AIA(01299)

Search documents

港股内险股集体拉升上涨,中国人寿涨超4%

Mei Ri Jing Ji Xin Wen· 2025-10-21 01:56

Core Viewpoint - The Hong Kong insurance stocks experienced a collective surge, with notable increases in share prices for major companies in the sector [1] Group 1: Stock Performance - China Life Insurance led the gains with an increase of over 4% [1] - China Pacific Insurance rose by 3.5% [1] - New China Life Insurance saw a rise of 2.6% [1] - Other companies such as New China Life, Ping An Insurance, China Pacific Insurance, and AIA Group all recorded increases of over 2% [1]

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]

友邦保险(01299.HK)获摩根大通增持768.1万股

Ge Long Hui A P P· 2025-10-20 23:21

Group 1 - JPMorgan Chase & Co. increased its stake in AIA Group Limited (01299.HK) by acquiring 7,681,993 shares at an average price of HKD 70.8549 per share, totaling approximately HKD 544 million [1] - Following the acquisition, JPMorgan's total holdings in AIA Group reached 948,937,401 shares, raising its ownership percentage from 8.96% to 9.03% [2]

智通ADR统计 | 10月21日

智通财经网· 2025-10-20 22:46

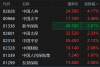

Core Insights - Major blue-chip stocks mostly rose, with HSBC Holdings closing at 102.033 HKD, down 0.07% from the previous close, while Tencent Holdings closed at 634.928 HKD, up 1.18% [2] Stock Performance Summary - Tencent Holdings: Latest price at 627.500 HKD, increased by 19.500 HKD, representing a 3.21% rise; ADR price at 634.928 HKD, up by 7.428 HKD compared to the Hong Kong stock [3] - Alibaba Group: Latest price at 161.900 HKD, increased by 7.500 HKD, representing a 4.86% rise; ADR price at 168.452 HKD, up by 6.552 HKD compared to the Hong Kong stock [3] - HSBC Holdings: Latest price at 102.100 HKD, increased by 1.200 HKD, representing a 1.19% rise; ADR price at 102.033 HKD, down by 0.067 HKD compared to the Hong Kong stock [3] - AIA Group: Latest price at 72.100 HKD, increased by 3.050 HKD, representing a 4.42% rise; ADR price at 72.889 HKD, up by 0.789 HKD compared to the Hong Kong stock [3] - BYD Company: Latest price at 104.800 HKD, increased by 1.600 HKD, representing a 1.55% rise; ADR price at 106.041 HKD, up by 1.241 HKD compared to the Hong Kong stock [3]

小摩增持友邦保险约768.1万股 每股作价约70.85港元

Zhi Tong Cai Jing· 2025-10-20 11:21

Core Viewpoint - JPMorgan has increased its stake in AIA Group Limited (01299) by acquiring 7,680,993 shares at a price of HKD 70.8549 per share, totaling approximately HKD 544 million, resulting in a new holding of about 949 million shares, representing a 9.03% ownership [1] Group 1 - JPMorgan's recent acquisition reflects a strategic investment in AIA Group, indicating confidence in the company's future performance [1] - The total amount invested by JPMorgan in this transaction is approximately HKD 544 million [1] - Following the purchase, JPMorgan's total shareholding in AIA Group has increased to approximately 949 million shares [1]

小摩增持友邦保险(01299)约768.1万股 每股作价约70.85港元

智通财经网· 2025-10-20 11:13

Group 1 - On October 15, JPMorgan increased its stake in AIA Group Limited (01299) by acquiring 7,680,993 shares at a price of HKD 70.8549 per share, totaling approximately HKD 544 million [1] - Following the acquisition, JPMorgan's total shareholding in AIA Group is approximately 949 million shares, representing a holding percentage of 9.03% [1]

大行评级丨花旗:预期友邦第三季新业务价值将加快增长 评级“买入”

