Beijing New Space Technology (605178)

Search documents

存储芯片板块高开,时空科技、盈新发展涨停

Xin Lang Cai Jing· 2025-10-24 01:27

Group 1 - The storage chip sector opened high, with significant gains in several companies [1] - Time Space Technology and Yingxin Development reached the daily limit up, indicating strong investor interest [1] - Aerospace Intelligent Equipment rose over 15%, reflecting positive market sentiment [1] Group 2 - Other companies such as Shannon Chip Creation, West Measurement Testing, Demingli, Jingrui Electric Materials, and Purun Co. also experienced upward movement [1]

业绩承压下的豪赌:时空科技跨界收购存储芯片厂商嘉合劲威

Guo Ji Jin Rong Bao· 2025-10-23 15:32

Core Viewpoint - After failing to transfer control, Shikong Technology is planning to diversify from landscape lighting into the lucrative semiconductor storage sector through the acquisition of 100% equity in Shenzhen Jiahe Jinwei Electronics Technology Co., Ltd. [2] Group 1: Acquisition Details - Shikong Technology announced a major asset restructuring plan on October 22, intending to acquire Jiahe Jinwei for cash and stock issuance to 19 parties, including its major shareholders [2] - The total amount of funds raised through the issuance will not exceed 100% of the transaction price, with the number of shares issued not exceeding 30% of the total shares before the issuance [2] - The raised funds will be used for cash payment, intermediary fees, taxes, and to supplement working capital, with a maximum of 25% of the transaction price allocated for debt repayment [2] Group 2: Jiahe Jinwei Overview - Jiahe Jinwei, established in 2012, is a well-known domestic memory module manufacturer focusing on the R&D, design, production, and sales of memory products, including memory bars and solid-state drives [4] - The company has established stable partnerships with major wafer manufacturers such as Samsung, Micron, and SK Hynix [4] - As of the signing date of the acquisition plan, the controlling shareholder Zhang Lili holds 22.14% of Jiahe Jinwei, while she and her spouse Chen Hui collectively control 50.20% of the voting rights [4] Group 3: Financial Performance - Jiahe Jinwei has shown growth in recent years, successfully turning a profit last year, with projected revenues of 854 million yuan, 1.344 billion yuan, and 1.123 billion yuan for 2023, 2024, and the first eight months of 2025, respectively [7] - Shikong Technology aims to enhance its profitability and create a second growth curve by entering the storage sector through this acquisition [7] Group 4: Shikong Technology's Historical Performance - Shikong Technology has faced declining performance since its listing, with revenues dropping from 897 million yuan in 2020 to 203 million yuan in 2023, and net losses accumulating to over 750 million yuan over four years [9] - The company has attempted various business transformations, including investments in smart parking and other sectors, but continues to face challenges in profitability [7][9] - Despite a slight recovery in revenue in 2024, the company reported an expanded net loss of 262 million yuan [9] Group 5: Recent Developments - This acquisition marks Shikong Technology's second major capital operation within three months, following an earlier attempt to change control that was ultimately terminated due to disagreements on key terms [10]

揭秘涨停 | 超导和煤炭板块多股涨停

Zheng Quan Shi Bao· 2025-10-23 10:34

Core Insights - The stock market saw significant activity on October 23, with 24 stocks having closing limit orders exceeding 1 billion yuan, indicating strong investor interest [1][3]. Group 1: Stock Performance - The top three stocks by closing limit order volume were Yingxin Development, Zhujiang Piano, and Guangtian Group, with limit order volumes of 1.96 million, 1.08 million, and 0.63 million shares respectively [2]. - Zhujiang Piano's limit order amount reached 668 million yuan, while Yingxin Development and Shikang Machinery also showed strong performance with limit orders exceeding 470 million yuan and 356 million yuan respectively [3][4]. Group 2: Company Strategies - Zhujiang Piano is a comprehensive enterprise focusing on pianos, musical instruments, and cultural tourism, and it plans to expand into new business areas while enhancing existing projects [3]. - The company successfully acquired the operational rights to the Bai Shui Zhai scenic area, aiming to develop a cultural and tourism hub [3]. Group 3: Sector Highlights - The superconducting concept stocks, including Guolan Testing and Dongfang Tantalum, saw notable gains, with Guolan Testing focusing on high-end cable technology for nuclear and superconducting applications [5]. - In the coal mining sector, companies like Shanxi Coking Coal and Yunnan Coal Energy reported strong performances, with Yunnan Coal Energy's project achieving a 94.51% capacity utilization rate [6][7]. Group 4: Emerging Trends - The short drama gaming sector is gaining traction, with companies like Haikan Co. and Huanrui Century actively engaging in interactive entertainment projects [9]. - The stock market also witnessed significant net purchases from institutional investors in companies like Huanrui Century and Yunhan Chip City, indicating strong institutional interest [11].

