CM BANK(600036)

Search documents

招商银行(600036) - 招商银行股份有限公司董事会决议公告

2025-10-29 10:15

A 股简称:招商银行 A 股代码:600036 公告编号:2025-051 招商银行股份有限公司(简称本公司或招商银行)于 2025 年 9 月 30 日以电 子邮件方式发出第十三届董事会第六次会议通知,于 10 月 29 日以书面传签方式 召开会议。会议应参会董事 14 名,实际参会董事 14 名。会议的召开符合《中华 人民共和国公司法》和《招商银行股份有限公司章程》等有关规定。 会议审议通过了以下议案: 一、审议通过了本公司 2025 年第三季度报告。 同意:14 票 反对:0 票 弃权:0 票 本公司董事会审计委员会已审议通过上述议案,并同意将其提交本公司董事 会审议。 二、审议通过了《2025 年第三季度第三支柱报告》。 同意:14 票 反对:0 票 弃权:0 票 招商银行股份有限公司 董事会决议公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 同意:14 票 反对:0 票 弃权:0 票 1 五、审议通过了《招商银行业务连续性管理工作规定(第四版)》。 同意:14 票 反对:0 票 弃权:0 票 六、审议通过了《关 ...

招商银行(03968) - 招商银行股份有限公司董事会决议公告

2025-10-29 10:13

招商銀行股份有限公司 CHINA MERCHANTS BANK CO., LTD. (於中華人民共和國註冊成立的股份有限公司) (H股股票代碼:03968) 海外監管公告 本公告乃根據《香港聯合交易所有限公司證券上市規則》第13.10B條而作出。 香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性 或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部份內容而產生或因倚 賴該等內容而引致之任何損失承擔任何責任。 招商銀行股份有限公司董事會 2025年10月29日 於本公告日期,本公司的執行董事為王良及鍾德勝;本公司的股東董事(非執行 董事)為繆建民、石岱、孫雲飛、江朝陽、朱立偉及黃堅;及本公司的獨立非執 行董事為李孟剛、劉俏、田宏啟、李朝鮮、史永東及李健。 A 股简称:招商银行 A 股代码:600036 公告编号:2025-051 招商银行股份有限公司 董事会决议公告 会议审议通过了以下议案: 一、审议通过了本公司 2025 年第三季度报告。 同意:14 票 反对:0 票 弃权:0 票 本公司董事会审计委员会已审议通过上述议案,并同意将其提交本公司董事 会审议。 二、 ...

