思元690

Search documents

寒武纪、摩尔线程与沐曦同日“快报”年度成绩单,国产算力芯片厂商营收规模普遍实现倍增

Jing Ji Guan Cha Wang· 2026-02-27 14:43

经济观察报记者 郑晨烨 2月27日,国内算力芯片三大龙头厂商——寒武纪(688256.SH)、摩尔线程(688795.SH)与沐曦股份(688802.SH)相继发布2025年度业绩快报。 财报数据显示,三家企业在过去一年均实现了三位数的营业收入增长,其中寒武纪首度实现年度扭亏为盈。 而在美东时间2月25日,英伟达(NVDA.US)也发布了2026财年第四季度财报。在随后的电话会议上,英伟达首席财务官Colette Kress确认,美国政府此前 批准向中国客户提供的H200产品,迄今尚未产生任何营收。 在某种程度上,这形成了一个对比:算力芯片领域的国产"新势力"正从技术验证转向商业上的规模替代。 在业务结构方面,寒武纪在2024年报中已将原有的"智能计算集群系统"业务并入"云端产品线"。 2025年,寒武纪云端产品线的主要产品包括思元590、思元690及思元370等加速卡。该公司在公告中表示,本期收入规模的大幅增长主要受益于人工智能行 业算力需求的持续攀升,公司凭借产品的竞争力和市场拓展,推动了人工智能应用场景的落地。 研发投入向来是算力芯片企业的核心支出,根据披露数据,2017年至2025年上半年,寒武纪累计 ...

ETF盘中资讯|寒王大动作!资本公积金弥补亏损!如何解读?科创人工智能ETF(589520)宽幅溢价,资金积极进场!

Sou Hu Cai Jing· 2025-12-16 03:29

Group 1 - The core point of the news is that AI chip manufacturer Cambricon plans to use 2.778 billion yuan from its capital reserve to offset accumulated losses, which will improve its financial condition by turning its retained earnings from negative to positive by the end of 2024 [1] - Market analysts indicate that the capital reserve adjustment is an internal accounting measure that does not affect the company's net assets or cash flow, thus posing no operational risks [1] - Cambricon has shown strong performance, with significant revenue and net profit growth expected in the first three quarters of 2025, driven by the substantial release of cloud products like the Siyuan 590 [1] Group 2 - The AI industry is shifting focus from hardware and infrastructure ("selling shovels") to practical applications and commercialization ("mining for gold"), indicating a growing potential in AI applications [2] - The Sci-Tech Innovation AI ETF (589520) is strategically positioned to invest in the AI industry chain, which is transitioning from cloud-based solutions to edge computing, emphasizing self-sufficiency in technology [2] - On December 16, the Sci-Tech Innovation AI ETF experienced a price drop of 1.77%, but it attracted significant investment, indicating strong buying interest despite market fluctuations [2] Group 3 - The importance of information and industrial security has been highlighted in the context of technological friction, with AI being a core technology for achieving self-sufficiency [4] - The Sci-Tech Innovation AI ETF and its connected funds focus on the domestic AI industry chain, with a high concentration in semiconductor stocks, indicating a strong offensive strategy [4]

寒王大动作!资本公积金弥补亏损!如何解读?科创人工智能ETF(589520)宽幅溢价,资金积极进场!

Xin Lang Cai Jing· 2025-12-16 03:27

Group 1 - The core point of the article is that AI chip manufacturer Cambricon plans to use 2.778 billion yuan from its capital reserve to offset accumulated losses, which will not affect its net assets or cash flow, and will allow for potential dividend distribution after the adjustment [1][6] - Analysts noted that the capital reserve adjustment is an internal accounting measure that increases retained earnings without actual cash flow impact, thus posing no operational risks [1][6] - Cambricon's performance has been strong, with significant revenue and net profit growth expected in the first three quarters of 2025, driven by the increased sales of its cloud products [1][6] Group 2 - The AI application sector is seen as having greater potential compared to computing power, with the investment logic shifting from hardware to actual applications and commercialization [2][7] - The Sci-Tech Innovation AI ETF (589520) is strategically positioned to capture the AI industry chain, focusing on software applications, terminal applications, and chips, indicating a shift towards domestic technology [2][7] - On December 16, the ETF experienced a price drop of 1.77%, but still showed strong buying interest, indicating potential for future investment [2][8] Group 3 - The importance of information and industrial security has been highlighted in the context of technological friction, emphasizing the need for self-reliance in core technologies like AI [4] - The ETF and its associated funds are heavily invested in the domestic AI industry, with over 70% of the top ten holdings focused on semiconductor sectors, indicating a high concentration and aggressive investment strategy [4]

