Midea Group(000333)

Search documents

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

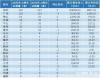

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

图解公募基金三季度重仓股

Ge Long Hui A P P· 2025-10-29 07:55

Core Insights - The top ten holdings of public funds for Q3 2025 include Ningde Times, Tencent Holdings, New Yi Sheng, Zhong Ji Xu Chuang, Alibaba-W, Luxshare Precision, Industrial Fulian, Zijin Mining, SMIC, and Kweichow Moutai [1][3] - Compared to the end of Q2 2025, Zhong Ji Xu Chuang and Industrial Fulian have entered the top ten holdings, while Midea Group and Xiaomi Group-W have exited [1] Public Fund Holdings - As of the end of Q3 2025, the total market value of public funds reached 35.85 trillion yuan, an increase of 6.30% from the previous quarter, with the A-share market value held by public funds exceeding 7 trillion yuan [3] - The top ten stocks held by public funds and their respective market values (in billion yuan) are: - Ningde Times: 758.81, 4.28% of circulating shares - Tencent Holdings: 699.38, 1.26% - New Yi Sheng: 560.70, 17.31% - Zhong Ji Xu Chuang: 558.13, 12.51% - Alibaba-W: 500.97, 1.62% - Luxshare Precision: 370.44, 7.88% - Industrial Fulian: 363.43, 2.77% - Zijin Mining: 340.18, 4.35% - SMIC: 290.86, 6.67% - Kweichow Moutai: 283.72, 1.57% [3][4] Active Fund Holdings - The top 20 active fund holdings in A-shares for Q3 2025 include: - Ningde Times: 796.90 billion yuan, 4.66% - Zhong Ji Xu Chuang: 577.49 billion yuan, 12.94% - New Yi Sheng: 571.59 billion yuan, 17.65% [4] - The top stocks with increased holdings include Zhong Ji Xu Chuang (100.30 billion yuan increase) and Industrial Fulian (50.94 billion yuan increase) [5] Passive Fund Holdings - The top 20 passive fund holdings in A-shares for Q3 2025 include: - Ningde Times: 1,273.84 billion yuan, 7.45% - Kweichow Moutai: 936.92 billion yuan, 5.18% - Zhong Ji Xu Chuang: 533.19 billion yuan, 11.95% [10] - The top stocks with increased holdings include New Yi Sheng (189.52 billion yuan increase) and Zhong Ji Xu Chuang (137.75 billion yuan increase) [9] Changes in Holdings - The top stocks with the largest reductions in holdings include: - Shenghong Technology: -99.62 billion yuan - Haiguang Information: -89.49 billion yuan - Midea Group: -64.91 billion yuan [7] - Notable reductions also include Ningde Times (-38.26 billion yuan) and Industrial Fulian (-27.23 billion yuan) [7][11]

公募基金三季度前十大重仓股出炉,宁德时代、中际旭创、工业富联在列

Ge Long Hui· 2025-10-29 07:39

Core Insights - The top ten holdings of public funds for the third quarter of 2025 have been released, featuring companies such as CATL, Tencent, and Alibaba [1] - Compared to the end of the second quarter of 2025, companies like Zhongji Xuchuang and Industrial Fulian have entered the top ten holdings, while Midea Group and Xiaomi have exited [1] Group 1 - The top ten stocks include: CATL, Tencent, New Yisheng, Zhongji Xuchuang, Alibaba-W, Luxshare Precision, Industrial Fulian, Zijin Mining, SMIC, and Kweichow Moutai [1] - Zhongji Xuchuang and Industrial Fulian are new entrants in the top ten holdings of public funds [1] - Midea Group and Xiaomi Group-W have been removed from the top ten holdings [1]

大摩、小摩、贝莱德等9大外资公募持仓出炉!光模块等AI科技成布局热门!