招商银行(03968) - 2025 Q3 - 季度业绩

2025-10-29 10:06

Financial Performance - Net profit attributable to shareholders rose by 0.52% year-on-year to RMB 113,772 million for the first nine months of 2025[6]. - Operating income for Q3 2025 was RMB 81,359 million, reflecting a 2.11% increase compared to the same period last year[6]. - Basic earnings per share for Q3 2025 was RMB 1.54, up from RMB 1.32 in the same period last year, representing a 16.67% increase[6]. - The company's pre-tax profit for the first nine months of 2025 was RMB 135,089 million, reflecting a 0.76% increase year-on-year[6]. - The net profit for the nine months ended September 30, 2025, is RMB 114,537 million, slightly up from RMB 114,039 million in the same period last year[48]. - The net profit attributable to shareholders for the nine months ended September 30, 2025, is RMB 113,772 million, compared to RMB 113,184 million in the same period last year[48]. Asset and Liability Management - Total assets increased by 4.05% year-on-year to RMB 12,644,075 million as of September 30, 2025[6]. - Total liabilities increased by 4.12% to RMB 11,368.94 billion, primarily due to growth in customer deposits[25]. - The total number of ordinary shareholders reached 498,392, with 471,874 being A-share shareholders and 26,518 being H-share shareholders[8]. - The company's net assets per share increased by 4.22% year-on-year to RMB 43.21 as of September 30, 2025[6]. - The group's equity attributable to shareholders reached RMB 1,267.285 billion, an increase of 3.37% compared to the end of the previous year[26]. Customer Deposits and Loans - Customer deposits totaled RMB 9,518.70 billion, reflecting a 4.64% increase year-on-year, with retail customer deposits growing by 6.88%[25]. - The total loans and advances amounted to CNY 7,136.285 billion, growing by 3.60% from the end of the previous year[13]. - The average balance of loans and advances increased by 3.60% to RMB 71,362.85 billion, with corporate loans growing by 10.01%[24]. - The total customer deposits reached CNY 9,518.697 billion, an increase of 4.64% from the end of the previous year[13]. Non-Performing Loans and Credit Risk - The non-performing loan balance was CNY 67.425 billion, with a non-performing loan ratio of 0.94%, a decrease of 0.01 percentage points from the end of the previous year[14]. - The company's loan loss provision balance was RMB 262.123 billion, with a provision coverage ratio of 426.89%, an increase of 1.66 percentage points from the previous year[35]. - The company generated new non-performing loans of RMB 48.003 billion from January to September 2025, with an annualized NPL generation rate of 0.96%, a decrease of 0.06 percentage points year-on-year[34]. - The non-performing loan (NPL) ratio for the real estate sector was 4.24%, a decrease of 0.50 percentage points from the end of the previous year[27]. Income and Expense Management - The company's net interest income for the period was CNY 160.042 billion, representing a year-on-year increase of 1.74% and accounting for 63.69% of total operating income[16]. - Non-interest net income for the first nine months of 2025 was RMB 91.24 billion, a year-on-year decline of 4.27%, accounting for 36.31% of total operating income[19]. - The group maintained a cost-to-income ratio of 29.86%, an increase of 0.27 percentage points year-on-year, while focusing on lean management and cost control[21]. Risk Management and Compliance - The company will continue to enhance risk management and support compliance projects to stabilize the quality of real estate assets[28]. - The company is actively monitoring industry risks and implementing post-loan management to maintain overall asset quality stability[31]. - The company plans to enhance risk compliance management and adjust operational strategies in response to macroeconomic changes[36]. Capital Adequacy - The core tier 1 capital adequacy ratio was 13.93% as of September 30, 2025, a decrease of 0.93 percentage points from the end of the previous year[38]. - The total capital adequacy ratio is 17.40%, down 1.77 percentage points from the end of the previous year[41]. - The Tier 1 capital adequacy ratio under the weighted method is 13.99%, down 0.64 percentage points from the end of the previous year[43]. Customer Growth and Wealth Management - The number of retail customers increased to 220 million, representing a growth of 4.76% year-over-year[45]. - The number of high-net-worth clients (with average total assets of RMB 1 million or more) increased by 10.42% to 5.78 million[45]. - Wealth management fees and commissions increased by 18.76% to RMB 20.67 billion, driven by growth in distribution scale and product structure optimization[20].

招商银行:第三季度净利润为388.42亿元,同比增长1.04%

Zheng Quan Shi Bao Wang· 2025-10-29 10:05

人民财讯10月29日电,招商银行(600036)10月29日发布2025年第三季度报告,第三季度营收为814.51亿 元,同比增长2.11%;净利润为388.42亿元,同比增长1.04%。前三季度营收为2514.2亿元,同比下降 0.51%;净利润为1137.72亿元,同比增长0.52%。截至报告期末,集团不良贷款余额674.25亿元,较上 年末增加18.15亿元;不良贷款率0.94%,较上年末下降0.01个百分点;拨备覆盖率405.93%,较上年末 下降6.05个百分点;贷款拨备率3.84%,较上年末下降0.08个百分点。 转自:证券时报 ...