寒王大动作!拟使用27亿资本公积金弥补亏损

财联社· 2025-12-15 14:50

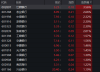

Core Viewpoint - The article discusses the announcement by AI chip manufacturer Cambricon to use 2.778 billion yuan from its capital reserve to offset accumulated losses, a move permitted under the new Company Law effective from July 1, 2024, which allows companies to use specific capital reserves for loss compensation [1][4]. Financial Operations - Cambricon plans to use 2.778 billion yuan from its capital reserve to cover its accumulated losses, with the aim of bringing its negative retained earnings to zero by the end of 2024 [1]. - As of December 31, 2024, the company's financial report indicates accumulated retained earnings of -2.778 billion yuan and a capital reserve balance of 9.625 billion yuan [1]. Market Reactions and Expert Opinions - Market analysts express interest in the implications and risks of such capital reserve operations. Industry expert Wang Jiyue notes that this method does not materially affect the company's net assets or cash flow, thus posing no risk to normal operations [5]. - Angel investor and AI expert Guo Tao emphasizes that this is an internal accounting adjustment, primarily aimed at helping profitable companies with negative retained earnings to meet conditions for dividends and refinancing [5]. Business Performance and Market Outlook - Cambricon's products are reportedly performing well in specific AI scenarios, such as large model training and inference, intelligent vision, and voice processing, which may lead to a continuous increase in orders [6]. - The company has seen significant revenue growth, with a reported revenue of 4.607 billion yuan for the first three quarters of 2025, a year-on-year increase of 2386.38%, and a net profit of 1.605 billion yuan, compared to a loss of 724.5 million yuan in the same period last year [7]. - The company maintains a strong focus on R&D, with increased actual investment despite a decrease in the proportion of R&D spending relative to revenue [7]. Stock Market Performance - As of December 15, Cambricon's stock closed down 0.9% at 1331.9 yuan per share, with a total market capitalization of 561.6 billion yuan [8]. - Cambricon has the highest closing price among stocks on the Sci-Tech Innovation Board, followed by other companies like Moole and Yuanjie Technology [9].

产能提升3倍 对标华为抢占市场份额?“小作文”突袭后尾盘猛拉 寒武纪紧急辟谣

Hua Xia Shi Bao· 2025-12-05 00:34

12月4日下午,一则有关寒武纪的"小作文"在市场流传,寒武纪尾盘快速拉升。 12月4日晚间,寒武纪发布严正声明称,公司关注到今日媒体及网络传播的关于公司产品、客户、供应及产能预测等相关信息,均为误导市场的不实信 息。 据智通财经报道,当天早些时候,有外媒援引知情人士的话报道称,寒武纪计划明年将人工智能(AI)芯片产量提升逾三倍,对标华为抢占市场份额, 并填补因英伟达被迫退出而产生的市场空缺。 该报道还称,寒武纪计划在2026年交付50万个AI加速器,其中包括多达30万个其最先进的思元590和690晶片。据悉,公司将主要通过中芯国际最新的7纳 米"N+2"工艺生产晶片。 上述消息一出,寒武纪尾盘放量拉升,收盘涨2.75%。12月4日早盘,寒武纪一度跌近3%,随后震荡拉升。 截至收盘,寒武纪报1369元/股,总市值为5773亿元。今年以来,寒武纪股价累计涨幅达108%。 在此,公司提醒广大投资者,寒武纪相关事项均以公开披露信息为准,请各位投资者提高信息辨别能力,不传播、不采信来源不明或未经核实的虚假信 息。 此外,对于任何捏造、散布传播不实信息的行为,公司将保留追究相关人员法律责任的权利。 根据公告,公司拟使用母 ...

