脂肪酸

Search documents

每周股票复盘:丰倍生物(603334)两度登龙虎榜

Sou Hu Cai Jing· 2026-02-07 18:42

Core Viewpoint - Fengbei Bio (603334) has experienced significant stock price fluctuations, with a recent increase of 25.93% to 59.3 yuan as of February 6, 2026, indicating strong market interest and trading activity [1][8]. Trading Information Summary - Fengbei Bio was listed on the "Dragon and Tiger List" for two consecutive days due to a daily turnover rate reaching 20% on February 5 and 6, 2026, marking its second appearance in the last five trading days [2][5]. - The stock also saw a cumulative price deviation exceeding 20% over two consecutive trading days, indicating abnormal trading activity [8]. Company Development and Products - Established in 2014, Fengbei Bio focuses on the comprehensive utilization of waste oil resources and has entered a rapid growth phase since 2018, emphasizing bio-based materials and biofuels [3]. - The main business includes waste oil resource utilization, with products such as bio-based materials (e.g., pesticide and fertilizer additives) and biofuels (e.g., biodiesel) [3][4]. - In the first half of 2025, the company produced 47,706.75 tons of biodiesel and 142,814.10 tons of industrial-grade mixed oil [4][5]. Market and Regulatory Environment - The company holds ISCC certification, allowing it to enter the EU market, which has stringent requirements for biofuel products [6]. - The revised Renewable Energy Directive (RED) aims to increase the EU's renewable energy target to at least 42.5% by 2030, impacting the biofuel market [6]. Client Relationships - Fengbei Bio collaborates with major global commodity traders and end customers, including TRFIGUR, GLENCORE, and SHELL, for its biodiesel sales [6]. - The company has established partnerships with key SF manufacturers for the sale of industrial-grade mixed oil [6]. Raw Material Sourcing - Waste oil is sourced from food processing, chemical companies, and kitchen waste treatment enterprises, with a nationwide supply network and efforts to expand overseas [7].

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:14

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products [1][2]. Company Overview - Established in 2014, Fengbei Bio primarily engages in waste oil resource utilization, with oil chemical products as a supplementary business [1]. - The company has developed a range of products including bio-based materials and biofuels, with a focus on agricultural additives and biodiesel [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 17.09 billion, 17.28 billion, and 19.48 billion CNY, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 1.33 billion, 1.30 billion, and 1.24 billion CNY, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - Fengbei Bio holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity [3]. - In the agricultural chemical sector, the company has a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives [4]. Research and Development - The company has obtained 135 patents, including 33 domestic invention patents and 3 international invention patents, and has been recognized as a national-level "little giant" enterprise [3]. Client Base - Fengbei Bio's clientele includes major global commodity traders such as TRAFIGURA and GLENCORE, as well as renowned end-users like CARGILL and BP [3].

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购丨打新早知道

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:04

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products, with a strong emphasis on bio-based materials and fuels [1][3]. Company Overview - Established in 2014, Fengbei Bio primarily engages in the comprehensive utilization of waste oil resources, with oil chemical products as a supplementary business [1]. - The company has developed a range of products, including bio-based materials (such as pesticide and fertilizer additives) and biofuels (mainly biodiesel) [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 1.709 billion, 1.728 billion, and 1.948 billion yuan, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 133 million, 130 million, and 124 million yuan, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - The company holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity as of the end of 2024 [3]. - In the agricultural chemical sector, Fengbei Bio has established long-term partnerships with leading companies, achieving a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives in 2023 [4]. Research and Development - As of June 30, 2025, Fengbei Bio and its subsidiaries have obtained 135 patents, including 33 domestic invention patents and 3 international invention patents [3]. - The company has been recognized as a national-level "little giant" enterprise and has established several engineering research centers in Jiangsu Province [3]. Investment Plans - The company plans to invest 750 million yuan in new projects, including the construction of facilities for producing 300,000 tons of oleic acid methyl ester and 50,000 tons of biodiesel, among other products [2].