招商银行(600036) - 2025 Q3 - 季度财报

2025-10-29 10:05

A 股简称:招商银行 A 股代码:600036 公告编号:2025-053 招商银行股份有限公司 CHINAMERCHANTSBANKCO.,LTD. 二○二五年第三季度报告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容 的真实性、准确性和完整性承担法律责任。 1 重要提示 本公司董事会、监事会及董事、监事、高级管理人员保证本报告内容的真实、准确、完整,不存在虚假 记载、误导性陈述或者重大遗漏,并承担个别和连带的法律责任。 本公司董事长缪建民,行长兼首席执行官王良,副行长、财务负责人和董事会秘书彭家文及会计机构负 责人孙智华声明:保证本报告中财务信息的真实、准确、完整。 本公司董事会审计委员会已审阅本报告并同意将本报告提交本公司董事会审议。本公司第十三届董事会 第六次会议和第十二届监事会第四十五次会议分别审议并全票通过了本公司2025年第三季度报告。 本报告中的财务报表按中国会计准则编制且未经审计,本公司按国际财务报告会计准则编制且未经审计 的季报详见香港交易及结算所有限公司网站。本报告中金额币种除特别说明外,均以人民币列示。 本报告中"招商银行""本公司""本行 ...

解密主力资金出逃股 连续5日净流出490股

Zheng Quan Shi Bao Wang· 2025-10-29 09:03

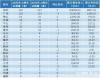

Core Insights - A total of 490 stocks in the Shanghai and Shenzhen markets have experienced net outflows of main funds for five consecutive days or more as of October 29 [1] - The stock with the longest continuous net outflow is Zhongju Gaoxin, with 31 days of outflows, followed by Hengshen New Materials with 21 days [1] - The largest total net outflow amount is from China Merchants Bank, with a cumulative outflow of 3.093 billion yuan over 12 days [1] Group 1: Stocks with Longest Net Outflows - Zhongju Gaoxin has seen net outflows for 31 days, with a total outflow of 559 million yuan and a cumulative decline of 6.91% [1] - Hengshen New Materials has recorded net outflows for 21 days, totaling 197 million yuan, with a decline of 9.80% [3] - China Merchants Bank has the highest net outflow amount of 3.093 billion yuan over 12 days, with a net outflow ratio of 6.98% and a cumulative increase of 1.65% [1] Group 2: Other Notable Stocks - Guotai Junan has experienced net outflows for 10 days, amounting to 1.877 billion yuan, with a net outflow ratio of 7.89% and a cumulative increase of 2.70% [1] - Shengbang Co. has seen net outflows for 12 days, totaling 1.826 billion yuan, with a net outflow ratio of 9.52% and a cumulative decline of 10.65% [1] - Huajian Group has recorded net outflows for 6 days, with a total outflow of 1.713 billion yuan and a significant decline of 40.29% [1] Group 3: Stocks with Significant Outflow Ratios - Jianan Intelligent has the highest net outflow ratio at 14.74%, with a decline of 2.98% over the past 5 days [1] - Other notable stocks with high outflow ratios include Huayi Development at 11.91% and Pianzaihuang at 11.84% [1] - The overall trend indicates a significant outflow of funds from various sectors, reflecting investor sentiment and market conditions [1]

银行行业今日跌1.98%,主力资金净流出20.90亿元

Zheng Quan Shi Bao Wang· 2025-10-29 09:03

Market Overview - The Shanghai Composite Index rose by 0.70% on October 29, with 24 out of 31 sectors experiencing gains, led by the power equipment and non-ferrous metals sectors, which increased by 4.79% and 4.28% respectively [1] - The banking and food & beverage sectors were the biggest losers, declining by 1.98% and 0.56% respectively, with the banking sector taking the lead in losses [1] Capital Flow - The net inflow of capital in the two markets was 5.406 billion yuan, with 12 sectors seeing net inflows. The power equipment sector had the highest net inflow of 16.132 billion yuan, followed by the non-ferrous metals sector with 5.997 billion yuan [1] - Conversely, 19 sectors experienced net outflows, with the electronics sector leading with a net outflow of 6.540 billion yuan, followed by the communications sector with 4.736 billion yuan [1] Banking Sector Performance - The banking sector saw a decline of 1.98%, with a net outflow of 2.090 billion yuan. Out of 42 stocks in this sector, only one stock rose while 39 stocks fell [2] - Among the banking stocks, China Bank had the highest net inflow of 299 million yuan, followed by CITIC Bank and Nanjing Bank with net inflows of 111 million yuan and 81.076 million yuan respectively [2] - The stocks with the largest net outflows included China Merchants Bank, Minsheng Bank, and Jiangsu Bank, with net outflows of 773 million yuan, 418 million yuan, and 241 million yuan respectively [2]

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

大摩、小摩、贝莱德等9大外资公募持仓出炉!光模块等AI科技成布局热门!

