hang Seng Index up 1.02%, the Hang Seng Tech Index up 1.48%, and the Hang Seng China Enterprises Index up 0.95%. Baidu Group led the tech index with a rise of over 5% [5][6] Specific Stock Highlights - In the non-ferrous metals sector, stocks like Antai Technology and Xiamen Tungsten both hit the daily limit with a 10% increase [15] - The rare earth sector remained active, with Northern Rare Earth and China Rare Earth showing significant gains [16] - The steel sector also saw strong performance, with stocks like Anyang Steel and Changbao Co. hitting the daily limit [19] Policy and Economic Outlook - Recent signals of easing tensions in US-China relations and the release of the "14th Five-Year Plan" are expected to enhance market risk appetite and provide a clear growth path for A-shares through technological breakthroughs and industrial upgrades [7] - The upcoming Financial Street Forum is anticipated to unveil a series of financial policies and projects, generating market expectations for a "policy package" [7]