A股申购 | 丰倍生物(603334.SH)开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:45

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times [1] Group 1: Company Overview - Fengbei Bio is a high-tech enterprise in the field of waste resource utilization, primarily producing resource products from waste oils, forming a recycling industry chain of "waste oils - biofuels (biodiesel) - bio-based materials" [1] - The main business of the company focuses on the comprehensive utilization of waste oil resources, with auxiliary operations in oil chemical products [1] - The primary products from waste oil resource utilization include bio-based materials and biofuels, with bio-based materials mainly consisting of pesticide and fertilizer additives, and biofuels primarily being biodiesel [1] Group 2: Market Position and Partnerships - Fengbei Bio has established long-term collaborations with leading companies in the agricultural chemical sector, including Fengle Seed Industry, Jiuyue Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1] - As of the end of 2024, the company has a biodiesel production capacity of 105,000 tons, ranking sixth in China's biodiesel industry [2] Group 3: Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.948 billion CNY for the years 2022, 2023, and 2024, respectively [2] - Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2] - The company indicated that its operating cash flow was good from 2022 to 2023, but a decline in 2024 was noted due to an increase in operating receivables [2]

丰倍生物开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:39

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a maximum subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times. The company operates in the waste resource utilization sector, focusing on converting waste oils into biofuels and biobased materials, establishing a comprehensive recycling industry chain [1]. Company Overview - Fengbei Bio is a high-tech enterprise specializing in the comprehensive utilization of waste resources, primarily focusing on waste oils to produce biobased products and biofuels. The main products include biobased materials such as pesticide and fertilizer additives, and biofuels like biodiesel [1]. - The company has established long-term partnerships with leading agricultural chemical firms, including Fengle Seed Industry, Jiuyi Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1]. Production Capacity - As of the end of 2024, Fengbei Bio's biodiesel production capacity is 105,000 tons, ranking sixth in China's biodiesel industry. Compared to peers like Zhuoyue New Energy and Jiaao Environmental Protection, Fengbei's net profit after deducting non-recurring gains is lower than Zhuoyue but higher than Jiaao and Longhai Bio [2][3]. Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.949 billion CNY for the years 2022, 2023, and 2024, respectively. Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2][4]. - Total assets as of December 31, 2024, are 12.368 billion CNY, with equity attributable to shareholders at 7.558 billion CNY. The asset-liability ratio has improved from 49.12% in 2022 to 43.13% in 2024 [4]. Profitability Metrics - For the fiscal year 2024, the company expects a net profit of approximately 1.238 billion CNY, with a basic earnings per share of 1.15 CNY. The return on equity is projected at 17.91%, down from 30.57% in 2022 [5].

丰倍生物:围绕三大方向 打造成为全球油脂资源综合利用行业领军企业——苏州丰倍生物科技股份有限公司首次公开发行股票并在主板上市网上投资者交流会精彩回放

Shang Hai Zheng Quan Bao· 2025-10-26 17:24

Core Viewpoint - The company aims to become a leading enterprise in the global oil fat resource comprehensive utilization industry, focusing on three main directions: basic research, material development, and application development [1][2]. Business Overview - The company's main business is the comprehensive utilization of waste oil resources, primarily producing resource-based products from waste oils, with oil fat chemical products as a supplementary business [1][2]. - The company has developed a production chain of "waste oil - biofuels (biodiesel) - bio-based materials" and provides oil fat chemical products to customers based on its core technology and channel advantages [1][2]. Financial Performance - The sales revenue from the waste oil resource comprehensive utilization business has shown rapid growth, with revenues of 1.36 billion, 1.41 billion, 1.59 billion, and 1.35 billion yuan for the years 2022 to 2025, accounting for 79.53%, 81.94%, 81.68%, and 91.33% of the main business income respectively [3]. - The company's total operating income for the reporting period was 1.71 billion, 1.73 billion, 1.95 billion, and 1.48 billion yuan, with a year-on-year growth of 49.62% in the first half of 2025 [9]. Research and Development - The company has invested in R&D, with expenses of 51.35 million, 58.57 million, 53.57 million, and 34.45 million yuan over the reporting period, representing 3.00%, 3.39%, 2.75%, and 2.74% of operating income respectively [10]. - As of June 30, 2025, the company has obtained 135 patents, including 33 domestic invention patents and 3 international invention patents [4]. Development Strategy - The company aims to enhance its technology level and expand the application of bio-based materials, while also increasing production capacity and stabilizing procurement channels [11][12]. - Future plans include exploring biodiesel applications in aviation and shipping, and enhancing the supply chain layout with upstream food processing enterprises [11][12][13]. Industry Position - The company is positioned in the waste resource comprehensive utilization industry, specifically in the processing of non-metal waste [18]. - The industry is supported by national policies encouraging the comprehensive utilization of waste oils, with significant potential for growth due to the increasing production of waste oils from the food service sector [20]. Market Share - The company is among the top tier in the domestic waste oil resource comprehensive utilization industry, with a biodiesel production capacity of 105,000 tons, ranking sixth in China's biodiesel industry [24]. - The company's biodiesel production accounts for approximately 4.68% of the national biodiesel output, which is projected to be around 1.71 million tons in 2024 [24]. Fundraising and Investment - The total amount of funds raised will be used for projects related to the company's main business, including the construction of new production facilities for various bio-based products [25][26]. - The implementation of these projects is expected to expand market share and enhance profitability [26][28].

