Beijing New Space Technology (605178)

Search documents

时空科技:拟购买嘉合劲威100%股权,股票今起复牌

Bei Ke Cai Jing· 2025-10-23 02:29

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% of Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd. through a combination of share issuance and cash payment, aiming to enter the storage sector and create a second growth curve [1] Group 1: Acquisition Details - The acquisition involves 19 counterparties, including Zhang Lili, Chen Hui, and Shenzhen Dongcheng Management Consulting Partnership [1] - The specific transaction price for the acquisition has not yet been determined [1] Group 2: Business Focus - Jiahe Jingwei specializes in the research, design, production, and sales of storage products such as memory modules and solid-state drives [1] - The company has three main product lines: Guangwei, Asgard, and Shenk, offering consumer, enterprise, and industrial-grade storage solutions [1] Group 3: Strategic Implications - Upon completion of the acquisition, Shikong Technology aims to accelerate its transformation towards new productive forces and increase new profit growth points [1] - The company's stock will resume trading on October 23 [1]

605178,重大资产重组!切入半导体存储领域,今天复牌!

Zheng Quan Shi Bao Wang· 2025-10-23 00:31

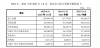

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jinwei Electronics Technology Co., Ltd. through a combination of issuing shares and cash payment, marking its entry into the semiconductor storage sector [1][2]. Group 1: Transaction Details - The acquisition involves 19 shareholders of Jiahe Jinwei, with a total fundraising amount not exceeding 100% of the transaction price [1]. - The share issuance price is set at 23.08 yuan per share, which is 80% of the average trading price over the last 20 trading days [1]. - The lock-up period for the newly issued shares is 12 months for the 19 shareholders and 36 months for the controlling shareholder, Gong Lanhai [1]. Group 2: Jiahe Jinwei Overview - Jiahe Jinwei, established in August 2012, specializes in the R&D, design, production, and sales of memory modules and solid-state drives, with a registered capital of 18.6133 million yuan [2]. - The company has shown steady financial improvement, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025, alongside a net profit turnaround from a loss of 20.1572 million yuan in 2023 to a profit of 42.2613 million yuan in 2024 [2]. - Jiahe Jinwei has established stable partnerships with major manufacturers like Samsung and Micron, ensuring a reliable supply chain for its products [2]. Group 3: Strategic Implications - Post-acquisition, Shikong Technology will shift its focus from night economy and smart city sectors to the semiconductor storage industry, aiming to create a second growth curve [3]. - The company plans to grant Jiahe Jinwei operational autonomy while leveraging its marketing and channel resources to expand market reach [3]. - The transaction is classified as a major asset restructuring under regulatory guidelines, but it does not constitute a change in control as the controlling shareholder remains the same [3].

财经早报:美国宣布制裁俄罗斯两大石油公司 基金10月参与定增热情升温丨2025年10月22日

Xin Lang Zheng Quan· 2025-10-23 00:16

Group 1 - The Shenzhen government has set ambitious merger and acquisition targets, aiming for over 200 deals and a total transaction value exceeding 100 billion yuan by 2027 [2] - The A-share market is witnessing a significant increase in net profits, with 233 out of 370 listed companies reporting year-on-year growth, including notable increases of over 1000% in companies like Qianfang Technology and Hengdian Film [6] - The U.S. has imposed new sanctions on two major Russian oil companies, Rosneft and Lukoil, in response to the ongoing Ukraine conflict, indicating a continued geopolitical tension affecting the market [7] Group 2 - The private equity sector is actively adjusting portfolios, with notable figures like Deng Xiaofeng reducing holdings in Zijin Mining and increasing positions in Yangjie Technology [4] - The interest in public offerings and private placements is rising, particularly in high-growth sectors such as technology and healthcare, as institutional investors seek quality growth companies [9] - Google has achieved a breakthrough in quantum computing with its Willow chip, which could accelerate advancements in quantum technology applications [10] Group 3 - The A-share market is experiencing a mixed performance, with major indices showing slight declines, while sectors like oil and banking are performing strongly [18] - The Hong Kong market is seeing increased activity, with international long-term capital showing renewed interest in Chinese tech innovation, reflecting a shift in global asset allocation [12] - Several companies are reporting significant increases in net profits for the third quarter, including Duofluoride and Wehua New Materials, with growth rates of 407.74% and 250.04% respectively [33][34]