时空科技四年半亏损超7亿 从照明到半导体存储跨界收购业务协同性差、此前高溢价收购标的陷亏损

Xin Lang Zheng Quan· 2025-10-23 08:56

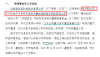

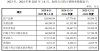

Core Viewpoint - The company, Time Space Technology, is planning to issue shares and pay cash to acquire assets, marking its entry into the semiconductor storage sector, despite its ongoing financial struggles and previous unsuccessful cross-industry ventures [1][18]. Group 1: Financial Performance - Time Space Technology has reported continuous losses over the past four years, with a cumulative loss exceeding 700 million yuan [5][4]. - The company's net profits from 2021 to the first half of 2025 were -18 million yuan, -209 million yuan, -207 million yuan, -262 million yuan, and -66 million yuan, respectively [6][4]. - Revenue figures for the same period were 896 million yuan, 746 million yuan, 330 million yuan, 203 million yuan, 341 million yuan, and 144 million yuan, showing significant year-on-year declines [6][4]. Group 2: Operational Challenges - The company's gross profit margin has been declining, dropping from 27.87% in the first half of 2023 to 18.26% in the first half of 2025, with a sharp decline to 8.52% in the second quarter [8]. - The net profit margin has remained negative since the first half of 2022, with figures of -16.94%, -69%, -46.23%, and -46.14% from the first half of 2022 to the first half of 2025 [8]. Group 3: Accounts Receivable Issues - The company's accounts receivable as a percentage of revenue was 279.99% in the first half of 2025, significantly higher than the industry average [10]. - A concerning 86.44% of accounts receivable were over one year old by the end of 2024, indicating poor collection efficiency [11]. Group 4: Acquisition Attempts and Market Reactions - Time Space Technology's acquisition of Jieanbo in 2023 did not yield the expected improvements and led to goodwill impairment due to the target company's poor performance [14][16]. - The stock price of Time Space Technology has shown unusual activity, with a 52.92% increase since September, often spiking before major announcements [19][2].

专业工程板块10月23日涨0.03%,圣晖集成领涨,主力资金净流出3.39亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:21

Core Insights - The professional engineering sector experienced a slight increase of 0.03% on October 23, with Shenghui Integration leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index also rose by 0.22% to 13025.45 [1] Stock Performance Summary - Shenghui Integration (603163) saw a significant rise of 10.01%, closing at 46.59 with a trading volume of 54,300 shares and a turnover of 246 million [1] - Other notable gainers included Shikong Technology (605178) with a 9.99% increase, closing at 39.41, and Zhitex New Materials (300986) which rose by 4.72% to 12.21 [1] - Conversely, Zhonghua Rock and Soil (002542) experienced the largest decline at 5.83%, closing at 4.20, with a trading volume of 3.7388 million shares and a turnover of 1.654 billion [2] Capital Flow Analysis - The professional engineering sector saw a net outflow of 339 million from institutional investors, while retail investors contributed a net inflow of 200 million [2] - Notably, Shenghui Integration had a net inflow of 60.77 million from institutional investors, representing 24.69% of its trading volume [3] - In contrast, Zhonghua Chemical (601117) experienced a net inflow of 47.51 million from institutional investors, but also saw significant outflows from retail investors [3]