丰倍生物通过注册:上半年营收近15亿 拟募资7.5亿

Sou Hu Cai Jing· 2025-09-13 05:33

Company Overview - Suzhou Fengbei Biotechnology Co., Ltd. (Fengbei Bio) is preparing to list on the Shanghai Stock Exchange, aiming to raise 750 million yuan [2] - The company specializes in the comprehensive utilization of waste resources, primarily producing bio-based materials and biofuels from waste oils [4] Financial Performance - Fengbei Bio reported revenues of 1.71 billion yuan in 2022, 1.73 billion yuan in 2023, and projected 1.948 billion yuan in 2024, with net profits of 133 million yuan, 130 million yuan, and 124 million yuan respectively [4] - In the first half of 2025, the company achieved revenues of 1.478 billion yuan, a 49.62% increase from 988 million yuan in the same period of the previous year [7] - For the first nine months of 2025, Fengbei Bio expects revenues between 2.1 billion and 2.3 billion yuan, representing a growth of 51.40% to 65.82% compared to 1.387 billion yuan in the same period of 2024 [8] Shareholding Structure - Pingyuan controls 85.4% of Fengbei Bio, holding 59.78% directly and additional shares through subsidiaries [9] - Post-IPO, Pingyuan's shareholding will decrease to 44.82%, while other shareholders will hold smaller percentages [10] Project Financing - The current financing round will fund the construction of several projects, including an annual production capacity of 300,000 tons of oleic acid methyl ester and 50,000 tons of bio-diesel [3]

丰倍生物IPO:行业竞争加剧业绩承压,负债高企偿债压力不小

Sou Hu Cai Jing· 2025-09-10 11:09

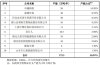

Core Viewpoint - The company, Fengbei Biological Technology Co., Ltd., is set to go public on the Shanghai Stock Exchange, aiming to raise 1 billion yuan for expansion projects in the waste oil resource utilization sector [1][3]. Financial Performance - The company has experienced declining revenue and net profit from 2022 to 2024, with revenues of 1.71 billion yuan, 1.73 billion yuan, and 1.95 billion yuan, and net profits of 135.92 million yuan, 123.04 million yuan, and 115.32 million yuan respectively, indicating a downward trend [3]. - The sales prices of the company's main products have also shown a downward trend during the same period [3][4][5]. Product Pricing - The sales prices for the company's biodiesel formulation products decreased from 0.77 million yuan/ton in 2022 to 0.61 million yuan/ton in 2024, while industrial-grade mixed oil prices fell from 0.91 million yuan/ton to 0.62 million yuan/ton [4]. - The sales prices for biofuels and oil chemical products also declined, with biofuels dropping from 0.98 million yuan/ton to 0.73 million yuan/ton, and oil chemical products from 1.18 million yuan/ton to 0.89 million yuan/ton [5]. Inventory and Liabilities - The company's inventory has been increasing, with values of 104.24 million yuan, 198.38 million yuan, and 242.01 million yuan from 2022 to 2024, indicating a growing stockpile [6]. - The raw materials, primarily waste oil and industrial-grade mixed oil, accounted for a rising proportion of total inventory, increasing from 30.77% in 2022 to 40.71% in 2024 [6]. - The company has a significant amount of current liabilities, with total current liabilities of 373.14 million yuan, 336.64 million yuan, and 358.53 million yuan over the same period, primarily consisting of short-term loans and accounts payable [7][8]. Legal Issues - The company is involved in ongoing litigation related to a fire incident at a leased facility, which resulted in significant inventory losses and subsequent lawsuits from various parties [10][11].