报道称明年AI芯片产量拟提高两倍,寒武纪尾盘拉升,深夜“严正声明”:不实

Hua Er Jie Jian Wen· 2025-12-04 21:05

12月4日周四,AI芯片厂商寒武纪股价因明年将大幅提升产能的市场传言尾盘大涨,后深夜紧急发布"严正声明"辟谣,称当日媒体及网络传播的公司相关 信息均不实,并保留追究法律责任的权利。 尽管寒武纪否认传言,国内外机构目前仍极为看好该司后市表现。国际投行Bernstein周四给出的目标价预示着,寒武纪股价较当天收盘还有46%的上涨空 间。多家机构认为,在国产替代加速背景下,寒武纪有望在新一轮算力投资周期中获得显著市场份额。 传言引发尾盘异动 周四早盘,寒武纪一度跌近3%,随后震荡拉升。午盘,有传言称寒武纪明年将大幅提升产能,目标为填补英伟达退出中国市场的空白份额。消息一出, 寒武纪尾盘放量拉升。 据证券时报报道,此前有媒体报道称,寒武纪计划在2026年将其人工智能(AI)芯片产量提升到目前的三倍,以争夺更多市场份额,并填补英伟达退出 后留下的市场空白。报道还称,寒武纪正准备在2026年交付50万颗AI加速器,其中包括多达30万颗其最先进的思元590与690芯片。 最终,寒武纪收涨2.75%,报1369元/股,总市值5773亿元。截至本周四收盘,寒武纪股价今年以来累计涨幅达108%。 公司深夜紧急辟谣 12月4日深夜 ...

寒武纪,紧急公告!

券商中国· 2025-12-04 15:13

12月4日深夜,"寒武纪科技"公众号发布消息称,公司关注到今日媒体及网络传播的关于公司产品、客户、供应及产能 预测等相关信息,均为误导市场的不实信息。 今日,寒武纪尾盘大幅拉升,最终收涨2.75%,报1369元/股,总市值 5773亿元。 日前,有媒体报道,寒武纪计划在2026年将其AI芯片产量提升到目前的三倍,以争夺更多的市场份额,并填补英伟达退出 后留下的市场空白。 东海证券此前指出,2025年前三季度该公司营收与归母净利润同比大幅增长,主要系以思元590为代表的云端产品大幅放 量所致,后续思元690也有望受益于量价齐升的逻辑。 东海证券表示,目前,以阿里、腾讯、字节等为代表的国内云厂商不断加码AI相关的资本开支,且国产替代的诉求日益深 刻,英伟达CEO黄仁勋近期发言称英伟达在中国市场的份额从95%降至0%,在中美科技摩擦的背景下,国产AI芯片迎来 加速替代期。 机构看好后市空间 虽然寒武纪年内涨幅巨大,但是不少机构仍然看好其股价空间。 12月4日,国际投行Bernstein(伯恩斯坦)将寒武纪的评级上调至跑赢大盘,目标价2000元,较现价还有46%的上涨空 间。 寒武纪紧急辟谣 "寒武纪科技"4日晚间发 ...

A股三大股指盘中弱势震荡整理,银行板块拉升,石油板块走高

Zheng Quan Shi Bao· 2025-10-22 09:55

Market Overview - The Shanghai Composite Index experienced weak fluctuations, closing down 0.07% at 3913.76 points, while the Shenzhen Component Index fell 0.62% to 12996.61 points, and the ChiNext Index dropped 0.79% to 3059.32 points [1] - The North Exchange 50 Index showed relative strength, rising 0.87% [1] - Total trading volume in the Shanghai, Shenzhen, and North exchanges was 169.05 billion yuan, a decrease of over 20 billion yuan compared to the previous day [1] Banking Sector - The banking sector saw significant gains, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains and reaching a historical high [2][3] - Other banks also performed well, with Jiangyin Bank up 3.56% and several major banks like Industrial and Commercial Bank of China and China Construction Bank rising over 1% [3][4] - Analysts from Everbright Securities noted that the banking sector currently offers good value for investment, with stable earnings expected in the upcoming quarterly reports [6] Oil Sector - The oil sector experienced a strong rally, with Keli Co. rising over 12% and several other companies like Junyou Co. and Beiken Energy hitting the daily limit [8][9] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish its strategic reserves, which may influence market dynamics [10] - International agencies like IEA, EIA, and OPEC have adjusted their forecasts for oil production, indicating a continued oversupply situation [10] AI Chip Sector - Cambrian (688256) saw a significant surge, with its stock price rising over 7% during the day and closing up 4.42%, leading the A-share market in trading volume at nearly 20 billion yuan [12][14] - The company reported a substantial year-on-year revenue increase of 2386% for the first three quarters, driven by the strong performance of its cloud products [14] - Analysts highlighted the growing demand for domestic AI chips amid U.S.-China tech tensions, positioning Cambrian favorably in the market [14]