时空科技“蛇吞象”!跨界收购存储企业,复牌后一字涨停

Ge Long Hui· 2025-10-23 03:45

Core Viewpoint - Company is attempting to find new growth engines through cross-border acquisitions after four years of losses in its main business of smart lighting engineering [1][8] Group 1: Acquisition Details - Company plans to acquire 100% of Shenzhen Jiahe Jinwei Electronic Technology Co., Ltd. through a combination of issuing shares and cash payment [1][2] - The acquisition involves 19 counterparties, including key individuals and management consulting partnerships [2][4] - Company intends to raise matching funds from its controlling shareholder, Gong Lanhai, not exceeding 100% of the acquisition price, with a maximum issuance of 30% of the total share capital prior to the issuance [2][5] Group 2: Financial Performance - Company reported a cumulative loss of approximately 696 million yuan over four years, with net profits of -17.67 million yuan, -209 million yuan, -207 million yuan, and -262 million yuan from 2021 to 2024 [8][10] - In the first half of 2025, company achieved revenue of 144 million yuan, a year-on-year decline of 10.95%, and a net loss of 66.27 million yuan [10][9] - The financial performance of Jiahe Jinwei shows projected revenues of 854 million yuan, 1.344 billion yuan, and 1.123 billion yuan for 2023, 2024, and the first eight months of 2025, respectively [6][8] Group 3: Strategic Shift - The acquisition is part of a strategic adjustment in response to pressure on the main business, with the company aiming to enhance its asset quality and risk resistance through the integration of semiconductor storage assets [6][8] - Company has been facing intensified competition in the landscape lighting industry, leading to compressed profit margins and increasing accounts receivable issues [10][11] - Company is also focusing on the development of night economy and smart city projects, with revenues from these sectors reported at 87.19 million yuan and 56.21 million yuan, respectively, in the first half of 2025 [10][11]

破发连亏股时空科技拟买嘉合劲威涨停 标的去年扭亏

Zhong Guo Jing Ji Wang· 2025-10-23 03:18

Core Viewpoint - The company, Shikong Technology, has resumed trading with a significant stock price increase of 9.99%, reaching 39.41 yuan, following the announcement of a major asset acquisition plan [1] Group 1: Transaction Details - The company plans to acquire 100% of Jiahe Jingwei's shares through a combination of issuing shares and cash payments to 19 counterparties, including Zhang Lili and Chen Hui [1] - The final transaction price and payment structure will be determined after the completion of auditing and evaluation work [1][2] - The cash payment for the transaction will be sourced from raised funds, self-owned funds, or bank loans, with the possibility of initial payments using self-raised funds before the completion of fundraising [2] Group 2: Fundraising and Use of Proceeds - The company intends to raise funds through issuing shares to its controlling shareholder, Gong Lanhai, with the total amount not exceeding 100% of the asset purchase price [2] - The raised funds will be used for cash payments related to the transaction, intermediary fees, taxes, and to supplement working capital for both the company and the target company [2] - If the fundraising is unsuccessful or insufficient, the company will cover any funding gaps through self-raised solutions [2] Group 3: Related Party Transactions - The transaction is expected to constitute a related party transaction, as the controlling shareholder and actual controller will be involved in the fundraising [3] - Prior to the transaction, there was no existing relationship between the counterparties and the company, but post-transaction, some counterparties will hold more than 5% of the company's shares [3] Group 4: Business Overview - Before the transaction, the company focused on night economy and smart city sectors, covering areas like landscape lighting and smart parking operations [4] - The target company, Jiahe Jingwei, specializes in the research, design, production, and sales of storage products, including memory bars and solid-state drives [4] - The acquisition aims to diversify the company's business into the storage sector, creating a second growth curve and enhancing profitability [4] Group 5: Financial Performance - As of the signing date of the proposal, Gong Lanhai holds 37.51% of the company's shares, making him the controlling shareholder [5] - Jiahe Jingwei's projected revenues for 2023, 2024, and the first eight months of 2025 are 854.30 million yuan, 1.34 billion yuan, and 1.12 billion yuan, respectively, with net profits showing a recovery trend [6][7] - Shikong Technology reported a revenue decline of 10.95% in the first half of 2025, with a net loss of 66.27 million yuan [9]