超导概念龙头 拟重大资产重组

Zhong Guo Zheng Quan Bao· 2025-10-22 23:25

Group 1: Mergers and Acquisitions - Shenzhen has issued the "Action Plan for Promoting High-Quality Development of Mergers and Acquisitions and Restructuring (2025-2027)", aiming for a total market value of listed companies to exceed 20 trillion yuan by the end of 2027 and to complete over 200 merger projects with a total transaction amount exceeding 100 billion yuan [1][2] - The plan includes the establishment of a matrix of merger funds to foster a trillion-level "20+8" industrial fund group, promoting collaborative mergers in key industrial chains [1] Group 2: Company Performance - China Unicom reported a net profit of 8.772 billion yuan for the first three quarters, a year-on-year increase of 5.2%, with a revenue of 292.985 billion yuan, up 1% [3][6] - Q3 results for various companies include: - Q3 revenue of 1.946 billion yuan for Qianfang Technology, up 5.69%, with a net profit of 19.224 million yuan, up 445.61% [3] - Q3 revenue of 2.4 billion yuan for Kaisheng New Materials, up 19.96%, with a net profit of 27.2706 million yuan [4] - Q3 revenue of 10.6 billion yuan for Taotao Vehicle, up 27.73%, with a net profit of 264 million yuan, up 121.44% [5] - Q3 revenue of 1.05 billion yuan for *ST Chengchang, up 266.57%, with a net profit of 33.7253 million yuan, up 565.20% [5] Group 3: Corporate Actions - Farsen plans to sell a 10% stake in China Belkalt Steel Cord Co., which is expected to constitute a major asset restructuring [5] - Time Space Technology announced plans to acquire 100% of Shenzhen Jiahe Jingwei Electronics Technology Co., which is also expected to constitute a major asset restructuring [5] - China Unicom intends to spin off its subsidiary Zhinet Technology for a listing on the Shenzhen Stock Exchange's Growth Enterprise Market [6] - Meili Ecology has received a notice from a creditor applying for restructuring due to inability to repay debts, indicating potential financial distress [6]

【早报】特朗普:取消与普京会面;公募基金业绩比较基准规则征求意见稿即将发布

财联社· 2025-10-22 23:11

Industry News - Shenzhen has released an action plan to promote high-quality development of mergers and acquisitions, aiming for a total market capitalization of over 20 trillion yuan for listed companies by the end of 2027, and to cultivate 20 companies with a market value of over 100 billion yuan [5] - The average wholesale price of pork in China has been declining for ten consecutive weeks since August, attributed to an increase in supply. Experts suggest that the pork price may have reached its lowest point for the year by mid-October [5] - The China Securities Investment Fund Association is set to release a draft for public consultation regarding performance comparison benchmarks for public funds, with major fund companies submitting various indices for consideration [7] - The average interest rates for different deposit terms in September 2025 were reported, with the 3-month term at 0.944%, 6-month at 1.147%, and 1-year at 1.277% [7] - The AI infrastructure service market in China grew by 122.4% year-on-year in the first half of 2025, reaching 19.87 billion yuan, with Alibaba Cloud holding a 24.7% market share [7] - Guizhou Moutai has adjusted the usage rules for electronic bank acceptance bills for channel merchants, clarifying that these bills can only be used for products other than its core product, Feitian Moutai [7] - The China Communications Standards Association has announced the initiation of testing and validation for computing power interconnectivity capabilities based on industry standards [7] Company News - TaiLing Microelectronics announced that its major shareholder, the National Integrated Circuit Industry Investment Fund, plans to reduce its stake by no more than 2% [8] - Tianpu Co., Ltd. reported that some investors have engaged in abnormal trading behaviors that mislead market decisions [8] - Shannon Semiconductor reported a 1.36% year-on-year decline in net profit for the first three quarters [8] - Hefei Urban Construction announced a net loss of 51.31 million yuan for the third quarter [8] - *ST Chengchang reported a 565% year-on-year increase in net profit for the third quarter, with multiple remote sensing satellite projects entering a phase of regular batch delivery [8] - Heertai announced a 69.66% year-on-year increase in net profit for the first three quarters, focusing on high-growth emerging fields such as robotics [8] - Vico Precision announced plans to jointly invest in semiconductor industry supporting precision components and automated production line projects with Chip Alliance Fund [8] - Tesla reported third-quarter revenue of $28.1 billion, exceeding market expectations [14]