再度爆发!601288 14连阳!688256 突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:36

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [2] - The Shenzhen Component Index fell by 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [2] - The Northbound 50 Index rose by 0.87%, with total trading volume in the Shanghai and Shenzhen markets reaching 16905 billion, a decrease of over 2000 billion from the previous day [2] Sector Performance - The coal, non-ferrous metals, brokerage, and semiconductor sectors saw declines, while the oil sector showed strong gains [2] - Notable performers in the oil sector included Keli Co., which rose over 10%, and several others that hit the daily limit [10] - The banking sector also rebounded, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [6][4] Noteworthy Stocks - Cambrian (688256) surged over 7% during the afternoon session, closing up 4.42% with a trading volume of nearly 200 billion, making it the top stock by trading volume in A-shares [14] - The stock price of Cambrian reached a peak of 1468 yuan, surpassing that of Kweichow Moutai during trading [14] - The newly listed Marco Polo on the Shenzhen main board saw a significant increase of 128.8%, closing at 31.46 yuan per share [2] Banking Sector Insights - Analysts from Guangda Securities noted that the banking sector currently offers good value after market adjustments, with stable earnings expected in the upcoming quarterly reports [8] - The sector is characterized by high dividends and low valuations, with a notable preference for Hong Kong-listed banks [8] - Citic Securities indicated that the banking sector is likely to see continued demand for stocks due to their defensive attributes amid rising risk aversion [8] Oil Sector Developments - The oil sector's rise is attributed to the U.S. Department of Energy's plan to purchase 1 million barrels of crude oil to replenish strategic reserves [12] - International agencies have adjusted their forecasts for oil production, indicating a potential oversupply situation in the near term [12] - Despite short-term price fluctuations, the long-term outlook for oil supply and demand remains optimistic, particularly for major oil companies and service providers [12] Cambrian's Financial Performance - Cambrian reported a significant revenue increase of 2386% year-on-year for the first three quarters, totaling 4.607 billion yuan [16] - The net profit attributable to shareholders reached 1.605 billion yuan, driven by the strong performance of its cloud products [16] - The company is positioned to benefit from the growing demand for domestic AI chip solutions amid increasing capital expenditures from major cloud providers [17]

再度爆发!601288,14连阳!688256,突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:19

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [1] - The Shenzhen Component Index fell 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [1] - The Northbound 50 Index rose by 0.87%, with total trading volume across the three markets reaching 169.05 billion yuan, a decrease of over 20 billion yuan from the previous day [1] Banking Sector Performance - The banking sector showed strength, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [2][4] - Other banks such as Jiangyin Bank and Industrial and Commercial Bank of China also saw increases, with Jiangyin Bank up 3.56% [2][3] Oil Sector Activity - The oil sector saw significant gains, with Keli Co. rising over 12% and several other companies hitting the daily limit [7][8] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish strategic reserves, which may influence market dynamics [9] Company-Specific Highlights - Cambricon Technologies (688256) experienced a notable surge, with its stock price rising over 7% during the day, closing up 4.42% with a trading volume of 19.8 billion yuan [10] - The company reported a substantial increase in revenue for the first three quarters, achieving 4.607 billion yuan, a year-on-year growth of 2386% [11] - The growth was attributed to the strong performance of its cloud products, particularly the Siyuan 590, amid increasing domestic demand for AI-related technologies [11]