时空科技开盘涨停,公司拟重大资产重组

Zheng Quan Shi Bao Wang· 2025-10-23 02:33

时空科技开盘涨停,公司今日公布发行股份及支付现金购买资产并募集配套自己的预案,本次交易预计 构成重大资产重组。 公司拟通过发行股份及支付现金的方式向张丽丽、陈晖、深圳东珵管理咨询合伙企业(有限合伙)、深 圳普沃创达管理咨询合伙企业(有限合伙)等19名交易对方收购嘉合劲威100%股份,并向控股股东、 实际控制人宫殿海发行股份募集配套资金。本次交易预计构成重大资产重组。 标的公司主要从事内存条、固态硬盘等存储产品的研发、设计、生产和销售,拥有光威、阿斯加特和神 可三大产品线,提供消费级、企业级、工业级存储器产品及行业应用解决方案。 本次交易完成后,上市公司将切入到存储领域,打造第二增长曲线,加快向新质生产力转型步伐,增加 新的利润增长点,从而进一步提高上市公司持续盈利能力。(数据宝) (文章来源:证券时报网) ...

时空科技:拟购买嘉合劲威100%股权,股票今起复牌

Bei Ke Cai Jing· 2025-10-23 02:29

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% of Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd. through a combination of share issuance and cash payment, aiming to enter the storage sector and create a second growth curve [1] Group 1: Acquisition Details - The acquisition involves 19 counterparties, including Zhang Lili, Chen Hui, and Shenzhen Dongcheng Management Consulting Partnership [1] - The specific transaction price for the acquisition has not yet been determined [1] Group 2: Business Focus - Jiahe Jingwei specializes in the research, design, production, and sales of storage products such as memory modules and solid-state drives [1] - The company has three main product lines: Guangwei, Asgard, and Shenk, offering consumer, enterprise, and industrial-grade storage solutions [1] Group 3: Strategic Implications - Upon completion of the acquisition, Shikong Technology aims to accelerate its transformation towards new productive forces and increase new profit growth points [1] - The company's stock will resume trading on October 23 [1]

605178,重大资产重组!切入半导体存储领域,今天复牌!

Zheng Quan Shi Bao Wang· 2025-10-23 00:31

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jinwei Electronics Technology Co., Ltd. through a combination of issuing shares and cash payment, marking its entry into the semiconductor storage sector [1][2]. Group 1: Transaction Details - The acquisition involves 19 shareholders of Jiahe Jinwei, with a total fundraising amount not exceeding 100% of the transaction price [1]. - The share issuance price is set at 23.08 yuan per share, which is 80% of the average trading price over the last 20 trading days [1]. - The lock-up period for the newly issued shares is 12 months for the 19 shareholders and 36 months for the controlling shareholder, Gong Lanhai [1]. Group 2: Jiahe Jinwei Overview - Jiahe Jinwei, established in August 2012, specializes in the R&D, design, production, and sales of memory modules and solid-state drives, with a registered capital of 18.6133 million yuan [2]. - The company has shown steady financial improvement, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025, alongside a net profit turnaround from a loss of 20.1572 million yuan in 2023 to a profit of 42.2613 million yuan in 2024 [2]. - Jiahe Jinwei has established stable partnerships with major manufacturers like Samsung and Micron, ensuring a reliable supply chain for its products [2]. Group 3: Strategic Implications - Post-acquisition, Shikong Technology will shift its focus from night economy and smart city sectors to the semiconductor storage industry, aiming to create a second growth curve [3]. - The company plans to grant Jiahe Jinwei operational autonomy while leveraging its marketing and channel resources to expand market reach [3]. - The transaction is classified as a major asset restructuring under regulatory guidelines, but it does not constitute a change in control as the controlling shareholder remains the same [3].