私募排排网· 2025-10-29 07:00

Core Viewpoint - The A-share market has shown a significant recovery this year, with the Shanghai Composite Index surpassing 4000 points, reflecting strong investment interest from foreign public funds, including major players like Morgan Stanley and BlackRock [3] Foreign Fund Holdings - In the third quarter, six foreign public funds increased their stock holdings, with Allianz Fund and Schroders Fund showing remarkable growth rates of 77.10% and 82.03% respectively [5] - Morgan Chase Fund's asset scale reached 213.22 billion, holding 194 stocks with a total market value of approximately 756.73 billion [6] - Morgan Stanley Fund's asset scale was 270.04 billion, with a focus on sectors like pharmaceuticals and AI, achieving an average return of 140.35% for its top twenty holdings [9] Key Stock Performances - The top holdings of Morgan Chase Fund included CATL, which saw a price increase of 45.29% year-to-date, with a total holding value of 3.66 billion [7] - New Yi Sheng, a key stock for Morgan Stanley Fund, experienced a staggering increase of 255.27% this year [10] - The top three holdings of Manulife Fund were all in the computing power industry, with 19 out of 20 stocks showing significant price increases [12] Investment Trends - The recent optimization of the Qualified Foreign Institutional Investor (QFII) system is expected to attract more foreign capital into the Chinese market, enhancing liquidity [3] - BlackRock Fund has notably increased its holdings in CATL, with a total market value of approximately 2.11 billion [15] - Fidelity Fund emphasizes the growth potential of Chinese technology stocks, despite a more diversified current portfolio [20] Market Outlook - The outlook for the A-share market remains optimistic, with expectations of new highs as the market stabilizes [18] - Roadshow Fund has maintained its positions in traditional blue-chip stocks while also focusing on technology stocks [19]

远程甩五菱!长安第三 大通超瑞驰 9月新能源轻客渗透率首破70% | 头条

第一商用车网· 2025-10-29 06:46

Core Viewpoint - The domestic new energy light commercial vehicle market is experiencing fluctuations, with a notable increase in sales and penetration rates, particularly in September 2025, which marked a record month for sales and growth in this segment [1][29]. Sales Performance - In September 2025, the new energy light commercial vehicle market sold 35,500 units, representing a month-on-month increase of 51% and a year-on-year increase of 48% [4][29]. - From January to September 2025, the cumulative sales of new energy light commercial vehicles reached 205,100 units, showing an 18% year-on-year growth [10][23]. Market Penetration - The penetration rate of new energy vehicles in the light commercial vehicle market exceeded 60%, with September 2025 achieving a record penetration rate of 70.12% [8][29]. - The cumulative penetration rate from January to September 2025 was 61.55%, up from 56.37% in the previous year [8][27]. Regional Insights - In the first nine months of 2025, all 31 provincial-level administrative regions in mainland China registered new energy light commercial vehicles, with Guangdong province leading with over 35,700 units [12][14]. - Most provinces experienced growth in new energy light commercial vehicle registrations compared to the previous year, with significant increases in Anhui, Chongqing, and Yunnan [14]. Vehicle Type Distribution - Pure electric vehicles dominated the new energy light commercial vehicle market, accounting for 99.977% of sales from January to September 2025, with negligible presence of hybrid and fuel cell vehicles [16]. Leading Companies - In September 2025, the top-selling companies in the new energy light commercial vehicle market included Yuan Cheng, which sold 8,011 units, followed by Wuling and Changan [18][21]. - The market share of the leading companies in the first nine months of 2025 was as follows: Wuling (21.93%), Yuan Cheng (19.38%), and Changan (12.63%) [27]. Future Outlook - The new energy light commercial vehicle market is expected to maintain its growth momentum, with the potential for continued increases in sales and market penetration [29].