私募排排网· 2025-10-29 07:00

Core Viewpoint - The A-share market has shown a significant recovery this year, with the Shanghai Composite Index surpassing 4000 points, reflecting strong investment interest from foreign public funds, including major players like Morgan Stanley and BlackRock [3] Foreign Fund Holdings - In the third quarter, six foreign public funds increased their stock holdings, with Allianz Fund and Schroders Fund showing remarkable growth rates of 77.10% and 82.03% respectively [5] - Morgan Chase Fund's asset scale reached 213.22 billion, holding 194 stocks with a total market value of approximately 756.73 billion [6] - Morgan Stanley Fund's asset scale was 270.04 billion, with a focus on sectors like pharmaceuticals and AI, achieving an average return of 140.35% for its top twenty holdings [9] Key Stock Performances - The top holdings of Morgan Chase Fund included CATL, which saw a price increase of 45.29% year-to-date, with a total holding value of 3.66 billion [7] - New Yi Sheng, a key stock for Morgan Stanley Fund, experienced a staggering increase of 255.27% this year [10] - The top three holdings of Manulife Fund were all in the computing power industry, with 19 out of 20 stocks showing significant price increases [12] Investment Trends - The recent optimization of the Qualified Foreign Institutional Investor (QFII) system is expected to attract more foreign capital into the Chinese market, enhancing liquidity [3] - BlackRock Fund has notably increased its holdings in CATL, with a total market value of approximately 2.11 billion [15] - Fidelity Fund emphasizes the growth potential of Chinese technology stocks, despite a more diversified current portfolio [20] Market Outlook - The outlook for the A-share market remains optimistic, with expectations of new highs as the market stabilizes [18] - Roadshow Fund has maintained its positions in traditional blue-chip stocks while also focusing on technology stocks [19]

招商银行跌2.02%,成交额29.42亿元,主力资金净流出5.80亿元

Xin Lang Cai Jing· 2025-10-29 06:53

Core Viewpoint - The stock price of China Merchants Bank has experienced a decline of 2.02% on October 29, with significant net outflows of capital, indicating potential investor concerns about the bank's performance and market conditions [1]. Group 1: Stock Performance - As of October 29, the stock price is reported at 40.76 CNY per share, with a total market capitalization of 1,027.96 billion CNY [1]. - Year-to-date, the stock has increased by 9.28%, but it has seen declines of 2.84% over the last five trading days, 1.90% over the last twenty days, and 7.66% over the last sixty days [1]. Group 2: Financial Metrics - For the first half of 2025, the bank reported a net profit attributable to shareholders of 749.30 billion CNY, reflecting a year-on-year growth of 0.25% [2]. - The bank's cumulative cash dividends since its A-share listing amount to 403.70 billion CNY, with 144.00 billion CNY distributed over the past three years [3]. Group 3: Shareholder Information - As of June 30, 2025, the number of shareholders is reported at 410,400, a decrease of 5.65% from the previous period [2]. - The average number of circulating shares per shareholder has increased by 6.35% to 53,781 shares [2]. - Hong Kong Central Clearing Limited is the fourth largest circulating shareholder, holding 1.366 billion shares, which is a decrease of 33.10 million shares from the previous period [3]. Group 4: Business Overview - China Merchants Bank, established on March 31, 1987, and listed on April 9, 2002, primarily engages in retail financial services (56.59% of revenue), wholesale financial services (41.37%), and other business activities (2.03%) [1]. - The bank operates in the banking sector, specifically categorized under joint-stock commercial banks [1].