Ge Long Hui· 2025-10-20 07:18

Core Viewpoint - Citigroup's research report anticipates that AIA's new business value will accelerate further in Q3, with year-on-year growth of 21% or 19% when calculated at AER or CER respectively [1] Group 1: Market Drivers - AIA benefits from the redistribution of wealth among mainland families, strong insurance demand under low interest rates, attractive products in Hong Kong, and the spillover effect of sales booms [1] - Southeast Asia and other markets are expected to continue healthy growth, with the primary sources of new business value growth coming from mainland China and Hong Kong [1] Group 2: Investment Recommendation - Citigroup sets a target price of HKD 99 for AIA, with a rating of "Buy" [1]

大行评级丨花旗:预期友邦第三季业务将继续表现向好 评级“买入”

Ge Long Hui· 2025-10-20 05:22

花旗认为市场或低估了友邦内地业务的快速复苏,以及香港市场在次季急促销售的韧性,给予"买入"评 级,目标价为99港元。 花旗发表研究报告,预期友邦第三季业务将继续表现向好,新业务价值(VNB)按年增长预期可进一步加 快,目前预测以实际汇率及固定汇率计算将分别增长21%及19%,对比首季及次季按实际汇率计算增幅 为13%及19%。 按固定汇率计算,该行认为VNB增长主要受内地及香港业务(分别增长36%及20%)推动,友邦将受惠于 内地家庭财富重新配置及低利率环境下对保险的强劲需求、香港保险产品仍具吸引力,以及6月下旬销 售热潮溢出效应的利好,同时相信东盟及其他市场预计将继续保持健康增长。 ...

恒指收跌641点,全周累跌1043点

Guodu Securities Hongkong· 2025-10-20 02:47

Group 1: Market Overview - The Hang Seng Index closed down 641 points, a decline of 2.48%, and accumulated a weekly drop of 1,043 points or 3.97% [2] - The Hang Seng Tech Index fell by 243 points or 4.05%, with a weekly loss of 499 points or 7.98% [2] - The trading volume for the day was 314.62 billion, with a net inflow of 6.30 billion from northbound trading [2] Group 2: Company Performance - HSBC Holdings (00005) closed down 1.9% at 100.9 HKD, while AIA Group (01299) fell 2.2% to 69.05 HKD [3] - Semiconductor companies like SMIC (00981) and Hua Hong Semiconductor (01347) saw declines of 6.5% and 6.9%, respectively [3] - BYD Electronics (00285) was the worst-performing blue chip, dropping 8.1% to 37.74 HKD [3] Group 3: Economic and Regulatory Developments - The Financial Secretary of Hong Kong, Paul Chan, emphasized the importance of attracting U.S. businesses and talent to invest in Hong Kong, highlighting the city's favorable business environment [6] - The Insurance Authority has classified AIA and Prudential as Domestic Systemically Important Insurers (D-SII), which will subject them to enhanced regulatory requirements [8] - The People's Bank of China Governor, Pan Gongsheng, discussed the need for multilateral cooperation in light of increasing global economic challenges [9] Group 4: Retail Sector Insights - Chow Tai Fook (01929) reported a 4.1% year-on-year increase in retail value for the second fiscal quarter, with same-store sales in Hong Kong and Macau rising by 6.2% [11] - Xtep International (01368) experienced low single-digit growth in retail sales in mainland China for the third quarter, with inventory turnover of approximately 4 to 4.5 months [14] Group 5: Financing Activities - Zhengli New Energy (03677) announced a placement of 45.92 million new H shares at a discount of 7.89% to raise approximately 504 million HKD for various projects [12] - Aneng Logistics (09956) received a conditional proposal for potential privatization from a consortium led by Dazhong Capital and Temasek [13]