2025广东企业500强出炉:中国平安、华润、华为位居前三

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 06:01

Core Insights - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1] - The total operating revenue of the top 500 enterprises reached 19.36 trillion yuan, with total assets exceeding 68 trillion yuan and total R&D investment amounting to 584.96 billion yuan [1][3] Revenue Growth - The total revenue of Guangdong's top 500 enterprises has increased from 16.73 trillion yuan in 2021 to 19.36 trillion yuan in 2025, marking a historical high with a growth rate of 3.36% in 2025, a significant rebound from 0.37% in 2024 [3][5] - The revenue growth reflects the resilience and innovative vitality of these enterprises amid complex international situations and domestic reform challenges [3] Asset Expansion - The total assets of Guangdong's top 500 enterprises grew from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5] - This growth indicates a continuous strengthening of the comprehensive strength of these enterprises [5] R&D Investment - The total R&D expenditure of Guangdong's top 500 enterprises is projected to reach 584.96 billion yuan by 2025, with a focus on basic research and key core technology areas [5] - The knowledge-intensive sectors, particularly scientific research and technical services, show a high R&D intensity of 19.00%, with R&D expenses amounting to 191.65 billion yuan [6] Tax Contributions - Despite the growth in assets and revenue, the total tax contributions of these enterprises have steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [6] Regional Coordination - The report highlights a significant disparity in the distribution of enterprises, with 98.25% of revenue and 98.91% of net profit concentrated in the Pearl River Delta region, while other regions like East Guangdong and West Guangdong have less than 0.3% [8][10] - To address this imbalance, the report suggests establishing a regional collaborative system that combines innovation radiation from the Pearl River Delta with the unique characteristics of East and West Guangdong [10]

2025广东企业500强出炉:中国平安、华润、华为位居前三

21世纪经济报道· 2025-10-29 05:56

Core Viewpoint - Guangdong's top 500 enterprises are accelerating their transition towards innovation-driven and value-creating models, becoming key carriers for the development of new productive forces [1]. Group 1: Scale and Growth - The total revenue of the top 500 enterprises in Guangdong reached 19.36 trillion yuan, setting a historical record [2][3]. - From 2021 to 2025, the total revenue of these enterprises is projected to increase from 16.73 trillion yuan to 19.36 trillion yuan, with a growth rate of 3.36% in 2025, significantly rebounding from 0.37% in 2024 [3]. Group 2: Asset Expansion - The total assets of Guangdong's top 500 enterprises are expected to grow from 56.62 trillion yuan in 2021 to 68.33 trillion yuan in 2025, accumulating an increase of over 11 trillion yuan over five years [5]. - In 2025, the total R&D expenditure of these enterprises is projected to reach 584.96 billion yuan, indicating a shift towards investing more in fundamental research and key core technologies [5]. Group 3: Industry Structure and R&D Investment - Knowledge-intensive sectors are particularly active, with the scientific research and technical services industry having a R&D intensity of 19.00%, amounting to 191.65 billion yuan in R&D expenses [6]. - The manufacturing sector, as a cornerstone of the economy, has a total R&D expenditure of 279.51 billion yuan [6]. Group 4: Taxation and Policy Impact - Despite growth in assets and revenue, the total tax paid by enterprises has steadily decreased from 901.27 billion yuan in 2021 to 681.19 billion yuan in 2025, reflecting a cumulative reduction of over 220 billion yuan [8]. - This "two increases and one decrease" trend indicates that tax reduction policies have created favorable conditions for enterprises to increase R&D investment and expand production [8]. Group 5: Regional Coordination and Challenges - The report highlights a significant disparity in performance among regions, with the Pearl River Delta region accounting for 98.25% of the revenue and 98.91% of the net profit of the top 500 enterprises [10]. - The report suggests establishing a regional collaborative system that combines "Pearl River Delta innovation radiation + unique undertakings in eastern and western Guangdong" to enhance coordination and innovation spillover effects [12].

A500ETF嘉实(159351)红盘蓄势,西部超导领涨成分股,机构:看好科技成长板块引领四季度行情

Xin Lang Cai Jing· 2025-10-29 02:19

Core Insights - The A500 index has shown a positive trend with a 0.55% increase, driven by significant gains in constituent stocks such as Western Superconducting (up 11.37%) and Sanhua Group (up 10.99%) [1][3] - The A500 ETF managed by Harvest has seen a trading turnover of 2.42% and a total transaction volume of 283 million yuan, with its latest scale reaching 11.67 billion yuan [3] - The A500 ETF has achieved a net value increase of 22.78% over the past year, with notable monthly returns and a consistent upward trend [3][4] Market Trends - Analysts are optimistic about the technology growth sector leading the market in the fourth quarter, focusing on "hard technology" areas such as semiconductors, AI computing power, and high-end equipment [4] - There is a recommendation to pay attention to sectors benefiting from policy support and domestic demand recovery, particularly those with historically low valuations [4] - Defensive sectors with high dividends and low valuations, such as banking and utilities, are also highlighted as providing stable cash flow and potential for valuation recovery [4] Key Stocks - The top ten weighted stocks in the A500 index include Ningde Times, Kweichow Moutai, and China Ping An, collectively accounting for 19% of the index [4][6] - Notable stock performances include Ningde Times with a 2.19% increase and China Ping An with a 2.20% increase, while Kweichow Moutai experienced a slight decline of 0.33% [6]