时空科技拟收购嘉合劲威 切入存储领域

Zheng Quan Shi Bao· 2025-10-22 17:23

Core Viewpoint - Company plans to acquire 100% equity of Shenzhen Jiahe Jinwei Electronics Technology Co., Ltd. to enter the semiconductor storage sector [1] Group 1: Acquisition Details - The acquisition will be executed through a combination of issuing shares and cash payments [1] - The total amount of supporting funds raised will not exceed 100% of the transaction price, with the number of shares issued not exceeding 30% of the company's total share capital prior to the issuance [1] - The issuance price is set at 23.08 yuan per share, with a 12-month lock-up period for new shares obtained by the 19 shareholders involved in the transaction [1] Group 2: Company Profile of Jiahe Jinwei - Jiahe Jinwei was established in August 2012 with a registered capital of 18.6133 million yuan, focusing on the R&D, design, production, and sales of memory modules and solid-state drives [2] - The company has established stable partnerships with major wafer manufacturers such as Samsung, Micron, and SK Hynix, ensuring the supply and quality of raw materials [2] - Financial data shows projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025, with net profits of -20.1572 million yuan, 42.2613 million yuan, and 42.1127 million yuan respectively [2] Group 3: Management and Strategic Direction - Zhang Lili and Chen Hui control 50.20% of Jiahe Jinwei's voting rights, with Zhang serving as the chairperson and Chen as the general manager [3] - Post-acquisition, the company aims to accelerate its transformation towards new productive forces while granting Jiahe Jinwei operational autonomy [3] - The transaction is classified as a major asset restructuring under relevant regulations, but does not constitute a change in control as the controlling shareholder remains the same [3]

时空科技拟收购嘉合劲威切入存储领域

Zheng Quan Shi Bao· 2025-10-22 17:23

时空科技(605178)10月22日晚间公告,拟通过发行股份及支付现金方式收购深圳市嘉合劲威电子科技 有限公司(简称 "嘉合劲威")100%股权,并向公司控股股东、实际控制人宫殿海发行股份募集配套资 金,切入半导体存储领域。 本次交易方案显示,时空科技拟向张丽丽、陈晖、深圳东珵管理咨询合伙企业(有限合伙)等19名嘉合 劲威股东收购其持有的标的公司全部股权。募集配套资金总额不超过发行股份购买资产交易价格的 100%,且发行股份数量不超过本次发行前上市公司总股本的30%,配套资金拟用于支付交易现金对 价、中介机构费用、补充流动资金及偿还债务、标的公司项目建设等用途,其中补充流动资金及偿还债 务比例不超过交易作价的25%或配套资金总额的50%。 本次发行价格确定为23.08元/股,19名交易对方因本次交易取得的新增股份自发行结束之日起12个月内 不得转让;宫殿海认购的配套资金股份及原有持股自本次发行结束之日起36个月内不得转让。 股权结构上,张丽丽与陈晖夫妇合计直接或间接控制嘉合劲威50.20%表决权,为共同实际控制人。张 丽丽一直担任公司董事长,对公司的企业发展方向、日常生产经营活动、人事任免等具有重要影响力; ...