成本供应双支撑 脂肪酸行情短期看涨

Zhong Guo Hua Gong Bao· 2025-09-02 02:48

Group 1 - The core viewpoint of the articles indicates a significant recovery in the fatty acid market, particularly for stearic acid and lauric acid, driven by the strong rise in palm oil prices since August [1][2] - As of August 31, the average price of stearic acid was 10,044 yuan per ton, an increase of 571.22 yuan (6.03%) from August 1, while lauric acid averaged 18,600 yuan, up 1,703.05 yuan (10.08%) [1][2] - The domestic market is experiencing tight supply and cost support, leading stearic acid producers to flexibly adjust prices based on their inventory, with expectations of price increases in the short term [1][2] Group 2 - The strong performance of palm oil, primarily imported from Malaysia and Indonesia, is influencing domestic prices, with palm oil prices rising to an average of 9,393.57 yuan, up 470.64 yuan (5.27%) since August 1 [2] - Malaysia's palm oil inventory was reported at 2.113 million tons, lower than expected, while exports increased by 3.82%, alleviating concerns of oversupply and supporting price increases [2] - Indonesia's biodiesel policies are expected to sustain demand for palm oil, further supporting international prices as exports decrease [2] Group 3 - The fatty acid market is facing supply constraints due to raw material shortages, low operating rates, and low inventory levels among companies, which are limiting the availability of stearic acid [3] - Despite weak terminal demand and reduced production capacity, the overall supply-demand balance remains tight, keeping stearic acid prices elevated [3] - The import volume of stearic acid in July was 15,700 tons, a decrease of 32.9% year-on-year, with rising import costs further suppressing import intentions [3] Group 4 - Demand for fatty acids is currently weak, with downstream industries primarily consuming previously low-priced orders and showing resistance to high-priced raw materials [4] - The tire and real estate sectors have not yet activated demand, leading to a supply surplus in the stearic acid market, where some manufacturers are forced to lower prices to stimulate sales [4] - The PVC production chain, which relies on stearic acid, is facing low demand due to limited new construction projects in real estate, resulting in only essential purchases from downstream enterprises [4] Group 5 - Lauric acid demand is also affected by seasonal changes, with a decline in demand from the daily chemical and food industries as they enter autumn and winter [5] - However, there is some minor replenishment of inventory due to the rising prices of palm kernel oil, despite overall market transactions being limited [5]

AES/LAS产销稳居全国榜首 赞宇科技上半年营收破65亿增逾四成

Quan Jing Wang· 2025-08-21 09:52

Core Viewpoint - Zanyu Technology (002637) reported a significant revenue increase of 41.71% year-on-year, reaching 6.553 billion yuan in the first half of 2025, with a net profit of 97 million yuan, reflecting the company's robust growth amid a complex global economic environment [1] Group 1: Business Performance - The company's main business segments include surfactants, fatty chemical products, and OEM/ODM personal care products, with over 97% of revenue derived from these core areas [1] - In the surfactant industry, the total production is projected to decline by 2.8% in 2024, while anionic surfactants are expected to see sales growth of 10.5% and 14.0% respectively [1] - Zanyu's market share in key products AES and LAS exceeds 70%, solidifying its leading position in the domestic market [1] Group 2: Industry Trends - The fatty chemical products sector is transitioning towards differentiation and high-end products, with a projected annual growth rate of 5% to 8% for major products like fatty acids and alcohols in 2024 [2] - The demand for green and low-carbon fatty chemical products is steadily increasing, supported by national policies [2] - The synthetic detergent production in China is expected to reach 12.246 million tons in 2024, marking a 14.3% year-on-year increase, providing ample space for the OEM business [2] Group 3: Strategic Initiatives - The company has established a comprehensive model integrating surfactant production and personal care product processing, with an OEM/ODM capacity of 1.1 million tons [3] - Zanyu has strategically positioned production bases across multiple regions, including Indonesia, to enhance supply chain efficiency and cost control [3] - The company invested 54.9981 million yuan in R&D during the first half of 2025, a 20.37% increase, focusing on new product development and process optimization [3] Group 4: Corporate Responsibility and Future Outlook - Zanyu actively engages in social responsibility initiatives, including environmental protection projects and compliance with national environmental policies [4] - The company aims to optimize product structure, enhance high-value product ratios, and strengthen supply chain resilience while continuing to innovate [4] - Zanyu is well-positioned to lead high-quality industry development through its comprehensive value chain advantages amid ongoing industry consolidation and upgrades [4]