5300亿元!钟睒睒第四次成中国首富;英伟达总市值逼近5万亿美元;00后用家用打印机造出250多万假币;中通快递被约谈...

Sou Hu Cai Jing· 2025-10-29 02:12

Group 1: Economic Data - The GDP data for various provinces in China shows significant disparities, with Jiangsu leading at 137,008 billion yuan, followed by Guangdong at 141,634 billion yuan, and Shanghai at 53,927 billion yuan [1][2] - Beijing has a GDP of 49,843 billion yuan with a population of 21.83 million, resulting in a per capita GDP of 22.8 million yuan [1] - The lowest GDP recorded is for Ningxia at 2,203 billion yuan, with a population of 729 thousand [2] Group 2: Corporate Developments - Zhong Shanshan, founder of Nongfu Spring, has become the richest person in China for the fourth time, with a wealth increase of 190 billion yuan, totaling 530 billion yuan [6] - Nvidia's market capitalization has approached 5 trillion dollars, driven by a nearly 50% increase in stock price this year, following significant announcements at the GTC conference [7] - Apple has reached a market capitalization of over 4 trillion dollars, becoming the third company to achieve this milestone [8] Group 3: Regulatory and Compliance Issues - The State Post Bureau has conducted an administrative interview with ZTO Express, highlighting issues with service quality and compliance, and requiring improvements [3] - Meituan has denied rumors of being fined by JD.com, stating that the claims are untrue [11][12] Group 4: Market Trends - The price of gold jewelry has dropped significantly, with some brands falling below 1,200 yuan per gram [3] - The wholesale price of Feitian Moutai has fallen below 1,700 yuan per bottle for the first time, marking a decline of over 31% from its initial price [12] Group 5: Technology and Innovation - Google plans to restart a nuclear power plant in Iowa to supply energy for its AI infrastructure, indicating a strategic move to meet growing power demands [17] - OpenAI has completed a capital restructuring, with Microsoft holding a 27% stake in the newly formed OpenAI Group PBC [15]

美的被京东罚款500万?知情人士:造谣!明显有平台操纵;小米密集调整:雷军亲自挂帅汽车新部门;巨人网络CEO张栋辞职,刘伟回归

雷峰网· 2025-10-29 00:40

Key Points - The rumor regarding Midea being fined 5 million by JD.com has been confirmed as false, indicating possible platform manipulation [4] - Xiaomi has made significant organizational adjustments, with Lei Jun leading a new automotive department and Chen Kai taking over Xiaomi Home [8][9] - The 2025 Q3 earnings report for Xiaomi is anticipated to show a profit of 722 million yuan for its electric vehicle segment, with another institution predicting a profit of 1 billion yuan [9] - Zhong Shanshan has regained the title of China's richest person with a wealth increase of 190 billion yuan, while Lei Jun's wealth surged by 196 billion yuan due to Xiaomi's automotive growth [11] - Meta's AI department has undergone major layoffs, with around 600 employees affected, attributed to the underperformance of the Llama4 model against Chinese competitors [30][31] - Apple's service revenue is projected to exceed 100 billion USD for the first time in fiscal year 2025, driven by strong growth in services like iCloud and Apple Pay [31][32] - The European new car market saw a 10.7% year-on-year increase in September, with BYD's sales skyrocketing by 398%, while Tesla's market share declined [36] - Tesla's Full Self-Driving (FSD) subscription rate is only 12%, with related revenue down compared to the previous year, highlighting challenges in customer adoption [37]