新华保险前三季度净利润同比预增45%-65%,将超去年全年;平安继续增持招商银行、邮储银行H股,持股比例突破17%|13精周报

13个精算师· 2025-10-18 03:03

Regulatory Dynamics - The National Healthcare Security Administration aims to achieve that by the end of 2026, instant settlement funds account for over 80% of local medical insurance fund monthly settlement funds [5] - The Financial Regulatory Bureau will host the first China Insurance Innovation Forum [6][7] - The Tianjin Financial Regulatory Bureau is constructing a technology insurance information data-sharing mechanism [8] - The Henan Financial Regulatory Bureau reported that the insurance industry invested over 12 million in disaster prevention and reduction due to the Huanghuai autumn rain disaster [9] - The Yunnan Financial Regulatory Bureau is developing specialty coffee insurance based on local coffee industry resources [10] - Hong Kong's Legislative Council passed a regulation requiring ride-hailing vehicles to hold appropriate third-party liability insurance [11] Company Dynamics - China Ping An increased its stake in Postal Savings Bank by 641,600 shares, totaling approximately 34.41 million HKD [13] - Ping An Life increased its holdings in China Merchants Bank H-shares, surpassing 17% of the total H-shares [14] - Guomin Pension plans to raise no more than 471 million shares, introducing up to five new shareholders [15] - Taikang Life established a corporate management company in Shanghai with a registered capital of 300 million [16] - China Life saw an increase of 162,000 shares from southbound funds [17] - Xinhua Insurance expects a net profit increase of 45%-65% year-on-year for the first three quarters [18] - PICC anticipates a net profit growth of 40% to 60% year-on-year for the first three quarters [19] - China Pacific Insurance reported a 10.9% year-on-year increase in original insurance premium income for the first three quarters [20] - Xinhua Insurance's cumulative original insurance premium income for the first nine months grew by 19% year-on-year [21] - ZhongAn Online achieved original premium income of 26.934 billion, a year-on-year increase of 5.64% [22] - China Life implemented a semi-annual A-share profit distribution [23] - China Export & Credit Insurance Corporation's underwriting amount for 2024 is expected to reach 102.144 billion USD, a 10% year-on-year increase [24] - China Life reported over 44 million claims in the first three quarters of 2025 [25] Personnel Changes - Zhang Shuguo and Wang Xiaolin were approved as vice general managers of China Coal Property Insurance [26] - Wang Yong was approved as vice general manager of Huaxia Jiuying Asset Management [27][28] - China Ping An appointed three independent non-executive directors to its board [29] - Taiping Fund underwent a significant leadership change with the resignation of its general manager and deputy general manager [30] Industry Dynamics - The insurance industry has maintained its position as the second largest in the world, with cumulative payouts reaching 9 trillion over the past five years [32] - Insurance capital has frequently participated in Hong Kong IPOs, with subscription amounts nearing 3 billion HKD, nearly three times last year's total [33] - 269 universal insurance products disclosed September settlement rates, with an average of 2.68%, down approximately 18 basis points year-on-year [34] - 1,469 combination insurance asset management products reported an average annualized return of 12.63% for the first three quarters [35] - CITIC Securities believes that the implementation of "reporting and operation integration" in non-auto insurance will optimize business expense ratios and enhance market share for leading insurers [36] - Dongwu Securities holds an optimistic outlook for new single premiums in 2026, citing improvements on both asset and liability sides [37] - Over 12,000 surveys have been conducted by insurance companies, with high dividends and technology growth sectors being favored [38] - UBS raised the target price for China Pacific Insurance to 22.5 HKD, expecting a significant increase in net profit [40] - UBS anticipates accelerated growth in new business value for AIA Insurance in the third quarter [41] - The A-share insurance sector has seen a six-day consecutive rise, with Xinhua Insurance's stock price increasing by 11.12% over five days [42] Product and Service Innovations - The "Beijing Inclusive Health Insurance" program has seen a continuous increase in participants, with a new product set to launch [46] - The 2025 "Tianjin Benefit Insurance" has been officially launched, maintaining a premium of 150 RMB with upgraded coverage [47] - PICC introduced a dedicated insurance package for foreign trade enterprises during the 138th Canton Fair [48] - China Pacific Insurance launched the first insurance product specifically for humanoid robots [49][50] - Ping An Property Insurance implemented a compensation insurance for application costs related to "specialized and innovative small and medium enterprises" [51]