每天三分钟公告很轻松 | 中国联通拟分拆子公司智网科技至深交所创业板上市

Shang Hai Zheng Quan Bao· 2025-10-22 15:19

Group 1: Earnings Reports - Tonghuashun reported a 39.67% increase in revenue to 3.261 billion yuan for the first three quarters of 2025, with a net profit increase of 85.29% to 1.206 billion yuan [2] - Weihua New Materials experienced a 15.18% decline in revenue to approximately 660 million yuan for the first three quarters, but a significant net profit increase of 250.04% in Q3 to approximately 25.38 million yuan [1] - Yanjing Co. achieved a 22.99% revenue growth to 1.295 billion yuan for the first three quarters, with a net profit increase of 27.95% to approximately 42.5 million yuan [1] - XH Technology reported a 26.47% revenue increase to approximately 742 million yuan for the first three quarters, with a net profit increase of 186.19% to approximately 95.47 million yuan [5] - Dongtian Micro reported a 53.91% revenue increase to approximately 637 million yuan for the first three quarters, with a net profit increase of 99.2% to approximately 80.03 million yuan [6] Group 2: Corporate Actions - China Unicom plans to spin off its subsidiary, Unicom Smart Network Technology, for listing on the Shenzhen Stock Exchange's Growth Enterprise Market, aiming to enhance innovation and competitiveness in the vehicle networking industry [3] - Kailer Co. is planning to acquire at least 50% of Kesheng Electromechanical, aiming to enter the high-end coating equipment sector [11] - Huitong Technology is preparing for an H-share listing in Hong Kong, with management authorized to initiate the process [11] Group 3: Other Notable Developments - Hengyi Petrochemical's subsidiary has successfully entered the trial production phase of a new project aimed at increasing its nylon production capacity [12] - Sichuan Chengyu's subsidiary signed a sand and gravel supply contract for a highway project, with a total transaction amount expected to be under 100 million yuan [14] - Sanwang Communication's board received a proposal for a share buyback plan, with a total amount not less than 20 million yuan [14]

605178 重大资产重组!周四复牌

Shang Hai Zheng Quan Bao· 2025-10-22 15:17

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jingwei Technology Co., Ltd. to enter the storage sector and create a second growth curve, enhancing its profitability and transforming its production capabilities [1][5]. Group 1: Acquisition Details - The acquisition will be executed through issuing shares and cash payments to 19 parties, with a share price set at 23.08 yuan per share [2]. - The company aims to raise funds not exceeding 100% of the asset purchase price, with a maximum issuance of 30% of the total share capital prior to the issuance [2]. - The raised funds will be allocated for cash payments, intermediary fees, taxes, and to support working capital and debt repayment [2]. Group 2: Target Company Overview - Jiahe Jingwei specializes in the R&D, design, production, and sales of storage products, including memory bars and solid-state drives, with three main product lines [3]. - The company has shown consistent revenue growth, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025 [3]. Group 3: Financial Performance - Jiahe Jingwei's financials indicate total assets of approximately 1.299 billion yuan and total liabilities of about 693.5 million yuan as of August 31, 2025 [4]. - The net profit for 2024 is projected at 42.71 million yuan, with a net profit of 42.29 million yuan reported for the first eight months of 2025 [3][4]. Group 4: Strategic Implications - The acquisition is expected to enhance the company's asset quality and risk resilience, facilitating its transition and growth in the information technology sector [5]. - The controlling shareholder, Gong Lanhai, has committed to a 36-month lock-up period for both newly issued and existing shares [6].

翻倍牛股,重大资产重组预案出炉!明起复牌

Zhong Guo Zheng Quan Bao· 2025-10-22 15:05

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% of Jiahe Jingwei through a share issuance and cash payment, marking a significant asset restructuring and related party transaction [1][2]. Group 1: Acquisition Details - The acquisition involves 19 parties, including major shareholders, with a share issuance price set at 23.08 yuan per share, which is 80% of the average trading price over the last 20 trading days [2]. - The total amount of funds raised through the share issuance will not exceed 100% of the asset purchase price, with the number of shares issued capped at 30% of the company's total shares prior to the issuance [2]. Group 2: Fund Utilization - The raised funds will be used for cash payments related to the transaction, intermediary fees, taxes, and to supplement working capital for both the company and the target company, as well as to repay debts and invest in project construction [3]. - The proportion of funds used for working capital and debt repayment will not exceed 25% of the transaction price or 50% of the total raised funds [3]. Group 3: Business Expansion - Jiahe Jingwei specializes in the research, design, production, and sales of storage products such as memory bars and solid-state drives, with three major product lines [3]. - Following the acquisition, Shikong Technology aims to enter the storage sector, creating a second growth curve and enhancing its profitability and sustainable earnings capacity [3]. Group 4: Financial Performance - In the first half of 2025, Shikong Technology reported revenues of approximately 144 million yuan, a year-on-year decrease of 10.95%, with a net profit attributable to shareholders of approximately -66.27 million yuan, indicating a reduction in losses compared to the previous year [4][5]. - The company's revenue from nighttime economy business was 87.19 million yuan, while the smart city business revenue was 56.21 million yuan, down 23.32% year-on-year, primarily due to reduced demand in the multi-story parking industry [4].